In this article, I will discuss the Safest Stablecoins in 2025, with the most digital stablecoins that provide security, transparency, and stability.

These stablecoins are pegged to reliable assets like the US Dollar, fully backed and heavily regulated, which makes them perfect for trading, payments, and other DeFi activities. I will cover the top options, their unique offerings, and why they will still be reliable in 2025.

Stablecoins – which are the primary focus of this article – are a new kind of cryptocurrency that aims to maintain price stability. They do this by tying their worth to some other currency or commodity. Stablecoins can be pegged to the US Dollar or even Gold.

What are Stablecoins?

Unlike popular cryptocurrencies which have a volatile price such as Bitcoin and Ethereum, stablecoins are more suited for transactions and savings since they are far more stable.

Stablecoins can be fiat-backed, where each coin is fully backed by the necessary reserves, crypto-backed, algorithmic, where contracts control supply.

Stablecoins are the best of both worlds: they provide the advantages of blockchain money by combining it with the stability of traditional money. This means that users can carry out transactions anywhere in the world without the stress of worrying about price volatility.

How To Choose Safest Stablecoins in 2025

Check Backing Type – Stablecoins prefer for their lower volatility by being fully backed by reserves like USDC or Tether are more fiat backed.

Audit and Transparency – The stablecoins should be regularly audited by third parties to establish reserves and compliance.

Regulatory Compliance – Stablecoins that have been approved or acknowledged by financial regulators are safer and much more preferred.

Market Capitalization – Stable coins with larger market caps tend to be more stable overall and widely accepted.

Liquidity & Exchange Support – Stable coins that are accessible on the major exchanges that have high trading volumes are much easier for stable transactions.

Smart Contract Security – Algorithmic and crypto backed stablecoins should have their smart contracts secured and audited.

History of Stability – The crypto coin must maintain its peg for a duration, its performance over the duration must be consistent.

Key Point & Safest Stablecoins in 2025 List

| Stablecoin | Market Cap (USD) | Type | Primary Backing |

|---|---|---|---|

| USD Coin (USDC) | $48B | Fiat-backed | US Dollar |

| Tether (USDT) | $83B | Fiat-backed | US Dollar |

| Dai (MakerDAO) | $5B | Crypto-backed | Collateralized crypto assets |

| Ethena USD | $50M | Algorithmic | Crypto & algorithmic reserves |

| Angle USD (ANG) | $200M | Crypto-backed | Tokenized collateral (stable) |

| PayPal USD | $30M | Fiat-backed | US Dollar |

| First Digital USD | $15M | Fiat-backed | US Dollar |

| TrueUSD (TUSD) | $1.2B | Fiat-backed | US Dollar |

| Frax (FRAX) | $600M | Fractional-algo | Partially collateralized + algorithmic |

| Pax Dollar (USDP) | $350M | Fiat-backed | US Dollar |

1.USD Coin

Starting in the year 2018, USD Coin (USDC) is one of the first cryptocurrencies issued in the form of dollar pegged stablecoins and is focusing on the US Dollar reserves and US regulatory high-value compliance. Circle, along with Coinbase, issues a full audit of USDC, and over 30 countries have completed USDC compliance documentation.

USDC is one of the world’s most traded and liquid crypto, with a market cap of over 48 billion dollars and high-level adoption in the crypto industry which makes it fully liquid, and extensively reliable to transact with or use in DeFi. Unlike algorithmic stablecoins, USDC enjoys a perpetual 1:1 ratio with the US dollar, which offers a high level of assurance to consumers, investors and users.

2.Tether

Since it creation in 2014, Tether (USDT) has become one of the most resilient stablecoins in 2025. This is due to the fact that it has been used and accepted in the cryptocurrency market for a very long time. Tether has been seen to be stable, as it is backed with a fine mix of fiat reserves, cash equivalents and various assets.

Tether has a market capitalization of over $83 Billion, which gives it high liquidity and hence, it is seen as a trusted option for payments, trading and even Defi applications. This, combined with Tether’s integration with other exchanges and platforms, the fact that it is still being audited and has plenty of reports based on transparency, gives Tether the ability to offer stable and secure transactions.

3.Dai (MakerDAO)

Dai (DAI) a stablecoin released in 2017 by MakerDAO, is believed in 2025 to be one of the most stable coins available due to the fact that it is collateralized by crypto and fully decentralized, which allows users visibility and control that does not depend on any one organization. Unlike fiat-backed stablecoins, Dai uses a complex set of smart contracts combined with over-collateralized crypto assets to maintain a stable 1:1 peg to a US Dollar.

These assets smart contracts self-adjust along with real-time changes in the crypto market. MKR token holders govern Dai which guarantees that the holders will make decisions that promote the stability and security of the protocol. Dai is still consistently trustworthy on DeFI platforms and all exchange markets, making it a worthwhile investment if one is looking for a transparent, stablecoin that is fully decentralized.

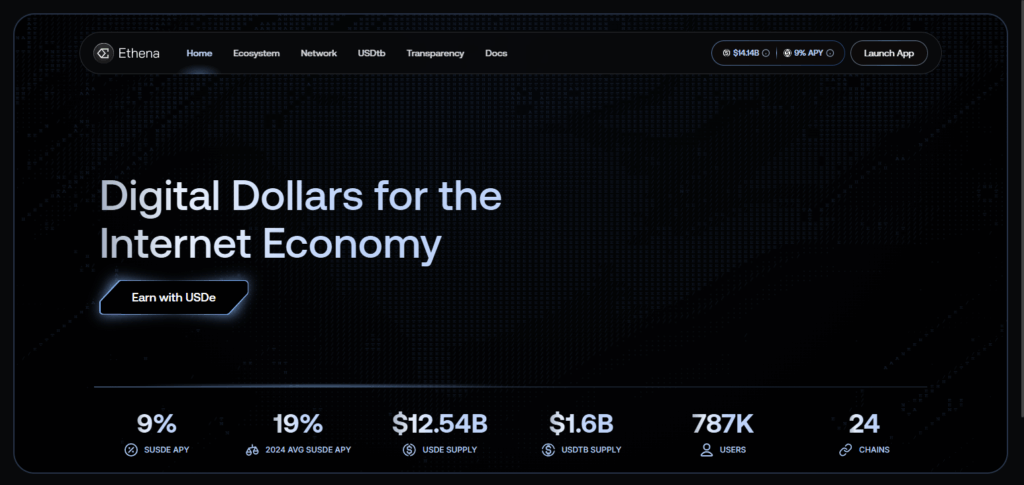

4.Ethena USD

Launched in 2021, Ethena USD has become, as of 2025, one of the safest stablecoins due to its unique blend of algorithmic stability and crypto reserve safety. Like other stablecoins, Ethena USD is pegged to the US Dollar. Its price stability is maintained by smart contracts ethat automatically balance supply and demand, while the eth backed reserves offer additional safety against market volatility.

Its sophisticated risk management mechanism minimizes the chances of depegging, and the protocol is subject to regular audits. The growing adoption of Ethena USD in DeFi and cross-border transactions makes it a stand out option as a safe, dependable, and modern stablecoin.

5.Angle USDA

Angle USDA joined the crypto market in 2022, and with its defensive decentralization, is considered one of the safest stablecoins in 2025. This is reflected from its crypto backed structure and the peg to the USD. USDA’s stable value is managed with peg stability through tokenized collateral, and a governance structure that conservatively monitors pegged reserves and market activity.

Conservative governance ensures over collateralization adequate to remediating depegging risks even during market turbulence. Regular audits, open-source protocols, and growing presence in DeFi platforms and exchanges enhances trust and crypto’s liquidity. Angle USDA’s stablecoin offering is distinguished with transparency, decentralization, and collateral risk securing value.

6.PayPal USD

PayPal USD (PYUSD) was released in 2023, and in 2025 it was recognized as one of the most secure stablecoins, owing to its full backing of US Dollar reserves as well as the financial infrastructure of PayPal. Tailored to work with PayPal’s payment platform, PYUSD enables instant, low-risk transactions with a stablecoin that has high liquidity in both online and crypto payments.

Instant transactions with a flexible market currency to the US Dollar are 1:1 with the stablecoin. Additionally, stablecoins undergo regular auditing and are thus stable. Given PayPal’s reliability and reputation, PayPal USD is a well-regulated stablecoin that works as a primary currency for safe and frequent digital transactions.

7.First Digital USD

First Digital USD (FDUSD), stemming from 2023, continues to hold one of the safest stablecoins positions in 2025 because its US Dollar reserves back it 1:1, and it is extremely compliant with financial regulation. It keeps its value stable, and easily accessible in exchange and payment platforms. This is to say that FDUSD combines the reliability of a fiat with the speed of a digital currency.

The risk of depegging is largely mitigated by its transparent auditing and robust institutional backing. In addition, its support in both the crypto and traditional finance ecosystems makes it versatile, dependable, and safe. In 2025, FDUSD remains one of the few stable, regulated digital currencies available for safe transaction.

8.TrueUSD

TrueUSD (TUSD), started in 2018, is considered one of the most secure stabelcoins in 2025 having its value fully backed with US Dollar reserves maintained in multiple reputable escrow accounts and guaranteed with full transparency and safety. It undergoes regular third-party audits, has its value pegged 1:1 with the American Dollar, and has its collateral verified at all times.

TrueUSD undergoes multiple audits owing to the legal covers and compliance regulations with the various regulatory authorities, giving the users and investors confidence. TrueUSD is fully supported having multiple uses across various crypto exchanges and DeFi platforms to give the users a safe, fully transparent, and stabel and predictable option for digital transactions.

9.Frax

Since 2019, Frax (FRAX) was introduced and due to its unique fractional algorithmic structure, is deemed one of the safest stablecoins in 2025. Frax makes use of crypto collateral and algorithmic functions to assist in balancing with the 1:1 algorithm with the US Dollar. The hybrid approach makes it easier for Frax to dynamically adjust supply in order to decrease volatility to provide enough liquidity for various DeFi platforms.

The smart contracts and regular crypto audits provide the basis for trust and security, along with the use and adoption in lending, trading, and DeFi. The algorithmic efficiency and backing of collateral makes Frax truly a resilient, modern, and sophisticated stablecoin for users whom are in search of innovation.

10.Pax Dollar

Pax Dollar (USDP), starting from 2018, is one of the most secure stablecoins Prospectively in 2025, this is primarily due to its, full backing of US Dollars and regulatory compliant. Each USDP Token is underpinned by verified fiat reserves custodied in regulated financial institutions which guarantees stability and risk of depegging.

It is the cash reserve system coupled with its transparent operations, US financial standards, frequent third-party audits which grants users confidence and assurance. Pax dollars is one of the most liquid and regulated stable coins in the world which is why it is one of the most trusted and secure digital transactions of 2025. It is accepted by numerous crypto exchanges and along with many DeFi platforms.

Pros & Cons

Pros

- Fully backed by reliable assets like US Dollars or crypto collateral.

- High liquidity; accepted on-chain and off-chain exchanges & DeFi platforms.

- Transparent operations; trusted by the public due to audits.

- The law, regulated; gives assurance to the user and legal protection to the firm.

- Stable in price; perfect for buying and selling as well as for digital payments and transactions.

Cons

- Centralized management for fiat-backed stablecoins can pose single point risks.

- Some algorithmic or crypto backed stablecoins are overly complex for beginner users.

- Adoption and liquidity for smaller or newer stablecoins are typically low.

- Some coins were not trusted in the past due to a lack of backing or transparent support.

- Stablecoins are designed for long-term stability, not profit; hence low returns compared to volatile crypto.

Conclusion

To wrap up, I believe the most stable stablecoins in 2025 are also transparent, secured, and ideal for trading and day-to-day purchases” fiat-backed stablecoins like USD Coin, Tether, TrueUSD, and Pax Dollar have the assurance of compliance and fully reserved assets, while decentralized or crypto-backed stablecoins like Dai, Frax, and Angle USDA offer pegged innovations with transparent and creative stablecoin frameworks.

New entrants like Ethena USD, PayPal USD, and First Digital USD also broaden the list of regulated and safe options available to customers. Choosing stablecoins with transparent reserve auditing, ample liquidity, and cross-border market adoption will instill confidence in the crypto ecosystem in 2025.

FAQ

Why are stablecoins considered safe in 2025?

Stablecoins with strong backing, regulatory compliance, transparency, and regular audits are considered safe. They maintain their peg, provide liquidity, and are widely accepted on exchanges and DeFi platforms.

What makes USD Coin (USDC) safe?

USDC is fully fiat-backed, regulated, widely accepted, and undergoes regular audits to ensure transparency and stability.

How can I choose the safest stablecoin?

Look for fiat backing, regulatory compliance, audits, market capitalization, liquidity, and adoption on exchanges and DeFi platforms.