In this article, I will cover the Best Russian Stocks to purchase based on the performance of the leading companies in the energy, banking, mining, and technology sectors.

These stocks Russian capitalist corporations are fundamentally important to the Russian economy as they provide significant growth opportunities, strong dividends, and have great fundamental value.

Besides geopolitical uncertainties, there is significant potential for capital appreciation for growth investors and value investors as well.

| Company | Ticker | Key Highlights |

|---|---|---|

| Gazprom | GAZP.MM | Rebounded to a net profit of $14.8B in 2024 after a $7B loss in 2023; revenue rose 25% to 10.7T RUB; EBITDA increased by 76% to 3.1T RUB; however, the 2025 budget does not anticipate any dividend from Gazprom. |

| Lukoil | LKOH.MM | 2024 net profit declined by 26.5% to 848.5B RUB due to increased taxes; revenue grew to 8.6T RUB; operates in 14 countries as of 2025. |

| Sberbank | SBER.MM | Russia’s largest bank by assets; accounts for about a third of all bank assets in Russia; majority state-owned; maintains a strong presence in the Commonwealth of Independent States. |

| Norilsk Nickel | GMKN.MM | 2024 net profit dropped 37% to $1.8B due to sanctions and lower metal prices; revenue decreased by 13% to $12.5B; EBITDA fell 25% to $5.2B; plans to withhold dividends for 2024. |

| Yandex | YNDX.MM | Russia’s leading tech company, often referred to as the “Russian Google”; offers services in search, e-commerce, and self-driving technology; continues to expand its digital ecosystem. |

| Novatek | NVTK.MM | Launched North Chaselskoye gas field in May 2024 with a capacity of 3 bcm/year; aims to reach LNG capacity of 70 MTPA by 2030; shifting focus to domestic markets amid sanctions. |

| Polyus Gold | PLZL.MM | Reported record EBITDA of $5.7B in 2024, up 49% year-on-year; net income surged 86% to $3.2B; gold output increased by 7% to 3 million ounces; plans to continue paying dividends at 30% of EBITDA. |

| Tatneft | TATN.MM | Fifth largest oil company in Russia; primarily operates in Tatarstan; involved in oil and gas exploration, production, refining, and petrochemicals; revenue amounted to 1.3 trillion RUB in 2022. |

| Rosneft | ROSN.MM | State-owned oil giant; revenue of $93.57B in 2022; net income of $10.11B; debt-to-equity ratio at 67.1%; interest coverage ratio of 17.5x; holds a 49.13% stake in Nayara Energy. |

| PhosAgro | PHOR.MM | Leading global fertilizer producer; benefits from rising food demand and focus on food security; continues to expand its production capacity and global market presence. |

1. Gazprom (GAZP.MM)

With a market size of nearly $32.3 billion, Gazprom (GAZP.MM) seems to be a cornerstone of the Russian stock market operating as one of the world’s largest energy producers and natural gas suppliers.

Also, considering its 16% stake in natural gas reserves, it’s apparent that Gapsrom holds a commanding position on world business. In case you still do not know, Gazprom is turning to profits with long-term marketing contracts to China alongside their strategic pivot towards Asia.

Like other companies, Russian sanctions do affect Gazprom, but not on the level that would make people lose hope. These benefits have enabled Gazprom to offer dividends which might be appealing to investors that are income driven along with averagely good returns and changes throughout the year.

The stock courses do change frequently butand volatility of the currency are raised, so risk aware investors might want to keep these options in mind.

Gazprom (GAZP.MM)

Pros:

- Charged profits from selling gas (synergy) and pipeline network

- Powerful distributor to Europe and Asia

- Substantial support from state and global competitiveness

Cons:

- Mistrust from outside with severe restrictions towards sanction-based trades and sales

- Fluctuation in dividend payments is likely

- Efficiency is less because of state level governance and control**

2. Lukoil (LKOH.MM)

With an integrated portfolio in exploration, production, and refining, Lukoil is one of the largest oil companies in Russia. It has over $45 billion in market capitalization (pre-sanction estimates).

Its international business, including holdings in the Middle East and Central Asia, buffers some of the Russia-specific risks while maintaining a strong focus on operational efficiency and cost control. In 2024, Lukoil remained profitable, paid consistent dividends appealing to income investors, and was resilient in volatile oil markets.

Despite trading restrictions on western exchanges, MOEX listings remain active and Lukoil’s sustained activity in the oil industry makes it a top pick.

Significant risks for the company stem from sanctions restricting access to Western controlled capital and volatile prices of crude oil. For this reason, Lukoil offers a compelling investment for those willing to monitor global energy trends intently.

Lukoil (LKOH.MM)

Pros:

- Has private holders meaning it isn’t exempt from obeying market dictates like state run contracors

- Provides exceptional returns on dividends, and maintains financial resources

- Significant business in 14 foreign markets

Cons:

- Increase in taxation impacts business profits

- Revenue growth restricted due to volatility in the oil market

- Risk class of foreign projects known under the name ‘Russia’

3. Sberbank (SBER.MM)

Having a market cap of roughly 40 billion USD, Sberbank is the most prominent bank in Russia. It heavily invests in digital services, capital management, and fintech. Sberbank is the owner of more than 40% of the retail banking sector in Russia.

It has also invested in e-commerce, cloud computing, and artificial intelligence, which makes Sberbank a tech-driven company. In 2024, Sberbank’s stock prices improved on the MOEX due to earnings and efforts to shift digitally, even though sanctions hindered international dealing.

Sberbank operates with a strong balance sheet dominance in the local market, making for a resilient option, but also faces challenges from currency shifts and increasing regulatory oversight.

Sberbank is an attractive investment in terms of growth and dividends, but the need to navigate carefully within the confines of sanctions makes trading on the MOEX tricky.

Sberbank (SBER.MM)

Pros:

- Operating in the Russian financial market, Sberbank is the most powerful and biggest

- Supports developments in digital banking, fintech

- Achieved stable profits and the level of clientele is wide**

Cons:

- High risk associated with domestic economic situation

- International activity is limited due to sanctions endured

- Political drawbacks because of public stake ownership**

4. Norilsk Nickel (GMKN.MM)

With a $25 billion market capitalization, Norilsk Nickel, the largest nickel and palladium producer in the world, is especially important for manufacturers of electric vehicles and renewable energy sources.

Its Siberian reserves are among the world’s largest, and its commitment to sustainable mining increases its appeal, giving it a further edge as the world’s demande for battery metals increases.

In 2024, Nornickel’s profitability remained strong even with environmental cleanup costs, and its shares held up quite well on the MOEX. The company is able to partially diversify its business through its global export markets.

However, sanctions and logistical problems might interrupt operations. It increasingly looks to investors who can trade Russian stocks with Nornickel as a bet on the shift to green energy, but there is a need for keen surveillance on the situation due to the environment, and geopolitical risks make close monitoring necessary.

Norilsk Nickel (GMKN.MM)

Pros:

- Internationally acknowledged – most powerful platinum and nickel producer

- High demand due to booming electric vehicles and renewable energy targets

- Considerable reserves of minerals associated will guarantee a long period of maintenance**

Cons:

- Restrictions emerging from international coalitions towards sales and trade and exports from partner institutions

- Dividends will be suspended for the year 2024.

- Price volatility of metals continues to be a major risk.

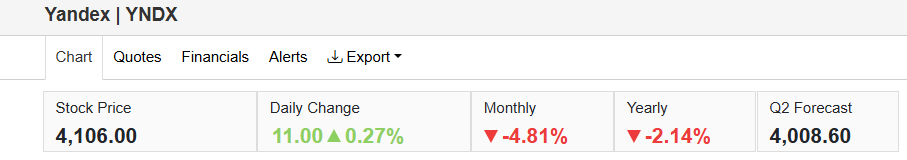

5. Yandex (YNDX.MM)

With a total market valuation close to $10 billion, Yandex is often referred to as “Russia’s Google” because of their undisputed reign over their internet services business, which includes search, ride-hailing, and e-commerce.

In contrast to other Western countries, Yandex maintains a leadership position in AI, cloud computing, and autonomous vehicles which puts it at a favorable position in the Russian digital economy.

In 2024, there was some stock rally on the MOEX which signified some optimism regarding Yandex’s domestic focus and return on investment concerning the sanctions levied on Western technology competitors.

However, the increased regulation along with little potential for international growth overshadowed this optimism. Yandex users on the MOEX might consider the stock due to the company’s innovation and market leadership, but need to be cautious of the Russia technology regulatory environment.

Yandex (YNDX.MM)

Pros:

- The largest technology company in Russia, offering a number of services.

- Considerable market share in AI along with digital advertising.

- Active Improvement in the cloud and mobility sector.

Cons:

- Risks of censorship and regulatory compliance.

- Vulnerable to Western technology competition.

- Earning instability due to current conflicts.

6. Novatek (NVTK.MM)

With a market cap of about $30 billion ever since Arctic LNG 2 was announced as a project, Novatek is one of the leading companies in the LNG sector of Russia. Its low-cost production model along with strategic relations with China and other Asian buyers fuel its expansion in the global LNG market.

Since the commencement of the Ukraine conflict, there have been sanctions that have postponed some projects, but the company focuses on emerging markets and maintains revenue stream stability through long-term contracts.

In 2024, the stock performed well on the MOEX, as global energy demand was on the rise. For the month of March, the stock added around 15% in value as energy prices rose.

Investors with access to Novatek on the MOEX might consider him a strong growth candidate for investment in the energy sector. This does come with some risks from sanctions, conservatively high capital expenditures, and ongoing geopolitical tensions.

Novatek (NVTK.MM)

Pros:

- The foremost exporter of LNG in Russia aspiring towards enormous growth.

- Tecknologically advanced in Arctic LNG projects.

- LNG Producing company with great margins and prospects.

Cons:

- International funding is restricted because of sanctions.

- Large investments to be made.

- Geothermal energy demand uncertainty.

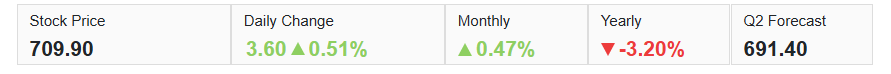

7. Polyus Gold (PLZL.MM)

With a market capitalization of roughly $15 billion, Polyus Gold is the largest gold producer in Russia. The global economic uncertainty benefits Polyus due to the high gold prices.

Moreover, his margins and cash flow are guaranteed due to low-cost mining operations, assets in Siberia and Siberian reserves. Due to high gold prices, Polyus’s MOEX stock among investors increased among investors looking for safe options.

Polyus has maintained operational focus on efficiency, cash flow, andasten gold debt which makes it appealing to investors. However, the low earnings potential due to sanctions on gold export and currency volatility are profit profitability.

Core Polyus traders seem to trade on gold commodities seem like a solid investment opportunity under the condition that gold commodity global trends are monitored appease volatility concerns.

Polyus Gold (PLZL.MM)

Pros:

- The cheapest gold minning company in Russia.

- Profits share dependent on EBITDA.

- Advantages from the rise of gold prices.

Cons:

- Commodities pricing affect heavily.

- Trade and finances will be affected by sanctions.

- Risk of instability associated with Russia.

8. Tatneft (TATN.MM)

With a market cap of approximately $12 billion, Tatneft is one of the most integrated oil and gas producers in Russia, focusing on upstream efficiency. Their assets in Tatarstan and collaborations with international companies aid in maintaining steady production growth.

In 2024, the company’s stock was holding up well on the MOEX and, in my opinion, sought the attention of income investors due to stable oil prices and consistent dividends. Their long-term investments in petrochemicals and renewable energy represent a shift towards diversification.

The company is however exposed to risk due to sanctions restricting technological access as well as volatility in global oil prices. For investors who have access to the MOEX, Tatneft offers a balanced risk-reward proposition, but caution is advised.

9. Rosneft (ROSN.MM)

Sitting at $60 billion market capitalization, Rosneft is ranked the biggest oil producer in Russia. Its Western partnerships in trading along with its large scale upstream and downstream operations aids in fulfilling global energy El demands.

In 2024 it’s state owned MOEX stock rose in value due to high oil demand and government support, which in turn stabilizes its value.

The company’s deemed increase in production capabilities due to Vostok Oil project gives promise for growth, although growth will take time due to stringent state regulation and lack of western capital access.

Geopolitical tensions make it sensitive, but those with trade capabilities on MOEX would find potential in it. Turned value on shares makes it appealing.

Tatneft (TATN.MM)

Pros:

- Self-contained with reliable local backing.

- Excellent dividend ratio and low debts.

- Declining resilient production coupled with downstream refining.

Cons:

- Minimal offshore investment balance.

- Sensitive to changes in domestic oil policy.

- Sanctioned.

10. PhosAgro (PHOR.MM)

With a market cap of 80 billion PhosAgro is on the list of world’s top phosphate-based fertilizers producing company.

The growing international demand for agriculture is beneficial for business. Focus on sustainable fertilizers enable them to capture an emerging global market, meaning vertically integrated operations and easy access to cheap raw materials ensures tighter control on profits.

The company greatly benefitted from increased exports coming from Asia & Latin America in 2024. The focus on PhosAgro on lifeline fertilizers and its low impact from sanctions positions them as a safe bet.

Rosneft (ROSN.MM)

Advantages:

- Among the top crude oil producers in the world

- Support from the Russian government is considerable

- Gaining recognition in Asia and other regions for developing new partnerships

Disadvantages:

- Considerable interference by government in company activities

- Risks related to sanctions for investors

- Issues relating to the environment and corporate governance

Conclusion

To recapitulate, purchasing the stocks of Gazprom, Lukoil, Sberbank, and Yandex provides access to the most relevant areas of the Russian economy which include energy, banking, mining, and technology.

These companies are leaders in their industries because there is abundant domestic demand as well as a lot of natural resources. But, as was already noted, geopolitical conflicts and other sanctions are very important to take into account.

For those investors who consider the long-term investment horizon and are ready to manage these risks, the stocks have good potential value, dividends, and growth opportunities.

Investing into a few of these top Russian companies will provide the balance between stability and opportunity in a volatile and resource abundant region.