In this post, I will cover the Top Aggregator To Check Bridging Route Times. These tools enable users to obtain the fastest and most efficient routes for transferring assets from one blockchain to another.

Their automation of cross-chain transactions based on real-time speed and cost data enhances overall efficiency, particularly as the multi-chain ecosystem continues to expand.

Key Point & Top Aggregators To Check Bridging Route Times List

| Name | Key Point |

|---|---|

| Synapse Protocol | Cross-chain interoperability with secure, low-slippage asset bridging. |

| Rango Exchange | Multi-chain DEX aggregator supporting swaps across 60+ blockchains. |

| Celer cBridge | Fast, low-cost token transfers using layer-2 scaling and message routing. |

| Across Protocol | Capital-efficient bridge using single liquidity pools and optimistic relays. |

| Hop Protocol | Rollup-to-rollup transfers with fast bridging and native asset swaps. |

| Stargate Finance | Unified liquidity layer enabling native asset transfers across chains. |

| Allbridge | Simple cross-chain transfers for both EVM and non-EVM blockchains. |

| Arbitrum Bridge | Official bridge connecting Ethereum to Arbitrum with secure rollup tech. |

| RhinoFi | L2-focused bridge offering fast, low-fee swaps and yield access. |

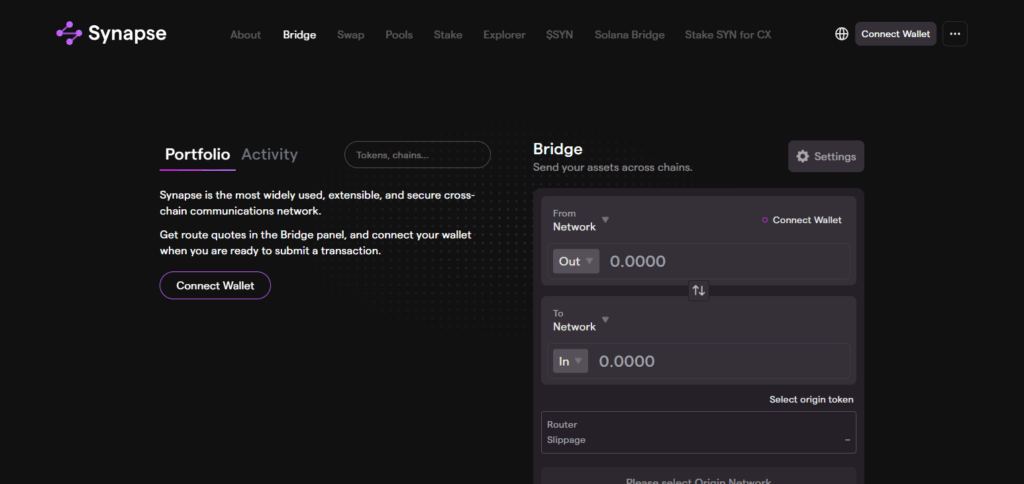

1.Synapse Protocol

Synapse Protocol is one of the leading aggregators to monitor bridging route times due to its smart routing strategy that factors in speed, cost, and security across a range of blockchains. Synapse offers dynamically updated windows into bridge performance, allowing users to select.

ideal routes for transfers across chains and swiftly changing ecosystems. The outstanding interoperability of Synapse is powered with an advanced layer that enables transfers of both assets and messages, thus ensuring low latency and high certainty while traversing complicated blockchain networks.

| Feature | Details |

|---|---|

| Name | Synapse Protocol |

| Type | Cross-chain bridging aggregator |

| Bridging Route Times | Provides real-time estimates for fastest transfer routes |

| Chains Supported | Multiple EVM-compatible chains and select non-EVM chains |

| KYC Requirement | Minimal KYC; mostly no KYC for typical bridging use |

| Unique Point | Low slippage, secure routing, and efficient cross-chain transfers |

| User Interface | Intuitive dashboard with clear bridging time and cost info |

| Security | Audited smart contracts and multi-sig governance |

| Fees | Competitive, with transparent fee structure |

2.Rango Exchange

Rango Exchange is the leading aggregator for checking bridging route times as it consolidates numerous cross-chain bridges and DEXs, providing real-time comparisons across more than 60+ blockchains.

Rango’s innovative algorithm determines the optimal route for asset transfers with the least expenditure, preventing users from expensive fees and unnecessary waiting times. What distinguishes Rango is its functionality of merging both EVM and non-EVM chains in a single interface which offers detailed metrics about route durations and performance prior to executing a swap.

| Feature | Details |

|---|---|

| Name | Rango Exchange |

| Type | Multi-chain bridge and DEX aggregator |

| Bridging Route Times | Real-time comparison of transfer speeds across 60+ blockchains |

| Chains Supported | EVM and some non-EVM chains |

| KYC Requirement | Minimal KYC; typically no KYC for basic bridging and swapping |

| Unique Point | Intelligent routing for fastest and cheapest cross-chain swaps |

| User Interface | User-friendly with detailed bridging time and fee estimates |

| Security | Integrates audited bridges and decentralized protocols |

| Fees | Transparent fees with competitive pricing |

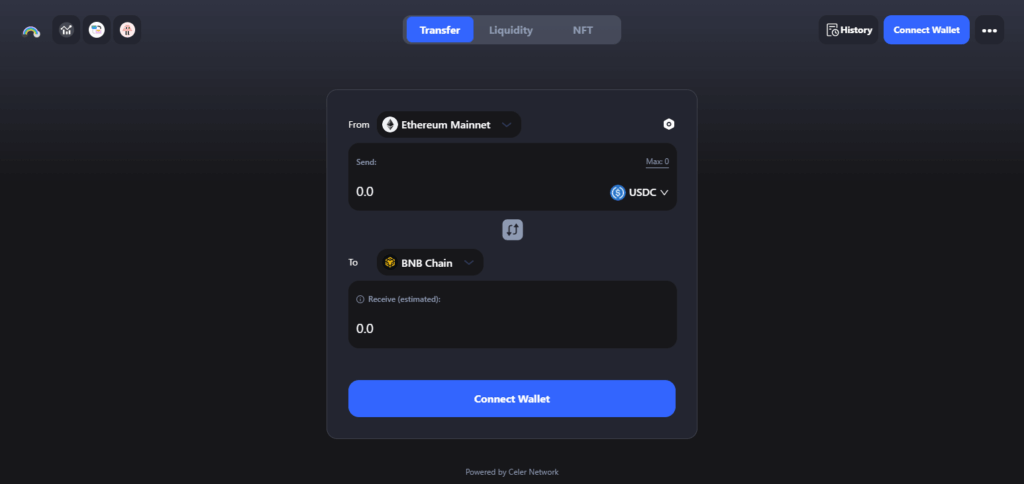

3.Celer cBridge

Celer cBridge has some of the fastest route times for bridging aggregators, because it uses a state channel-based architecture which allows for quick cross-chain transfers. Celer is able to provide near-instant transaction finality and minimal fee transactions through the use of layer 2 scaling and off-chain communication.

What makes Celer stand out is its estimation display of real-time transfer duration which aids users in decision-making for the fastest routes for assets during interchain movements. It is a trusted solution for loading cross-chain operations in cases where time is especially of the essence, because of the way it routs.

| Feature | Details |

|---|---|

| Name | Celer cBridge |

| Type | Cross-chain Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, Arbitrum, Optimism, and more |

| Speed | Fast bridging with low latency route times |

| Fees | Low and competitive bridging fees |

| Security | Audited smart contracts with strong security protocols |

| User Interface | Simple, intuitive dashboard for quick bridge selection |

| Token Support | Supports a wide range of tokens across chains |

| Liquidity Source | Aggregates liquidity from multiple sources for optimal routing |

| Popular Use Case | Token transfers, DeFi asset bridging |

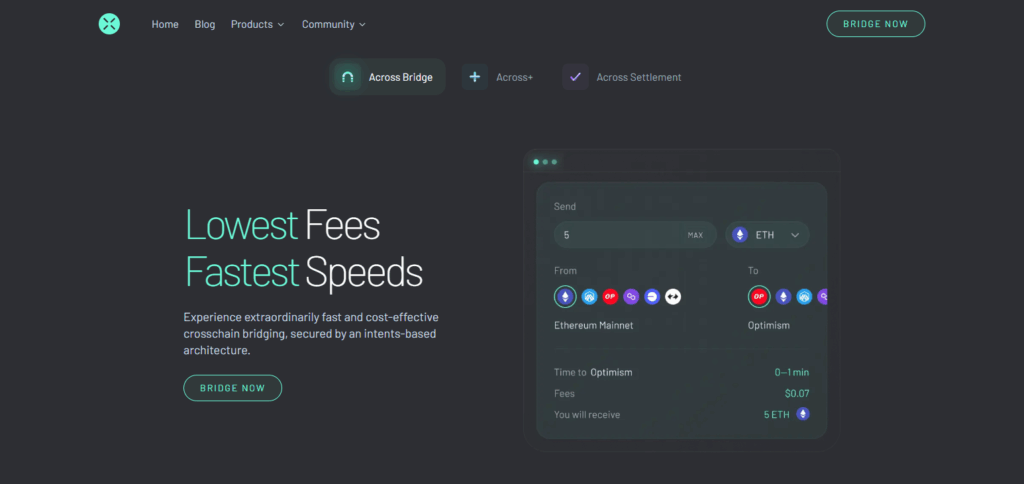

4.Across Protocol

Because of its optimistic relay method and one liquidity pool per asset system, Across Protocol is an industry leader in bridging route time aggregation. These frameworks enable seamless and affordable transfers.

It highlights its accuracy on how long bridges take by using precise estimations and metering slippage and latency. Focusing on real time performance data and capital efficiency, Across allows users to freely choose the most effective route ensuring prompt transaction processing across supported networks.

| Feature | Details |

|---|---|

| Name | Across Protocol |

| Type | Cross-Chain Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum, Arbitrum, Optimism, Avalanche, Binance Smart Chain |

| Speed | Fast and efficient bridging with optimized route times |

| Fees | Low, transparent fees |

| Security | Fully audited, uses optimistic rollup technology for security |

| User Interface | User-friendly with clear bridging options |

| Token Support | Supports a wide variety of ERC-20 and native tokens |

| Liquidity Source | Decentralized liquidity pools |

| Popular Use Case | Seamless asset transfers across layer-2 and layer-1 chains |

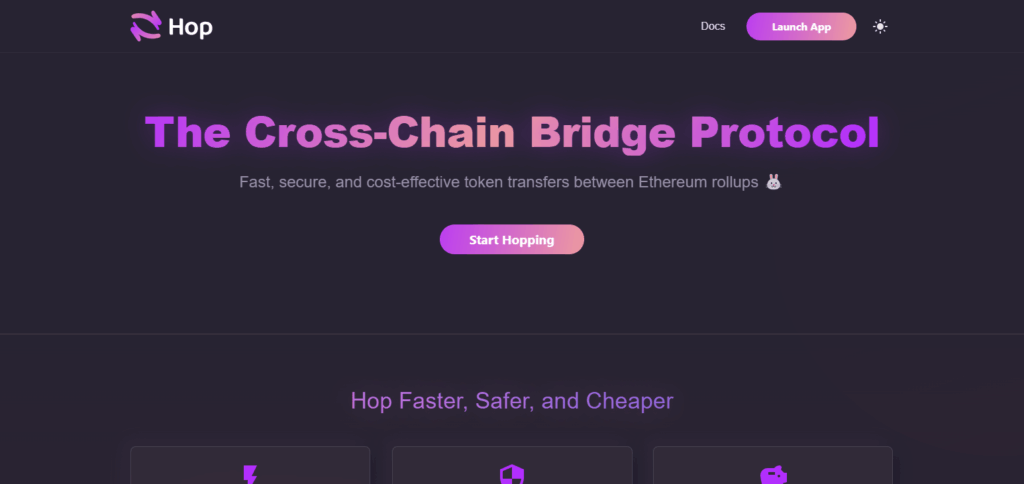

5.Hop Protocol

Hop Protocol stands as one of the best aggregators for checking bridging route time owing to its concentration on fast roll-up-to-roll up transfers. By implementing hTokens and AMMs, it provides efficient cross-chain swaps with minimum time lags.

What makes Hop different is its estimation and execution of quick transfer times between significant layer-2 networks like Optimism, Arbitrum, and Polygon. This precision in estimating routing time makes it the best for users who require speed and reliability in moving their assets.

| Feature | Details |

|---|---|

| Name | Hop Protocol |

| Type | Cross-Chain Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum, Polygon, Arbitrum, Optimism, Gnosis Chain |

| Speed | Fast bridging optimized for low latency |

| Fees | Competitive and transparent fees |

| Security | Audited smart contracts with decentralized validators |

| User Interface | Clean and simple interface for easy bridging |

| Token Support | Supports ERC-20 tokens and native assets |

| Liquidity Source | Utilizes liquidity pools and hop bridges |

| Popular Use Case | Quick token transfers between Layer 2 and Layer 1 chains |

6.Stargate Finance

Stargate Finance is one of the best in checking bridging route times because it utilizes a liquidity model that allows for instant and native asset transfers to be done on multiple blockchains. It offers accurate estimates of bridging duration because its unique delta algorithm dynamically calculates the most efficient transfer path.

Unlike fragmented liquidity bridges, Stargate’s architecture ensures consistent speed and reliability which enables users to assess and carry out cross-chain transfers with precise expectations on route performance and minimal execution lags.

| Feature | Details |

|---|---|

| Name | Stargate Finance |

| Type | Cross-Chain Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, Optimism, Arbitrum |

| Speed | Fast and reliable bridging with optimized route times |

| Fees | Low, transparent fees |

| Security | Audited smart contracts with on-chain liquidity pools |

| User Interface | User-friendly dashboard with seamless bridging |

| Token Support | Supports wide range of tokens including stablecoins |

| Liquidity Source | Unified liquidity pools across supported chains |

| Popular Use Case | Cross-chain asset transfers with instant finality |

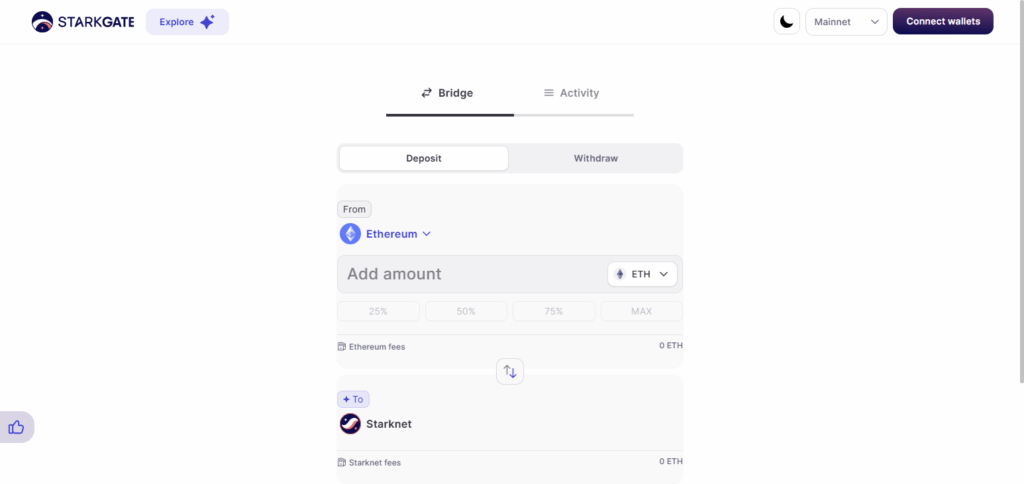

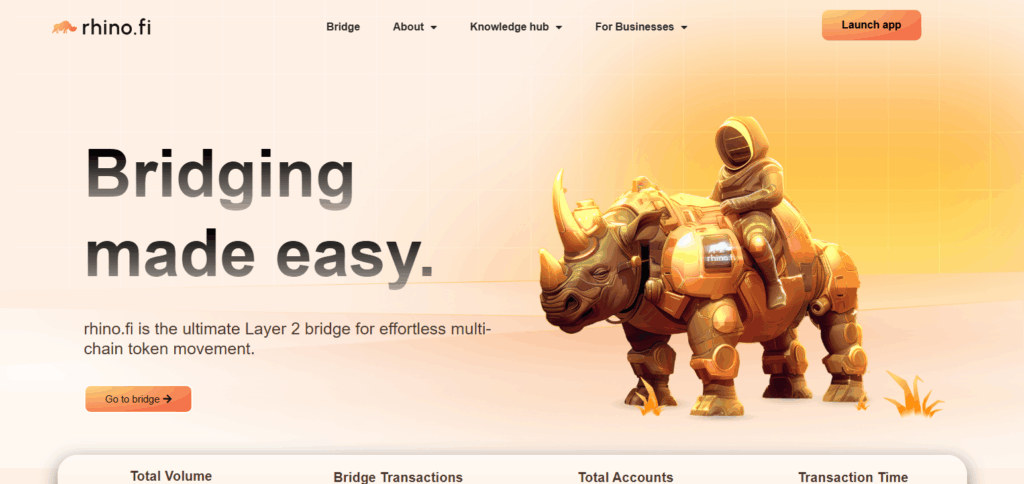

7.Allbridge

Allbridge is considered one of the best aggregators for checking bridging route times because it supports transfers across both EVM and non EVM chains, offering wide interoperability. Its routing system gives up to the minute information on transfer speeds so that users can assess and select the most efficient bridging routes.

What makes Allbridge different is its streamlined framework which minimizes congestion and latency. This results in improved communication across different blockchain networks which is vital for users who value speed, clarity and precision when assets are transferred across multiple blockchain networks.

| Feature | Details |

|---|---|

| Name | Allbridge |

| Type | Cross-Chain Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Solana, Arbitrum, Optimism, and more |

| Speed | Fast bridging with efficient route times |

| Fees | Low and transparent fees |

| Security | Audited contracts with strong security measures |

| User Interface | Intuitive and easy-to-use interface |

| Token Support | Supports a broad range of tokens |

| Liquidity Source | Aggregates liquidity from multiple protocols |

| Popular Use Case | Smooth asset transfers across diverse blockchain networks |

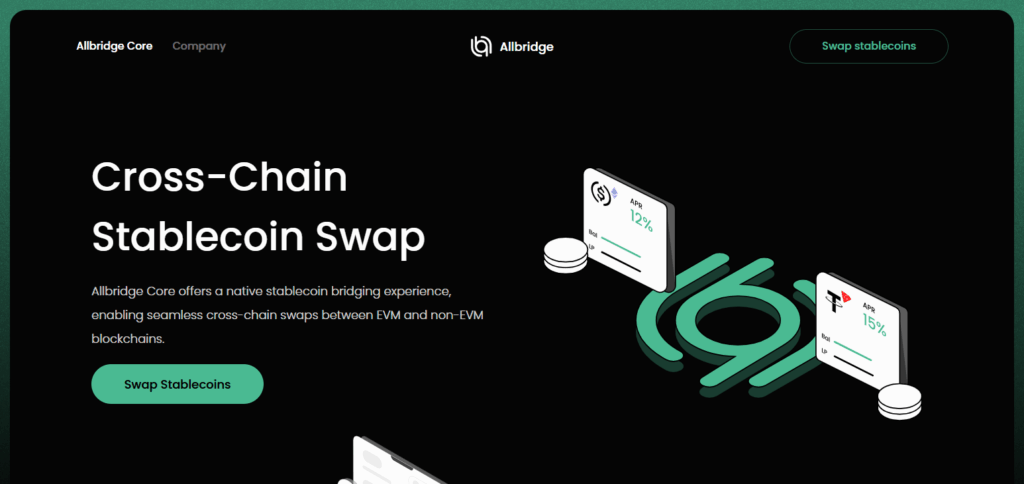

8.Arbitrum Bridge

Arbitrum Bridge is an excellent bridging time aggregator because it enables secure and effortless transfer between Ethereum and Arbitrum using rollup technology. What makes it remarkable is the ability to guarantee exact transfer time predictions due to the use of Arbitrum’s scaling solution.

Users are provided with reliable estimates, which allows for better cross-chain interactions. Through its efficient network and low levels of congestion, Arbitrum Bridge allows users to make informed decisions about transfer routes using up-to-the-minute data on speed and effectiveness.

| Feature | Details |

|---|---|

| Name | Arbitrum Bridge |

| Type | Layer 2 to Layer 1 Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum Mainnet ↔ Arbitrum Layer 2 |

| Speed | Fast withdrawals and deposits optimized for low latency |

| Fees | Low bridging fees |

| Security | Secured by Ethereum’s mainnet consensus |

| User Interface | Simple and clean interface for seamless bridging |

| Token Support | Supports ERC-20 tokens and native ETH transfers |

| Liquidity Source | Liquidity secured by Arbitrum validators |

| Popular Use Case | Efficient asset transfers between Ethereum and Arbitrum |

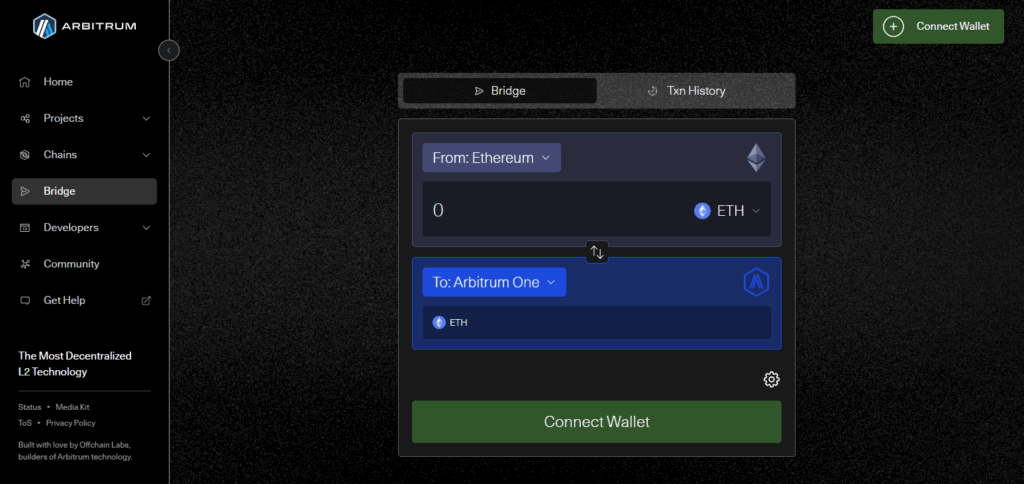

9.RhinoFi

RhinoFi is one of the best aggregators to check bridging route times owing to its rapid and gas-economical transfers over several layer-2 and layer-1 networks.

Unlike others, it aggregates bridges and gives users estimates of the time required, aiding them in choosing the quickest movement path.

Smart routing engines of RhinoFi evaluate the paths on both costs and transit times making the decision making less complex. Its cross-network integration allows users to monitor estimated time values while bridging assets in real-time.

| Feature | Details |

|---|---|

| Name | RhinoFi |

| Type | Layer 2 Bridge Aggregator |

| KYC Requirement | Minimal to No KYC |

| Supported Networks | Ethereum Mainnet ↔ zkSync Layer 2 |

| Speed | Fast and low-latency bridging |

| Fees | Low transaction and bridging fees |

| Security | zkRollup technology ensuring high security |

| User Interface | User-friendly and intuitive interface |

| Token Support | Supports ERC-20 tokens |

| Liquidity Source | Secured by zkSync Layer 2 liquidity pools |

| Popular Use Case | Efficient, secure asset transfers on zkSync |

Conclusion

Lastly, checking bridging route times is offered by top aggregators which aids in optimizing the transfer of assets between different chains as they provide real-time information on the data and analytics of speed, cost, and reliability.

Users can make decisions by choosing the most efficient and timely routes when utilizing different blockchains, these platforms assist in getting the most out of their investment. They improve the user’s experience in decentralized finance and multi-chain ecosystems by reducing delays and fee optimization, making secure and timely bridging accessible like never before.