In this article, I will cover the Top Rebase Tokens which are a specific class of cryptocurrencies that autonomously modify their supply in response to fluctuations in value to stabilize or achieve certain economic objectives.

These tokens create a new class of FinTech by utilizing elastic supply strategies in order to reinvent decentralized finance and provide novel opportunities for users to engage within DeFi. Let us examine the factors that make these tokens distinctive in the world of digital currency.

Key Point & Top Rebase Tokens List

| Project | Key Point |

|---|---|

| Ampleforth (AMPL) | Elastic supply token that adjusts supply daily based on demand to target $1. |

| Olympus (OHM) | Protocol-owned liquidity and staking model with treasury-backed reserve. |

| Yam Finance (YAM) | Experimental elastic supply token with on-chain governance. |

| Base Protocol (BASE) | Token pegged to the total crypto market cap divided by 1 trillion. |

| Benchmark Protocol (MARK) | Elastic collateral utility token pegged to SDR and VIX volatility. |

| Graviton (GTON) | Multichain liquidity protocol combining DeFi and DAO mechanics. |

| Ditto (DITTO) | Elastic supply token on BNB Chain, pegged to $1 via rebase. |

| KlimaDAO (KLIMA) | Carbon-backed DAO aiming to drive carbon offset demand via DeFi. |

1.Ampleforth (AMPL)

Ampleforth (AMPL) has distinguished itself as one of the leading rebase tokens because of its unique supply elasticity mechanism that adjusts daily in an attempt to keep its price near $1.

Unlike stablecoins which rely on reserves, AMPL’s algorithmic supply modifications are made universally to all wallets, thus preserving proportional ownership.

This feature allows for reduced correlation with traditional assets, enhancing its role as a diversification asset in crypto portfolios and underscoring its unique standing relative to other rebase tokens within decentralized finance.

| Aspect | Details |

|---|---|

| Token Name | Ampleforth (AMPL) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Algorithmic supply adjustments to target $1 price without pegging |

| Unique Point | Supply elasticity that maintains proportional ownership across wallets |

| Rebase Mechanism | Daily automatic supply rebasing across all holders |

| KYC Requirement | Minimal / None for trading and holding |

| Blockchain | Ethereum |

| Primary Use Case | Portfolio diversification and price stabilization |

| Governance | Community-influenced protocol adjustments |

2.Olympus (OHM)

Olympus (OHM) ranks top of the rebase tokens as it was the first to use protocol-owned liquidity,“” distinguishing it from other projects in DeFi. In contrast to most projects that aim for price stability, OHM attempts to create a treasury-backed reserve currency with OHM’s high yield staking rewards, which is backed by a robust ecosystem.

Its distinguishing feature is the bonding mechanism which enables the protocol to obtain and control its own liquidity, lessening the need for outside siphons. This self-sustaining model provides long-term utility value for OHM aside from supply elasticity.

| Aspect | Details |

|---|---|

| Token Name | Olympus (OHM) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Protocol-owned liquidity and treasury-backed currency |

| Unique Point | Uses bonding to acquire liquidity and sustain treasury value |

| Rebase Mechanism | Periodic supply adjustments rewarding stakers |

| KYC Requirement | Minimal / None for staking and trading |

| Blockchain | Ethereum |

| Primary Use Case | Creating a decentralized reserve currency |

| Governance | Community-driven DAO governance |

3.Yam Finance (YAM)

Yam Finance (YAM) is one of the leading rebase tokens owing to its unique experiment of decentralised governance with elastic supply.

What makes YAM unique is the governance model, which is community driven and enables the token holders to make decisions and vote on chain. It intended to defend a target price while incentivizing growth via treasury allocations.

Though it faced several technical challenges in the beginning, YAM received attention for being the first one to introduce governance first rebase model focusing community driven control with flexible monetary policy.

| Aspect | Details |

|---|---|

| Token Name | Yam Finance (YAM) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Combines elastic supply with decentralized governance |

| Unique Point | Community-driven protocol with on-chain voting and treasury management |

| Rebase Mechanism | Automatic supply adjustments to target price stability |

| KYC Requirement | Minimal / None for participation and trading |

| Blockchain | Ethereum |

| Primary Use Case | Experimental governance and adaptive monetary policy |

| Governance | Fully decentralized DAO governance |

4.Base Protocol (BASE)

Base Protocol (BASE) is a leading rebase token as it uniquely connects cryptocurrency with the market sentiment at large. Its value is algorithmically pegged to the total cryptocurrency market cap divided by 1 trillion, giving holders exposure to the entirety of the market’s performance through one asset.

The ability of BASE to adjust according to market trends through a dynamic peg and supply rebasing makes it a distinctive instrument for macro-level speculation in decentralized finance where measurable benchmarks are invaluable.

| Aspect | Details |

|---|---|

| Token Name | Base Protocol (BASE) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Pegged to total crypto market cap / 1 trillion |

| Unique Point | Provides exposure to overall crypto market performance through rebasing |

| Rebase Mechanism | Supply adjusts automatically based on market cap fluctuations |

| KYC Requirement | Minimal / None for trading and staking |

| Blockchain | Ethereum |

| Primary Use Case | Macro-level crypto market exposure |

| Governance | Community-driven governance |

5.Benchmark Protocol (MARK)

Benchmark Protocol (MARK) secures its position among the top rebase tokens by utilizing a dual-peg system which anchors its value to the Special Drawing Rights (SDR) and the VIX. This integration offers novel protection from systemic economic shocks.

MARK’s elasticity in supply modification during periods of volatility makes it more robust under stress conditions. MARK offers the unique capability to provide stable value and respond to volatility simultaneously, making it a multi-purpose instrument for mitigating risks in decentralized finance ecosystems.

| Aspect | Details |

|---|---|

| Token Name | Benchmark Protocol (MARK) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Dual-peg to SDR (Special Drawing Rights) and VIX (volatility index) |

| Unique Point | Supply adjusts based on market volatility and economic indicators |

| Rebase Mechanism | Elastic supply changes responding to volatility and currency stability |

| KYC Requirement | Minimal / None for trading and staking |

| Blockchain | Ethereum |

| Primary Use Case | Risk management and hedging in DeFi |

| Governance | Community-driven via DAO |

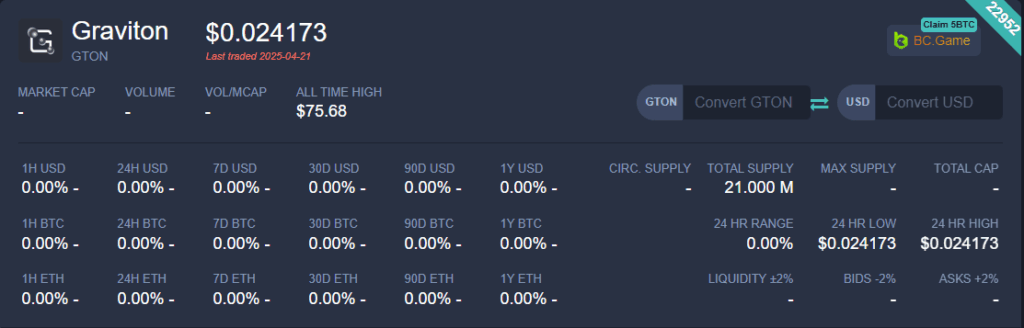

6.Graviton (GTON)

Graviton (GTON) stands out as one of the leading rebase tokens because it attempts to build an overarching ecosystem integrating liquidity mining, cross-chain infrastructure, and decentralized governance. Its multichain asset management capacity and supply balancing through ecosystem-rebasing make GTON unique.

Designed as an active protocol instead of a responsive monetary tool, it becomes a primary building block for scalable DeFi products across diverse blockchains, making GTON a proactive solution ecosystem-deflation adaptable protocol.

| Aspect | Details |

|---|---|

| Token Name | Graviton (GTON) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Multichain liquidity and governance protocol |

| Unique Point | Cross-chain DeFi with adaptive rebasing supply |

| Rebase Mechanism | Supply adjusts to balance ecosystem growth and liquidity |

| KYC Requirement | Minimal / None for participation |

| Blockchain | Multichain (Ethereum, BSC, others) |

| Primary Use Case | Scalable DeFi infrastructure with governance |

| Governance | Decentralized DAO-driven decisions |

7.Ditto (DITTO)

Ditto (DITTO) is one of the top ranking rebase currencies on the BNB Chain for its community-oriented approach to elastic supply. Loreto describes Ditto’s primary differentiator as maintaining minimal user complexity while trying to achieve a soft peg to $1.

Its rebasing replaces balances proportionately, but without the token crafting chaos seen with other assets. Focusing on ease of use, clear expectations, and strong governance drives participation by the community, Ditto makes rebasing for users in DeFi less daunting and more stable.

| Aspect | Details |

|---|---|

| Token Name | Ditto (DITTO) |

| Type | Elastic Supply Rebase Token |

| Core Feature | Soft peg to $1 with proportional supply rebases |

| Unique Point | Simple, predictable rebasing on BNB Chain |

| Rebase Mechanism | Automatic daily supply adjustments across all wallets |

| KYC Requirement | Minimal / None for trading and staking |

| Blockchain | Binance Smart Chain (BSC) |

| Primary Use Case | Stable-value rebase token for easy DeFi access |

| Governance | Community governance with decentralized control |

8.KlimaDAO (KLIMA)

KlimaDAO (KLIMA) stands out among rebase tokens as one of the best examples, as it aligns both economics and environmental impact. Its main innovation is to utilize carbon credits as treasury assets, thus making climate action a DeFi-native activity. In KLIMA’s ecosystem, carbon assets become valuable through rebasing, which rewards users and increases the demand for carbon offsets.

The fusion of sustainability and decentralized finance allows KLIMA to transcend the status of a token; it empowers users take responsibility for environmental issues through participation in the economy and blockchain technology.

| Aspect | Details |

|---|---|

| Token Name | KlimaDAO (KLIMA) |

| Type | Rebase Token / Carbon-Backed DAO Token |

| Core Feature | Elastic supply token incentivizing carbon offset holding |

| Unique Point | Treasury backed by carbon credits, promoting sustainability |

| Rebase Mechanism | Periodic supply adjustments to increase holder rewards |

| KYC Requirement | Minimal / None for participation in staking and trading |

| Blockchain | Polygon Network |

| Primary Use Case | Drive demand for carbon offsets via DeFi incentives |

| Governance | Community-driven DAO with on-chain proposals |

Conclusion

To summarize, AMPL, OHM, YAM, BASE, MARK, GTON, DITTO, and KLIMA demonstrate the diverse objectives that an elastic supply model can achieve, from price stability and market participation to eco-friendly operation and decentralized governance.

With each token added, the DeFi landscape becomes more innovative, reinforcing the notion that rebasing within the blockchain realm goes far beyond a speculative endeavor. It’s a powerful adaptable design strategy for community-governed financial systems.