In This article i will discuss the Best Crypto Tax Software. To simplify tracking, reporting and filing crypto taxes, I have chosen the best tax software for the job.

The objective of these tools is to ensure that you are tax compliant, save time and reduce errors. These suggestions will help you manage your crypto taxes without any stress or anxiety.

What is Crypto Tax Software?

The main purpose of a crypto tax software is to help people and companies compute their taxes correctly with respect to cryptocurrency transactions.

Governments worldwide have imposed laws on individuals who own digital assets such as Bitcoin or Ethereum hence requiring them to report their holdings as well as trades made using these currencies for taxation purposes.

Much of the work involved in this procedure can be done by computer programs which are designed specifically for calculating gains or losses incurred from buying/selling different types of coins on various exchanges.

They also take care of generating comprehensive reports that conform with applicable regulations governing taxations.

These systems make use of complicated formulas coupled with blockchain integration so as to simplify what would otherwise be time consuming tasks while at the same time guaranteeing compliance with tax rules by users.

How to Find the Best Crypto Tax Software to Suit Your Needs

Research and Compare: You should start your research by looking at what different types of crypto tax software are available on the market.

Check out user reviews, expert opinions and ratings to help you gauge the general reputation as well as reliability of any given program.

Evaluate Features: Make sure that you also assess what features each software offers. For instance, look out for things like automated data importation from exchanges or wallets.

Support for various cryptocurrencies; real-time calculations of taxes owed; comprehensive reporting capabilities among other functionalities.

User-friendliness: Another thing worth considering is how easy it would be for you to use a particular crypto tax software.

Go for one that provides an intuitive workflow plus a friendly interface especially if technical stuff never excites your mind.

Customer Service: Does this company provide responsive customer service? It is important to find out their availability hours alongside checking feedbacks from previous clients who may have had issues or needed clarification about using these programs before making up your mind on which among them will work best according to your needs.

Safety Measures: Considering the sensitivity attached with financial data, security must be given top priority when choosing accounting system.

Check whether they have features such as encryption of data, two-factor authentication (2FA) and compliance with industry standards so as not only protect own personal but also safeguard against possible hacking attempts aimed at stealing sensitive information like credit card numbers etc.

Cost/Pricing Structure: Take into account price tags slapped onto each package vis-à-vis its functionality then determine if it’s worth investing in or not based on ones’ budgetary limits besides specific requirements expected out of such software solution(s).

Some providers offer tiered plans depending on transaction levels while others include additional features at higher rates which may suit some people better than others depending on their specific circumstances

Trial Period/Demo Version: If there are trial periods provided by different companies go ahead and utilize them because this allows one try before buy so that they can test waters first hand thus avoiding regrets later when already locked into long-term contracts with unsuitable vendors who fail to deliver as promised initially due lack of features wanted/needed or simply because system does not work well together other existing programs used within same organization.

Integration Compatibility: Check whether accounting system integrates smoothly other financial/accounting software(s) being used currently.

This way, it becomes possible manage all financial affairs from one central point thus streamlining entire process involved towards achieving better control over cash flows

While minimizing errors associated with multiple entries of same data into different systems leading into discrepancies that may go unnoticed during reconciliation exercises thereby creating unnecessary headaches for both management staffs and auditors alike

User Feedback/Recommendations: Ensure get some advice peers community members have already interacted with crypto tax software programs.

Here is list of Best Crypto Tax Software

| Crypto Tax Software | Key Point |

|---|---|

| Koinly | User-friendly interface for beginners |

| ZenLedger | Comprehensive tax reports |

| TokenTax | CPA-assisted services |

| TurboTax | Integrates with major exchanges |

| TaxSlayer | Affordable pricing |

| H&R Block | In-person and online support |

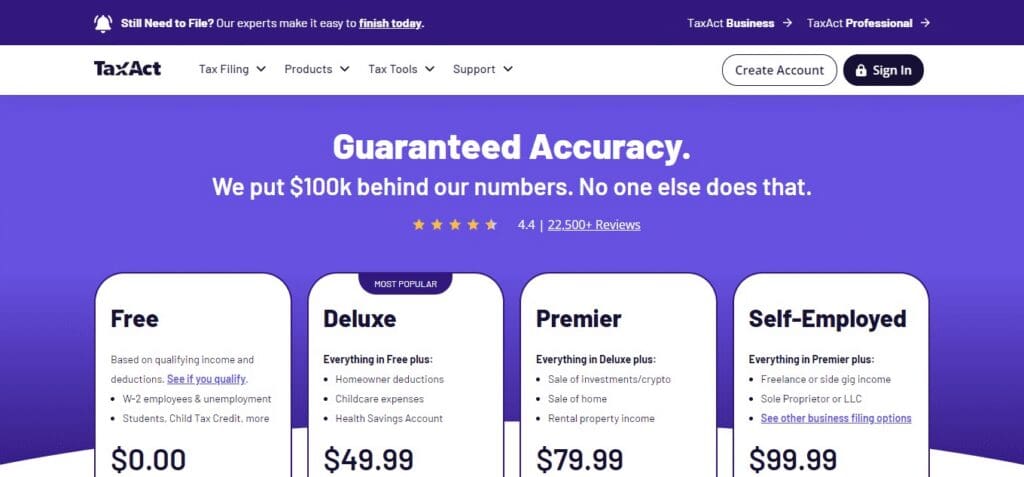

| TaxAct | Robust tax calculations |

| TaxBit | Enterprise-level solutions |

| CoinLedger | Detailed transaction tracking |

| Coinpanda | Supports multiple countries’ tax laws |

10 Best Crypto Tax Software

1. Koinly

Koinly is one of the most popular cryptocurrency tax software. It has an easy-to-use interface and many functions that make reporting taxes on digital assets less intimidating.

Koinly can import transactions from different exchanges and wallets automatically so users don’t need to do it manually.

This automates capital gains and losses calculations since you don’t have to enter all information by hand.

The service works with lots of coins and integrates with major trading platforms too, which guarantees precise and fast computation of taxes.

In addition, Koinly gives out detailed reports on crypto income according to local regulations so people know what they owe exactly.

It takes care about everything related to the confusion around taxation on virtual money for individuals who use its services in different countries thus ensuring their tranquility.

If you have been thinking about getting involved into cryptocurrencies as an investor or trader this year then look no further than koinly because even though it may seem complicated at first glance but once fully understood will become clear how invaluable tool truly is within these markets.

Koinly Tax Software Features

- Koinly facilitates the process of tax reporting with automation, making it fast and easy.

- For instance, supporting syncs from more than 400 different crypto exchanges as well as wallets to ensure smooth transaction tracking.

- The Crypto traders can be able to monitor their results on an ongoing basis through real-time tracking of their transactions in crypto.

- Supporting more than 100 countries, Koinly software generates tax reports that could be used across borders which allows for compatibility with various international tax laws.

- Besides complying with all the necessary requirements, Koinly also supports multiple accounting systems such as first-in-first-out (FIFO), last-in-first-out (LIFO) and average cost basis.

2. ZenLedger

When it comes to tax software for cryptocurrencies, ZenLedger is one of the best. It provides users with a seamless and complete way to manage their crypto taxes.

The process of tracking and reporting cryptocurrency transactions becomes simpler with this program due to its user-friendly interface and strong functions.

A person can import data from several exchanges and wallets easily so that capital gains and losses are calculated more quickly.

This service handles many types of virtual currencies and works well with major exchanges, thereby ensuring precise tax calculations as well as efficiency in them.

In addition, the system generates detailed tax reports designed in accordance with the requirements of different jurisdictions which relieves people from having to deal with intricate tax laws.

ZenLedger has intuitive design that allows even inexperienced investors understand how to report their digital asset investments correctly under current IRS guidelines without any problems or stress at all.

ZenLedger Tax Software Features

Automation of Calculations: ZenLedger has automated calculations for your cryptocurrency transactions.

Broad-scale Integration: Works with more than 400 exchanges, 100+ DEFI & NFT protocols, 50 blockchains, over 7000 tokens, 13 mobile wallets and 10 desktop wallets.

Monitoring portfolios: Tracking cryptocurrency portfolios is free and it also covers NFTs.

Specialized Responsiveness : Help can be gotten from their customer support at any time seven days a week through live chat via email through phone call or even video calls.

3. TokenTax

TokenTax is known to be one of the best cryptocurrency tax software programs available, and it supplies a complete service for managing your crypto tax reporting.

By having an user-friendly interface and strong features, TokenTax simplifies tracking and reporting all transactions related to digital currencies.

The system enables importing data from many wallets or exchanges which allows calculating capital gains/losses becomes a much easier task as everything is done automatically;

Moreover it supports almost all cryptocurrencies in existence as well as cooperates seamlessly with most popular exchanges making sure that tax calculations are accurate and efficient.

What’s more, this software creates extensive tax reports meeting requirements set forth by different countries’ laws so that its users can feel safe about complying with their fiscal obligations.

Whether you are experienced trader or just starting off in the world of cryptocurrencies — TokenTax has got your back: user-oriented design combined with easy navigation will help even those who find it hard to comprehend intricacies behind digital asset taxation systems.

TokenTax Software Features

Extensive Integrations: TokenTax supports over 120 crypto exchanges and wallets, including web3 wallets and centralised exchanges.

One-Click Tax Form Generation: Provides one click tax form generation simplifying tax filing process.

Tax Loss Harvesting: Incorporates a tax loss harvesting tool that helps to decrease your tax liability.

Staking And Mining Income Reports: This provides reports for income from staking and mining.

Audit Trail Report: Enriches the transparency and traceability of your transactions through an audit trail report feature.

4. TurboTax

TokenTax is one of the top cryptocurrency tax software options available. It provides a complete and user-friendly platform to manage all your crypto taxes.

It simplifies this process by creating an intuitive interface that can track complex transactions with ease.

Allowing users to import data from several exchanges and wallets – which makes calculating capital gains or losses much simpler too.

The wide range of supported currencies ensures accurate calculations because they seamlessly integrate with well-known exchanges on the market.

Additionally, TokenTax offers full tax reports compliant with different jurisdictions’ rules which will help you comply with what is required by law without any hassle on your part.

Whether seasoned in investing cryptos already or just starting out: it does not matter as long as TokenTax remains around since it will always be there for us when we need them most – especially during periods like these!

TurboTax Software Features

Crypto Platforms Integration: TurboTax is connected to many other platforms which include the likes of Coin base, Blockchain.com and Binance1.

Major Cryptocurrencies Supported: This program can manage all major cryptocurrencies1.

Auto-Import for Crypto Activity: One can easily import their crypto transactions from crypto platforms in TurboTax2.

Reporting Cost Basis: Turbotax tracks down missing cost basis values in order to have accurate capital gains and losses reporting2.

Contact with Professionals on Taxation of Cryptos: Users could get help from professional tax experts who deal exclusively with taxation concerning investment as well as cryptos

5. TaxSlayer

TaxSlayer is best known as a tax preparation service for traditional investments, but it now also covers cryptocurrency tax reporting.

This means users can import their digital money transactions from various exchanges and wallets on TaxSlayer which simplifies the calculations of their capitals gains or losses made.

The platform has a simple interface that helps take people through reporting their activities with crypto currencies for taxation purposes.

Some of the more niche crypto tax software may have better features specifically designed around them than what is offered by TaxSlayer although this could still be used alongside other forms of taxes since it’s integrated into wider tax preparations services.

In conclusion, if you’re an individual who likes dealing with all your traditional and nontraditional monetary duties in one convenient place then this app should suffice.

TaxSlayer Software Features

- Guided navigation: TaxSlayer guides you through all its software’s sections.

- All Significant Forms Supported: TaxSlayer supports all primary schedules and forms.

- Tax Professionals Anytime: TaxSlayer Premium has consultation with tax experts without limit.

- IRS Inquiry Support for One Year: With TaxSlayer, you can make inquiries to IRS for one year.

- Integration with Exchanges & Blockchains: In the case of exchanges and blockchains, this is how TaxSlayer integrates with CoinLedger

6. H&R Block

Tax preparing service H&R Block has adopted to the rise in popularity of cryptocurrency by providing support for reporting crypto transactions.

The platform of H&R Block allows users to import their crypto data from exchanges and wallets to calculate capital gains or losses, but it is not only specialized for this kind of software.

H&R Blocks’ familiar interface and expert guidance help people navigate through the complex process of reporting cryptocurrencies activities for tax purposes.

It is true that there might be missing advanced features found in dedicated crypto tax software however it still remains as one convenient option among many other such services which offer reliability with their comprehensive supports towards tax preparation based on trust.

Generally speaking , according my opinion ,H & R block is a very good choice if you are looking for something that can enable you manage your cryptocurrency taxes along side traditional filing needs.

H&R Block Tax Software Features

- H&R Block Offers User-friendly Data Entry and On-Demand Assistance: You will have no problem entering information or getting assistance with crypto taxes here.

- CoinTracker and Coinbase are Integrated: CoinTracker and Coinbase have been integrated with this platform, making it easy to file taxes within a short time.

- Support for Cryptocurrency Disposals: This feature is only available in H&R Block’s top version3.

- Transaction Data Importation: It is possible to automatically import transaction data from exchanges and wallets4.

- Online Help from Tax Professionals: You can speak to knowledgeable tax professionals at H&R Block

7. TaxAct

TaxAct, the tax preparation service that is known for being easy to use, has increased its operations by including cryptocurrency tax reporting support.

Although not designed for taxes in this particular area,

TaxAct’s platform enables users to import their digital currency transactions from different exchanges and wallets which will make it easier for them to calculate capital gains or losses.

TaxAct has a user-friendly interface and provides step-by-step instructions so that people can report their crypto activities correctly when doing their taxes.

It might not have all of the advanced features seen in specialized software for crypto taxes but still serves as an excellent choice among such programs.

That give convenience without any unnecessary complexity to individuals who want one place where they could take care of both conventional and digital money-related filing requirements.

All things considered, this is an uncomplicated solution for managing other tax obligations alongside those related with cryptocurrencies through Tax Act which remains one of the most straightforward ways available today to handle such matters within one system.

Tax Act Software Features

- TaxAct’s wide exchange support includes more than 600 exchanges and wallets including famous Coinbase, Binance, and Kraken.

- It provides region-specific report formatting for US users to ensure that they strictly adhere to IRS and state rules.

- For example, with the Trader Plan, one can track and generate reports on up to 100,000 transactions per tax year.

- TaxAct is also compatible with other tax software like TurboTax, making it easy for the importation of their tax reports2.

- Additionally, TaxAct offers an interactive portfolio which shows transaction fee charges as well as taxable income generated during the investments2

8. TaxBit

TaxBit is considered by many to be among the best cryptocurrency tax software solutions available. It provides users with a complete system for handling their crypto tax obligations.

The user-friendly interface and advanced functions of TaxBit make it easy to track and report on transactions involving digital currencies.

Which can otherwise be very complicated. With this platform, anyone can import information from different exchanges

And wallets in order to calculate gains or losses made on invested capital more easily; moreover, through its integration with commonly used exchanges,

The program ensures accuracy while performing tax calculations due to supporting various cryptocurrencies as well as pairing seamlessly with popular exchanges for accurate and efficient tax computations.

Additionally, the company also offers detailed reports about taxes that adhere to different laws around the world so people do not have trouble with them while dealing with taxes concerning virtual money .

Which often proves confusing for most individuals even those who are experienced in trading or new investors

Therefore whether one has been trading cryptos heavily already or just started investing in them recently then TaxBit still remains a great option because it combines power with simplicity when it comes to managing taxes related to digital assets.

TaxBit Software Features

- Automated Tax Calculations: TaxBit makes it easy to track cryptocurrency transactions through automated tax calculations, thereby simplifying things.

- Exchange Compatibility: With almost every global exchange compatible, it effortlessly harmonizes with them all.

- User-Friendly Dashboard: For ease of use and data analysis, TaxBit comes with a user-friendly dashboard and reporting tools.

- Real-Time Exchange Rates: TaxBit computes real-time exchange rates to determine taxable income.

- Latest Tax Laws Information: It is an essential source for current tax laws that ensure tax compliance at all times

9. CoinLedger

CoinLedger is recognized as one of the best cryptocurrency tax software options available. It provides users with an all-inclusive platform for managing their crypto tax obligations.

CoinLedger employs a user-friendly interface and powerful tools to make tracking and reporting cryptocurrency transactions easy.

Users can import data from many exchanges and wallets, which allows for quick calculation of capital gains or losses.

The system works with a wide variety of coins and integrates seamlessly with popular exchanges so that taxes are calculated accurately and efficiently.

Additionally, detailed tax reports are generated by Coinledger which meet different jurisdiction’s requirements thus saving time on complex tax regulations navigation.

Whether you’re an experienced trader or just starting out in crypto investing, this program will help streamline your reporting process by being intuitive and simple to use at any level of expertise in this field

CoinLedger Software Features

- CoinLedger makes it easy to import crypto transactions from wallets and exchanges.

- This software automatically follows the transaction and does the accurate taxation for each one3.

- DeFi, NFT, Coinbase, Gemini and Kraken are platforms that are compatible with CoinLedger.

- For instance, a report on Tax-Loss Harvesting is provided by CoinLedger to identify the largest tax saving opportunities in your portfolio.

- Another service provided by CoinLedger includes Expert Review which looks at your taxes even before you file them

10. Coinpanda

Coinpanda is considered one of the best choices for a software in paying taxes on cryptocurrency.

This service is very extensive and allows users to control all of their obligations in this field.

The interface is friendly and there are many advanced features which simplify tracking transactions with digital money.

In addition, it supports connection with different exchanges and wallets so that users could import data easily and calculate capital gains or losses without any problems.

It also has multi-currency support as well as integration with popular exchanges for accurate tax assessment. Moreover,

Coinpanda creates reports that meet various tax requirements around the world thereby giving confidence to those who deal with complex issues like cryptocurrency taxation.

No matter whether you have been trading for years or just starting out investing into virtual assets – this platform will always be here to lend you a hand in staying tax compliant.

Coinpanda Software Features

- User-friendly integrations: Integration in Coinpanda is done through API or CSV imports that enables a trader navigate and use features seamlessly.

- Good pricing model: Coinpanda has put in place a good reasonable and competitive pricing model, which accommodates both casual and high-volume traders.

- Comprehensive DeFi Coverage: Coinpanda supports tracking of all DeFi operations across 150+ blockchains and 2,000+ protocols.

- Customized Assistance: Personalized assistance is provided by the coin panda’s experts on cryptocurrency taxation. This ensures that people are assisted when they need it

Benefits Of Best Crypto Tax Software

Definitely! Here are a number of profits for utilizing the best crypto tax software to put things in simple words:

Efficiency: It saves time and energy by automating tracking and calculating crypto transactions.

Accuracy: This ensures that capital gains and losses are calculated rightly, minimizing errors in tax reporting.

Compliance: The tax reports generated should comply with the revenue regulations of different countries, thus reducing chances of non-compliance and penalties charged thereof.

Convenience: The interface is user-friendly while data can be easily imported from various exchanges as well as wallets so as make tax reporting easy for you.

Comprehensiveness: Many different cryptocurrencies are supported coupled with seamless integration into popular exchanges thereby providing holistic solution for managing all aspects relating to crypto taxes.

Peace-of-Mind: Detailed tax reports along with guidance will give you confidence needed when meeting your obligations towards taxation therefore bringing peace-of-mind feeling among users.

What Does Crypto Tax Software Class as a Transaction?

Yes! Here’s the usual definition of a transaction by crypto tax software:

Purchases and Sales: Any buying or selling of cryptocurrency – whether you’re purchasing Bitcoin with fiat currency or selling Ethereum for cash.

Trades on Exchanges: Trades between different cryptocurrencies. For example, exchanging Bitcoin for Ethereum.

Transfers: Movement of cryptocurrency from one wallet to another, or from a wallet to an exchange, etc.

Mining Rewards: Receipt of cryptocurrency as income from mining/staking activities.

Airdrops and Forks: You get new coins/ tokens if there is a fork (a split in the blockchain), or if a project decides to give them away (airdrop)

Interest and Dividends: Receipt of cryptocurrency as interest or dividends earned through lending/staking activities.

Gifts and Donations: Gifting or giving away crypto to someone else, including charity organizations. Also includes receiving it back.

Purchases and Payments: Using cryptocurrency directly to buy goods/services BEYOND trading/investing purposes.

Conclusion

In conclusion, it is very important to choose the right crypto tax software for managing the taxes on your cryptocurrency well.

With how complicated taxing crypto can be and always changing regulations, a good software may be what you need.

Topping tracking and reporting of transactions off with accuracy and compliance to top crypto tax software provides multiple advantages.

Whether an experienced trader or someone who has just started investing into digital currencies – these platforms have easy-to-use interfaces,

Powerful features and ensure that all necessary tax requirements are met.

By using the most reliable crypto tax solutions one can navigate through this difficult process confidently knowing everything is done correctly.

FAQ

What is crypto tax software?

Crypto tax software is a tool designed to help cryptocurrency investors and traders track, calculate, and report their crypto transactions for tax purposes. It automates the process of organizing transaction data, calculating capital gains and losses, and generating tax reports.

Why do I need crypto tax software?

Crypto tax software simplifies the complex task of managing your cryptocurrency taxes. It helps you ensure accuracy in your tax reporting, saves time and effort, and reduces the risk of errors or non-compliance with tax regulations.

How does crypto tax software work?

Crypto tax software typically works by allowing users to import transaction data from various exchanges and wallets. It then analyzes this data to calculate capital gains and losses based on tax regulations, generating tax reports that can be used for filing taxes with relevant authorities.

What features should I look for in crypto tax software?

When choosing crypto tax software, look for features such as easy data import from exchanges and wallets, support for a wide range of cryptocurrencies, accuracy in tax calculations, compliance with tax regulations, user-friendly interface, and comprehensive tax reporting capabilities.

Is crypto tax software suitable for beginners?

Yes, many crypto tax software options are designed to be user-friendly and accessible to beginners. They often offer step-by-step guidance and intuitive interfaces to help users navigate the complexities of cryptocurrency taxation.