In this article, I will discuss the How to Invest in Cryptocurrency in the UK, detailing the steps necessary for beginners to commence their journey with confidence and safety.

From the choice of FCA-regulated exchanges to the nuances of UK tax obligations and risk management, this guide offers critical strategies and insights that every UK investor must possess before venturing into the realm of digital assets.

What is Cryptocurrency?

Cryptocurrency refers to a type of digital or virtual currency which utilizes cryptography to make fraudulent activities almost impossible. Unlike traditional currencies like the British Pound, cryptocurrencies are operating on decentralized networks running on blockchain technology.

Some of the most popular cryptocurrencies such as Bitcoin, Ethereum and Litecoin are widely used for trading and investment in UK. They facilitate peer-to-peer transactions, eliminating the need for banks, which makes the process easily accessible and more transparent. However, the value of cryptocurrencies is often highly volatile which makes it a risky yet rewarding investment.

How to Invest in Cryptocurrency in the UK

Here’s one clear step-by-step example of investing in cryptocurrency in the UK:

Example: Purchasing Bitcoin in the UK

Step 1: Select a Cryptocurrency Exchange

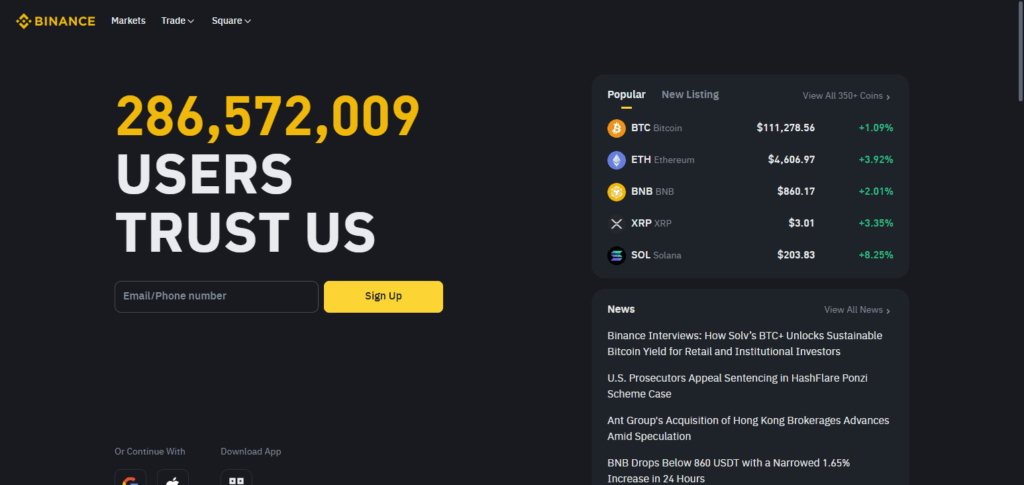

Check out one of the UK-friendly exchanges: Coinbase, Binance, or Kraken. Confirm that they are registered with the FCA.

Step 2: Register and Confirm Your Account

Register with your email, and create a strong password. Complete KYC verification with your ID and proof of address.

Step 3: Deposit Funds

Use a bank transfer, debit card, or PayPal to add funds. Bank transfers are usually cheaper.

Step 4: Cryptocurrency Purchase

Look for Bitcoin (BTC), enter the desired amount and click Buy.

Step 5: Ensure Your Crypto Is Secure

For optimal security, move your Bitcoin to a hardware wallet like Ledger or BitBox02.

Step 6: Assess and Manage

Check your investment via the exchange app or any portfolio app, then decide to hold or trade.

Is Cryptocurrency Legal in the UK?

Legally, cryptocurrency exists in the UK, though it is neither recognized as a form of legal tender nor embraced as legal currency. The Financial Conduct Authority (FCA) has jurisdiction over specific crypto-related activities, predominantly to safeguard users and mitigate money laundering risks.

UK citizens are permitted to purchase, sell, and trade cryptocurrencies such as Bitcoin and Ethereum on exchanges that are registered with the FCA. Nonetheless, the FCA prohibits the trading of crypto derivatives with retail clients due to significant risks. Moreover, the crypto profits are also taxed based on the HMRC’s regulation, and thus, investors are required to declare and pay tax on their capital gains.

Best Platforms to Buy Cryptocurrency in the UK

Coinbase

Coinbase is regarded as one of the premier platforms for purchasing cryptocurrency in the UK due to its emphasis on user accessibility and its adherence to compliance regulations. It offers a protected ecosystem under the FCA and facilitates easy GBP deposits via bank transfers and card payments, thus, it is beneficial for UK investors.

A distinctive benefit of Coinbase is its comprehensive education tools and rewards for novice users, enabling users to learn about cryptocurrency through active participation. The mixture of trust, education, and simplicity increases its reliability as a trusted platform.

Uphold

Uphold is remembered as one of the best places to purchase cryptocurrency in the UK due to its “Anything-to-Anything” trading feature, which enables users to trade crypto, fiat currencies, and even commodities without the need to convert to GBP first.

For UK crypto investors looking for more than just basic trading, this saves time and lowers costs. Uphold’s strong transparency, FCA compliance, and effortless GBP deposit make it appealing for both new and seasoned investors looking for a one-stop platform offering simplicity and flexibility and a GBP is a plus.

Risks of Investing in Cryptocurrency

High Volatility

The cryptocurrency market is characterized by extreme price fluctuations; the value of a cryptocurrency can soar or plummet within a matter of hours.

Regulatory Uncertainty

The legal climate surrounding cryptocurrencies is in a constant state of flux, both in the UK and the rest of the world, creating uncertainty regarding trading and investment opportunities.

Security Threats

Inadequately protected cryptocurrencies are vulnerable to hacks, phishing, and breaches of exchanges which can result in the permanent loss of funds.

Scams and Fraud

The crypto industry’s notorious reputation stems from the abundance of fictitious initiatives, Ponzi schemes, and rug pulls.

No Investor Protection

A vast majority of crypto assets are not guaranteed by insurers, unlike traditional banking assets, thus making any funds lost irretrievably.

Liquidity Issues

Selling some lesser-known cryptocurrencies can be a challenge without incurring significant losses in value.

Technology Risks

Sudden devaluation can be brought about by bugs, errors in the blockchain or failed projects.

Tax Implications for UK Crypto Investors

In the UK, cryptocurrency falls under the jurisdiction of HMRC for taxation purposes, and investors are required to track their activities with precision. Crypto is regarded as an asset; thus, any profits obtained from selling, trading, or exchanging are liable to Capital Gains Tax (CGT) provided they exceed the annual tax-free threshold.

Other activities such as mining, staking, or receiving crypto as a form of income might be liable to Income Tax. Each investor is obligated to maintain meticulous documentation of every transaction, including the pertinent dates, amounts, and their GBP value. In the UK, not declaring cryptocurrency gains may incur severe penalties, which is why UK investors are advised to utilize crypto tax software.

Tips for Beginner UK Investors

Start Small – While learning the ropes of the market, start with an amount you can afford to lose.

Use FCA-Registered Exchanges – Use the FCA-registered platforms for convenience and safety.

Secure Your Assets – Keep coins in private wallets instead of in exchanges to ensure better security.

Understand Taxes – Be informed of the taxation policies of HMRC related to crypto gains and take adequate records.

Diversify Investments – Spread investments across multiple coins instead of single asset concentration.

Avoid Emotional Trading – Preserve strategy and avoid frantic buying or selling.

Stay Updated – Monitor news in the UK and bearings related to cryptocurrency and other regulations.

Learn First, Invest Later – Go through educational materials before committing significant funds to investments.

Pros & Cons

Pros

- High Growth Potential – Increased returns in comparison to traditional investments.

- 24/7 Market Access – Cryptocurrency trading operates without time restrictions.

- Diversification – Enhances an investor’s portfolio.

- Accessibility – GBP purchase through UK-regulated exchanges is simple.

- Ownership Control – Investors have full control of their digital assets via wallets.

- Innovation Opportunities – Access to new blockchain, DeFi, NFTs, and other developing sectors.

Cons

- Extremely Volatile – Prices can fluctuate suddenly, risking potential losses.

- Regulatory Uncertainty – Access and use is subject to FCA restrictions and laws.

- Security Risks – Existing hacks, scams, and phishing remain major threats.

- Tax Complexity – HMRC rules demand record-keeping and reporting.

- No Investor Protection – Lost crypto is unrecoverable.

- Learning Curve – Exchanges, wallets, and blockchains can be difficult to grasp.

Conclusion

To summarize, digital asset investments in the UK come with great prospects as well as cautious strategy formulation and risk consideration. Utilizing FCA-registered exchanges, practicing strong security measures, and adhering to HMRC’s tax rules allows newcomers to securely embark on their crypto journey.

While the crypto market and regulations need monitoring, success stems from starting with a small, diversified portfolio. Despite the high potential rewards, investors must keep in mind the volatility of digital assets and, thus, focus on sustainable strategies and a long-term perspective to yield profitable returns.

FAQ

Is it legal to buy cryptocurrency in the UK?

Yes, buying and selling cryptocurrency is legal in the UK, but it is not considered legal tender. Investors must use FCA-registered platforms.

Do I need to pay tax on cryptocurrency in the UK?

Yes, HMRC taxes crypto profits under Capital Gains Tax (CGT) or Income Tax, depending on the activity. Keeping records is essential.

What is the safest way to store cryptocurrency?

The safest option is a hardware wallet (cold storage). Hot wallets are convenient but carry higher security risks.