In this article, I will discuss on the Top Largest Corporate Holders of Bitcoin.

These firms have made investments into Bitcoin with the belief that it could serve as a store of value and a long term asset.

Their significant investment in Bitcoin not only guarantees the future of cryptocurrency, but further cements their role as pioneers of the new digital economy.

Key Point & Top Largest Corporate Holders of Bitcoin List

| Company | Key Points |

|---|---|

| MicroStrategy | Leading business intelligence firm, significant Bitcoin holdings, uses Bitcoin as a treasury reserve asset. |

| Marathon Digital | Bitcoin miner, operates large-scale mining operations in North America, publicly traded. |

| Riot Platforms | Focused on Bitcoin mining, has energy-focused operations, one of the largest miners in the U.S. |

| Tesla | Electric vehicle manufacturer, holds Bitcoin as part of corporate treasury, innovative in tech and sustainability. |

| Hut 8 Mining | One of the largest Bitcoin miners in North America, focuses on scaling operations with renewable energy. |

| Coinbase Global | Leading U.S. cryptocurrency exchange, provides trading and custody services, publicly traded. |

| CleanSpark | Bitcoin mining company with an emphasis on sustainability, using renewable energy for mining operations. |

| Block | Formerly Square, focuses on financial services and technology, active in crypto payments. |

| Galaxy Digital | Crypto investment firm, focuses on digital assets, blockchain, and crypto market infrastructure. |

| Bitcoin Group SE | German investment company, primarily focuses on Bitcoin mining and blockchain-related businesses. |

1.MicroStrategy

MicroStrategy is the largest corporate holder of Bitcoin after its strategic decision to adopt it as its primary treasury reserve asset.

The company began purchasing Bitcoin as a hedge against inflation and for value preservation under CEO Michael Saylor’s leadership in 2020.

Their approach is value added as they continue to construct their balance sheet with Bitcoin on a massive scale, acquiring more than 100,000 BTC, which indicates deep conviction regarding Bitcoin’s potential along with trust in its future value.

MicroStrategy Features

- MicroStrategy Holds A Lot of Bitcoin: MicroStrategy controls the most Bitcoin of any company, with more than 400,000 BTC in its balance sheet.

- MicroStrategy’s Bitcoin As A Reserve: For the company, mitigating the risk posed by inflation and currency devaluation meant adopting Bitcoin as a primary treasury reserve asset.

- Consistent Further Purchases: MicroStrategy is buying more and more Bitcoin, showcasing its faith in the cryptocurrency’s value and growth.

2.Marathon Digital

Marathon Digital is one of the top largest corporate holders of Bitcoin, known for its aggressive Bitcoin acquisition strategy.

The company has advanced machinery which makes it possible to create large amounts of Bitcoin and generates profit from mining.

Marathon holds a distinctive position because the company is committed to not selling its mined Bitcoin, but instead, allows it to reserve. Marathon acquiring Bitcoin as the company mines it has led them to pride themselves on leading reserves.

This phenomenon shows the company’s dominance in trust regarding the protracted worth of cryptocurrency after years.

Marathon Digital Features

- Wide-Ranging Mining Activities: Marathon Digital strategically manages large operational Bitcoin farms, emphasizing mining productivity and growth.

- The Collection of Bitcoins: Rather than liquidating mined bitcoins, the company prefers to store them, enhancing their assets in the process.

- Conservation of Energy: Marathon places a strong focus on eco-friendly sustainable mining by using less power-consuming devices and green energy options.

3.Riot Platforms

Riot Platforms is one of the major corporate owners of Bitcoin primarily as a result of its emphasis on large-scale mining operations.

Subsequently, the firm has invested heavily on energy efficient mining infrastructure which allows it to mine Bitcoin competitively.

In particular, Riot has been focused on increasing its mining capacity while simultaneously possessing significant amount of Bitcoin on its balance sheet, which makes it an important player in the crypto ecosystem.

This approach to operating bitcoins allows the firm to effectively dominate the market in the long run which solidifies its growth strategy.

Riot Platforms Features

- Heavyweight Bitcoin Miner: Riot Platforms, Inc. runs extensive Bitcoin mining operations, making them one of the largest Bitcoin miners in America.

- Bitcoin Reserve Ask: The company keeps a considerable amount of Bitcoin it mines, adding to its appreciation as a long-term asset.

- Prioritization of Energy Riot: Riot is dedicated to environmental responsibility through the employment of energy-efficient technologies and the use of renewable energy sources.

4.Tesla

In the world of cryptocurrency, Tesla is one of the foremost global corporate holders of Bitcoin. Tesla stands out for its innovative approach to technology integration with business.

In 2021, Tesla gained international recognition after buying $1.5 billion worth of Bitcoin. The company positioned a leading asset in the crypto space as a hedge against inflation while also aligning with its innovation-centric strategy.

Another unique element of Tesla’s business strategy is using Bitcoin as a currency for transactions (even though he suspended this practice) demonstrating his belief in cryptocurrency as part of the future of finance where technology, sustainability, and innovation meet and cooperation.

Tesla Features

- Putting Money In Bitcoin Smartly: Tesla spent $1.5 billion on bitcoin with the intention of accumulating it as an asset while simultaneously protecting themselves from inflation.

- Integrating Cryptocurrency: The organization accepted bitcoin payments for their cars for a short period as an expression of faith in the currency’s future.

- Focused On Innovation: Involvement with bitcoin is consistent with Tesla’s innovative character as the company integrated new technologies into its investment strategies.

5.Hut 8 Mining

Hut 8 Mining is one of the few corporations who have over $11 Million worth of Bitcoin in their wallets. They focus on scalability and sustainability practices in green energy Bitcoin mining.

The company uses renewable energy which enables Hut 8 to position itself as an eco-friendly leader in the industry. Hut 8’s unique strategy is based on conservative finance, where the firm retains most of the Bitcoin it mines with the vision of maximally increasing shareholders’ value through Bitcoin.

This commitment to both growth and sustainability sets Hut 8 apart in the competitive mining space.

Hut 8 Mining Features

- Sustainable Mining: Hut 8 Mining emphasizes the use of green energy in its Bitcoin mining operations, demonstrating a high level of environmental concern.

- Bitcoin Accumulation: The company has an increasing reserve of mined Bitcoins since they hoard the mined Bitcoins.

- Large-Scale Operations: Hut 8 aims to maintain optimal production and growth as they operate one of the largest facilities for Bitcoin mining in North America.

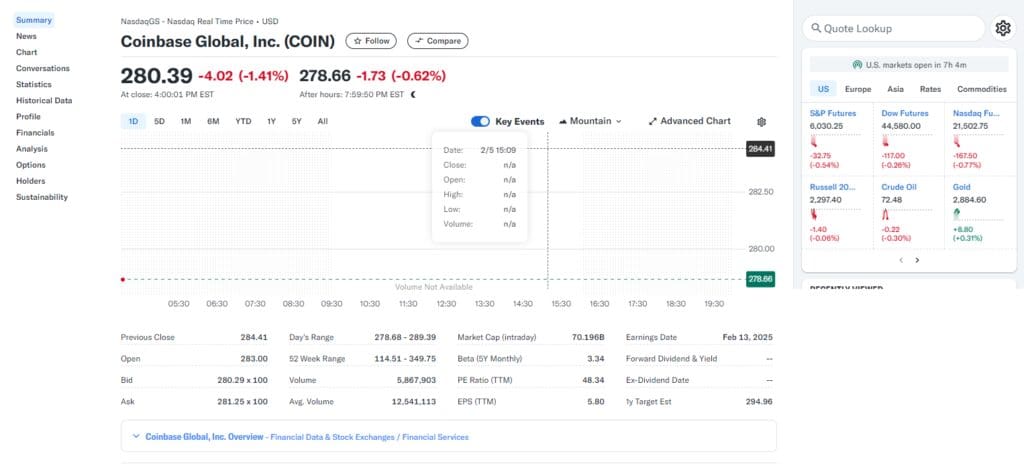

6.Coinbase Global

Coinbase Global is one of the world’s largest corporate holders of Bitcoin, amassing vast amounts owing to its status as a leading cryptocurrency exchange.

As a listed company, Coinbase has considerable amounts of Bitcoin on its balance sheet for trading and liquidity purposes.

It’s unique position is a consequence of it’s trading services, custodial services, and services for institutional investors, which makes it a prominent player in the ecosystem of Bitcoin as its supporting the growth of the crypto currency and Bitcoin in particular.

Coinbase Global Features

- Top Crypto Exchange: On Coinbase’s large-scale use, a single user can buy, sell and store Bitcoin, irrespective of time with millions of transactions occurring every day.

- Bitcoin Balance: The organization keeps large volumes of Bitcoin on its books in notion of doing business as well as tax planning.

- New Business Lines: Coinbase expands the scope of its participation in the crypto ecosystem by offering custody services and trading for institutional clients.

7.CleanSpark

CleanSpark is the top company holder of Bitcoin and is well-known for its sustainable Bitcoin mining.

The company is a pioneer in renewable energy crypto mining through the integration of solar energy into its mining operations.

CleanSpark’s innovative approach of increasing Bitcoin acquisitions while simultaneously reducing carbon emissions makes the company a leader in sustainable environmental practices and cryptocurrency growth.

It is this unique combination that drives its tremendous success in the market.

CleanSpark Features

- Mining Innovations: CleanSpark drives renewable energy use in Bitcoin mining, harnessing the power of the sun to fuel its operations.

- Holding Company Assets: CleanSpark preserves most of the mined Bitcoin, which subsequently bolsters the company’s emerging value as time passes.

- Established Increase in Efficiency: CleanSpark has increased its operational mining power with a continued focus on energy conservation and ecological stewardship.

8.Block

Previously referred to as Square, Block has integrated itself into the corporate Bitcoin ecosystem.

Under the direction of Jack Dorsey, the company has incorporated Bitcoin into its financial services by allowing users to buy, sell, and spend Bitcoin on the Cash App.

Block stands out through its investment in Bitcoin as a part of its treasury management strategy because of its aim to promote deeper levels of financial inclusion, making it one of the most innovative firms in the crypto industry.

Block Features

- Integration of Bitcoin: Block (previously known as Square) allows users to transact in Bitcoin via its Cash App, meaning they can buy, sell, and spend Bitcoin at their convenience.

- Accounting Investment in Bitcoin By Corporations: The company is confident in the cryptocurrency market and, in turn, holds Bitcoin as put in the corporate treasury.

- Advances in Block Payment Technology: Block boosts financial inclusion as well as new payment methods by using Bitcoin and recognizes its innovation potential within the established financial ecosystem.

9.Galaxy Digital

Driven by the focus on digital asset and blockchain technology, Galaxy Digital is one of the top largest corporate holders of Bitcoin.

As an investment firm specializing in cryptocurrency, it provides numerous services, such as trading, asset management, and even venture capital.

The firm’s proprietary strategy is to use its expert knowledge to manage a diversified portfolio of Bitcoin along with other digital assets which helps the firm to be one of the leaders in the increasing cryptocurrency market and demonstrates the firm’s substantial conviction towards the value of Bitcoin in the future.

Galaxy Digital Features

- Investment in Cryptocurrency: Galaxy Digital is focused on investing in digital assets like Bitcoin. They manage a broad portfolio containing different assets.

- In-Depth Services: The company’s deep involvement in the Bitcoin sphere is further enhanced by the provision of trading, asset management as well as venture capital services.

- Tactical Reserves Of Bitcoin: Galaxy perceives Bitcoin as crucial for long-term growth and, therefore, holds significant amounts.

10.Bitcoin Group SE

Germany-based Bitcoin Group SE is one of the world’s largest corporate holders of Bitcoin because of its strategic investment focus on Bitcoin mining and other blockchain-related activities.

The company engages in large scale Bitcoin mining and maintains significant reserves of Bitcoins on its balance sheet.

This strong market position is a result of the company’s diversified business model which encompasses mining, trading and blockchain technology development, making it a leader in the European crypto market and proving the company’s faith in the future of Bitcoin.

Bitcoin Group SE Features

- Bitcoin Mining Leader: As one of Europe’s largest Bitcoin mining companies, Bitcoin Group SE is increasing its market presence by operating a significant mining farm.

- Bitcoin Reserves: The corporation’s assets include a large reserve of Bitcoin which was obtained through the company’s mining activities.

- Blockchain Investments: In a bid to deepen its footprint in the cryptocurrency industry, Bitcoin Group SE has diversified its investments to include blockchain technology and other associated entities.

Conclusion

To sum up, corporate holders of Bitcoins like MicroStrategy, Marathon Digital, Tesla, Coinbase, and so forth comprise a heterogeneous group of corporations that view Bitcoin as both an inflation hedge and a strategic asset.

These firms are uniquely committed to Bitcoin for its prospective future value, be it through large-scale mining, sustainable business operations or through cryptocurrency-assisted business models.

Collectively, these firms’ belief in the future of Bitcoin demonstrates the cryptocurrency’s increasing significance in the global economy.