In this article, I will discuss the Best Stable Coins On Tron Network blockchain and their unique offerings.

Tron has been integrated with several stablecoins, including USDT, USDC, TUSD, USDJ, DAI, and many others.

The fast and cheap transactions on the Tron blockchain makes it a perfect option for stablecoins. Each stablecoin provided serves its unique purpose for traders, DeFi services, and global payments.

key Point & Best Stable Coins On Tron Network List

| Stablecoin | Issuer / Backing | Blockchain(s) | Peg Mechanism | Notable Features |

|---|---|---|---|---|

| USDT (Tether) | Tether Ltd. / Fiat-backed | Ethereum, Tron, Solana, others | Centralized | Most widely used stablecoin |

| USDC (USD Coin) | Circle & Coinbase / Fiat-backed | Ethereum, Solana, others | Centralized | Regularly audited, strong compliance |

| TUSD (TrueUSD) | Archblock / Fiat-backed | Ethereum, Tron, BSC, others | Centralized | Real-time attestations |

| USDJ | TRON ecosystem / Collateral-backed (JUST platform) | Tron | Decentralized | Backed by TRX collateral |

| Dai (DAI) | MakerDAO / Crypto-backed | Ethereum | Decentralized | Collateralized by multiple assets |

| sUSD (Synthetix USD) | Synthetix / Crypto-backed | Ethereum | Decentralized | Backed by SNX collateral |

| USTC (TerraClassicUSD) | Terra Classic (formerly LUNA) / Algorithmic | Terra Classic | Decentralized | Failed peg, speculative use now |

| FRAX | Frax Finance / Partially algorithmic | Ethereum, others | Hybrid | Fractionally backed stablecoin |

| HUSD | Stable Universal / Fiat-backed | Ethereum | Centralized | Depegged and discontinued |

| QUSD (QCash) | QCash Foundation / Fiat-backed | Ethereum | Centralized | Mostly used in Chinese markets |

1.USDT (Tether)

USDT (Tether) is the best stablecoin on the Tron network due to its speed, low fees, and high adoption rate. USDT on Tron (TRC-20) enables virtually instant transfers unlike Ethereum based stablecoins.

USDT’s vicinity and heavy integration with numerous exchanges and wallets improves usability.

Trons scalable architecture guarantees efficient processing of vast transaction sums which provides USDT with the status of the best performing soft currency on the blockchain in regard to speed and volume.

| Feature | USDT (Tether) |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

2.USDC (USD Coin)

USDC USD Coin is one of the best stablecoins on the Tron network due to its regulatory transparency, security, and efficient transactions.

One of the reasons why USDC is better than other stablecoins is that USDC is issued by Circle which is audited regulary. This USDC Trust is further enhanced by strong compliance and regulation. On Tron TRC-20, it enjoys rapid transfers with ultra low fees.

This makes it ideal for payments, DeFi, and cross border settlements. Its USDC adoption on Tron allows easier access without losing full fiat backing, making it a great alternative for reliable and low cost blockchain based financial transactions.

| Feature | USDC (USD Coin) |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

3.TUSD (TrueUSD)

With full fiat backing, TUSD (TrueUSD) is unmatched to the current leading players in the Tron network because of its effective on-chain attestations made in real-time.

Unlike other stablecoins, TUSD’s reserves are verified using independent audits, thus enhancing trust and providing greater security. It is also very affordable to trade, make payments and participate in DeFi functions because it has efficient on Tron (TRC-20).

Tron TUSD has increased liquidity on the network through its integration which allows for virtually flawless and cheap transactions on the blockchain, giving the digital dollar a verifiable and stable value.

| Feature | TUSD (TrueUSD) |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

4.USDJ

USDJ is the most reliable stablecoin on the Tron ecosystem, given that it is backed by TRX collateral on JUST platform.

Unlike stablecoins issued on a fiat basis, USDJ is created on a decentralized CDP (Collateralized Debt Position) model so as to do away with the reliance on traditional banking systems.

It features fast and inexpensive TRC-20 transactions which makes it great for DeFi services.

USDJ serves users looking for a decentralized stablecoin through its algorithmic stability mechanisms which facilitate maintenance of the coin’s peg to a United States dollar.

| Feature | USDJ |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

5.Dai (DAI)

DAI stands out among the decentralized stablecoins on Tron because of its multi-collateral backing and algorithmic stability. Supported by crypto rather than fiat, DAI is over-collateralized which offers strength against centralization risks.

Additionally, on Tron, it benefits from fast, low-cost transactions which helps preserve it’s full de-centralization.

The absence of central authorities such as banks or regulators makes it an appealing option for DeFi, and provides great security and strength to the Tron ecosystem.

| Feature | Dai (DAI) |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

6.sUSD (Synthetix USD)

Synthetix USD, or sUSD, is one of the best stablecoins on the Tron network due to its unique mechanism: synthetic assets.

Unlike traditional stablecoins, sUSD is minted through Synthetix’s decentralized protocol, which is backed by crypto assets instead of fiat reserves.

On Tron, it provides fast, low-cost transactions and effortless dApp integration. sUSD allows users to maintain a stable value while gaining exposure to synthetic assets; this feature makes it an innovative and decentralized solution for blockchain-based financial applications.

| Feature | sUSD (Synthetix USD) |

|---|---|

| Blockchain | Ethereum (ERC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low transaction fees |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

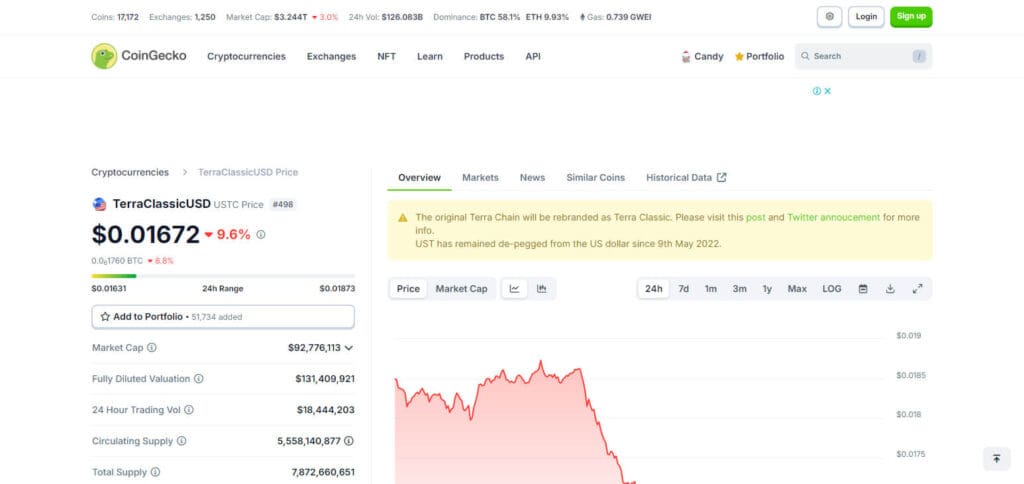

7.USTC (TerraClassicUSD)

USTC (TerraClassicUSD) is still recognized as a distinct stablecoin on the Tron network due to the rest appeal brought about by its integration with decentralized applications.

Even though it has lost its original peg, USTC is still able to transact on Tron (via cross-chain bridges) at a reasonable speed and low cost which makes trading during times of volatility appealing.

Unlike purely fiat backed stablecoins, it’s algorithmic model used to allow for a decentralized one, but that is no longer the primary use. Even though its primary use has changed over time, USTC is still actively traded and utilized in some DeFi environments on Tron.

| Feature | USTC (TerraClassicUSD) |

|---|---|

| Blockchain | Terra Classic |

| Stability | Pegged to USD |

| Transaction Fees | Low transaction fees |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

8.FRAX

Frax is considered one of the best stablecoins on the Tron network due to its unique blend of collateral backing and algorithmic stability.

Unlike fully collateralized stablecoins, FRAx dynamically adjusts its collateral ratio based on market conditions which ensures efficiency and optimization of capital.

This cross-chain deployment enables the use of cheaper, faster transactions, making it ideal for DeFi use cases. The combination of these characteristics improves liquidity and stability in the ecosystem of Tron.

| Feature | FRAX |

|---|---|

| Blockchain | Ethereum (ERC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low transaction fees |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

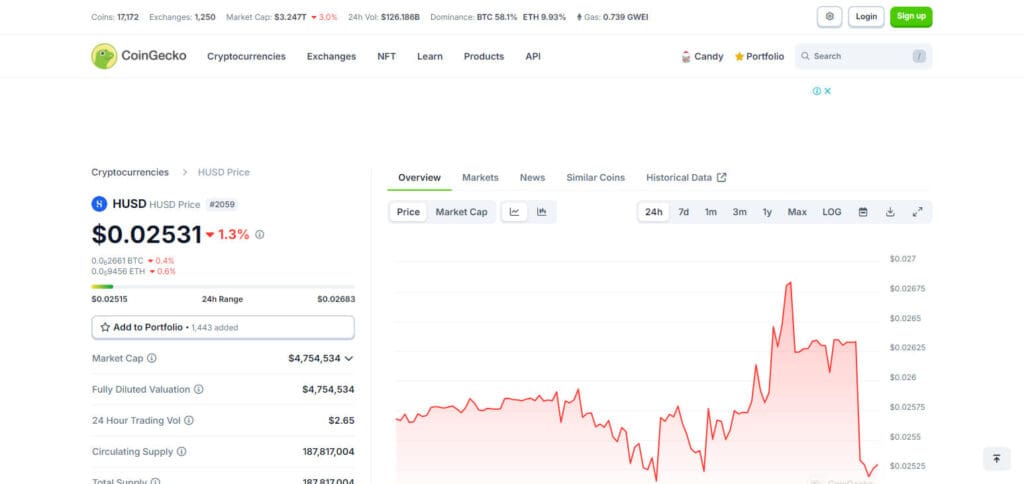

9.HUSD

HUSD’s stablecoin promise on the Tron blockchain was appealing because of its compliance with regulations and full fiat backing. Because HUSD focusded on reserve management as opposed to other stablecoins, it was easy to maintain the peg.

Moreover, unlike most coins, it had the capability of offering extremely cheap, quick TRC-20 transactions which made it a viable option for DeFi and payment services.

Its usage dwindled after it faced liquidity issues and was eventually delisted. Now, because HUSD is no longer available, users have switched to other stablecoins that are more actively used, even though it was a great option for offsetting market volatility.

| Feature | HUSD |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

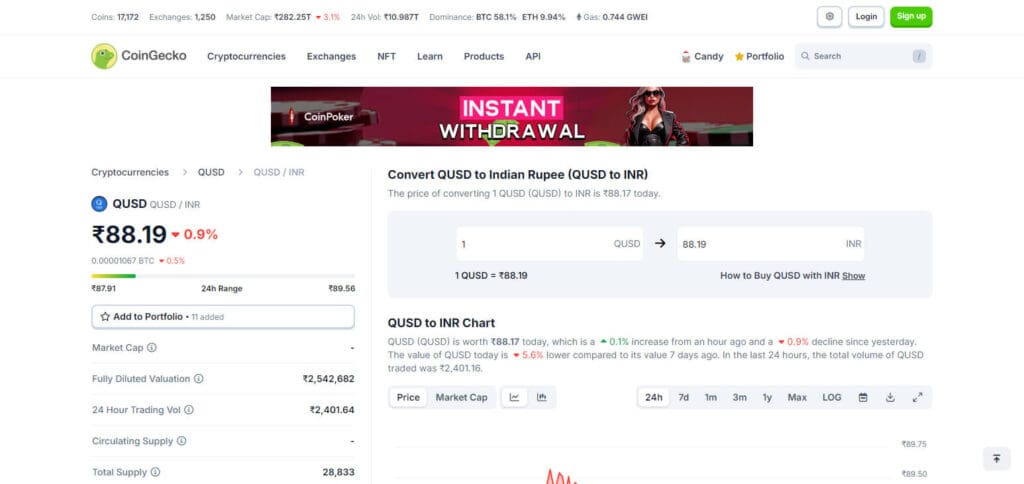

10.QUSD (QCash)

QUSD (QCash) stands out as one of the most robust stablecoins on the Tron network due to its heavy presence in Asian markets and quick connect with Financials.

Unlike most global stablecoins, QUSD is mostly utilized in China’s digital finance ecosystem which increases its worth for local transactions as well as for cross-border dealings.

QUSD is a TRC-20 token which means it can be transferred swiftly and cheaply on the Tron network, increasing its use. Due to its wide adoption and demand in the region, it has become a dominant player in Asia-focused blockchain finance.

| Feature | QUSD (QCash) |

|---|---|

| Blockchain | Tron (TRC20) |

| Stability | Pegged to USD |

| Transaction Fees | Low or zero transaction fees on the Tron network |

| Speed | Fast transactions, typically under a minute |

| KYC Requirements | Minimal KYC required for most transactions |

| Use Cases | Trading, remittances, payments, and DeFi applications |

Conclusion

Various types of stablecoins can be hosted on Tron Network, with USDT (Tether) having the highest adoption and liquidity and USDC being regulatory compliant.

Furthermore, TUSD guarantees real time attestations, USDJ provides a captured alternative, and Zephyr, DAI, sUSD enhance the defi ecnomic potential with crypto collateralized models. FRAX pioneer an innovative fractional algorithmic model.

While USTC and HUSD sustain the relevance in some niche markets, they have struggled with other issues. Finally, QUSD plays an important role in Asian finance.

Tron network is essential for international blockchain adoption due to its swift transactions and low cost of operating these stablecoins.