In this article I will discuss the How to Buy Crypto with SEB Bank. You will understand how to connect your SEB account with a crypto exchange, fund your account via SEPA transfers, and buy cryptocurrencies safely.

This guide will assist you in navigating the purchasing process whether you are looking for a trustworthy investment pathway through SEB Bank or are new to crypto entirely.

What is SEB Bank?

SEB Bank, or Skandinaviska Enskilda Banken, is the leading financial group in the South of Sweden, spearheaded from Stockholm.

As a banking institution with deep heritage starting as early as in 1856, it offers unique and distinct banking functions such as personal accounts, corporate loans, investments, as well as accounts for people who have assets with the bank.

They have a well established presence in Northern Europe. Looking at the reputation of the bank, its well known for serving its customers with good quality services, stability and innovation.

The bank serves both individuals and businesses who want modern and reliable ways to manage their finances, focusing on digital platforms and sustainability.

How to Buy Crypto with SEB Bank

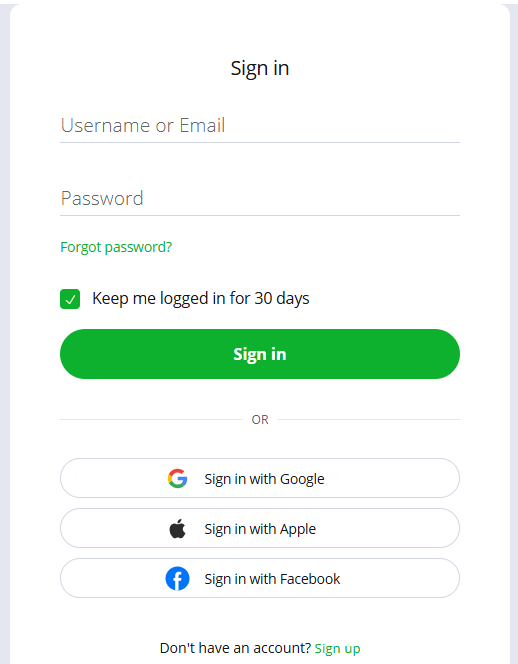

Example: Buying Crypto with SEB Bank via eToro

Step 1: Create an eToro Account

- Head over to eToro and register.

- Complete KYC verification by submitting required documents.

Step 2: Deposit Funds from SEB Bank

- Head to the Funding area in eToro.

- Choose to deposit in either SEK or EUR.

- Select bank transfer option and transfer funds from your SEB Bank account.

Step 3: Buy Cryptocurrency

- Check the list of assets available for purchase, like Bitcoin, Ethereum, Solana, etc.

- Specify the quantity you wish to purchase.

- Confirm the transaction.

Step 4: Secure Your Crypto

- Move your cryptocurrency to a private wallet for added security.

- For long-term storage, consider a hardware wallet.

Other Place Where to Buy Crypto with SEB Bank

Uphold

Uphold serves as an efficient platform to purchase crypto using SEB Bank because of their integration with the European banking system like SEPA transfers. Thttps://coinroop.com/how-to-become-a-tech-influencer/his streamlines account funding from SEB.

What distinguishes Uphold are the clear-cut fees and the capability of consolidating various forms of assets—crypto, fiat currencies, and even precious metals—which caters optimally to a SEB user looking for a convenient multi-functional crypto exchange.

Binance

With SEB Bank, Binance stands out as the ideal choice for buying crypto since it accepts SEPA Transfer, allowing customers to deposit euros directly and at a low cost. Its most exceptional feature is the vast liquidity for hundreds of trading pairs, guaranteeing efficient trading even for large volumes.

For SEB customers, Binance offers low cost when compared to the advanced trading features provided which, coupled with the global crypto market, makes it usable for both novice and expert traders.

Deposit Funds from SEB Bank

To top up your account at the crypto exchange with funds from SEB Bank, please go to the corresponding section of the exchange and select deposit. Choose euro (EUR) and also select SEPA transfer as the method of deposit which is supported by SEB.

The exchange will provide details of the bank including IBAN and some unique reference code. After that sign in to your SEB online banking and begin new SEPA transfer with the provided details. Remember to add proper reference code or else your transfer will be delayed.

Typically transfers take 1-2 business days so after that you will see your funds in your exchange wallet.

Store Your Crypto Safely

Get a Private Wallet

For your own protection and increased safety, keep your cryptocurrency in a personal wallet rather than an exchange.

Select Between Hot and Cold Wallets

- Hot wallets are more accessible as they are software based.

- Cold wallets are hardware devices that guarantee maximum protection while being offline.

Enable 2-Step Verification (2SV)

Protect your wallet and exchange accounts with an additional security layer.

Your Wallet Keys Should Be Backed Up

Backup your wallet keys, keeping seed phrases and private keys, offline in multiple secure locations.

Update Systems Regularly

A consistent update schedule for apps, firewalls, and antivirus software will eliminate any exposed vulnerabilities.

Avoid Disclosure of Sensitive Information

Never tell anyone your private keys or recovery phrases.

Common Issues and Troubleshooting

SEB Blocking Payments to Exchanges

Certain payments to crypto-based platforms may be flagged or completely blocked. Please contact SEB support and verify the authenticity of the payment.

Delayed SEPA Transfer Payment Receipts

As a rule, the payment receipts for SEPA payments take 1–2 working days. In case of delays, check your SEB account and the status page of the exchange for updated information.

Wrong Payment Reference Code

The reference codes with missing or erroneous fragments delay crediting of funds; thus, it is very important to confirm that the SEPA transfer has all the required references.

Restrictions on Deposits of the Exchange

Check that the value of the deposit is not higher than the limit set by the exchange or is within the daily transfer limit set by SEB.

Deposits linked to Accounts not Verified

Unverified exchange account may restrict deposits.

Suspicious Charges on your account for Deposits of other currencies

Ensure to convert currencies to buy using EUR otherwise you might be charged without reason.

Tips Safe For SEB Bank

Use Trusted Crypto Platforms

Use only regulated and reputable crypto exchanges that allow SEPA transfers.

Enable SEB Bank Security Features

2FA, transaction alerts, and biometric login should be enabled for enhanced security.

Avoid Public Wi-Fi

Accessing crypto platforms and SEB Bank should only be done over private and secure internet connections.

Verify Transfer Details Carefully

Confirming SEPA transfers necessitates verification of IBAN, recipient name, and beneficiary codes.

Stay Updated on SEB Policies

Blocked or reversed transactions on crypto may be incurred by not regularly checking the terms of SEB.

Pros & Cons

| Pros | Cons |

|---|---|

| Supports SEPA transfers with low fees | SEPA transfers can take 1–2 business days |

| Strong bank security and fraud protection | Possible transaction blocks on crypto payments |

| Easy integration with European exchanges | Limited direct crypto services by SEB |

| Transparent fees when using SEPA | Some exchanges require full KYC verification |

| Reliable customer support from SEB Bank | Currency conversion fees if not using EUR |

Conclusion

In summary, purchasing crypto with SEB Bank is easy when one uses reputable exchanges which accept SEPA transfers.

If you link your SEB account to a reputable exchange, deposit funds, and complete verification, you can begin your cryptocurrency investing journey.

Always use private wallets and be up to date with bank regulations for security. With sufficient patience and caution, users of SEB Bank can confidently step into the crypto market and handle their digital assets efficiently.