In this article, I will discuss the Weird Crypto Alternatives to Owning Physical Gold: from asset tokens which are backed by actual gold bullion to strange tokens that represent the value of gold in unexpected ways.

For the crypto fanatic or the interested investor, these methods provide novel opportunities to reserve value, speculate, or reevaluate one’s fortune in the age of blockchain. So, let us jump into the rush for virtual gold.

Key Point & Weird Crypto Alternatives to Physical Gold

| Crypto Alternative | Value Proposition |

|---|---|

| Tether Gold (XAUt) | Combines gold’s stability with crypto liquidity |

| PAX Gold (PAXG) | Each token = 1 fine troy ounce of gold |

| DigixGlobal (DGX) | Uses Proof of Provenance for gold tracking |

| Perth Mint Gold Token (PMGT) | Backed by Australia’s Perth Mint, zero storage fees |

| AABB Gold Token (AABBG) | Tied to physical gold and tradable on AABB Exchange |

| GoldCoin (GLC) | Misleading name—purely speculative crypto |

| Kinesis Monetary System (KAU/KAG) | Earn yield from spending gold-backed tokens |

| HelloGold (HGT) | Designed for emerging markets and small investors |

| Zugacoin (SZC) | Controversial project with unclear gold reserves |

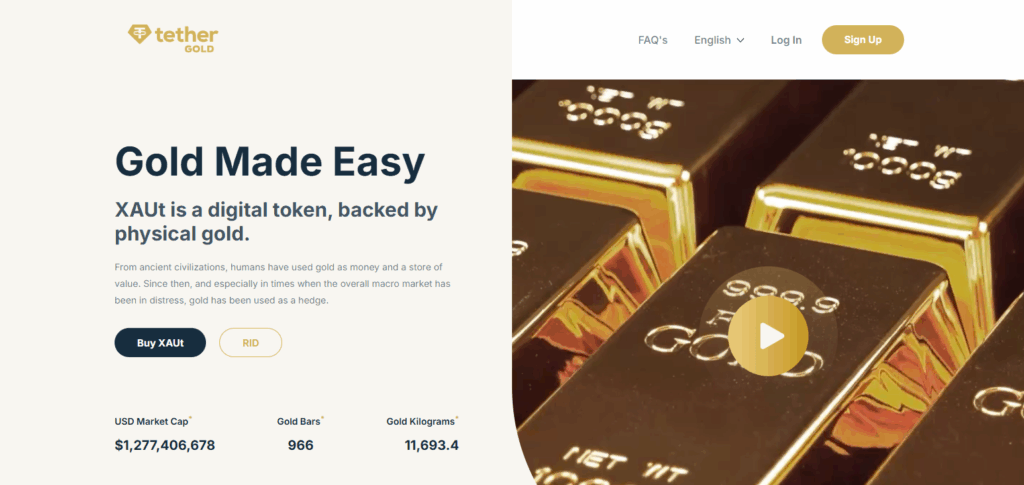

1. Тether Gold (XAUt)

Tether launched Gold (XAUt) as a digital token that is tied to a troy ounce of physical gold stored in Swiss vaults at a 1:1 ratio. Each token is completely backed and redeemable for actual gold and ownership is tracked on the Ethereum and TRON blockchains.

For the realms of Weird Crypto Alternatives to Owning Physical Gold, it stands out because it combines the liquidity of crypto and the safety of physical gold. Tether Gold holders can transfer, trade, or redeem their tokens without dealing with physical bars.

It serves as a hedge against fiat inflation and is a forward-thinking asset for digital traders and investors seeking stability due to its absence of traditional gold storage costs.

Tether Gold (XAUt)

Pros:

- ✅ Fully backed by physical gold stored in Swiss vaults

- ✅ Fractional ownership as low as 0.000001 ounces

- ✅ Major crypto exchanges support 24/7 trading and withdrawals

- ✅ Can be redeemed for gold or fiat currencies

- ✅ Gold bar serial numbers are tracked and publicly visible

Cons:

- ❌ Trust issues due to centralized issuer (Tether)

- ❌ Limited redemptions outside Switzerland

- ❌ Tether controversies might affect its acceptance

- ❌ Limited support across wallets and platforms.

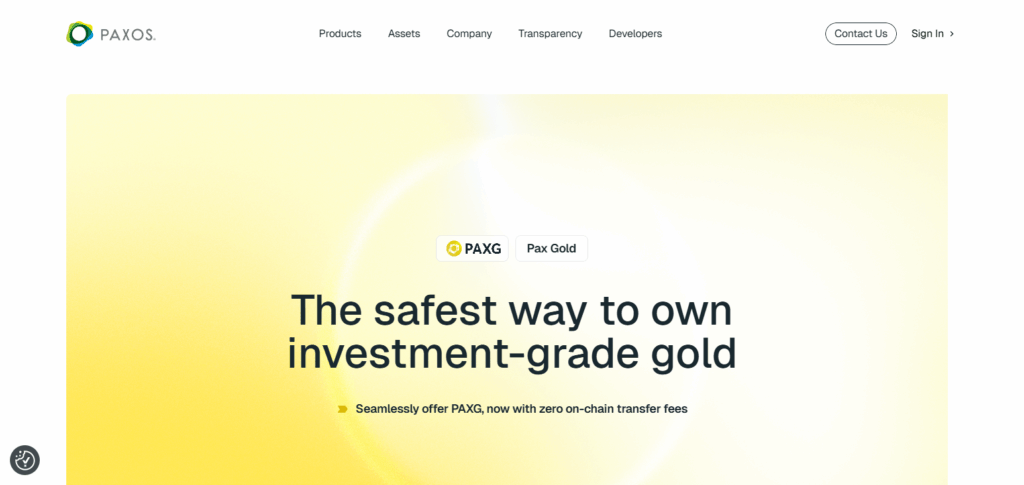

2. PAX Gold (PAXG)

PAX Gold (PAXG) is one of the latest ERC-20 tokens created by the Paxos Trust Company. It is fully collateralized by gold bars which are stored in Brinks vaults and are part of the LBMA accredited gold bars.

Paxos Gold issues each gold token for one ounces of gold and therefore ownership is legally linked to the physical gold bar. Out of all the Weird Crypto Alternatives to Owning Physical Gold, PAXG stands out for its instant settlement, fractional ownership, and ease of global transport.

It follows the regulation of Paxos which is under the NYDFS. PAXG is under the jurisdiction of NYDFS which provides a regulatory balance on the blockchain’s operational advantages.

PAXG allows a person to redeem gold-backed tokens for physical gold or cash, therefore providing a transparent, cost-efficient, and trustable method of investing in gold using crypto networks.

PAX Gold (PAXG)

Pros:

- ✅ 1 token represents 1 troy ounce of gold stored as London Good Delivery gold

- ✅ Strong compliance due to regulation by NYDFS

- ✅ Gold can be redeemed in large quantities

- ✅ Transparent audits at regular intervals

- ✅ Major exchanges like Binance and Kraken support trading

Cons:

- ❌ Centralization problem with Paxos Trust’s control

- ❌ Minimum redemption (e.g. 400 PAXG) too high for many.

- ❌ Limited value propositions offered.

- ❌ Vulnerable to stablecoin-style regulatory oversight.

3. DigixGlobal (DGX)

Each DGX token issued by DigixGlobal corresponds to one gram of gold certified by the London Bullion Market Association (LBMA) and stored in Canada and Singapore.

This project attempts to solve the problem of trust in gold-backed cryptocurrencies by blockchain tokenization of physical gold and provides complete transparency via Proof of Asset documents and audits.

Partway through the discussion of Weird Crypto Alternatives to Owning Physical Gold, DGX is unique in that it allows the purchase of gold in smaller units, broadening access for more people.

DGX holders may transfer their gold-backed assets as they would any ERC-20 token and still maintain complete control of the gold.

Additionally, DGX was among the first to offer tokenization of assets, giving traders and savers a form of stored value that is inflation-resistant, digital, and borderless while directly linked to real physical gold bullion.

DigixGlobal (DGX)

Pros:

- ✅ Each DGX token is equivalent to 1 gram of gold

- ✅ Gold’s Proof of Provenance is executed via Ethereum smart contracts

- ✅ Gold provenance from LBMA-approved refineries

- ✅ Adheres to Bureau Veritas audits for gold reserve claims

- ✅ Advanced asset tracking through DAOs for transparent governance

Cons:

- ❌ Storage costs are high (~0.6% a year)

- ❌ Limited liquidity and exchange options

- ❌ Decreasing interest and adoption for the project

- ❌ Lack of integration into DeFi systems and crypto wallets

4. Perth Mint Gold Token (PMGT)

The Perth Mint Gold Token (PMGT) is issued by InfiniGold in partnership with the Perth Mint, Australia’s largest precious metals enterprise. Each PMGT token is backed by government-guaranteed gold reserves, insured and audited regularly.

In the sphere of Weird Crypto Alternatives to Owning Physical Gold, PMGT offers a rare combination of sovereign guarantee and blockchain accessibility. Holders can redeem tokens for physical bullion or trade them like a cryptocurrency.

The Perth Mint ensures transparent gold holdings through its GoldPass system, permitting users to verify their backing.

With zero custody fees and full Australian government backing, PMGT provides the trust and reliability of a national mint blended with the speed and flexibility of crypto assets.

Perth Mint Gold Token (PMGT)

Pros:

- ✅ Gold held with the government-owned Perth Mint provides the backing

- ✅ No associated storage or management fee costs

- ✅ Can be redeemed for the physical gold

- ✅ Offers audits and compliance for transparency

Cons:

- ❌ Discontinued project in 2023 because of regulatory concerns

- ❌ Hurt from AUSTRAC investigation

- ❌ Poor adoption from the market resulting in illiquid supply

- ❌ Lack of support from Trovio or Perth Mint

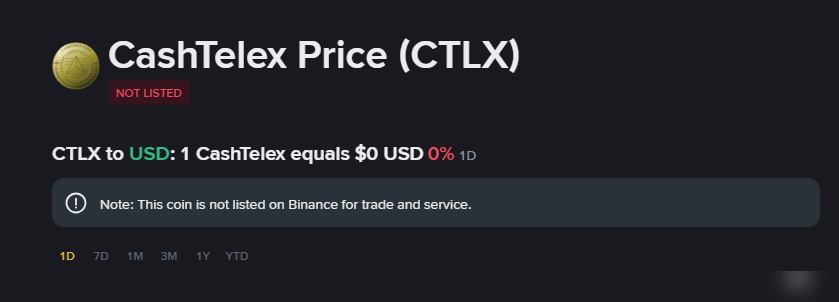

5. Cash Telex (CTLX)

Cash Telex (CTLX) is a niche cryptocurrency that seeks to integrate digital payments with the stability of being backed by gold. The project seeks to issue CTLX tokens that are backed by gold reserves, thus providing a blend of payment functionality and a secured asset.

Within the scope of Weird Crypto Alternatives to Owning Physical Gold, CTLX is unique in that it tries to fulfill both the roles of a payment system and an investment asset.

Though not as mainstream as other gold tokens, CTLX advocates for low fee, cross-border transactions that are underpinned by gold.

It aims at users from developing countries who require a two-in-one remittance and currency hedging tool, positioning CTLX as a dual-purpose cryptocurrency within the gold-linked digital asset world.

Cash Telex (CTLX)

Pros:

- ✅ Allegedly backed assets of gold, diamonds, silver, and property

- ✅ Provides services for mobile money, debit cards, and currency exchange

- ✅ Utilizes its proprietary blockchain with Proof of Wealth (PoWL)

- ✅ Specifically targets users in Africa and the Middle East

Cons:

- ❌ Limited verifiable audits

- ❌ Unmet ecosystem promises

- ❌ Insufficient exchange listings, low liquidity

- ❌ Asset reserves ambiguity increases risk

6. AABB Gold Token (AABBG)

Asia Broadband Inc. issues AABB Gold Token (AABBG) and each token represents a share of physical gold from the company’s mining operations. It aims to provide a reliable digital asset while harnessing gold produced by the company.

In Weird Crypto Alternatives to Owning Physical Gold, AABBG stands out for its innovative approach of tying value to a producer’s output instead of relying on dormant reserves. It functions on a mine-to-token system, and ensures intrinsic value for each token issued.

AABB intends to incorporate AABBG into the company’s crypto exchange to provide liquidity and redeemability for physical gold. This combination of mining operations and blockchain technology offers a new approach to digital gold investment.

AABB Gold Token (AABBG)

Pros:

- ✅ Issuer, Asia Broadband Inc. holds physical assets backing 100% of token’s value.

- ✅ Vertical integration from their mine-to-token model.

- ✅ Accessible through AABB Wallet and AABB Exchange.

- ✅ Token price pegged to 0.1 gram of gold, ensuring value.

Cons:

- ❌ Cannot exchange the token for physical gold.

- ❌ Limited exchange support outside the AABB ecosystem.

- ❌ Centralized with opaque audits.

- ❌ Demand-driven price inflation only.

7. GoldCoin (GLC)

GoldCoin (GLC) differentiates itself from other cryptocurrencies in two significant ways, its lack of direct backing to gold and the mining process which incurs a cost.

Gold Coin utilizes a proof-of-work mechanism. The strategy employed by GoldCoin to set market value definitely draws a lot from the value of gold.

In terms of strategy, GoldCoin does market itself as a gold replacement denying the difficulty of redeeming GoldCoin for gold and other precious metals. GLC attempts to position itself as Gold 2.0 while at the same time striving to be a bitcoin alternative.

It targets individuals who desire digitalized gold, similar in value to the actual cryptocurrency without the storage difficulties.

GoldCoin (GLC)

Pros:

- ✅ Independent blockchain operations.

- ✅ Low sends, fast delivers.

- ✅ Community development; open-source.

- ✅ Gold-themed as a value store.

Cons:

- ❌ Does not have physical gold backing despite the name

- ❌ Can be easily confused for gold’s actual value which may mislead investors

- ❌ Limited liquidity exchange and platform support

- ❌ Suffer greater underperformance than gold-backed or collateralized tokens

8. Kinesis Monetary System (KAU/KAG)

KAU and KAG tokens of Kinesis Monetary System are issued with underlying physical gold and silver balled in vaults all around the world. Kinesis users earn yield through spending, holding, or referring someone to the fretwork.

Under Weird Crypto Alternatives to Owning Physical Gold, Kinesis merits the most for developing a payment system that rewards the participant instead of encouraging ‘hoarding’.

Each KAU is issued for gold equivalent of one gram and is redeemed through a Kinesis Visa debit card in real world transactions. This innovation converts gold from a stagnant investment into a dynamic, spendable, income-generating asset.

Its global vaulting network and transparent audits in real-time guarantee security while enabling everyday transactions of precious metal-backed currencies.

Kinesis Monetary System (KAU/KAG)

Pros:

- ✅ Fully collateralized by physical gold (KAU) and silver (KAG)

- ✅ Yield credits are earned for holding and spending tokens.

- ✅ No fees for vault storage of the metals.

- ✅ Can be redeemed for physical metals.

- ✅ Global partnerships (ex: Indonesian post office) for better reach.

Cons:

- ❌ Onboard with KYC requirements.

- ❌ Increased minimums on redemption (100g gold).

- ❌ Complex systems may turn off casual users.

- ❌ Limited support on major exchanges.

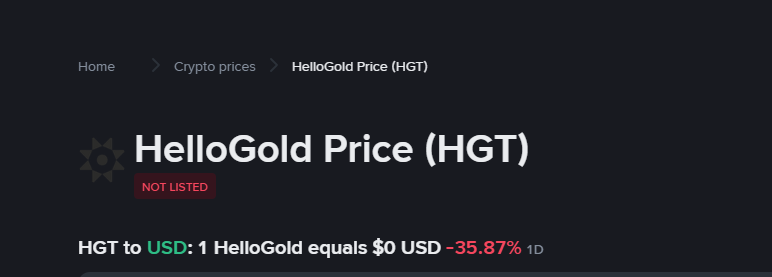

9. HelloGold (HGT)

With HelloGold (HGT), users can now purchase, sell, and store gold through a gold-backed blockchain platform, making gold investment more affordable.

As a gold-backed blockchain platform, HelloGold allows users to buy and sell and even store gold in small amounts through gold-backed blockchain technology.

This gold-backed blockchain platform offers a gold purchasing and selling platform with a focus in the emerging markets in Malaysia and Thailand. With partnerships on mobile applications, users can now start saving gold from as little as 1 gram.

As with most cryptocurrencies, HGT token holders also enjoy the reduced fees as well as platform perks. This right here allowed HelloGold to become a pioneer as a socially impactful gold investing platform in the cryptocurrency space.

HelloGold (HGT)

Pros:

- ✅ Shariah-compliant gold investment.

- ✅ Micro-investing starting from RM1.

- ✅ Gold with vaulted storage in singapore.

- ✅ SmartSaver auto-investing options.

- ✅ Investing for users in emerging markets through mobile.

Cons:

- ❌ 2% on gated annual storage.

- ❌ Low exchange and liquidity support for HGT token.

- ❌ Low community involvement and centralized governance.

- ❌ Not redeemable for physical gold purchases directly.

Conclusion

Historically, gold has been a symbol of value, but now even this traditional asset is undergoing a blockchain transformation. From partitioned holdings through Tether Gold (XAUt) to yield-generating systems like Kinesis (KAU/KAG), these crypto gold substitutes reverse the traditional notion that wealth is always cumbersome, tangible, and confined to secure locations.

Some of these crypto gold substitutes offer genuine value while others lean into speculative Red Bull branding, yet all highlight a desire to merge innovation with stability.

If you are looking for a hedge against inflation, trying micro-investments, or simply are fascinated by crypto gold, these experiments offer proof that gold no longer has to pacify the gluttonons—it can reside on the blockchain, evolve with ecosystems and even earn yield. In this new crypto paradigm, value not only is stored but can now be programed.