In this post, we will analyze the Yield Aggregator Platforms To Watch that I consider as the most appealing candidates for 2025. Yeild Aggregator Platforms optimize and manage DeFi farming strategies automatically which enables users to earn more with less work.

These include familiar names such as Yearn Finance and Beefy, but also new players like Sommelier and Reaper Farm. These and other aggregators help automate passive income earning strategies within DeFi and offer effective, auto-compounding approaches.

Key Points & Yield Aggregator Platforms To Watch

| Platform | Key Point |

|---|---|

| Yearn Finance (YFI) | Automated DeFi yield farming strategies with vaults optimizing returns. |

| Beefy Finance (BIFI) | Multi-chain yield optimizer offering auto-compounding vaults for various assets. |

| Autofarm (AUTO) | Cross-chain yield aggregator with auto-compounding and vault strategies. |

| Harvest Finance (FARM) | DeFi yield farming platform with automated strategies and reward distribution. |

| Idle Finance (IDLE) | Automated yield rebalancer offering both risk-adjusted and fixed-income DeFi strategies. |

| Sommelier Finance (SOMM) | DeFi yield optimization protocol with automated rebalancing powered by co-processors. |

| Reaper Farm | Fantom-based yield optimizer with auto-compounding and multi-strategy vaults. |

| Convex Finance (CVX) | Boosts yields on Curve Finance by aggregating CRV staking and rewards. |

| Pickle Finance (PICKLE) | DeFi yield aggregator that optimizes farming rewards and reduces gas fees. |

| Yield Yak (YAK) | Avalanche-based auto-compounding yield optimizer with low fees and optimized returns. |

1. Yearn Finance (YFI)

Yearn Finance is one of the leading Ethereum DeFi yield aggregators that automates yield farming with Vaults that move funds between Aave, Curve, Compound, and other protocols to help earn the maximum returns.

Yearn’s automated compounding removes the user’s burden of manual rebalancing, which guarantees efficiency.

The YFI token is the governance token and its holders have the right to vote on the platform’s decisions and share in the protocol’s revenue.

For both retail and institutional investors, Yearn is often sought after due to its high-yield with low-maintenance strategies.

Yearn Finance (YFI) Features

- Automated Vaults: Uses DeFi protocols to cross-chain, thus optimizing yield.

- Ethereum-Based: Focused on Ethereum and uses protocols like Aave, Compound, and Curve.

- Fee Sharing: The holders of YFI tokens share a portion of the platform’s fees.

- Governance: Decisions concerning governance with YFI are voted on by its holders.

- Low Maintenance: No active management. Provider performs compounding and rebalancing.

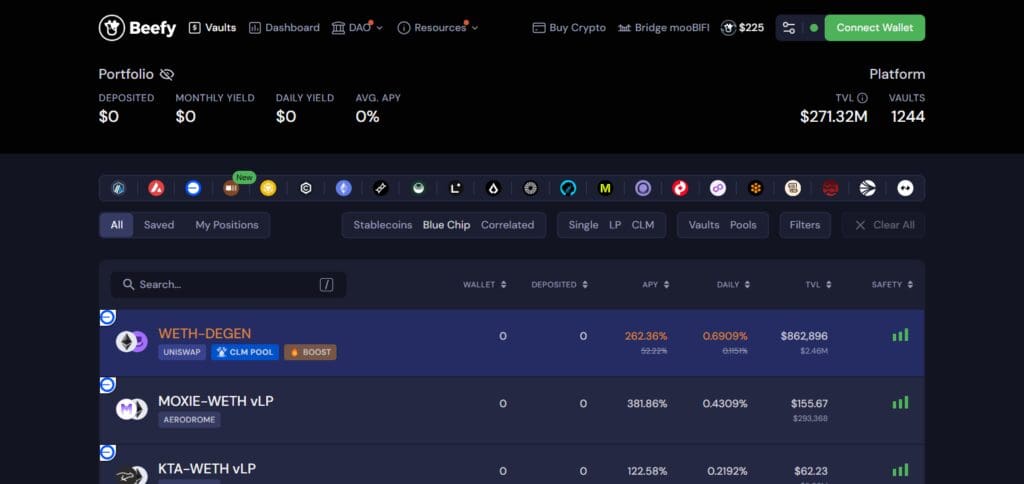

2. Beefy Finance (BIFI)

Beefy Finance is a decentralized finance platform that has auto-compounding vaults and offers multi-chain yield optimization. It works on Avalanche, Polygon, and Binance Smart Chain (BSC), helping to expand beefy’s reach.

Its vaults automatically reinvest farm rewards, greatly increasing APY while reducing work for the user.

Its governance and revenue sharing token is the BIFI token. The low fee and cross-chain support make beefy a go-to DeFi platform for users looking for varied multifarming opportunities.

Beefy also forms highly effective vault strategies through partnerships with other protocols, making it a top choice for multi-chain yield farming.

Beefy Finance (BIFI) Features

- Multi-Chain Support: Available on BSC, Avalanche, Polygon, etc.

- Auto-Compounding Vaults: Reinvests rewards automatically to boost APY.

- Low Fees: Transaction cost is lower because of optimized strategies.

- Profit Sharing: Comprising fees of the BIFI holders earn the platform’s profits.

- Governance: Decisions concerning protocol are voted on by BIFI holders.

3. Autofarm (AUTO)

Like other cross-chain yield aggregators, Autofarm optimizes and compounds returns for users on bimodal protocols such as BSC, Polygon, and Fantom.

Users can maximize returns with gas-efficient rewards reinvestment in Autofarm’s Vaults, which lower gas fees and increase APYs.

The platform’s DEX aggregator also ensures users receive the most favorable token swap deals possible.

The AUTO token, which also acts as the governance token of the platform, allows holders to vote on numerous platform decisions and receive rewards.

Due to multi-chain accessibility, low fees, and automated farming, Autofarm is one of the most preferred DeFi platforms for users focused on cross-chain yield farming.

Autofarm (AUTO) Features

- Cross-Chain Support: Accessible on BSC, Polygon, Fantom, etc.

- Auto-Compounding Vaults: Reinvesment of rewards is done automatically.

- DEX Aggregator: Swapping tokens on different platforms at different rates is utilized and the best rates are found here.

- Governance: Protocol governance can be voted on by AUTO token holders.

- Low Fees: Transaction costs are cut down by diesel powered strategies.

4. Harvest Finance (FARM)

With integrations in Curve, Uniswap, and SushiSwap protocols, Harvest Finance is an Ethereum-based yield optimizer democratizing farming strategies by pooling user funds.

Furthermore, the automation of reward compilation makes manual intervention redundant. Harvest Finance’s native FARM token, apart from being a governance and platform reward token, provides additional staking incentive.

Harvest Finance is well-known for its market-competitive gas fees which attracts big farmers looking to save on transaction cost.

The platform is also generous when it comes to profit sharing by paying FARM token holders a portion of the platform fees for a more appealing long-term investing model.

Harvest Finance (FARM) Features

- Ethereum-Based: Works well with Curve, Uniswap, and SushiSwap.

- Auto-Farming: Automating yield farming and compounding strategies is known as auto-farming.

- Profit Sharing: FARM token holders share the platform’s fee.

- Governance: Users who hold a FARM token, vote on protocol governance.

- Gas Efficiency: Decreases gas expenditure via transaction bundling.

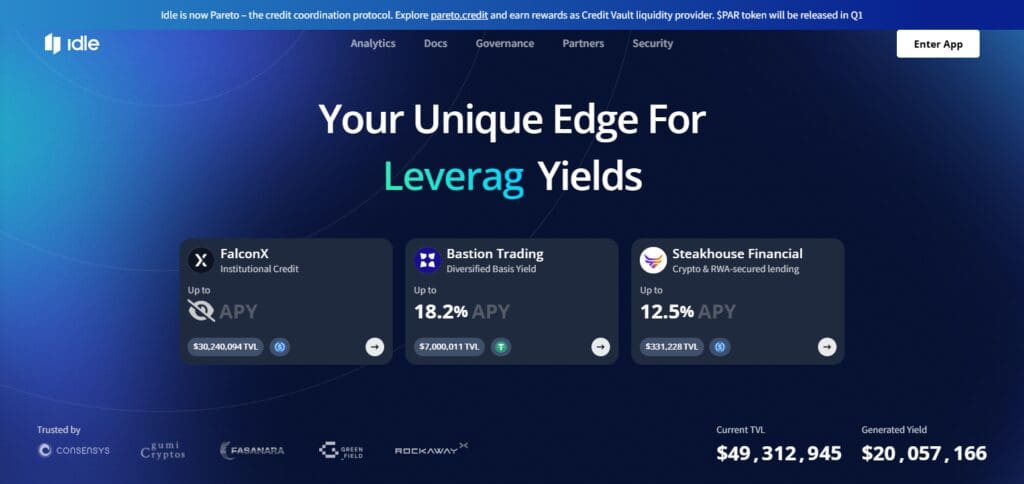

5. Idle Finance (IDLE)

Offering risk-adjusted and fixed-income strategies, Idle Finance is a yield rebalancing platform on Ethereum.

The system reallocates user funds across lending protocols like Aave, Compound, and dYdX, facilitating optimal returns. The best yield strategy offers dynamic APY, while the risk adjusted strategy is more conservative.

Governance powered by the IDLE token lets users vote about the protocol’s modifications and share the protocol’s revenue.

With automated portfolio balancing, Idle decreases the risk while increasing the yield, thus making it best for investors who are looking for passive income in DeFi without actively managing their accounts.

Idle Finance (IDLE) Features

- Yield Rebalancing: Shifts funds from one lending protocol to another automatically.

- Dual Strategies: Both risk-adjusted strategies and fixed-yield strategies are available.

- Multi-Protocol: Works with Aave, Compound, and dYdX.

- Governance: Protocols are voted on by users holding IDLE tokens.

- Fee Distribution: A fraction of protocol earnings is distributed to IDLE holders.

6. Sommelier Finance (SOMM)

Sommelier Finance is an Ethereum and Cosmos based dual-chain yield optimizer. They have made use of co-processors which facilitates the automation and active rebalancing of strategies in DeFi, which makes it more superior than passive ones.

Sommelier aims at maximizing profits and adjusting them to real-time changes in the market. The SOMM token grants governance permission to its holders allowing them to influence decisions concerning protocol’s policies.

Owing to its cross-chain, and automated portfolio management capabilities, along with offering adaptive yield strategies makes Somelier the go-to option for DeFi users wanting intelligent and automated farming.

Sommelier Finance Features

- Dual-Chain: Running on Ethereum and Cosmos.

- Active Rebalancing: Strategy modification is enabled by the use of co-processors.

- Cross-Chain Liquidity: Yield is improved via multi-chain activities.

- Governance: Decision-making is exercised by the holders of SOMM tokens.

- Adaptive Strategies: Strategies change according to market shifts in real-time.

7. Reaper Farm

Reaper Farm is a yield optimizer built on Fantom network that has a range of multi-strategy vaults. The platform boosts the APY by auto-compounding the rewards through harvesting and reinvesting them into the vaults. Reaper is well known for its low fees which makes it affordable for constant compounding.

Its “multi-strategy approach” deploys various protocols for yield integration. Although there is no native token, it associates with other Fantom DeFi projects for better perks.

It is preferred by farmers within the Fantom ecosystem looking for sustainable returns because of the network’s efficient gas usage and rapid transactions.

Reaper Farm Features

- Fantom-Based: Belonging to the Fantom network.

- Multi-Strategy Vaults: Uses multiple protocols to increase returns on investment.

- Auto-Compounding: Rewards are reinvested into the vaults automatically.

- Low Fees: Economical strategies that use little gas fees.

- Rapid Transactions: Transactions are quick and smooth due to Fantom’s low-latency network.

8. Convex Finance (CVX)

During the harvesting season, Convex Finance provides its customers with lucrative CRV token rewards as a yield booster for Curve Finance. It enables liquidity providers to receive boosted returns without having to directly lock CRV tokens.

By aggregating CRV staking, Convex enhances the returns and serves the reward share among Defi stakeholders. The CVX token serves as the governance and staking reward paying token.

This makes it an additional income source. For liquidity providers who want high, passive returns without too much attention, Convex is their goto. Striking high passive returns with minimal effort makes it one of the most popular DeFi platforms.

Convex Finance (CVX) Features

- Curve Booster: Increases the yields of Curve Finance.

- CRV Staking: Increases staking rewards by aggregating CRV staking.

- Governance: Changes in protocol are proposed by CVX token holders.

- Fee Distribution: Revenue from the platform is shared with CVX stakers.

- Liquidity Incentives: Providers of liquidity are given higher APY to motivate support.

9. Pickle Finance (PICKLE)

It is a yield aggregator on Ethereum networks whose primary function is to minimize efforts on farming while optimizing the end result. Instead of providing manual reinvestment, it provides Jars that automatically compound farming rewards.

Alongside these great features, the platform reduces gas costs through transaction bundling. The community that holds the PICKLE token can use it for governance and funding the staking pool while earning the platform’s rewards.

Pickle’s gas-efficient strategies incentivize farmers with high APY expectations. Its innovative farming strategies and return optimization efforts position it well within the DeFi yield aggregation industry.

Pickle Finance (PICKLE) Features

- Ethereum Based: Works on Ethereum and improves yield farming strategies.

- Auto-Compounding Jars: Reinvests rewards without user intervention.

- Gas Efficiency: Bundles and outsources transactions to reduce gas expense.

- Governance: PICKLE holders vote on platform decisions.

- Profit Sharing: Stakers of PICKLE share some of the protocol fees.

10. Yield Yak (YAK)

Yield Yak is an automated yield optimizer on the Avalanche platform that specializes in auto-compounding strategies. It automatically harvests and reinvests farming rewards.

Yield Yak is particularly attractive for passive income earners because of their low-fee policies paired with high automation. Users can stake YAK tokens to receive cashback of profits generated by the platform.

Yield Yak’s highly profitable passive automation combined with Avalanche native support makes it the best yield optimizer on the network for users who prefer cheap farming methods.

Yield Yak (YAK) Features

- Avalanch Based: Exclusively used in Avalanche ecosystem.

- Auto Compounding: Automatically reinvests into rewards pools.

- Low Fees: Transactions are much cheaper on Avalanche.

- Staking Rewards: Holders of YAK share some of the platform revenue.

- Efficient Farming: Custom built for cheap and profitable farming.

Conclusion

Yield aggregators assist in maximizing returns in DeFi by streamlining and automating farming processes, resulting in high efficiency with less input needed from the user. Companies such as Yearn Finance, Beefy, and Convex offer lucrative governance models, which is why customers rely on their strategies.

At the same time, tech-savvy money-managers are also drawn to Sommelier and Reaper Farm, who’s emerging platforms provide complex multi-chain rebalancing features.

As DeFi moves forward, the most important features of yield aggregators will be multi-chain support, low costs and efficient auto-compounding. Noticing the right platforms will give investors the ability to optimize their yield strategies and focus on making profits with DeFi.