In this piece, I will explore the Best Bridging Aggregators for Multi-Network Tokens. These services merge multi-chain token swap and transfers, providing efficient, fast, low-cost, and secure conversions.

By pooling liquidity from various bridges and DEXs, they ensure low slippage and the most efficient token routes. Traders, DeFi users, and developers alike will find these aggregators make cross-chain token management easy and dependable.

What is Bridging Aggregators for Multi-Network Tokens?

Bridging aggregators for multi-network tokens are the only platforms that consolidate multiple bridges enabling users to transfer tokens across blockchains with ease.

Instead of using a single bridge, these aggregators check many routes to get the fastest, least expensive, and most secure option for a cross-chain swap.

Blockchain fragmentation is resolved by seamless access to liquidity across Ethereum, Polygon, Avalanche, BNB Chain, and beyond.

Bridging aggregators cross-chain asset movement, thereby bettering interoperability and user experience while lowering transaction fees. These are vital for traders, DeFi users, and projects that span across many networks.

How To Choose Best Bridging Aggregators for Multi-Network Tokens

Security & Trustworthiness: Find out if the aggregator has been audited and if the operations are transparent and well trusted in the crypto community.

Supported Networks: Find an aggregator that supports multiple blockchains such as Ethereum, Polygon, Avalanche, BNB Chain, Arbitrum, Optimism.

Speed of Transactions: Review the transaction speed, the top aggregators will confirm and process payments quicker than the rest.

Fees & Cost: Choose an aggregator that fulfills the promise of the best fee through aggregat Route without the addtion of surreptitious charges.

Liquidity Access: Confirm that the aggregator’s deep liquidity sources will prevent slippage for various tokens.

User Experience: An easy to use interface and transaction summaries will reduce the chances of making mistakes.

Customer Support & Community: Good bridging aggregators will have well established support and community for them.

Key Point & Best Bridging Aggregators for Multi-Network Tokens List

| Bridging Aggregator | Key Point Highlight |

|---|---|

| Rango Exchange | Multi-chain DEX and bridge aggregator with wide blockchain and token support. |

| Jumper Exchange | User-friendly cross-chain swap aggregator focusing on fast and cheap routes. |

| Chainspot | Provides one-click multi-chain swaps with strong interoperability features. |

| LI.FI Protocol | Developer-focused aggregator offering SDKs and APIs for seamless dApp integration. |

| Squid Router | Cross-chain router built on Axelar, enabling dApps to access multiple ecosystems. |

| Symbiosis Finance | Liquidity protocol that aggregates DEXs and bridges for cross-chain swaps. |

| Celer cBridge | Popular bridge with high-speed transfers and strong liquidity for multiple networks. |

| Across Protocol | Optimized for low-cost and instant transfers across Ethereum rollups and chains. |

| Hop Protocol | Designed for Ethereum Layer-2 transfers with fast and trust-minimized bridging. |

| GhostSwap | Decentralized cross-chain aggregator focusing on anonymous and secure swaps. |

1. Rango Exchange

Rango Exchange is one of the Best Bridging Aggregators for Multi-Network Tokens because it integrates cross-chain bridges and decentralized exchanges onto one platform. Unlike traditional bridges which only allow token movement on certain blockchains, Rango provides access to deep liquidity pools on multiple blockchains for efficient swaps with minimum slippage.

This is unique since Rango also supports not only the popular chains of Ethereum, Polygon, and BNB Chain but also supports other emerging ecosystems which provides users great flexibility. Through smart routing, Rango identifies the most economical path for swaps which is beneficial to traders and DeFi users in multi-network setups.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, and more |

| Token Support | Wide range of ERC-20, BEP-20, and other cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher limits |

| Transaction Speed | Fast, optimized via smart routing across multiple bridges |

| Fees | Competitive, automatically selects cheapest route |

| Security | Non-custodial, audited smart contracts, trust-minimized bridging |

| Unique Feature | Combines DEX swaps and multi-chain bridging in a single interface |

| User Type | Suitable for traders, DeFi users, and projects needing multi-chain access |

2. Jumper Exchange

Jumper Exchange has earned recognition for being the Best Bridging Aggregator for Multi-Network Tokens due to the ease and speed they focus on for cross-chain transactions.

Unlike other platforms that bombard users with complex technical processes, Jumper positions itself simply and simply offers the user-friendly platform on which to conduct multi-chain swaps – whether you are a novice or seasoned trader.

There’s a smarter” routing system that checks multiple bridges and liquidity sources in real-time, guaranteeing users the lowest routes and fastest transit times. Jumper’s integration with multiple chains, along with real-time transparency at each stage, provides unparalleled efficiency and trust.

| Feature | Details |

|---|---|

| Platform Name | Jumper Exchange |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism |

| Token Support | ERC-20, BEP-20, and other major cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher transaction limits |

| Transaction Speed | Fast, optimized via automatic route selection |

| Fees | Low and competitive, smart routing ensures cheapest path |

| Security | Non-custodial, audited protocols, trust-minimized swaps |

| Unique Feature | User-friendly interface with one-click multi-chain token swaps |

| User Type | Ideal for traders and DeFi users needing fast, low-cost multi-network transfers |

3. Chainspot

Chainspot is one of the Best Bridging Aggregators for Multi-Network Tokens because it specializes in one-click integration and the easing of the intricacies of cross-chain transactions.

Unlike the standard bridging platforms, Chainspot enables users to carry out multi-layer swaps in… This innovative approach decimates manual steps, time, and the chances of user error. With support for over 200 networks and tokens, it also provides guaranteed deep liquidity and competitive pricing.

By simply finishing the most difficult steps of bridging Chainspot becomes both the most convenient and the most trusted. This makes it an increasingly valuable instrument for effortless cross-chain usage.

| Feature | Details |

|---|---|

| Platform Name | Chainspot |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism |

| Token Support | ERC-20, BEP-20, and other widely used cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher transaction limits |

| Transaction Speed | Fast, optimized via automated routing across multiple bridges |

| Fees | Competitive, smart routing ensures lowest cost |

| Security | Non-custodial, audited smart contracts, trust-minimized bridging |

| Unique Feature | One-click multi-step swaps with simplified cross-chain execution |

| User Type | Traders, DeFi users, and projects seeking seamless multi-network swaps |

4. LI.FI Protocol

The LI.FI Protocol is one of the top Multi-Network Token Bridging Aggregators because it is built for both developers constructing cross-chain solutions and end-users.

Offering and supporting powerful APIs and SDKs that enable seamless integration of multi-chain swaps, LI.FI helps developers immensely.

LI.FI connects many bridges, relay DEXs, and varying liquidity, so users are guaranteed optimized routes and the best combination of speed, cost, and security.

Projects using LI.FI are able to offer users embedded interoperability and frictionless cross-chain liquidity. Opting for API and SDK integration liberates them from complex multi-chain DeFi architecture and makes LI.FI central to construction.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, and more |

| Token Support | ERC-20, BEP-20, and cross-chain tokens supported by integrated bridges |

| KYC Requirement | Minimal – mostly non-custodial; optional KYC for higher limits |

| Transaction Speed | Fast, optimized via automatic multi-bridge routing |

| Fees | Competitive, dynamically selects lowest-cost path |

| Security | Non-custodial, audited, developer-focused trust-minimized bridging |

| Unique Feature | Provides APIs and SDKs for seamless dApp integration with cross-chain swaps |

| User Type | Traders, DeFi users, and developers integrating multi-network token support |

5. Squid Router

Squid Router has won accolades as the Bridging Aggregator relaying to multi-network tokens because of its capability of performing cross-chain routing.

With Squid Router, dApps, and users can move tokens to and from various blockchains without engaging in tiresome and unwieldy manual procedures, as the dApps and users move tokens aided by the Axelar network.

The key to Squid Router is its unique ability to instantly determine the most performant bridge paths which minimizes costs and optimizes swift transaction completion.

Accessible deep liquidity coupled with unparalleled interoperability guarantees seamless and dependable token movement across networks. This multi-chain flexibility complemented with remarkable agility and wallet-friendly rates renders Squid Router one of the most preferred choice by users and developers engaging with cross-chain.

| Feature | Details |

|---|---|

| Platform Name | Squid Router |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism |

| Token Support | ERC-20, BEP-20, and other widely used cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher limits |

| Transaction Speed | Fast, optimized through automatic routing across multiple bridges |

| Fees | Low and competitive, smart routing selects the cheapest path |

| Security | Non-custodial, audited contracts, trust-minimized bridging |

| Unique Feature | Built on Axelar network, enabling seamless multi-chain token transfers |

| User Type | Traders, DeFi users, and dApp developers needing multi-network swaps |

6. Symbiosis Finance

Symbiosis Finance has been noted as one of the Best Bridging Aggregators for Multi-Network Tokens for its cross-chain swaps and liquidity aggregation which provides users with one of the most efficient and versatile platforms.

Its more unique advantage is using multiple decentralized exchanges and bridges through one single interface which results in cross-chain transactions with the lowest slippage and the most optimized fees.

Symbiosis is one of the most interconnected cross-chain liquidity providers providing deep liquidity and seamless token transfers for Ethereum, BNB Chain, and Polygon and a number of other blockchains.

Symbiosis Finance with its liquidity aggregation and decentralized exchange automation and route selection algorithm makes it a an excellent DeFi platform for seamless trading with low cost and high-speed efficient route selection automated for users and DeFi projects.

| Feature | Details |

|---|---|

| Platform Name | Symbiosis Finance |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism |

| Token Support | ERC-20, BEP-20, and cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher transaction limits |

| Transaction Speed | Fast, optimized via smart routing and liquidity aggregation |

| Fees | Competitive, reduces slippage by accessing multiple liquidity sources |

| Security | Non-custodial, audited smart contracts, trust-minimized swaps |

| Unique Feature | Aggregates DEXs and bridges in one platform for seamless multi-chain swaps |

| User Type | Traders, DeFi users, and projects requiring efficient cross-chain transfers |

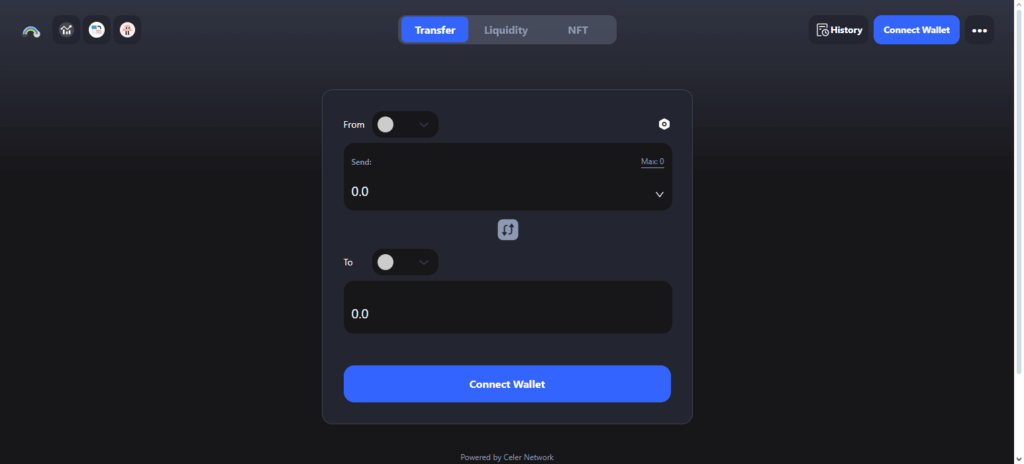

7. Celer cBridge

Celer cBridge is one of the few bridging aggregators that has focused on speed, security, and scalability and as a result has received accolades for each of these features.

Few bridges can claim that they facilitate near instant, low fee, cross blockchain token mobility. cBridge’s support of Ethereum, Polygon, BNB Chain, Avalanche, and many other networks coupled with sufficient liquidity for low slippage transcends that of most other bridges.

Trust-minimized transfer of value and real-time route optimization to the profit-maximized path of a transfer enhances cross-chain operational effectiveness. This has made cBridge immensely popular among traders, developers, and users of DeFi who require swift and safe movement of tokens across multiple networks.

| Feature | Details |

|---|---|

| Platform Name | Celer cBridge |

| Network Support | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism |

| Token Support | ERC-20, BEP-20, and major cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher transaction limits |

| Transaction Speed | Near-instant transfers via layer-2 scaling technology |

| Fees | Low and competitive, optimized by smart routing |

| Security | Non-custodial, audited contracts, trust-minimized bridging |

| Unique Feature | High-speed, scalable cross-chain transfers with deep liquidity |

| User Type | Traders, DeFi users, and developers seeking fast, secure multi-network swaps |

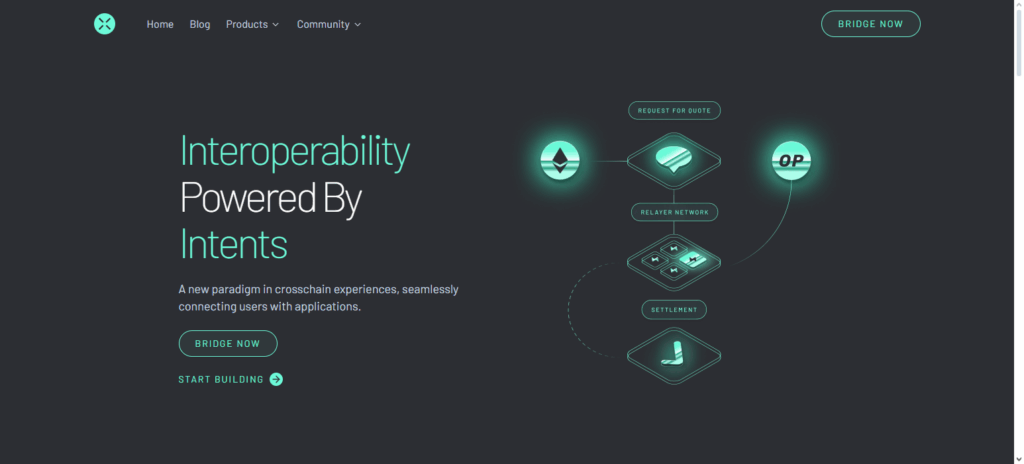

8. Across Protocol

Across Protocol has received praise as one of the Best Bridging Aggregators for Multi-Network Tokens because of its focus on speed, reliability, and low-cost transfers. Its unique core competency lies in route optimization across chains to minimize transaction costs and to enhance pace and security in token movements across Ethereum, Layer-2 networks, and other leading blockchains.

Alongside the trust-minimized approach, Across Protocol simplifies counterparty risks frequent in multi-chain swaps. Also, its interface alleviates many complex bridging processes, thus enhancing its usability for novices and experts alike. All in all, the protocol has superb multi-network token transfer capabilities and its combination of cost, security, and operational efficiency makes it the most preferred.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Network Support | Ethereum, Polygon, Arbitrum, Optimism, and other Layer-2 networks |

| Token Support | ERC-20 and other widely used cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher limits |

| Transaction Speed | Fast, optimized via efficient bridging routes |

| Fees | Low, dynamically selects the cheapest path |

| Security | Trust-minimized, non-custodial, audited smart contracts |

| Unique Feature | Optimized for low-cost and instant transfers across Ethereum rollups and other chains |

| User Type | Traders, DeFi users, and projects needing fast cross-chain swaps |

9. Hop Protocol

Hop Protocol is considered one of the Best Bridging Aggregators for Multi-Network Tokens because it focuses on rapid, trust-minimized transfers between Ethereum Layer-2s and other blockchains. Its competitive edge is the focus on minimizing transaction time and cost.

This is done by the use of liquidity pools on each of the supports chains for near-instant token swaps without the slow finality confirmation. Hop Protocol also eliminates this risk of control by using decentralized security mechanisms which avoids the common single-point failures of traditional bridges.

Hop Protocol is able to combine speed and low fees with strong interoperability which makes it seamless for cross-chain transactions. This is the preferred solution for traders, DeFi users, and developers working on multiple ecosystems.

| Feature | Details |

|---|---|

| Platform Name | Hop Protocol |

| Network Support | Ethereum, Polygon, Arbitrum, Optimism, other Layer-2 networks |

| Token Support | ERC-20 and widely used cross-chain tokens |

| KYC Requirement | Minimal – mostly non-custodial, optional KYC for higher transaction limits |

| Transaction Speed | Near-instant transfers using liquidity pools on each chain |

| Fees | Low and competitive, optimized through trust-minimized routing |

| Security | Non-custodial, audited contracts, decentralized and secure bridging |

| Unique Feature | Focused on fast, trust-minimized Layer-2 transfers with low slippage |

| User Type | Traders, DeFi users, and developers needing efficient multi-network swaps |

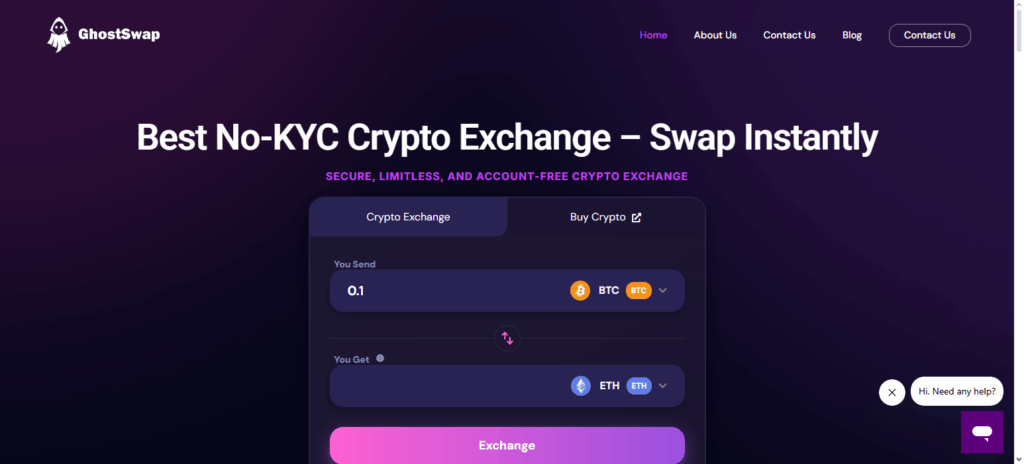

10. GhostSwap

GhostSwap calls itself one of the Best Bridging Aggregators for Multi-Network Tokens thanks to its focus on privacy and secure cross-chain transactions.

Unlike other bridging platforms, GhostSwap supports the transfer of tokens across multiple blockchains, including Ethereum, Polygon, and BNB Chain with complete anonymity.

Its key advantage stems from incorporating decentralised routing and depth of encryption to ensure speed and cost-effective swaps without the risk of tracking or front-running.

With GhostSwap’s deep liquidity, optimized routes, and the intuitive interface, traders and DeFi users can access robust privacy and seamless multi-network interoperability.

Pros & Cons Bridging Aggregators for Multi-Network Tokens

Pros

- Cross-Chain Bridging – Transfer tokens effortlessly among Ethereum, Polygon, BNB Chain, Avalanche, and other chains.

- Transaction Cost Reduction – Transaction fees are lowered due to route optimization.

- Transaction Speed – Transfers are near-instant due to pools and optimized bridges.

- Security and Trust – The majority are non-custodial and audited, so your counterparty risks are minimized.

- Access to Multiple DEXs with Reduced Slippage – Slippage is lowered due to the aggregation of several decentralized exchanges and bridges.

- Engaging and Simplified Interfaces – Complex cross-chain swaps are simplified for newbies and advanced users.

- APIs and SDKs for Developers – Developers like LI.FI provide dApp integration.

Cons

- Limited Verification for Transfers Above a Certain Amount – Minimal KYC may flag for manual verification above a set threshold.

- Risk of Underlying Smart Contracts – Underlying contracts being insecure is an issue.

- Peak Transfer Slowing – Transfers get sluggish at peak usage of the blockchain.

- Currently Unsupported Tokens for Aggregators – New and niche tokens are often unsupported.

- Understanding Multi-Chain Bridging – Bridging beginners will need to learn about multiple chains.

Conclusion

To sum it up, the Best Bridging Aggregators For Multi-Network Tokens have become invaluable wizards for dealing with an ever-more splintered blockchain world.

Rango Exchange, Jumper Exchange, Chainspot, LI.FI Protocol, Squid Router, Symbiosis Finance, Celer cBridge, Across Protocol, Hop Protocol, GhostSwap, and the other ever-more-present cross network aggregators deliver fast, seamless, safe, and inexpensive transfers of tokens through many networks.

Bypassing complex cross-chain movement for traders, DeFi participators, and developers, these cross-chain aggregators deliver speedy transactions, considerable liquidity, and the ability to KYC-limited users.

While these almost frictionless aggregators can be a welcome relief, analysts still caution users to assess their preferred options of speed, supported networks, pricing, and security, to guarantee a seamless and trusted multi network token movement.

FAQ

Why use a bridging aggregator instead of a single bridge?

Aggregators automatically find the fastest and cheapest routes, reduce slippage, provide deeper liquidity, and simplify the process compared to using individual bridges manually.

Are bridging aggregators safe to use?

Most top aggregators are non-custodial, audited, and trust-minimized, reducing counterparty risks. However, smart contract vulnerabilities and network congestion remain potential risks.

Do I need KYC to use these aggregators?

Minimal KYC is required on most platforms, usually only for higher transaction limits, while standard usage often remains non-custodial and privacy-focused.

Which networks do these aggregators support?

Popular aggregators support Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, and other Layer-2 or emerging blockchains.