In this article, I will discuss the Best Ways To Research Altcoins which will help you know how to make intelligent investment choices.

The steps outlined here will cover examining a developer’s wallet, token velocity, market manipulation, and more. This will give you the opportunity to assess altcoins beyond the marketing hype and discover their genuine long term value.

Key Point & Best Ways To Research Altcoins List

| Key Point | Description |

|---|---|

| Analyze Developer Wallet Activity | Track transactions from known developer wallets to identify potential insider movements or project developments. |

| Investigate Smart Contract Forks | Monitor forks of existing smart contracts to detect potential copycat projects, improvements, or exploit attempts. |

| Check Blockchain Gas Usage | Analyze gas fees and transaction patterns to identify network congestion, increased activity, or potential bot-driven manipulation. |

| Monitor Insider Job Listings | Review job postings from crypto projects for hints about upcoming developments, partnerships, or internal shifts. |

| Examine Staking and Validator Behavior | Track staking trends and validator actions to assess network security, decentralization, and potential governance risks. |

| Observe Token Velocity | Measure how frequently a token is transacted to evaluate liquidity, market speculation, or long-term holding trends. |

| Assess NFT or Metaverse Integration | Investigate whether a project is integrating NFTs or metaverse elements to capitalize on trends or expand utility. |

| Review Discord and Telegram Moderator Behavior | Monitor admin and mod actions in community chats for signs of project stability, censorship, or upcoming announcements. |

| Analyze Code Deployment Frequency on GitHub | Track GitHub commits and releases to gauge active development and project progress. |

| Cross-Reference Exchange Wallets for Market Manipulation | Compare exchange wallet movements with price actions to detect potential wash trading, pump-and-dump schemes, or whale activities. |

1.Analyze Developer Wallet Activity

Examining the activity of developer wallets is one of the effective altcoin research techniques since it is insightful enough to give information regarding internal matters before they are made public.

Observing the movements of wallets may indicate early stages of token accumulation, team buybacks, or sell-offs which assists investors to gauge the confidence of the investors in a project.

Unlike hype signals, developer transactions are much more reliable and focus on actual financial engagement which makes them a unique signal for measuring a project’s sustainability and its market value impact.

Analyze Developer Wallet Activity Features

- Insider Insights: It is beneficial for developers to keep an eye on wallets as it might hint at a potential insider dealing, for instance big token purchases or sales that show confidence or fear towards the project. Actions of this nature are executed right before a major announcement or network update.

- Project Commitment: Attempted sell-offs that are controlled, or token holdings that are constant, by the developers can signal long-term dedication to the project. Sudden large transfers can signal issues and lack of confidence towards the project long-term.

- Market Sentiment Gauge: The developer’s wallet activity is an informative aspect that reveals how the core team is engaging with the market and helps investors understand the amount of devout speculation as opposed to real development.

2.Investigate Smart Contract Forks

Researching the forks of smart contracts is an efficient method to look into altcoins as it determines if a project is trying to innovate or just copying existing code.

A fork accompanied by substantial improvements indicates positive development, whereas a simple clone suggests a lack of creativity, or worse, a scam.

Investors can evaluate a project’s strength in execution and whether it can survive the long term marketing encompasses and speculatory overpromises by examining code revisions, security patches, and added features.

Investigate Smart Contract Forks Features

- Fake Work vs. Real Work: Understanding smart contract forks helps differentiate between projects that add value versus projects that are picking existing code. An original fork with good modifications or distinct implements indicates there is a greater chance for success, whereas a simple copy is a sign of very little creativity.

- Code Analysis and Acquired Risk: Certainly the created modification of Existing Project C has concealed risks like security breaches and weaknesses due to a poorly executed code. There is a high chance that a forked project with a weak execution will lead the network to additional risks along with its exploits.

- Commitment and Activity Level of Developers: A fork that is under active development and support depicts a healthy working environment. A project’s fork stagnating stagnation shows a lack of active support. Having too much or too little of these aspects might indicate lack of active participation or intervention.

3.Check Blockchain Gas Usage

Evaluating gas consumption on the blockchain can provide much insight into altcoins because it shows the actual network demand and user activities.

High gas prices are often linked to greater use of the blockchain that requires active transactions; this usually means that there is solid utility. On the flip side, low gas consumption may indicate weak utilization or a flat ecosystem.

Trends in gas consumption can determine the real use and market hype, which is a primary indicator when assessing the value of altcoins.

Check Blockchain Gas Usage Features

- Network Demand: High gas consumption shows strong activity on the network, suggesting that the altcoin is used in real-world transactions and has significant adoption levels.

- Transaction Costs: Studying gas fees may give information about the network being oversaturated or having an inefficient structure, which may have ramifications on the project’s scalability and user experience.

- Investor Sentiment: Gas usage patterns tend to correlate with market sentiment—an indicator for determining whether the project has real growth or is only driven by market speculation.

4.Monitor Insider Job Listings

Keeping track of insider job postings is a good way to gather research on altcoins because it provides early indications of a project’s expansion, collaborations, partnerships, or new developments.

Increasing teams are often a sign of ongoing development and deep commitment, while large scale executive hiring may indicate a change in business strategy.

Investors can look at blockchain engineer or marketing lead positions and expect new features, network developments, or new business verticals to be added before the actual announcements are made, thus giving them an edge in market research.

Monitor Insider Job Listings Features

- Indicators of Growth in Projects – Having new job openings indicates expansion and growth which in turn tell us about a project’s sustainability in the long run.

- Change in Strategy – Changing position names to develop in a marketing or blockchain specific role can indicate an intention that would help shift the business in different strategies or innovations.

- Team Cohesion – Regular updates to job posts indicates stability and a robust committed team, while irregular updates suggest internal strife or some ambiguous restructuring.

5.Examine Staking and Validator Behavior

Looking into the activities of validators and staked tokens is a critical method for studying altcoins. This “researching” shows an evaluation of a network’s security, decentralization, and the confidence clients have in the system.

A high percentage of authority staked tokens indicates a strong commitment from the holders, while concentration from a few validators can unmask centralization risks.

Looking too closely at sudden changes in staking trends may also be perceived as a shift in sentiment or a pending protocol change. Through the lens of these considerations, investors can make options regarding an altcoin’s stability and resilience, well-defining the investment beyond the market speculations.

Examine Staking and Validator Behavior Features

- Network Security: Several active stake holders and a variety of validators show that the risk of centralization is low in the network, hence it is secured and decentralized.

- Community Confidence: In most cases, increased staking activity demonstrates the confidence investors have as the holders are actively pledging their tokens for the project’s success.

- Governance Insights: Watching the behavior of certain validators helps to understand if any changes in governance are forthcoming which helps in evaluating the possibility of the project’s ecosystem being transparent and equitable.

6.Observe Token Velocity

Token velocity helps research altcoins because it shows how often a token is traded. Its adoption and utility are measured in its transactions. A high number indicates strong utility in payments or DeFi, whereas a low number could mean that the token is being preserved or it lacks demand.

Investors can then make a distinction between speculative noise and active usage of a token by looking into the transaction patterns to distinguish projects that truly benefit from the market.

Observe Token Velocity Features

- Practical Application: High token velocity suggests active participation in transactions which demonstrate considerable demand and utility.

- Market Analysis: Low velocity can be a sign of token hoarding which demonstrates a certain level investor confidence or a lack of market liquidity.

- Market Sentiment: Volatility in token velocity provides valuable insights into market sentiment highlighting potential trends or speculative activity.

7.Assess NFT or Metaverse Integration

Exploring how an altcoin incorporates NF or metaverse is an excellent way to conduct altcoin research as it shows how a project is positioning itself to benefit from the emerging digital economies.

Authentic adoption portrays innovation and utility while shallow integration mostly indicates trend-obsessed behavior.

Examining business partnerships, platform features, and actual usage activity grants investors the insight needed to determine whether value is being sustainably built or hype is being exploited. This becomes crucial in determining the likelihood of long term growth.

Assess NFT or Metaverse Integration Features

- Innovation and Utility: Real NFT or metaverse implementation shows that a project can innovate, providing real utility outside the scope of speculation.

- Market Differentiation: Effective implementation of the project’s vision distinguishes it within the marketplace, enabling the project to capture new users and investors looking for digital assets.

- Long-Term Viability: Projects with robust use cases in the NFT or metaverse are more likely to sustain growth amidst changes in the digital economy.

8.Review Discord and Telegram Moderator Behavior

Evaluating Discord and Telegram moderators is an efficient means to studying altcoins as it gives an understanding of the project’s visibility, community, and risk.

Skilled active moderators suggest that there is a professional ecosystem while a lot of censorship and abrupt steps suggest other problems. Investors can assess a project’s credibility, developer commitment, and their willingness to support long-term growth by observing how the teams manage questions, criticisms, and project updates.

Review Discord and Telegram Moderator Behavior Features

- Community Engagement: There are professional moderators who maintain proper decorum in the community which helps provide useful information and positivity while also relaying transparency and stability of the project.

- Transparency: It is clear from moderation, particularly from how issues and questions are dealt with, how much a project is ready to expose itself to users.

- Censorship Risk: Cautious members may be viewing extraneous strict moderation, such as sudden member removal. These actions, if unchecked, can begin to show issues with community acceptance.

9.Analyze Code Deployment Frequency on GitHub

The first step of analyzing altcoins research is analyzing the code Deployment frequency of the GitHub repository.

Github repositories with active development always provide updates which translates to ongoing development. Stale repositories most likely indicate lack of development or innovation.

Using those parameters, investors can identify projects with real technological progress from those that only depend on market hype which leads to more informed investment decisions.

Analyze Code Deployment Frequency on GitHub Features

- Active Development: Regularly submitting code reveals consistent enhancement in the project as well as the involvement of a professional team.

- Project Progress: Regular deployments indicate that the project is evolving, continuously adding new functionalities, or fixing underlying problems.

- Long-Term Commitment: The consistency of updates demonstrates promise towards the long-term sustenance of the project, unlike dormant or abandoned ones.

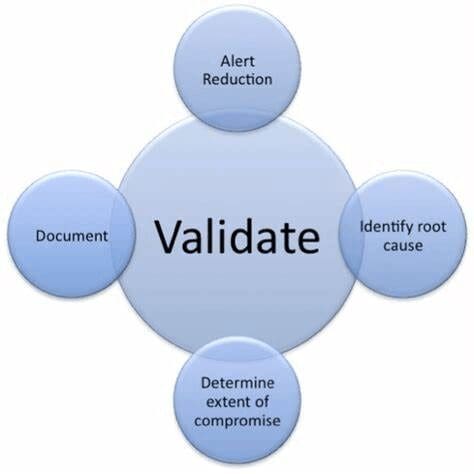

10.Cross-Reference Exchange Wallets for Market Manipulation

Cross-checking trading accounts for any signs of market manipulation will give a very detailed analysis of the altcoins by revealing the trading patterns, including wash trading or price manipulation by large holders.

Investors can spot market manipulation by analyzing wallet movements between different exchanges and their effect on market prices so, this method, in a way, gives a clear picture of the market which helps the investor escape projects that have a constant price that is higher than the true value or is mostly traded by a small group of people.

Cross-Reference Exchange Wallets for Market Manipulation Features

- Integrity of Markets: Analyzing wallets enables the detection of dubious trading activities and patterns like gaming, wash trading, and pump-and-dump schemes which can affect the markets.

- Whale Trade Activity Tracking: Tracking large movements of a few wallets can assist in determining if a small cluster of traders is conducting the price actions for sentiment control.

- Detection of Price Manipulations: Seeing abnormal wallet exchanges between two or more exchanges can reveal efforts of price manipulation, thus keeping the investors safe from deceitfully overpriced projects.

Conclusion

To wrap this up, it’s evident that researching altcoins requires a blended approach involving some level of technical research as well as behavioral research.

Investors can analyze developer wallet activity, the fores of smart contracts, gas usage, nepotism job postings, staking, token velocity, NFT/metaverse modules, moderator actions, GitHub active deployment, and apparent market manipulation to gain comprehensive insight on an altcoin’s potential.

These methods go beyond simply following the market movement or other popular coins, and instead take a more proactive stance in detecting projects with significant sustainable growth.