In this article, I will explain how to purchase euros for travel, business, or any personal needs in the easiest and the most secure way possible.

Be it cash, a forex card, or online transfers, knowing your options helps you save money as well as avoid unnecessary charges.

In addition, I will also tell you the best places to get the exchange rates and the relevant documents required for the process.

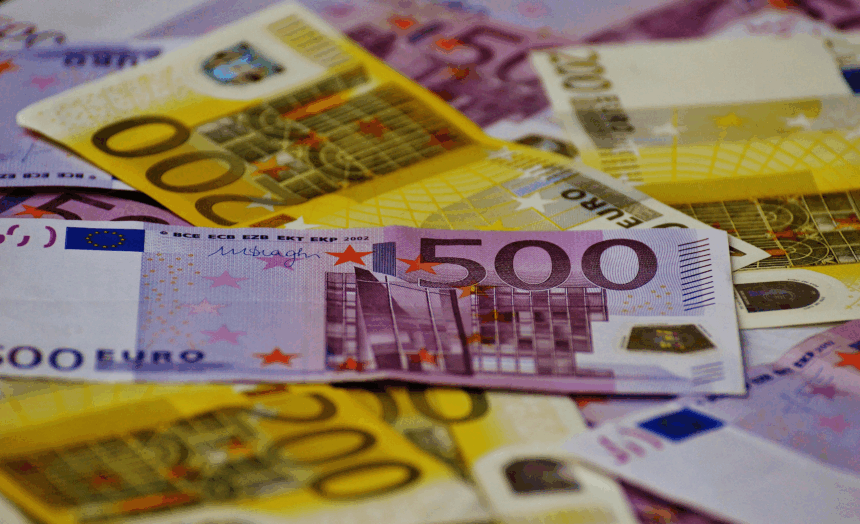

Understanding The Euro (EUR)

The euro (EUR) is the official currency of 20 member countries of the European Union, making it one of the most traded currencies in the world. Introduced in 1999, it aids the movement of people and businesses within Europe.

The euro symbol is € and is renowned for its value and presence in the world’s financial and trade markets.

How To Buy Euros

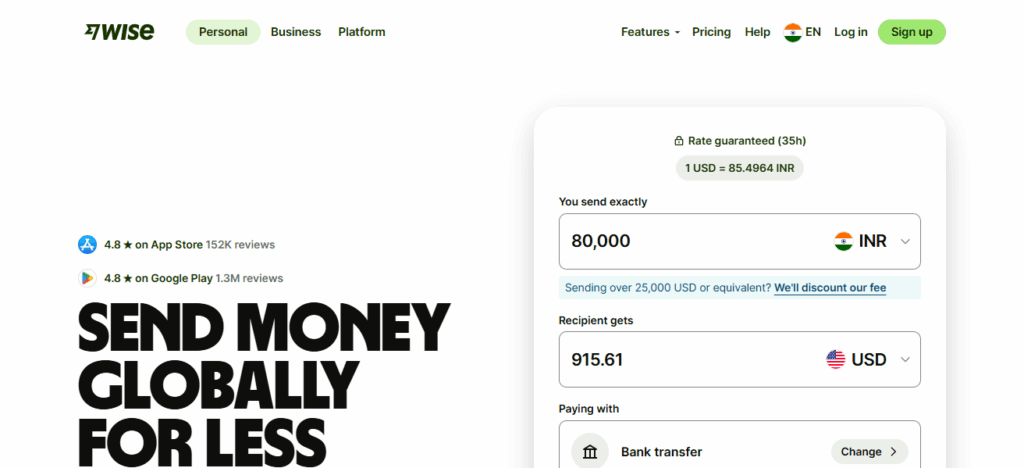

Step-by-Step Guide: Buying Euros on Wise

Create a Wise Account

- Alex visits wise.com or downloads the Wise mobile app.

- He signs up with his email address, then verifies his identity with a passport or national ID.

Check Exchange Rates

- On the Wise dashboard, Alex selects “Convert CAD to EUR.”

- He sees:

- Live exchange rate (real mid-market rate, not inflated)

- Transfer fee

- Total EUR he will receive

Wise locks the rate for a short period (typically up to 48 hours), giving Alex time to confirm the transfer.

Fund the Transfer

- Wise offers Alex several ways to pay:

- Bank transfer from his Canadian bank account

- Debit card

- Credit card (higher fees)

- Apple Pay/Google Pay (in some countries)

- He chooses a bank transfer to keep fees low and follows the instructions to send CAD to Wise’s local Canadian account.

Choose How to Receive the Euros

Alex has two options:

- Send Euros to a European bank account (e.g., N26, Revolut, or a Portuguese bank)

- Convert into Euros in his Wise Multi-Currency Account and order a Wise debit card for spending across Europe

He chooses to load the Euros into his Wise EUR balance, which he can spend directly using the Wise debit card.

Confirm the Transaction

- After Alex funds the transfer, Wise converts the money at the locked rate.

- He receives a confirmation email and can track the transfer in real-time.

- The EUR balance appears in his app — ready to use.

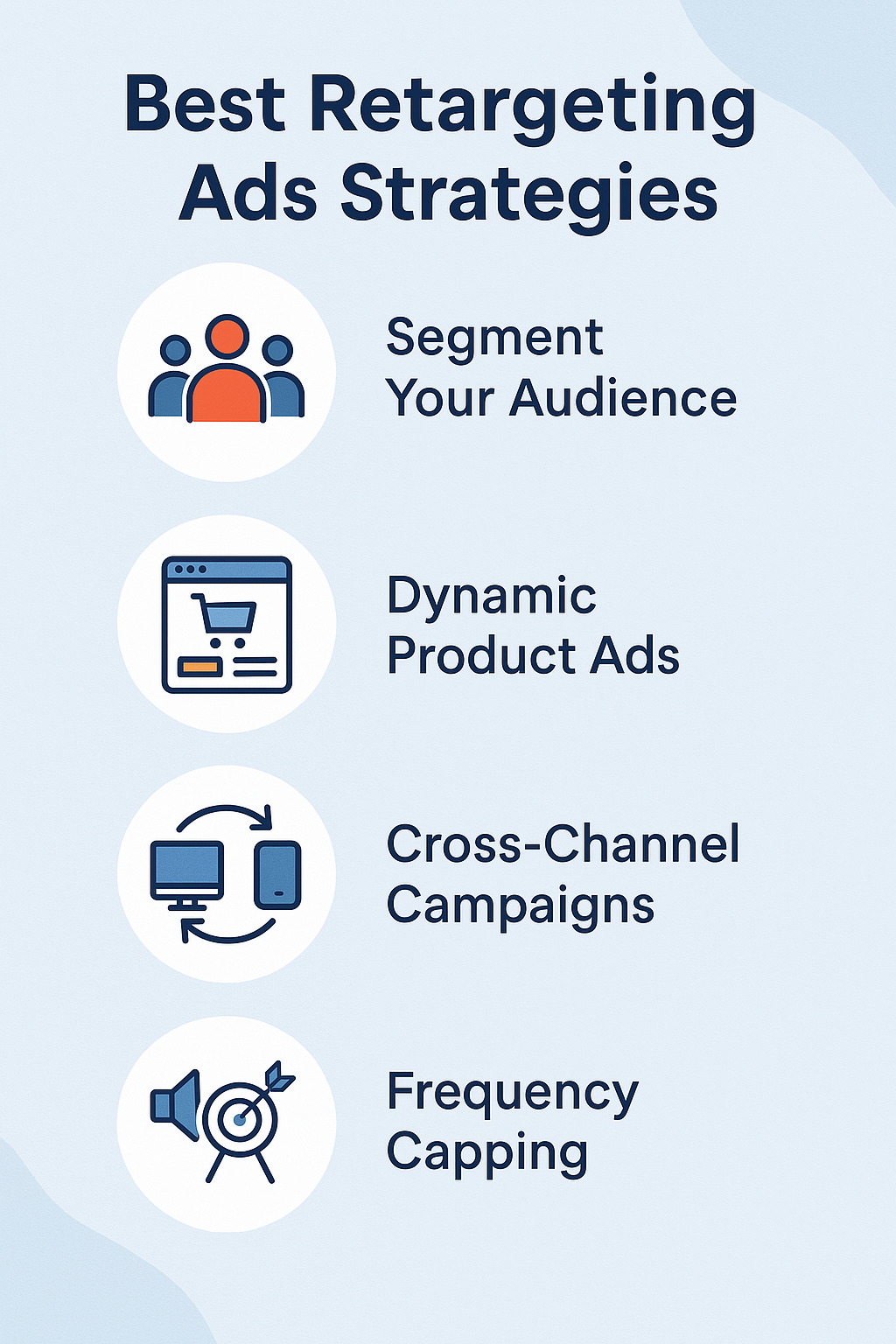

Tips for Getting the Best Exchange Rate

Compare Rates Across Providers Prior to purchasing euros, obtain multiple quotes from banks, online services, and physical counters for the best euro rate.

Use Online Currency Tools Real-time offer comparison against mid-market rates on XE and Google allows you to benchmark what providers are giving you.

Avoid Airport Exchanges Only use airport kiosks in emergencies because their rates are extremely poor and their fees are at all-time high.

Choose Local Currency Payment Abroad When paying or withdrawing money outside your home country, always select the option to charge you in the local currency.

Watch for Hidden Fees Always confirm the final amount received, as some services boasting ‘zero commission’ hide their charges in terrible exchange rates.

Use Forex Cards or Online Wallets Compared to physical exchanges, prepaid forex cards and digital wallets offer better rates and lower transaction fees during the exchange.

Pros And Cons

| Pros | Cons |

|---|---|

| – Safe and secure- Trusted source | – Rates may not be the best- Limited hours |

| – Instant cash- Available in major cities and airports | – High fees at airports- Poor exchange rates |

| – Competitive rates- Home delivery or pickup- Easy comparisons | – Requires uploading documents- Not instant in all locations |

| – Convenient abroad- Real-time rates via bank network | – Foreign transaction and ATM fees- Daily withdrawal limits |

| – Safer than cash- Lock-in exchange rate- Usable at ATMs & POS | – Reload limits- Inactivity or reload fees |

| – Instant payment- Widely accepted | – May attract foreign transaction fees- Credit cards may charge interest |

| – Mid-market rates- Transparent fees- Fast transfers | – Requires digital literacy- No physical cash option |

Conclusion

In conclusion Purchasing euros is simple and handy with several options available such as banks, online sites, euro forex cards, and ATMs overseas.

For maximum benefit, comparing rates, avoiding hidden charges, and planning in advance is a must.

Whether for leisure or work, using the appropriate method allows you to cut costs and reduces chances of rushing at the last minute.

Keep talking to reliable contacts and always use trusted service providers to guarantee an effortless process.

FAQ

Where can I buy euros?

Banks, currency exchange counters, online platforms, forex cards, or ATMs in Europe.

What do I need to buy euros?

Valid ID (passport), PAN (in India), and sometimes visa/ticket details.

Is it cheaper to buy euros online?

Often yes—online platforms offer better rates and lower fees.