In this article, I will discuss How to Track Stablecoin Whales Across Blockchain. You will learn how to track significant stablecoin transactions, follow cross-chain movements, and analyze whale activity by utilizing specific tools and methods across various platforms.

These methods can help investors track and manage market movements, risks, and decisions towards reactive cryptocurrency.

Understanding Stablecoin Whales

A stablecoin whale is associated with stablecoins (cryptocurrencies linked to stable instruments like US dollars) and holds extensive amounts of them.

Describes as “whales” in crypto, unlike the bulk of crypto holders, these individuals are able to tilt the market due to the volume of stablecoins owned.

Their buying and selling activities are able to create changes in liquidity, alter trading cycles, and even change market mood. Tracking such stablecoin holders is key to assess onboard capital movement and detecting patterns of flow.

Investors as well as analysts are able to foresee border movement on different blockchains. These individuals whale holders tend to work on variety of chains, thus cross-chain tracking is vital for precise information.

How to Track Stablecoin Whales Across Blockchains

Example: Tracking a Stablecoin Whale on Ethereum and BSC

Step 1: Identify a Whale Wallet

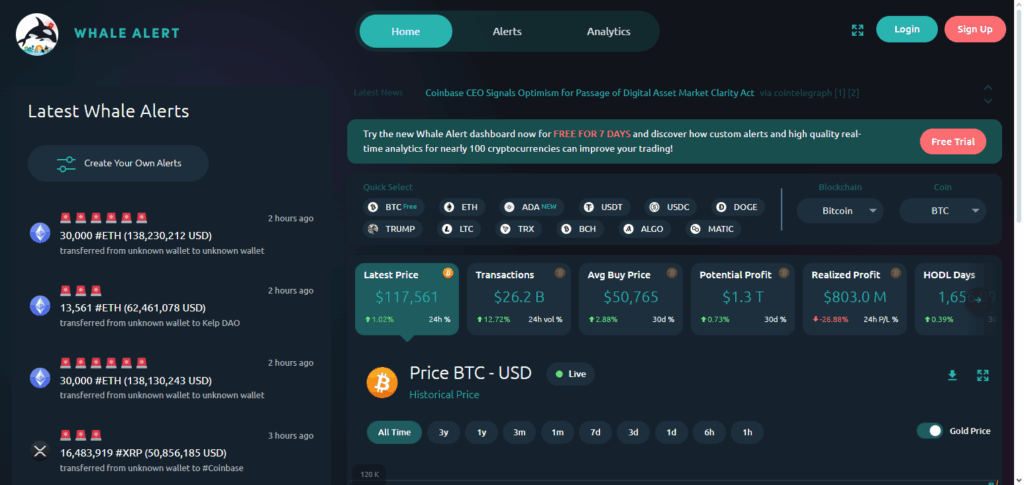

In order to track wallets storing a considerable quantity of stablecoins, use resources like Whale Alert or Nansen (for example, wallets stored with USDT or USDC).

Step 2: Monitor Wallet Transactions on Blockchain Explorers

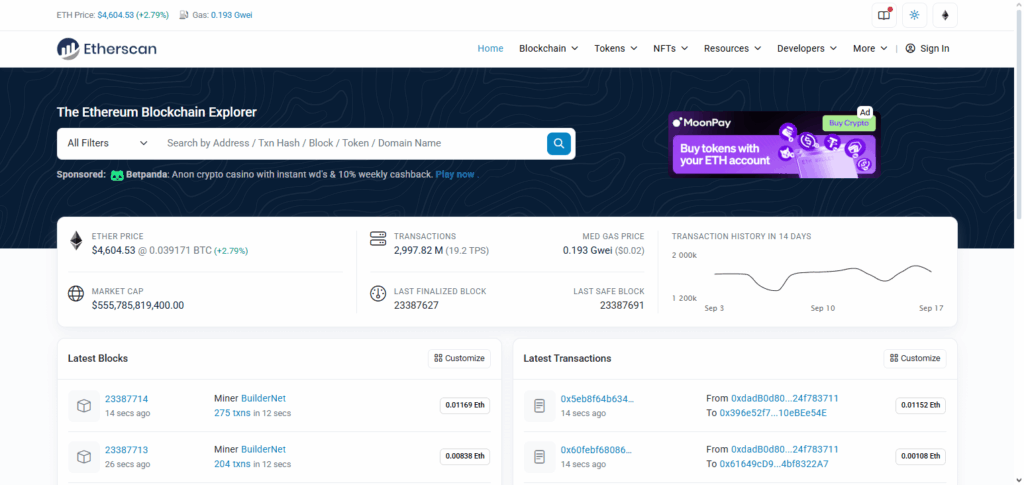

Go to Etherscan (for Ethereum) or BscScan (for Binance Smart Chain).

Insert the whale’s wallet address to search transaction histories.

Step 3: Set Up Alerts for Large Transfers

In Whale Alert or Nansen, spend time setting up alerts to notify you when the wallet either sends or receives a large stablecoin.

Step 4: Track Cross-Chain Transfers

If the whale bridges assets to a separate chain (like Ethereum to BSC) make sure to check the bridging contract and destination wallet for the other chain.

Use multi-chain analytic resources (like Debank, Dune Analytics, etc.) to confirm the transfer.

Step 5: Identify and Analyze Change in Patterns

Make a note of transaction volume, regularity, and target.

Try to observe a set of identifiable patterns which could be large transactions during a market change.

Step 6: Intergrate Off-Chain Information with On-Chain Data

Look for context behind whale movements on news, social media, or exchange announcements.

Step 7: Make The Right Choices

Use whale tracking information to predict changes in liquidity, probable shifts in the economy, and possible trades.

Why Track Whales Across Multiple Blockchains

Market Surveillance: The movements of whales, particularly stablecoins, can help traders predict market direction.

Monitoring Liquidity: Whale trades can impact liquidity across DEXs and trading pairs.

Foresight: The detection of large transfers alerts traders and investors to possible major price movements.

Cross-Chain Interoperability: Whales tend to move across chains, so tracking multiple blockchains can offer valuable insights.

Better Understanding: Whale activity can help set investment and portfolio strategies.

Research Development: Studying the crypto space in relation to blockchain tracking for cross-chain tracking adds innovation to the blockchain and crypto industry.

Challenges in Tracking Whales

Anonymity

The identities of whales are usually concealed behind wallet addresses which makes it difficult to identify individuals with significant assets.

Complex Transactions

Whales often divide transactions among numerous wallets and/or utilize mixers which makes tracing more difficult.

Cross-Chain Movement

Transferred assets between blockchains require sophisticated technologies to track.

High Volume of Data

Considerable size networks produce massive amounts of transaction information. This makes monitoring transactions in real time exceedingly difficult.

Delayed or Limited Alerts

Few platforms offer immediate notice of significant transactions which decreases the efficiency of monitoring in real time.

Privacy Protocols

Certain blockchains use privacy measures where transaction information can remain hidden which reduces the level of disclosure.

Tools and Platforms for Whale Tracking

Blockchain Explorers: Tools like Etherscan, BscScan and PolygonScan give the ability to track specific wallet addresses and transaction activity and track large movements of assets in real-time. Each of them provide sufficient amounts of metrics in respect to the level of on-chain activity.

Whale Tracking Services: Tools like Whale Alert and Nansen provide large stablecoin movements reports, wallet clusters and activity in whales on multiple blockchains.

Multi-Chain Analytics Tools: Tools like Debank, Dune Analytics and Zapper consolidate data on multiple blockchains to make it easier to track cross-chain movements as well as liquidity and wallet movements.

Automated Alerts & Bots: Bots may be programmed to provide real-time notifications for the movements of stablecoins which gives traders the ability to make spontaneous decisions based on the real-time market.

Best Practices

Setup Alerts for Whale Transactions and Transfers

Streamline the process of tracking multiple wallets and set up automated alert systems. Use software like Whale Alert and Nansen to receive first-hand updates of large scale stablecoin transfers to and fro from the wallets of whales.

Track Key Wallets

Don’t just track the transactions. Analyze the movements of the wallets and track the real-time transaction pattern over a span of time.

Monitor Chains

Track movements from different wallets across various chains of chains and different blockchains.

Measure Transaction Volume to Analyze Activity

Analyze and monitor the corresponding transaction volumes to assess the scale and impact.

Integrate On-Chain and Off-Chain Data

Social media, breaking reports, and mining news are examples of off-chain information. Parallelly, use the transaction history from the chain to get a closer view of the user.

Report Writing

Track the movements and assess the documents of the whales to better predict their activities in the future better.

Conclusion

Whale activities regarding stablecoins on the various chains is a technique used to understand the current trends in the market and predict the future of the cryptocurrency market.

Blockchain explorers and whale tracking windows alongside multi-chain analytics tools will allow you to tail the heavy hitters of stablecoin transactions. Of course the anonymity and the complicated cross chain transfers can cause some difficulty.

But following the standard protocol such as setting alerts, tracking major wallets and dissecting the patterns in transactions will mitigate the issue.

Augmenting on-chain information with off-chain data will provide whale trackers an all encompassing analytics. In the end, strategically observing and whale tracking allows you to hone in on crypto tendencies and prepare.

FAQ

Why track stablecoin whales?

Tracking whales helps investors anticipate market trends, detect large capital flows, and make informed trading decisions by monitoring significant stablecoin movements.

Which tools can I use to track whales?

Popular tools include Etherscan, BscScan, Whale Alert, Nansen, Debank, and Dune Analytics, which provide transaction monitoring and cross-chain analytics.

Can I track whale movements across multiple blockchains?

Yes, multi-chain analytics tools and whale tracking platforms allow monitoring of transactions across Ethereum, BSC, Polygon, and other major blockchains.

Are there challenges in whale tracking?

Yes, challenges include anonymity, complex transactions, cross-chain movement, privacy protocols, and the sheer volume of on-chain data.