In this piece, I will talk about the Hidden Correlations Between Bitcoin and Major Forex Pairs. Many traders do not realize how interconnected the crypto and currency markets are.

Understanding the relationships between markets, including USD dominance, inflation trends, and risk sentiment and liquidity flows, will help traders anticipate price movements and improve their decisions in highly volatile environments.

Why These Correlations Matter for Traders

Diversification and Hedging Strategies: Identifying Bitcoin’s correlating pairs allows for improved hedging and diversification, ultimately reducing overall risk.

Market Move Prediction: With Forex correlations, traders can forecast Bitcoin price movements based on Forex price trends or changes in market sentiment.

Managing Risk in Bitcoin’s Volatile Conditions: Understanding the connections between Bitcoin and major Forex currencies allows traders to anticipate macroeconomic events and manage positions better during volatility and liquidity crunches.

Identifying Global Economic Trends: While Bitcoin portrays market sentiment and risk appetite, Forex shows economic activities. Together, they provide a more comprehensive understanding.

Automated Trading Model Enhancements: Forex pairs correlating with Bitcoin can improve quant traders’ bots and algorithms for more precise automated trade execution and better exit strategies.

Key Point & Hidden Correlations Between Bitcoin and Major Forex Pairs

| Correlation Factor | Key Point (What Traders Gain) |

|---|---|

| USD Dominance Factor | BTC often reacts to USD strength/weakness, helping traders gauge global risk appetite. |

| Inflation Hedge Correlation | Bitcoin may rise when inflation climbs, acting as a hedge like commodities. |

| Risk-On vs Risk-Off Behavior | BTC typically rises in risk-on markets and drops in risk-off sentiment, aligning with equity flows. |

| Liquidity Timing Overlap | Forex and BTC volatility spikes during overlapping sessions (US–EU), offering strategic trade timing. |

| Safe-Haven Parallels | BTC sometimes behaves like gold during crises, signaling defensive investor flows. |

| Correlation with Emerging Market Currencies | BTC can rise when EM currencies weaken due to capital flight into digital assets. |

| Interest Rate Influence | Higher rates can pressure Bitcoin similar to risk assets—useful for macro positioning. |

| Gold and BTC Link through Forex | Movements in XAU/USD may predict BTC sentiment shifts during inflation or dollar swings. |

| Global Liquidity Cycles | Bitcoin thrives in loose liquidity cycles, mirroring USD liquidity and FX funding markets. |

| Dollar Index (DXY) Mirror Effect | BTC often shows inverse correlation with the DXY, helping spot directional biases. |

| Asian Market Impact | Early volatility from Asia sessions can signal momentum for full-day BTC direction. |

| Crypto–FX Carry Trade Shifts | Funding rate and FX carry trade dynamics affect capital flows into BTC trading pairs. |

| Global Sentiment Indicators | BTC moves strongly with sentiment-driven assets—useful for sentiment-based trading models. |

| Tether (USDT) and USD Liquidity Correlation | Stablecoin inflows/outflows reflect real-time crypto liquidity tied to USD demand. |

| Long-Term Store-of-Value Behavior | Bitcoin’s narrative as “digital gold” influences long-term correlation with macro economic cycles. |

1. USD Dominance Factor

The U.S. dollar influences and serves as the basis of international finances as well as commodities, Forex, and Bitcoin. As the dollar strengthens, liquidity tends to flow into dollar-denominated assets which pressures Bitcoin’s price positively.

To gauge sentiment in dollar movements, mid-market participants focus on analyzing the Hidden Correlations Between Bitcoin and Major Forex Pairs.

Investors tend to shift to riskier and alternative assets such as cryptocurrencies for yield and diversification. The variations in the demand for BTC in international trading centers make USD-BTC correlation for traders assessing global capital flows.

USD Dominance Factor Features

- Globally, as the USD strengthens, Bitcoin tends to weaken as well.

- Shifts in USD liquidity directly affect BTC’s purchasing power.

- Risk sentiment is influenced by the relative capital flows between USD and BTC.

2. Inflation Hedge Correlation

The effect of inflation causes people to invest in assets to get inflation protection. Bitcoin has known to be referred to as “digital gold”, especially with inflation.

In this case, the Hidden Correlations Between Bitcoin and Major Forex Pairs suggests that BTC will rise in value while Fiat currencies will lose value. During periods of BTC inflation, Forex traders who hedge inflation spikes tend to shift their BTC holdings.

In the long run, the narrative of Bitcoin as an inflation hedge has not changed during periods of high inflation. This has led to the bitcoin hedge narrative attracting long term institutional interest during inflationary periods.

Inflation Hedge Correlation Features

- Relative to other fiat currencies, BTC value increases and usually remains high during inflationary periods.

- The demand for cryptocurrency increases during periods of inflation for fiat currencies.

- Traders usually enter BTC during a spike in consumer prices.

3. Risk-On vs Risk-Off Behavior

Risk on and risk-off market cycles tend to correlate with crypto market and Forex trading. In risk on environments, Bitcoin and high-yield Forex currencies tend to increase in value together.

In contrast, when markets are afraid of geopolitical changes or recession, traders go into safe haven fiat currencies like the USD or JPY, which carries with it a bitcoin devaluation. Seasoned investors are able to use the Hidden Correlations Between Bitcoin and Major Forex Pairs to help predict changes in market sentiment.

Crypto has behaved more like risk tech assets, which correlate with the rest of the market. This correlation helps traders with predicting the other assets that will flow with digital currencies and Forex risk currencies.

Risk-On vs Risk-Off Behavior Features

- Bitcoin is treated as a high-risk asset during bullish trends.

- In periods of financial crisis, investors tend to USD/JPY for safe-haven assets.

- The correlation allows the prediction of BTC’s behavior due to macroeconomic changes.

4. Liquidity Timing Overlap

The most extreme price changes in Bitcoin and principal currency pairs take place in overlapping trading sessions, especially between the US and Europe. At this point, the Hidden Correlations Between Bitcoin and Major Forex Pairs can be tracked in real time.

As liquidity increases, price discovery happens more quickly, trading volume rises, and arbitrage opportunities multiply across different exchanges and platforms. Traders who use liquidity windows for their entry and exit points are more likely to lock in price changes as they become more predictable.

Because Bitcoin markets operate around the clock, the market can be very responsive to changes in sentiment, caused by Forex trading, which makes timing more important to intraday and algorithmic traders in Bitcoin and other cryptos.

Liquidity Timing Overlap Features

- The highest volatility in both markets occurs in the US-EU session overlap.

- Opportunities for trade timing improve due to faster price discovery.

- The correlation strengthens due to arbitrage activities during high liquidity.

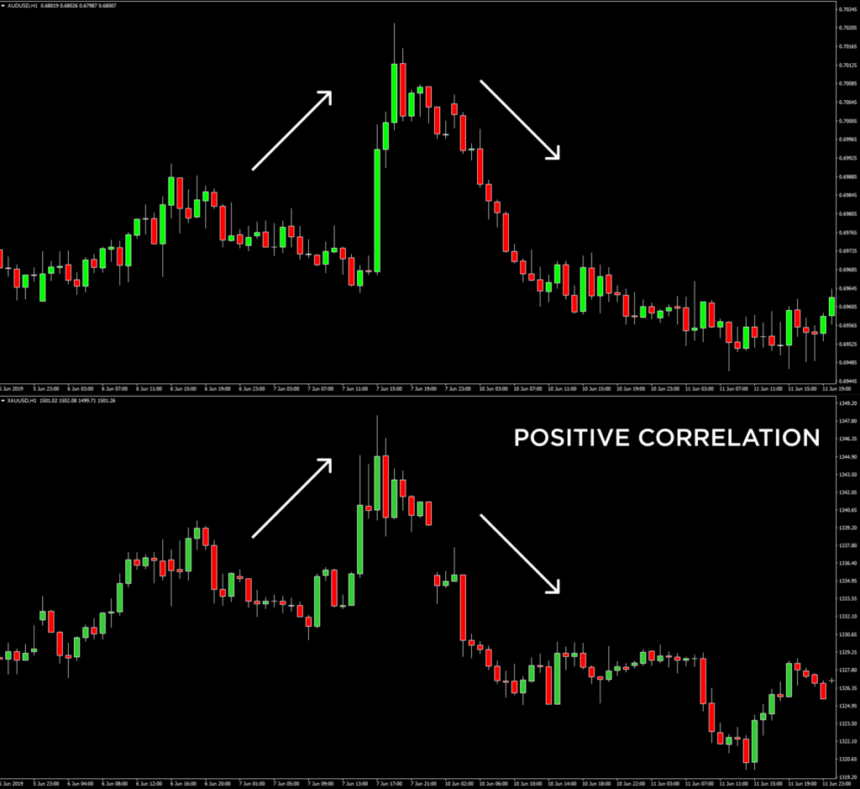

5. Safe-Haven Parallels

During times of crises, when the traditional markets are in turmoil and the prices of safe-haven assets, such as gold, are rising, Bitcoin follows this same pattern. This is why the Hidden Correlations Between Bitcoin and Major Forex Pairs is useful for determining the timing of defensive capital rotation- when investors are moving their money into safe assets.

When BTC strengthens along with other safe-haven currencies, such as JPY and CHF, this signals a protective shield. Yet, because Bitcoin is still a developing market, extreme conditions can cause it to become illiquid.

This liquidity sell-off is something traders watch for using patterns in safe-haven currencies, to determine if Bitcoin is being used in current.

Safe-Haven Parallels Features

- BTC, like gold, is a safe-haven asset during times of economic turmoil.

- BTC increases in value during periods of high demand for CHF/JPY.

- Protective BTC behavior is evident in the fear-driven capital flows.

6. Correlation with Emerging Market Currencies

Valuable resources BTC becomes an option as protective resources during inflation and currency depreciation. Shifts toward BTC can accommodate substantial wealth when inflation occurs and the domestic market collapse.

Since EM depreciation occurs wealth preservation and speculative demand both drive the inflow of BTC. Instability during periods of heightened inflation leads to substantial demand as speculative wealth preservation becomes the priority.

High BTC momentum can be predicted during instability in inadequate developing countries, driven by weakened EM currencies and increased speculative demand preservation.

Correlation with Emerging Market Currencies Features

- The weakness of EM currencies drives adoption of Bitcoin BTC.

- Bitcoin is a safe haven against domestic inflation.

- Speculative inflows of BTC increase when there is foreign exchange instability.

7. Interest Rate Influence

The USD strengthens as interest rates rise due to attractive government bonds, and BTC faces increased financial pressure as interest rates rise due to increased borrowing costs.

The Hidden Correlations Between Bitcoin and Major Forex Pairs can help to anticipate BTC trends in advance and detect macro shifts, particularly around Fed meetings. Interest rate cuts means increased investment in BTC as it becomes a risk asset.

The association of BTC with macro assets and increased Forex-Crypto convergence means that shifts in yield expectations can indicate shifts in BTC price to predict and assess risk in highly leveraged BTC positions.

Interest Rate Influence Features

- Increases in interest rates strengthen currencies and put pressure on the liquidity of BTC.

- BTC becomes a major target when capital is put in riskier assets due to lower interest rates.

- The correlation becomes extreme in either direction due to the impact of central bank policies.

8. Gold and BTC Link through Forex

Gold (XAU/USD) and Bitcoin attract similar types of investors—those who are looking to hedge against the weakening of the currency and financial instability.

Traders who study the Hidden Correlations Between Bitcoin and Major Forex Pairs take gold price movements as leading sentiment signals. Gold and BTC can both rise when the USD weakens. However, divergence can also happen—gold may rise due to defensive inflation hedging while Bitcoin behaves like a risk asset.

Gold.inverse forex traders who track the gold’s influence on USD pricing are able to predict Bitcoin’s momentum better during inflation and monetary stimulation periods.

Gold and BTC Link Through Forex Features

- Both assets protect against the weakening of the U.S. dollar and hold off financial instability.

- The direction of movement in Gold is a strong indicator of Bitcoin sentiment.

- For macro alignment purposes, traders analyze the correlation between bitcoin and gold.

9. Global Liquidity Cycles

Crypto, like any other asset, does best when liquidity is high due to the abundance of cheap capital. These dynamics are confirmed by the Hidden Correlations Between Bitcoin and Major Forex Pairs.

Analyses that focus on USD liquidity and global funding trends are able to predict BTC price. During periods of liquidity tightening, capital is withdrawn from riskier assets and Bitcoin is driven down.

Crypto analysts track shifts on central bank policies to forecast crypto demand. They do this to set positions for large macro-driven trends. Understanding liquidity showed traders the best position to take to capture these large macro-driven trends.

Global Liquidity Cycles Features

- Bitcoin is positioned to do well in liquidity.

- Speculative assets are unattractive when liquidity is tight.

- The state of liquidity will help to predict either a BTC bull phase or a phase of correction.

10. Dollar Index (DXY) Mirror Effect

The DXY Dollar Index demonstrates a reflection of the Bitcoin market in a Duplicate the Contrarian Correlations Between Bitcoin and Major Forex currency pair analysis perspective. The global strength of the dollar triggers a decrease in demand for Bitcoin, and an increase in demand for the dollar, in weak dollar periods.

The inverse relation demonstrates the demand for risk alternative assets. A drop in the DXY after strong bullish periods demonstrates a strong correlation with Bitcoin price breaks and an increase in bullish sentiment.

The inverse correlation in market assumptions and variables demonstrates the DXY and Bitcoin correlation in market overlays. Structuring your estimates with this DXY-Bitcoin relation as your foundation, will improve your probability of success in betting Bitcoin with the mainstream currency dollar.

Dollar Index (DXY) Mirror Effect Features

- The strength of the U.S. dollar and BTC do show a correlation.

- The major uptrends of Bitcoin are preceded by peaks of the dollar index.

- Forex traders make BTC trading decisions based on the dollar index.

11. Asian Market Impact

Asian market influences on the Bitcoin market are derived from the Forex correlation of the JPY and CNY bullish relation. Major Asian countries, specifically Japan, South Korea, and Hong Kong have a strong influence on Bitcoin market volatility in early Asia.

The volatility derives from the regional risk sentiment and regulatory policies. Bitcoin typically shows an increase in price as regulatory risk sentiment around the JPY or CNY is bullish, and risk sentiments in the Western region is bearish.

The shift in risk sentiments often triggers regulatory policies, generating an increase in volatility on the downside for Western noon session. The correlation of JPY and CNY on Bitcoin volatility demonstrates influence of Asian market sentiments on direct market assumptions for the day.

Asian Market Impact Features

- Volatility in the Asian session is a major driver of early BTC momentum.

- Movements in the Chinese and Japanese currencies layout the framework for crypto trading.

- The sentiment in the crypto market centers in Asia, permeating into the EU and US session.

12. Crypto–FX Carry Trade Shifts

The behavior of funding rates in crypto markets and carry trades in Forex is similar with regard to capital flow behavior. Hidden Correlations Between Bitcoin and Major Forex Pairs enables traders to take advantage of interest-based positioning strategies.

When crypto yields are high, traders borrow capital to take positions in Bitcoin, and this behavior is consistent with the logic of currency carry trades. Funding cost heightened during periods of extreme volatility, which is then followed by an unwind of the carry trade.

This unwind, which is termed carry trade reversal, could lead to substantial downward shifts in the Bitcoin price. Liquidation and shifts in momentum are best predicted by observing funding rates in the stablecoin and FX derivatives markets.

Shifts in Crypto-FX Carry Trades Features

- Institutional funding rates impact the leverage demand for BTC.

- Unwinding of carry trades will often cause BTC to reverse quickly.

- FX–crypto funding correlations are useful in risk management.

13. Global Sentiment Indicators

Like high-beta currency pairs, Bitcoin is highly responsive to global risk sentiment. This leads to strong Hidden Correlations Between Bitcoin and Major Forex Pairs during significant occurrences, like geopolitical events or market crises.

Bitcoin is highly sensitive to events occurring in equity and currency markets, so sentiment indicators such as the VIX, PMI reports, and market risk trends are great crypto trading instruments.

These instruments help traders forecast price direction and volatility for Bitcoin. As the crypto market matures, psychological trends across various instruments become even more correlated, making these indicators more useful predictors.

Global Sentiment Indicators Features

- Bitcoin behaves like high-beta FX pairs, tracking a similar psychology.

- BTC volatility is forecasted by risk appetite indicators such as the VIX.

- Sentiment shocks tend to hit BTC quicker than Forex.

14. Tether (USDT) and USD Liquidity Correlation

Most crypto market participants, let alone retail and institutional market makers, have not realized Tether’s (USDT) issued and redeemed balances are paid and received for real-time USD liquidity flowing into and out of the crypto market.

Market observations, such as those in Hidden Correlations Between Bitcoin and Major Forex Pairs, show Bitcoin rallies while USDT supply increases, suggesting new Tether liquidity is available. USDT’s Forex demand pegged to USD used in Forex volatility also explains demand for USDT supply.

By tracking the on-chain issue and exchange reserves of other crypto market stablecoins, crypto market participants have predictable leading indicators on expected liquidity-driven moves of Bitcoin, insights that are not available in any Forex market.

Correlation Between Tether (USDT) & USD Liquidity Features

- The crypto market begins to witness inflows of USD when USDT is issued.

- Demand for stablecoins is closely linked to BTC.

- Exchange inflows are predictive of a shift in crypto volatility.

15. Long-Term

Stable demand and supply of Bitcoin in the Forex market, especially during international monetary system changes, encourage Bitcoin’s long-term investors and holders to perceive it as a store-of-value and hedge against decaying fiat currency.

Analysis of the Hidden Correlations Between Bitcoin and Major Forex Pairs shows the longer the time frame (i.e. a few years as opposed to a few days or weeks), Bitcoin’s performance against fiat currencies becomes more evident. This, coupled with decentralized monetary systems and Bitcoin’s finite supply leading to increased adoption, explains the outperformance of Bitcoin in the long-term.

Traders using a fiat currency as a means of payment to buy Bitcoin benefit as the correlation increases within periods of time. especially as more investors use Bitcoin and allocate it as a fiat currency diversification tool.

Long-Term Store-of-Value Behavior Features

- Over longer multi-year periods when BTC is measured against fiat, BTC will perform better.

- BTC is seen by institutions as a hedge against the diminishing value of currency.

- Bitcoin is more likely to be adopted in worse economic scenarios.

Risk & Consider

Correlations Can Break Unexpectedly

In certain market cycles, Bitcoin and currency pairs may seem to be correlated, but will swiftly decouple because of crypto news, shocks to liquidity, or regulation.

Extreme BTC Volatility Will Magnify Losses

Crypto’s aggressive price fluctuations will cause mispricing risk on correlated pairs Forex market pairs, because the Forex market moves are more tightly range bound. Hence, the risk of loss on correlated pairs will be far more excessive during BTC volatility spikes.

Overrelying on Macro Sentiment Signals

Bitcoin doesn’t always fit the risk-on/risk-off market narrative. It can behave like a risk asset one week and then flip to a safe haven the next.

Mismatched Liquidity Between Markets

In Forex, trades operate under deep institutional liquidity. In crypto, liquidity can dry up and cause slippage and false correlation.

Central Bank Policies Affect Forex More Strongly

BTC will respond much slower to moves because of interest rate policies, making misalignment of Forex driven strategies on BTC more likely.

Conclusion

The relationship between Bitcoin and the major Forex pairs shows the integration of global markets and how interconnected they have become. Strength of the coin, inflation, shifts in global liquidity, and global liquidity all affect the price of Bitcoin.

Knowing the hidden correlations in between Bitcoin and the pairs of major Forex assists in price prediction, managing risk, and positioning passively in the market during macroeconomic events.

Correlations change in no time, but integrated cross market analysis combined with risk management creates market confidence to withstand shifts. Bitcoin and Forex are in the same financial ecosystem. The integration of global markets affects how trading will be conducted in the future.

FAQ

Which Forex pair is most correlated with Bitcoin?

Bitcoin often shows the strongest inverse correlation with the U.S. Dollar Index (DXY), affecting major pairs like EUR/USD and GBP/USD due to USD dominance in global markets.

Why do Bitcoin and major Forex pairs show increasing correlations?

As institutions trade Bitcoin using macro strategies, crypto is becoming more influenced by interest rates, inflation, and global liquidity—just like traditional currencies.

Can traders rely on these correlations for consistent profits?

Not always. Correlations can shift quickly due to crypto-specific catalysts such as regulatory news, exchange shocks, and major whale movements. They work best as supportive indicators.