In this article, I will explore the Pros And Cons Of Cross-chain Bridging, a method that allows interaction and sharing of assets between different blockchain networks.

With the rise of decentralized ecosystems, bridging solutions have emerged as Interoperability’s utmost prerequisite.

Nonetheless, these solutions, while providing ease of access and extended availability, simultaneously pose a range of threats and difficulties that need to be addressed.

What is Cross-chain Bridging?

Cross-chain bridging refers to the users’ ability to transfer assets or data between different blockchain networks. This process removes the boundaries of isolated blockchains, allowing cooperation between Ethereum, Solana, and Binance Smart Chain.

Cross-chain bridges further improve user experience by permitting the free flow of assets across different networks, thus improving liquidity, scalability, and the overall usefulness of blockchain ecosystems.

Pros And Cons Of Cross-chain Bridging

Pros

Interoperability: Different blockchains are linked together using bridges. Moreover, new tokens and NFTs can now be traded on Solana and the Binance Smart Chain. This interconnection cultivates growth in a ecosystem that is more integrated.

Increased Liquidity: New trading opportunities will attract increasingly higher volumes of assets. Therefore, fragmentation in the market is reduced as assets in chains with significant trading opportunities will now freely flow.

Access to Diverse Ecosystems: Distinct features from different blockchains can be harnessed, such as layer-2 solutions with lower fees or specific DeFi protocls on other chains.

Industry Innovation: Developmers can build dApps that are cross-chain by blending the numerous networks togther. For example: Ethereum security strengthens Solana’s speed.

User Rigidity: Users have full control and flexibility to move to chains that suit according their personal needs. For example to chains with cheaper transaction or faster confirmations.

Cons

Security Risks: Cross-chain bridging are crucial focus of attempts to hacks for different chains. For example billions werer lost because of exploits from Wormhole and Ronin. Funds can be compromised due to smart contracts missing security loopholes or custodial risks.

Bridging Protocals: Wrapped tokens aid speed through delay. However, with high complexity comes failure risk that leads to user wrangling and increased chances for blunders.

Centralized Risks: Numerous bridges utilize some form of centralization or partial centralization like multisig wallets which violate the principles of a decentralized network.

Additional Cost: Transferring data across different chains tends to be overly expensive, particularly on heavily used and busier networks such as Ethereum, which diminishes its appeal.

Latency and Delays: Transactions on cross-chain bridges may take a longer time than chain transactions due to inter-chain validation, which poses a risk to user convenience.

How Does Work Cross-Chain Bridging?

Cross-chain bridging solves the problem of interoperability by allowing the transfer of assets and data across chains. Here’s the process:

Smart Contracts

In the source chain, specific assets such as Bitcoin (BTC) can be “wrapped” into wBTC and later “minted” on destination chains like Ethereum as ERC tokens.

Liquidity Pools

Other bridges have cryptocurrency pools available for direct swapping, meaning users can exchange without locking or minting assets.

Cryptographic Techniques

Advanced cross-chain trust techniques such as zero-knowledge proofs and threshold signatures utilize sophisticated inter-chain verification.

Burn & Mint Mechanism

When users wish to revert their assets to the original chain, wrapped tokens are destroyed, wBTC is relinquished, and native tokens are retrieved.

These methods depend on interoperability protocols & built on consensus algorithm architectures for effective secure cross-chain communications.

Popular Cross-Chain Bridges

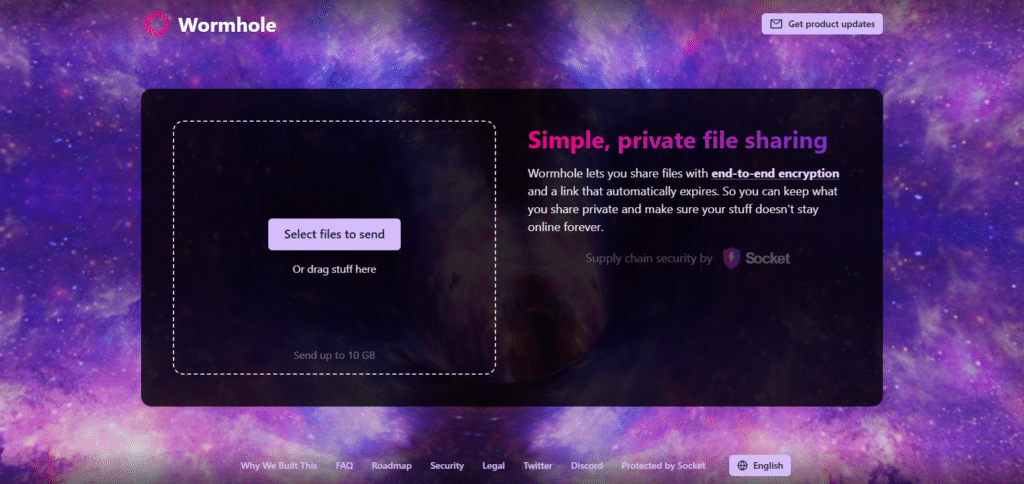

Wormhole

Wormhole is a messaging protocol that is a self-contained system integrating multiple Ethereum-compatible chains like Solana, Avalanche, and BNB Chain. It allows the transfer of tokens, data and NFTs cross-border.

Decentralized trust-based systems, walls of separation, trust scalability, and requiring neither locks nor gatekeepers molds the DeFi and NFT worlds. This cross world functioning transfer bridge operates in the fragments of value and smart contracts chains.

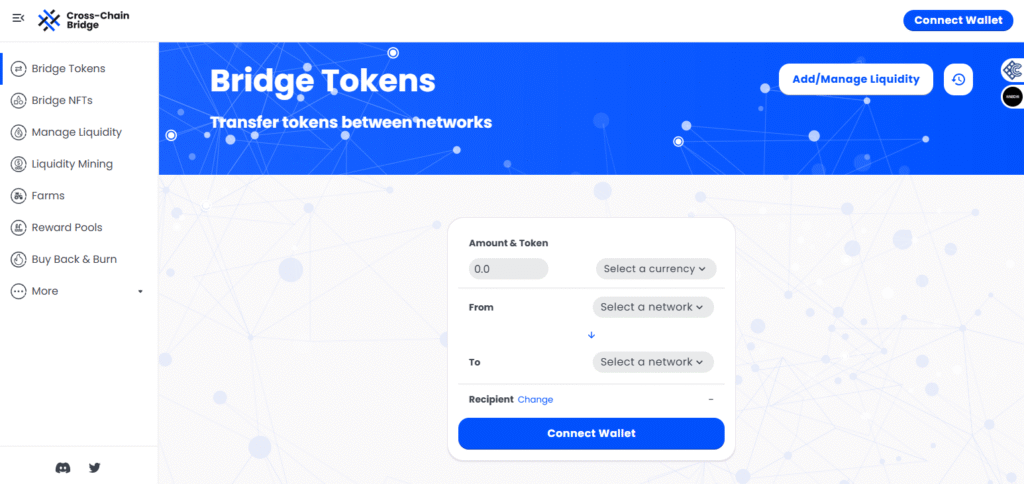

AllBridge

AllBridge aims to integrate EVM compatible chains like Ethereum, Solana, and even Non-EVM chains like Near Protocol. The platform allows users to transaction tokens and wrapped assets in these diverse multi chains.

AllBridge is popular for its interface users shields in the DeFi empty-space. The low-fee impact enables thrust and ease of interest rate yield exploitation across allied ecosystems. AllBridge provides developers a target-rich environment across diversified chains

Synapse

Synapse stands out as a cross-chain protocol enabling secure transfer of assets, token swaps, and smart contract interactions across various chains. With an in-built automated market maker(AMM), it guarantees low slippage fees.

Synapse has network support from Ethereum, Arbitrum, Optimism, and Avalanche hence is considered a go-to bridge for stablecoins and cross-chain liquidity providers. Its security-oriented architecture with rapid execution speeds is the reason it is highly used in DeFi.

ChainBridge

ChainBridge is a particularly adaptable open source bridge by ChainSafe capable of handling custom assets and data transfers between multiple blockchains. It can operate in permissioned and permissionless networks and is considered more versatile than other bridges.

While other bridges are primarily designed to cater numerous users, ChainBridge is often adopted by enterprises and researchers with precise cross-chain solutions. Its developer friendly features along with seamless customization make it perfect for creating tailored integration systems.

Future of Cross-Chain Bridging

The innovative solutions capable of transforming asset transfers and data exchange between networks of differing architectures and standards are yet to be unleashed. This is how the following notable trends are affecting the domain:

Increased Security Protocols: New generation bridging systems greatly invest into strong security to protect against hacking and other forms of fraudulent activities.

Comprehensive-Chain Compatibility: The direction of the industry is progressively headed towards single unifying frameworks which would enable the operation of multi-chain systems concurrently.

Decentralized Apps (dApps): With the use of cross-chain bridges, developers are building dApps powered by the best features of different chains, like Ethereum incorporating and using smart contracts while Solana provides cost-efficient transactions.

Sponsorship Bridges: Issuers of assets like USDC are starting to create their own bridges which will likely replace traditional liquidity swap bridges.

Atomic Swaps and Sidechains: Such approaches are gaining popularity for offering decentralized and flexible cross-chain transaction solutions.

Even with issues like security, expensive expenses, and adoption barriers, improvements are still targeted towards overcoming and addressing these problems.

Use Cases and Applications

DeFi Protocols

As Bridges enable users to access various chains, they eliminate the need for asset conversion.

NFT Transfers

Supports transferring NFTs from one blockchain to another thus enhancing their usability and market.

Gaming and Metaverse

Cross-chain bridges facilitate the transfer of assets (tokens, items) between blockchain-based games and virtual worlds.

Token Arbitrage

Asset bridges enable traders to cross chains with the aim of profit exploitation due to price differences on assets.

DAO Governance

Governance participation in multi-chain DAOs is facilitated through the movement of voting tokens across chains.

Conclusion

In bridging cross-chain ecosystems, users can enjoy DeFi and NFT offerings while gaining flexibility to access different assets. Assets can also be moved across varous Chains thanks to Bridging NFTs.

However, cross-chain activities still pose security risks such as system exploitation, centralization issues, and increased network complexity.

With every technology, its limitations need to be recognized alongside the advantages. This understanding will provide users the security needed in executing cross-chain transactions.