In this article, I will look at which proprietary trading firms use dxFeed for trading. These prop firms use dxFeed’s real-time market data for more accurate and speedy trading decisions.

From programs that cater to beginners to professional trading firms, dxFeed is vital in improving efficiency, precision, and trading results.

Key Points & Prop firms That Use DXFeed

| Firm Name | Key Details |

|---|---|

| FundingPips | FundingPips is a modern proprietary trading firm that distinguishes itself through the integration of DXFeed |

| My Funded Futures | Offers live funding after simulated challenges; integrates dxFeed for real-time market data; supports platforms like TradingView, Tradovate, and NinjaTrader. |

| OneUp Trader | Provides a one-step evaluation process; offers accounts ranging from $25,000 to $250,000; integrates dxFeed for real-time market data; supports platforms like TradingView. |

| Earn2Trade | Emphasizes trader education and discipline; offers access to over 50 futures instruments; integrates dxFeed for real-time market data; supports platforms like TradingView and NinjaTrader. |

| Blue Guardian Futures | Offers a maximum allocation of $450K; provides a 60% discount on challenges; integrates dxFeed for real-time market data. |

| The Trading Pit | Provides a maximum allocation of $1.25M; offers a 15% discount on challenges; integrates dxFeed for real-time market data. |

| Heldental & Co. | Offers comprehensive tutoring and trading strategies; integrates dxFeed for real-time market data; utilizes dxFeed HeldenTrader platform. |

| GTS (Global Trading Systems) | A proprietary trading and market making firm; utilizes dxFeed for market data services. |

| Akuna Capital | Engages in proprietary and algorithmic trading; utilizes dxFeed for market data services. |

| DRW Trading Group | Involved in proprietary trading and market making; utilizes dxFeed for market data services. |

| Flow Traders | Provides liquidity in the securities market; utilizes dxFeed for market data services. |

11 Prop firms That Use DXFeed

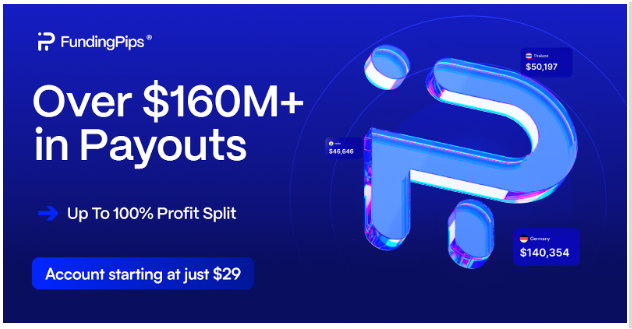

1. FundingPips

FundingPips is a modern proprietary trading firm that distinguishes itself through the integration of DXFeed, a market data provider best known to top tier market participants.

Best of all, because of FundingPips use of DXFeed, traders have ultra low latency, accurate, and reliable price feeds that meaningfully reduces slippage and provides a fair and respectful trading experience, equ all traders the same quality when data.

Outsized data quality means traders can execute strategies FundingPips has the highest levels of trust and transparency of any prop firm DXfeed provides a phenomenal trading conditions, and traders are able to use their sophisticated reliable tools to trade in highly institutional conditions.

Payouts: Over $160 Million

Payout cycles: Total 6 Payout Cycles.

- For 1 step and 2 Step (Monthly 100%, Bi-weekly 80%, Tuesday 60%, On-demand 90%)

- 2 Step Pro (Daily 80%, Weekly 80%)

- FundingPips Zero/Instant (Bi-weekly 95%)\

USPs:

- No payout denial (Track record of 0 payout denial)

- 29,900 Reviews on Trustpilot (4.5 stars)

- Up to100% Profit split

- Account starting at just $29

- Over 100K+ traders

- Flexible Payout Cycles

2. My Funded Futures

My Funded Futures is a proprietary trading firm that specializes in futures and provides traders with a simplified evaluation process to obtain funded accounts.

Having fast payouts and flexible trading rules, the firm leverages DXFeed for reliable, low-latency market data, which aids traders in the real-time execution of their strategies.

Multiple account sizes are available, and the firm supports withdrawal frequency on a weekly or bi-weekly basis.

Highly active traders, particularly scalpers and day traders, will find value in the DXFeed integration that provides precise price data and efficient order execution.

The absence of daily loss limits and no-rule consistency during the simulation phase makes My Funded Futures a great option for traders in need of flexibility and honesty in their trading experience.

Features My Funded Futures

- dxFeed Integration: Uses dxFeed for US futures data and analysis.

- Platform Support: Works with NinjaTrader, Tradovate, and VolSys.

- Funding Options: The “Starter” and “Expert” accounts are among the funding options.

- Profit Sharing: Holds 90% profit share after 100% payout on the first $10,000.

3. OneUp Trader

OneUp Trader provides aspiring futures traders with a simple evaluation program to earn funded accounts. It partners with top data providers like DXFeed to ensure high-quality, real-time market data.

Traders benefit from a user-friendly dashboard, daily performance tracking, and access to professional trading platforms. DXFeed’s integration enhances the precision of trade execution and market analysis.

OneUp Trader emphasizes discipline and consistency, requiring traders to meet profit targets and risk parameters.

Once funded, traders receive 80% of profits and can scale up their accounts. The firm’s streamlined approach and reliable data make it ideal for traders seeking a clear path to funding.

Features OneUp Trader

- Evaluation Process: One-step evaluation process is quick and allows for funding immediately.

- Funding Levels: Accounts are funded up to $250,000.

- Profit Splits: Traders get 90% of the profit split.

- Platform Compatibility: Compatible with TradingView and NinjaTrader.

4. Earn2Trade

Earn2Trade is an educational prop firm that combines trader development with funding opportunities. It offers programs like the Gauntlet Mini, where traders prove their skills to earn a funded account.

DXFeed powers its market data, ensuring fast and accurate price feeds for futures trading. The firm emphasizes risk management and trading discipline, with clear rules and performance metrics.

Earn2Trade also provides mentorship and trading courses, making it suitable for beginners and intermediate traders.

Once funded, traders receive a profit split and access to professional platforms. DXFeed’s integration supports precise execution and real-time analysis, enhancing the overall trading experience.

Features Earn2Trade

- Gauntlet Mini™: This 10-day evaluation program is for intraday traders.

- Advanced Tools: Includes Journalytix for performance analysis and tracking.

- Risk Management: Risk management is a central pillar of discorded trading and earning them profit.

- Opportunities For Funded Accounts: We offer profit-sharing opportunities to our successful traders funding our accounts!

5. Blue Guardian Futures

Blue Guardian Futures is a proprietary trading firm focused on futures markets. It offers traders a chance to earn funded accounts through a structured evaluation process.

DXFeed provides the firm with robust market data, enabling fast execution and accurate charting.

Blue Guardian emphasizes transparency, offering clear rules and generous profit splits. Traders can choose from various account sizes and benefit from features like trailing drawdowns and weekly payouts.

The firm’s partnership with DXFeed ensures reliable data delivery, which is crucial for high-frequency and intraday trading strategies.

Its supportive environment and competitive structure make it attractive to serious futures traders.

Features Blue Guardian Futures

- Capital Allocation: Lets traders manage up to $450,000 in simulated funds.

- Profit Sharing: 100% profit sharing. We give you all your profits, 100%!

- Cost-Effective Trading: No activation fee, 1-time fee, or monthly fee, whatever you choose, it will be cost-effective.

- Payout Reliability: Weekly payouts are guaranteed, and you receive $200 if we delay your payouts.

6. The Trading Pit

The Trading Pit is a worldwide proprietary trading firm that offers trading opportunities in futures, forex, and equities. It uses DXFeed for top-tier cross-platform market data, making sure traders can professionally execute orders.

The firm offers a comprehensive support and pedagogical mentorship approach which is part of their multi-stage evaluation process. After being funded, traders split profits and can scale their accounts.

With enhanced firm infrastructure received through the integration of DXFeed, The Trading Pit is able to provide high quality low-latency data to users through reliable connections.

The ample support and worldwide presence of The Trading Pit makes it ideal for traders looking for long-term development and the ability to trade globally.

Features The Trading Pit

- Global Access: We provide access to traders from all over the world, currently over 180 countries!

- Account Leveling: Level your accounts up to €5 million. The earning potential is significant.

- Profit Sharing: 80% profit retention for the traders, an impressive collection.

- Integrated Tools: Quantower and TradingView are showcased integrated tools for better trading.

7. Heldental & Co

Heldental & Co. is a proprietary trading firm specializing in algorithmic and quantitative trading strategies. It leverages DXFeed’s advanced data solutions to support high-frequency trading and real-time analytics.

The firm focuses on building and deploying automated systems across global markets. DXFeed’s low-latency feeds and customizable APIs allow Heldental to optimize its trading infrastructure.

Traders at Heldental work in collaborative teams, developing models and executing trades based on statistical analysis.

The firm’s emphasis on technology and precision makes DXFeed a natural fit. Heldental offers a dynamic environment for data-driven traders and researchers aiming to innovate in financial markets.

Features Heldental & Co

- Focus On Trading: We offer fully-fledged trading systematically in the strategy and skills programs.

- Market Access: US equity markets are now accessible. More trading!

- dxFeed Real-Time Integration: Industry-leading dxFeed is used to enhance trading with more real-time and accurate trading.

- Multi-Platform: Use dxFeed HeldenTrader, ATAS, and more with layered system support. Flexible trading styles are encouraged.

8. GTS (Global Trading Systems)

Global Trading Systems (GTS) is a leading electronic market maker and proprietary trading firm. It uses DXFeed to access high-speed market data essential for its algorithmic and quantitative strategies.

GTS operates across equities, ETFs, and futures, focusing on liquidity provision and efficient execution. DXFeed’s reliable data feeds support GTS’s infrastructure, enabling real-time decision-making and risk management.

The firm invests heavily in technology and research, offering roles for developers, quants, and traders. GTS’s partnership with DXFeed ensures it remains competitive in fast-moving markets.

Its sophisticated systems and data-driven approach make it a powerhouse in electronic trading.

Features GTS (Global Trading Systems)

- Market Expertise: Trades over 30,000 financial instruments around the world, demonstrating profound understand of the marketplace.

- Liquidity Provision: Integrates and supplies liquidity to institutions for enhanced marketplace operational capabilities.

- Advanced Technology: Uses advanced in-house developed technology for best results in trading.

- Global Presence: Office locations in Chicago, Sydney and Shanghai for world-wide coverage.

9. Akuna Capital

Akuna Capital is a tech-driven proprietary trading firm specializing in derivatives and algorithmic trading. It integrates DXFeed to access real-time market data for options, futures, and cryptocurrencies.

Akuna’s trading strategies rely on speed and precision, making DXFeed’s low-latency feeds essential. The firm emphasizes innovation, offering roles in trading, development, and quantitative research.

Akuna supports a collaborative culture where teams build and refine models using cutting-edge tools. DXFeed enhances Akuna’s ability to analyze market trends and execute trades efficiently.

With a focus on technology and talent, Akuna Capital is a top destination for ambitious traders and engineers.

Features Akuna Capital

- Specialization: Derivatives market making and advanced modeling to serve the specialized market.

- Global Operations: Engages in international trading from their offices located in Chicago, Sydney, and London.

- Technology-Driven: Utilization of advanced technology for trading to maintain market competition.

- Market Coverage: Active in commodities, equity index, fixed income, and crypto options trading.

10. DRW Trading Group

DRW is a diversified trading firm that combines technology, research, and risk management to trade across asset classes.

It uses DXFeed to support its data infrastructure, enabling accurate and timely market insights. DRW’s strategies span futures, options, fixed income, and cryptocurrencies.

firm values innovation and offers opportunities in trading, software development, and quantitative research. DXFeed’s robust data feeds help DRW maintain its edge in algorithmic and discretionary trading.

The firm fosters a collaborative environment and invests in proprietary systems. DRW’s integration with DXFeed ensures it can adapt to market changes and execute complex strategies with precision.

Features DRW Trading Group

- Proprietary Trading: Engages in trading for their own account and market-making and arbitrage operational strategies.

- Global Reach: Engages in various markets which include equities, fixed income and cryptocurrencies.

- Technology Integration: Uses technology for trading and managing the risks associated with it.

- Research-Driven: Engages quantitative research for making trading decision.

11. Flow Traders

Flow Traders is a global market-making firm specializing in exchange-traded products (ETPs) and digital assets. It uses DXFeed to access real-time market data, supporting its high-frequency trading operations.

Flow Traders focuses on liquidity provision and arbitrage strategies, requiring fast and accurate data feeds. DXFeed’s integration enhances the firm’s ability to monitor markets and execute trades across multiple venues.

The firm combines technology and trading expertise, offering roles in quant research, development, and trading.

Flow Traders’ partnership with DXFeed ensures it remains competitive in volatile markets. Its global presence and tech-driven approach make it a leader in electronic trading.

Features Flow Traders

- Market Making: Engages in the provision of market liquidity and financial instruments in various markets.

- Global Operations: Active on various platforms which include equities and derivatives.

- Use of Technology: Uses in-house developed technology for trading and managing risk.

- Compliance: Follows and abides the laws provided in all places of operation.

Conclsuion

To wrap things up, dxFeed customers enjoy the best market real-time updates and precise market tools. Firms using dxFeed streamlining their data and trading tools to higher decision and trading trading cutting their time loss.

From trading education firms like Earn2Trade to world trading market makers such as GTS and Flow Traders, dxFeed provides a range of trading strategies and platform scalability.

Modern data substantiates the success of proprietary trading and dxFeed’s integration is equally as crucial in proprietary trading.

FAQ

What is dxFeed?

dxFeed is a market data provider offering real-time and historical financial data for trading platforms.

Why do prop firms use dxFeed?

Firms use it for accurate, low-latency market data to enhance trading decisions and strategies.

Which prop firms use dxFeed?

Examples include My Funded Futures, OneUp Trader, Earn2Trade, Blue Guardian Futures, GTS, Akuna Capital, DRW, and Flow Traders.

Does dxFeed support global markets?

Yes, it provides data across equities, futures, options, and crypto markets worldwide.

Which trading platforms support dxFeed?

Platforms like NinjaTrader, TradingView, Quantower, and HeldenTrader are compatible.