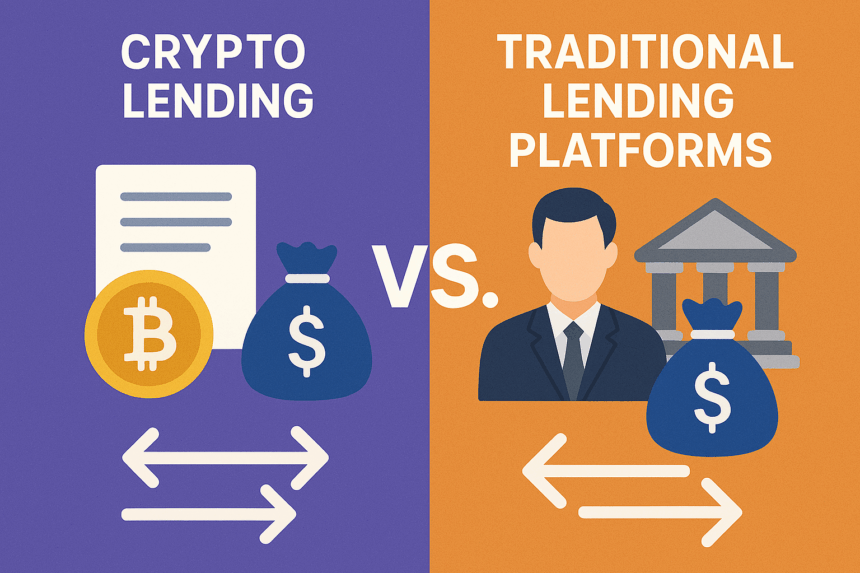

This article explores Crypto Alternatives to Traditional Lending Platforms, highlighting how decentralized finance (DeFi) is revolutionizing borrowing and lending practices.

Decentralized finance platforms like Aave, Compound and MakerDAO offer permissionless, collateral-based loans without banks or credit checks – these innovative solutions provide faster, borderless financial access than conventional institutions ever could.

Key Point & Crypto Alternatives to Traditional Lending Platforms

| Platform | Key Point |

|---|---|

| Aave | Offers decentralized lending with features like flash loans and interest rate switching. |

| Compound | Enables algorithmic money markets where users earn interest or borrow via smart contracts. |

| MakerDAO | Allows users to generate DAI stablecoins by locking crypto collateral in smart contracts. |

| CoinRabbit | Provides instant, custodial crypto loans without credit checks or KYC for small amounts. |

| Venus Protocol | Combines lending and synthetic stablecoins on BNB Chain with fast, low-fee transactions. |

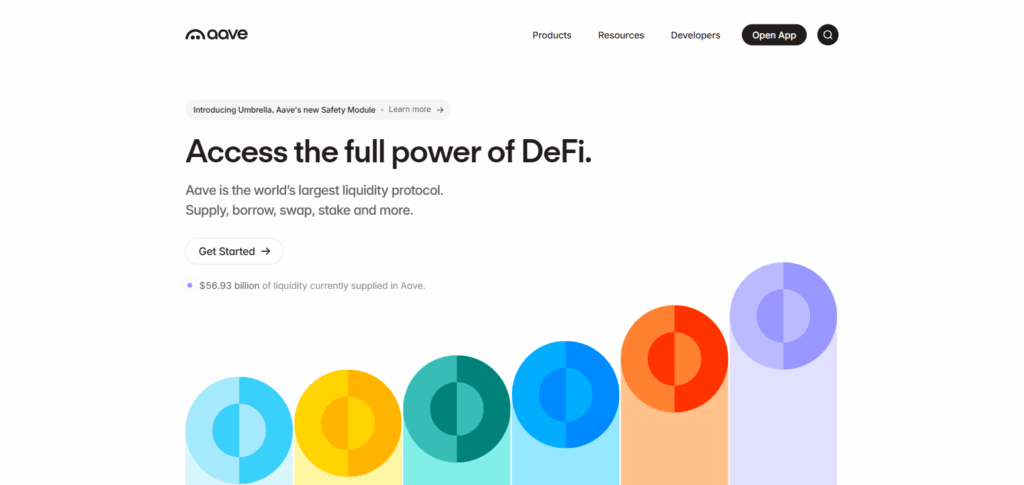

1. Aave

Aave is a powerful crypto alternative to traditional lending platforms is a decentralized, non-custodial liquidity protocol that enables users to lend and borrow crypto assets across various blockchains.

Its standout feature is flash loans – this enables borrowers to borrow funds without collateral provided repayment can occur within one transaction block, opening up advanced strategies like arbitrage and refinancing that would otherwise be unavailable in traditional finance.

Aave supports over 20 assets across 14 EVM compatible networks offering dynamic interest rates via the AAVE token – its open-source nature combined with extensive audits makes AAVE an efficient alternative bank

Brief Details:

- Supports 20+ assets including ETH, USDC, DAI

- Offers both stable and variable interest rates

- Uses aTokens that accrue interest in real-time

- Governed by AAVE token holders

- Non-custodial and open-source with extensive audits

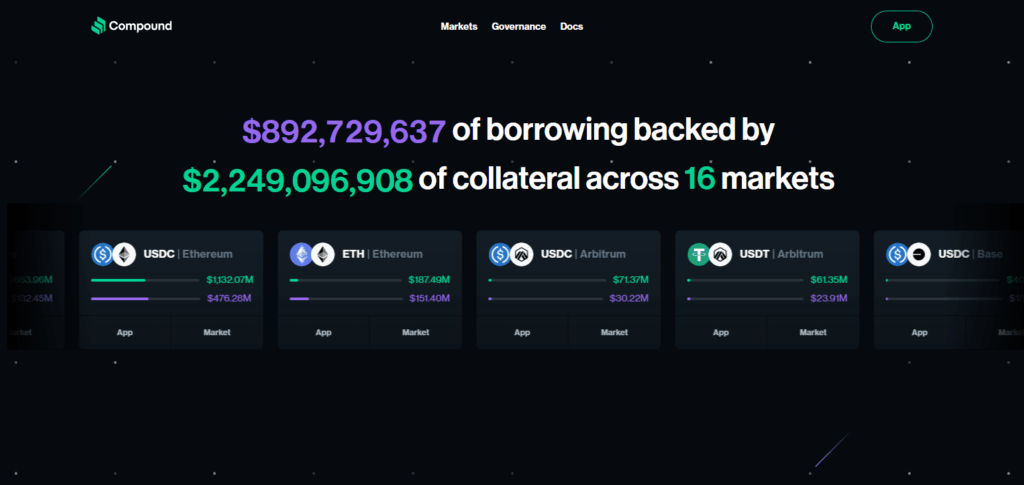

2. Compound

Compound is a leading crypto alternative to traditional lending platforms is a permissionless lending protocol built on Ethereum that automates borrowing and lending via smart contracts. Its key innovation is cTokens–interest-bearing tokens distributed when people supply assets; these accrue interest that can then be used across other DeFi applications, providing composability within its ecosystem.

Interest rates adjust automatically according to supply and demand to create a self-regulating market while Compound’s COMP token provides decentralized governance by enabling voters to vote on protocol upgrades and asset listing decisions.

Brief Details:

- Built on Ethereum with dynamic interest rates

- No intermediaries—fully smart contract-based

- COMP token enables governance and rewards

- Supports ETH, WBTC, USDC, and other major assets

- Transparent, algorithmic interest rate model

3. MakerDAO

MakerDAO stands out as a crypto alternative to traditional lending platforms by pioneered decentralized stablecoin lending with their DAI stablecoin pegged to the US dollar. Users lock up collateral (such as Ethereum or other ERC-20 tokens) in smart contracts for collateralized debt positions (CDPs) created from this system to mint DAI tokens – unlike volatile crypto loans – creating DAI coins instead.

Furthermore, MakerDAO uses their MKR token for governance to enable community decisions on risk parameters and stability fees, making MakerDAO an appealing fiat-free alternative suitable for users seeking dollar pegged liquidity without banks!

Brief Details

- Uses two tokens: DAI (stablecoin) and MKR (governance)

- Loans are managed via Collateralized Debt Positions (CDPs)

- Stability fees and automatic liquidation mechanisms

- DAO governance allows MKR holders to vote on protocol changes

- Focused on long-term stability and transparency

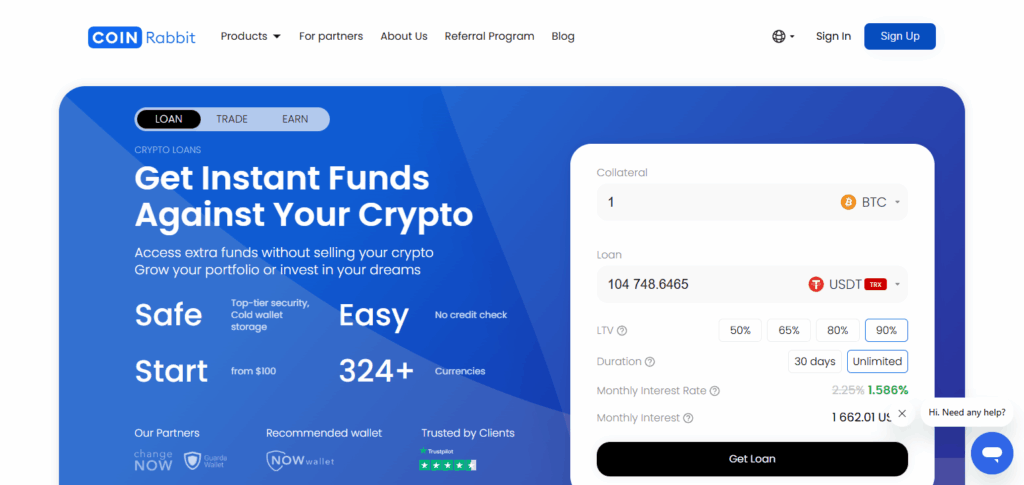

4. CoinRabbit

CoinRabbit offers a simplified crypto alternative to traditional lending platforms by stands out with its no-KYC lending model, enabling users to borrow stablecoins like USDT or USDC against cryptocurrency collateral without identity verification.

It supports DOGE, NANO and BCH assets and offers either fixed or flexible loan terms with automated top-up of collateral to avoid liquidation – with no deposit or withdrawal fees applied either by CoinRabbit itself!

CoinRabbit stands out due to its user-friendliness (loans processed within minutes) and accessibility – ideal for privacy-minded borrowers looking for loans elsewhere!

Brief Details:

- Supports 300+ assets as collateral

- Fixed interest rates (5–16% APR)

- Unlimited loan duration and no monthly payments

- Collateral stored securely in cold wallets

- Ideal for retail users seeking quick liquidity

5. Venus Protocol

Venus Protocol is a decentralized money market on the BNB Chain was initially created on BNB Chain but has since expanded to support Ethereum L2s like zkSync and Arbitrum, offering multichain lending and borrowing with algorithmic interest rates and isolated risk pools.

One unique feature is Venus Asset Index (VAI), an innovative stablecoin created through overcollateralized debt positions.

To represent assets provided to Venus Protocol users can use vTokens while voting can take place using XVS governance allowing users to vote on upgrades and risk parameters – offering real time collateral monitoring as well as automated liquidations providing a secure alternative to traditional credit systems.

Brief Details

- Overcollateralized lending and borrowing

- vTokens represent deposited assets

- Governance via XVS token

- Real-time collateral monitoring and automated liquidations

- $1.9B+ TVL across six major networks

Conclusion

Crypto alternatives to traditional lending platforms are revolutionizing finance by providing open, transparent, and borderless access to credit and yield opportunities. Platforms like Aave, Compound, MakerDAO, CoinRabbit and Venus Protocol eliminate banks, credit scores or paperwork for accessing credit; replacing them instead with smart contracts and user-controlled collateral.

Each platform introduces unique mechanisms such as algorithmic interest rates, overcollateralized stablecoins and non-expiring loans demonstrating how decentralized finance (DeFi) empowers individuals with greater financial autonomy empowering individuals empowering individuals more financial independence; not just disrupting legacy systems – these alternatives are building inclusive financial futures!

FAQ

What are crypto alternatives to traditional lending platforms?

They are blockchain-based protocols that allow users to borrow and lend assets without banks or intermediaries. These include platforms like Aave, Compound, MakerDAO, CoinRabbit, and Venus Protocol.

How do these platforms differ from traditional banks?

Crypto lending platforms use smart contracts to automate lending, don’t require credit checks, and offer 24/7 global access. Traditional banks rely on credit scores, paperwork, and centralized approvals.

Is my collateral safe on these platforms?

Your crypto is locked in smart contracts as collateral. While generally secure, risks include smart contract bugs, liquidation during volatility, or protocol failures.

Can I earn interest with crypto lending platforms?

Yes. By supplying assets like USDT, ETH, or BTC, users can earn interest based on demand for borrowing those assets.

What is overcollateralization in DeFi lending?

It means borrowers must deposit more value in crypto than they borrow to secure the loan. This protects the system from volatility and defaults.