In this article, I will cover the Best Bitcoin Exchange For Instant Trading, focusing on the most precise sprint trading services, instant order execution, high liquidity, security, and usability.

For both novice and advanced traders, the easiest-to-use exchange that optimally fulfills the needs of users ensures uninterrupted trading, dependable execution, and swift dealings in the modern volatile crypto ecosystem.

Key Point & Best Bitcoin Exchange For Instant Trading

| Exchange | Unique Feature |

|---|---|

| Kraken | High security, Proof of Reserves |

| Crypto.com | Crypto Visa card with cashback |

| Uphold | Instant asset-to-asset swaps |

| Gemini | Strong US regulatory compliance |

| Coinbase | Beginner-friendly UX |

| Bitstamp | One of oldest regulated exchanges |

| BitFlyer | Japan’s largest exchange by volume |

| eToro | Social trading & copy trading |

| CEX.IO | Multiple fiat currency support |

1. Kraken

As a spot, futures, staking, and margin trading exchange, Kraken is a staple. This exchange was created in 2011 and has a global reach. Their low fees of 0% to 0.26% make it a great option.

With full KYC undergoing verification check, it is possible to use bank, SWIFT, SEPA, and even cryptocurrency transfers for deposits and withdrawals.

Because of their proof of reserves audits and strong in system security, Kraken is known to be the Best Bitcoin Exchange For Instant Trading – Kraken.

For customer support, they offer 24/7 live chat, email, and extensive help articles. Helping both new and veteran trader, the platform is flexible, safe and offers effortless trading crypto services.

Kraken

| Attribute | Details |

|---|---|

| Founded Year | 2011 |

| Key Products | Spot, Margin, Futures, Staking, Kraken Pro, Kraken Wallet |

| Fees | 0.16% maker / 0.26% taker; Kraken+ offers zero-fee up to $10K/month |

| KYC/Verification | ID, selfie, proof of address; tiered verification for higher limits |

| Deposit/Withdrawal | ACH, SEPA, SWIFT, wire, crypto; fiat fees vary by region |

| Customer Support | 24/7 live chat, email, help center |

2. Crypto.com

Crypto.com provides spot trading, derivatives trading, staking, and other services, as well as a popular Visa card that offers cashback in cryptocurrency. Founded in 2016, the company’s trading fees are within the industry’s considered competitive range of 0.075% and 0.10%.

Like most trading platforms today, Crypto.com requires full KYC verification. Deposits and withdrawals are available through bank transfer, credit and debit cards, and cryptocurrencies.

Crypto.com has been rated the Best Bitcoin Exchange For Instant Trading due to the speed of its trading engine and the quality of its mobile app. The company also boasts over 250 crypto assets and offers integration with DeFi wallets.

Customers are able to contact support via a 24/7 live chat, email, or help center. The crypto exchange is well known for its ecosystem, including investment instruments and daily payment services.

Crypto.com

| Attribute | Details |

|---|---|

| Founded Year | 2016 |

| Key Products | Spot, Margin, Derivatives, Visa Card, NFT Marketplace, DeFi Wallet |

| Fees | 0.075% base; lower with CRO staking; higher for card purchases |

| KYC/Verification | ID, selfie, proof of address; app-based onboarding |

| Deposit/Withdrawal | ACH, SEPA, PayPal, card, crypto; withdrawals incur network fees |

| Customer Support | In-app chat, email, help center |

3. Uphold

Uphold is a multifaceted platform supporting cryptocurrencies, stocks, and precious metals, which launched in 2015. It operates with KYC requirements and has a spread-based fee structure averaging 1%.

Funds can be deposited and withdrawn via bank transfer, debit and credit cards, and cryptocurrencies. It is recognized as the Best Bitcoin Exchange For Instant Trading – Uphold due to its feature of instant swaps between two assets without fiat conversion.

Alongside assets and accounts, Uphold publishes real-time reserve data reinforcing trusts claim, enhancing the user’s confidence in the system. Support is available through email, tickets, and a help center.

The platform works best for people who value a clean user interface and want to manage various types of assets in one account.

Uphold

| Attribute | Details |

|---|---|

| Founded Year | 2014 |

| Key Products | Crypto, Fiat, Metals, Stocks; Anything-to-Anything trading |

| Fees | ~0.25% for stablecoins; 1.4%–2.95% for BTC/ETH/altcoins (spread-based) |

| KYC/Verification | ID, selfie, proof of address |

| Deposit/Withdrawal | Bank, card, Apple Pay, crypto; withdrawals are free |

| Customer Support | Email only |

4. Gemini

Gemini offers spot trading, custody, staking, and a rewards credit card. It was launched in 2014, and the KYC verification step is mandatory for all users. Additionally, users can fund their accounts through bank transfers, debit cards, and cryptocurrency deposits.

Gemini has active users and is recognized as the Best Bitcoin Exchange For Instant Trading – Gemini due to its fast and reliable dollar-to-Bitcoin exchange. Gemini’s ActiveTrader platform advanced charting and order types for professional traders.

Gemini’s customer support can be contacted through email and through the help library. For traders that prioritize security, transparency, and strict compliance to regulations, Gemini is a great exchange.

Gemini

| Attribute | Details |

|---|---|

| Founded Year | 2014 |

| Key Products | Spot, Earn, Pay, ActiveTrader, Custody |

| Fees | 0.25% maker / 0.35% taker; 3.49% for debit card purchases |

| KYC/Verification | ID, selfie, address proof |

| Deposit/Withdrawal | ACH, wire, crypto; 10 free crypto withdrawals/month |

| Customer Support | Email, help center |

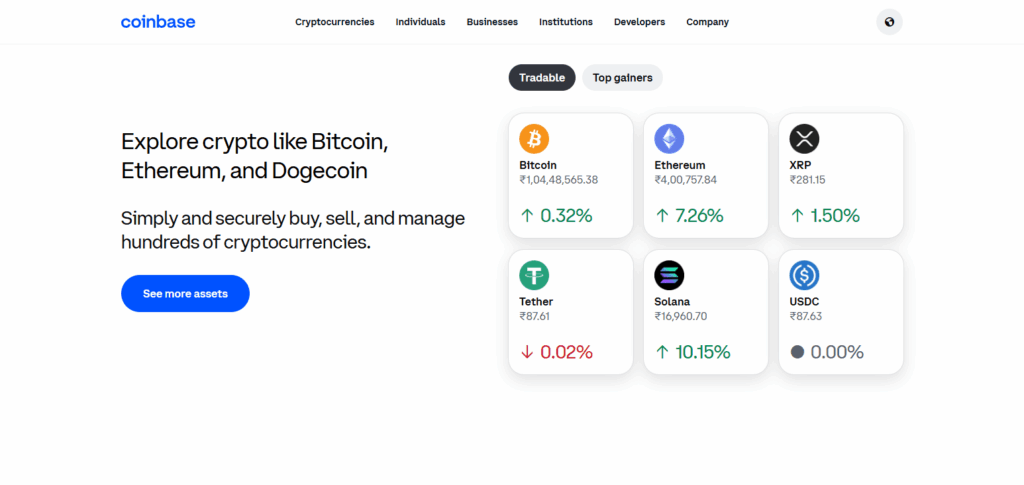

5. Coinbase

Coinbase is a U.S.-based exchange founded in 2012 that is renowned for offering spot trading, staking, and crypto custody. With a relatively steep fee structure starting at 0.6% plus a spread and needing full KYC verification, payment methods include bank transfers, debit and credit cards, PayPal, and crypto.

Its reputation as the Best Bitcoin Exchange For Instant Trading – Coinbase demonstrates its popularity for the easy-to-use interface, instant buy/sell, and instant trading features. Coinbase has implemented safety measures for custody-held digital assets that include cybersecurity insurance.

Their customer support options include live chat, email, and a comprehensive knowledge base. Coinbase is renowned as the best platform for educational materials and gaining crypto trading skills.

Coinbase

| Attribute | Details |

|---|---|

| Founded Year | 2012 |

| Key Products | Spot, Advanced Trade, Wallet, Earn, Commerce |

| Fees | 0.4%–0.6% spot; lower on Advanced Trade; $5 withdrawal fee |

| KYC/Verification | ID, selfie, address proof |

| Deposit/Withdrawal | ACH, SEPA, PayPal, card, crypto |

| Customer Support | Chat, ticketing, help center |

6. Bitstamp

Established in 2011, Bitstamp is one of the oldest regulated crypto exchanges and offers spot trading and staking. KYC verification is required; however, fees sit between 0% and 0.3% making it appealing for lower cost trading.

Deposits and withdrawals include bank transfer, SEPA, credit and debit cards, and crypto transfers. Bitstamp is considered the Best Bitcoin Exchange For Instant Trading – Bitstamp and is known for high liquidity and great execution speeds.

The exchange upholds regulatory and compliance standards and prioritizes transparency. Customer support includes email, and a ticket and phone support system.

Bitstamp is appealing for traders wanting a straightforward, safe, and long-established exchange for reliable crypto trading.

Bitstamp

| Attribute | Details |

|---|---|

| Founded Year | 2011 |

| Key Products | Spot, Staking, Lending, Bitstamp Pro |

| Fees | 0.30% base; lower with volume |

| KYC/Verification | ID, address proof |

| Deposit/Withdrawal | Bank, card, PayPal, crypto, Apple/Google Pay |

| Customer Support | Email, phone, FAQ |

7. BitFlyer

A prominent cryptocurrency exchange in Japan, BitFlyer was established in 2014. It provides spot and futures trading and charges some of the lowest fees in the industry, 0.01% to 0.15%. Trading requires KYC verification.

Users can deposit and withdraw through bank transfer and crypto. BitFlyer is often awarded as the Best Bitcoin Exchange For Instant Trading – BitFlyer for its reputation for high-speed execution and compliance with strict regulations in Japan, the U.S., and Europe.

BitFlyer’s customer support is done through email and is supplemented with a help center. Traders who prioritize fees will find BitFlyer appealing, especially with its strong regulations for the Japanese and Asian markets.

BitFlyer

| Attribute | Details |

|---|---|

| Founded Year | 2014 |

| Key Products | Spot, Margin, Futures, Recurring Buy |

| Fees | 0.10% base; tiered down to 0.03% with volume |

| KYC/Verification | ID, address proof |

| Deposit/Withdrawal | Bank transfer, PayPal, crypto |

| Customer Support | Email only (Weekdays 9 AM–6 PM CET) |

8. eToro

Just like any other asset virtually available today, cryptocurrencies, stocks, ETFs, and CFDs can be found in one place – the eToro platform. Established in 2007, eToro uses spread-based fees, charging approximately 1% for cryptocurrencies and mandates KYC for identity verification.

Users can deposit and withdraw using bank transfers, card payments, and e-wallets like PayPal. eToro is famous for allowing users to copy the strategies of successful social traders, thus, earning the title of Best Bitcoin Exchange For Instant Trading – eToro.

Novice traders face no restrictions as the platform interface is user friendly. Meanwhile, seasoned traders are provided with eToro’s advanced tools. In case of any inquiries, eToro can be contacted using live chat, ticketing, or the help center.

eToro

| Attribute | Details |

|---|---|

| Founded Year | 2007 |

| Key Products | Crypto, Stocks, ETFs, CopyTrader, Smart Portfolios |

| Fees | 1% crypto buy/sell; $5 withdrawal fee |

| KYC/Verification | ID, selfie, address proof |

| Deposit/Withdrawal | Card, PayPal, bank transfer, wire |

| Customer Support | Email, ticketing; priority for Platinum+ users |

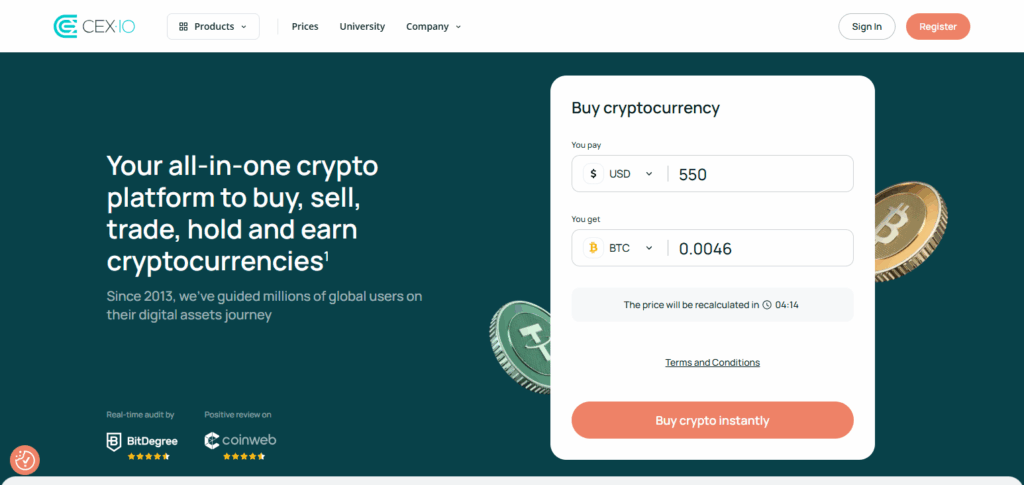

9. CEX.IO

Providing instant loans alongside other services such as spot trading, staking, and even offering crypto loans and savings accounts, CEX.IO is the best place to go. Established in 2013, CEX.IO charges low fees between 0.15-0.25% and mandates KYC verification.

Users can deposit and withdraw funds using bank transfers, credit cards, and even cryptocurrencies. Due to its wide range of supported cryptocurrencies, it has thus been titled the Best Bitcoin Exchange For Instant Trading – CEX.IO.

CEX.IO provides 24/7 customer services with email as well as chat features and a help center. CEX.IO caters to traders in search of a multi-faceted exchange that strikes a balance between fiat and crypto availability, liquidity, and global reach.

CEX.IO

| Attribute | Details |

|---|---|

| Founded Year | 2013 |

| Key Products | Spot, Staking, Instant Buy/Sell, Savings |

| Fees | Varies by asset and method; spreads on instant buys |

| KYC/Verification | ID, selfie, address proof |

| Deposit/Withdrawal | Card, bank, PayPal, crypto |

| Customer Support | Email, help center |

Conclusion

For immediate transactions in Bitcoin, the exchange that offers the best combination of speed, liquidity, security, and user-friendly infrastructure tools is ideal. Each of the listed exchanges, Kraken, Crypto.com, Uphold, Gemini, Coinbase, Bitstamp, and CEX.IO, BitFly and eToro, have their core offerings which range from super-fast execution and liquidity to robustness in regulation and flexible funding options.

The Best Bitcoin Exchange for Instant Trading, for example, supports real-time execution and best pairs for trading from a mobile gateway algorithm, which is perfect for on the go trading. Adequate regulation and performance of the exchange is a base for instant execution of orders, with an added layer of fund security, granting traders safety on market exposure and positioning.

FAQ

What makes an exchange the best for instant Bitcoin trading?

The best exchange offers high liquidity, fast order execution, low latency trading systems, and a reliable platform that processes buy/sell orders instantly without delays.

Which exchanges are considered top choices for instant Bitcoin trading?

Popular options include Kraken, Crypto.com, Uphold, Gemini, Coinbase, Bitstamp, BitFlyer, eToro, and CEX.IO, each offering speed, security, and easy access to funds.

Do I need to complete KYC to trade instantly?

Most top exchanges require KYC for instant trading to comply with regulations and prevent fraud, though the process is usually quick.

Which payment methods allow instant deposits?

Credit/debit cards, PayPal, and some instant bank transfers enable near-instant deposits, while crypto deposits are generally processed quickly after network confirmation.

Are instant trades more expensive in fees?

Some exchanges charge slightly higher fees for instant buys, but platforms like Kraken and Bitstamp offer competitive rates for fast execution.