I understand that your situation might feel scary, but trading in a car with negative equity is possible. You need to know how much you owe on your car, how much it is worth now, whether you will need to roll negative equity into your next loan, and what offer you’ll receive on your new car to understand your options.

You can manage this kind of situation with careful planning, as well as obtaining loan preapproval of your next vehicle and a good vehicle purchase and loan overall. This way you can manage the amount of additional debt you take on and keep your trade balance within your means.

What is Negative Equity on a Car?

Negative equity in a car loan is when you owe more on your loan than the car is currently worth. Loans are considered upside down in these cases. It happens because cars lose value quickly; when they’re newly purchased they can lose up to 20 percent value in the the first year.

Several things can play a role in having negatie equity. If no down payment is made, the risk increases. A car that is heavily worn or kept in a poor condition can lower a car’s resale value. Extended loans, 6 or 7 years, can also increase having a car equaty negative because the value of the car will depreciate quicker than the loan is being paid off.

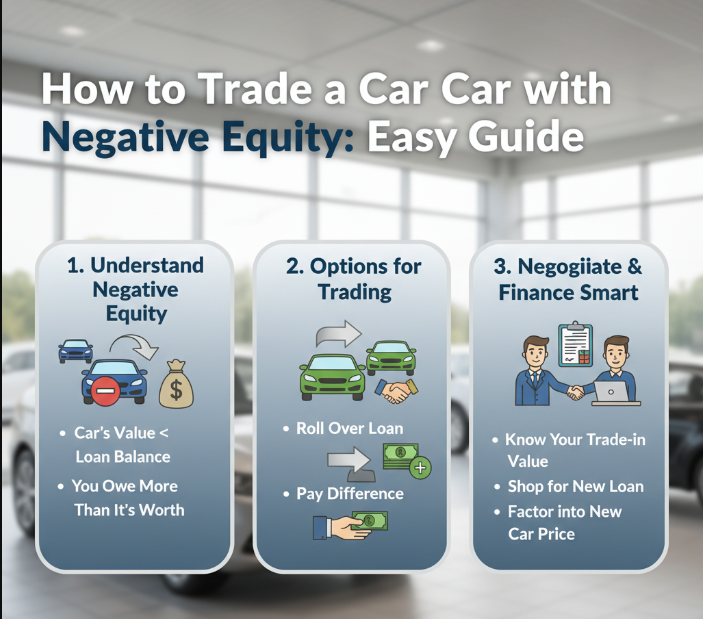

How to Trade a Car with Negative Equity?

1. Calculate your equity

First, ask your lender for a payoff quote, then find your car’s trade-in value. Kelley Blue Book (KBB) is a great place for free online estimates based on a car’s make, model, and condition. For the best estimate, visit a dealership for an appraisal.

Example: If KBB values your car at $14,000, but your loan payoff is $17,500, you’re $3,500 upside down, and this will probably roll into your new loan when you trade-in.

2. Estimate your financing

In the case of negative equity, your new loan will cover the car’s price and the shortfall. Preparing an estimate of your financing is best done using an Edmunds auto loan calculator. Input the loan terms, APR, and trade-in information.

For example, buying a $22,000 car with $3,500 negative equity will make your loan value $25,500. This way, you will know your estimated monthly payments, and understand how the rolled debt will affect your overall financing.

3. Get a Preapproval

Prior to a purchase, obtain a preapproval to review your loan options. Websites like Capital One Auto Navigator allow you to explore potential financing without it impacting your credit score. Submit applications with at least three lenders within 45 days to ensure the inquiries count as one.

For example, one lender offers 8% and another offers 6%: picking the lower rate could save you thousands. Preapproval makes it more certain that you’re prepared to handle the cost of negative equity in your loan when the time comes.

4. Trade in your vehicle at a dealership

After your financing is finalized, trade in your vehicle at a dealership. As with loan applications, gather quotes from multiple dealerships to maximize the value of your trade-in. You can receive instant online offers from CarMax to compare with local dealers.

For example, if CarMax offers $15,000 and another dealer offers $14,200, going with the higher trade-in reduces your negative equity and helps with the extra debt on the new loan.

Can you transfer negative equity into a new car?

Transferring negative equity to a new car is possible. This is called rolling over the loan. Sometimes dealers suggest rolling the negative equity to your next car loan. This is super convenient but not advised. This will put you into negative equity on your new car loan right away. You are just getting a larger loan that will accrue more interest.

This option can work if you don’t have cash to pay off the negative equity and are having a hard time paying for the car you currently have. It can also work if the new loan is at a lower interest rate or if you are buying a less expensive car.

How to Roll Over a Car with Negative Equity

Rolling over a car loan with negative equity can be risky. Here’s what to do:

How Much Negative Equity Do You Have? – Negative equity is the amount owed on a loan minus its market value minus any payoff amount. For instance, if a car loan payoff amount is $20,000 and the car value is $15,000, the negative equity is $5,000.

Buy a Less Expensive Car – If you first buy a cheaper, maybe older used car to mitigate depreciation, it’s possible to drive down negative equity. Newer cars depreciate faster than used cars, and older ones hold value much better.

Length Of The Loan – You can decrease total monthly payments by taking out a longer loan, although it is the opposite with the total interest your pay over the life of the loan which is substantially higher. Use a loan calculator to get close to a payment amount that’s comfortable.

Estimating New Loan Payments – When estimating monthly payments include the amount you still need to pay on your car, the cost of the new car, the loan term you want, and interest rate. This helps determine affordability.

Get Prequalified – Before heading to a dealership, get pre-approval. This not only gives you a budget but also helps you negotiate better.

Review the Contract – Ensure you go over all the terms to avoid surprises later. After finalizing the deal, double-check that your old loan has been completely paid off, and keep proof from your lender.

Negative Equity Car Loan

Owing more for a car loan than what the car currently is worth is termed as a negative equity car loan. Negative equity means you are “upside down” on the loan. Say, for instance, the trade-in value of the car is $20,000, and you owe $30,000 on the loan, the difference means you are $10,000 upside down on the loan.

Having negative equity on your car does not mean you are unable to trade in your car. This is especially true if you are trying to downsize to a more affordable vehicle. You are also able to find your equity position by using a trade-in calculator online.

When finances are negative equity is more commonly the case. In order to minimize the risk of rolling negative equity into the new loan, it is usually more practical to wait until positive equity is gained on the loan.

Conclusion

It is possible to trade in a car with negative equity situation with additional focus and planning. Find out your negative equity balance and it’s likely impact on your new loan. Get preapproval from several lenders to shop around for the best rates and compare offers on your trade-in from several dealerships.

If applicable, try to take a less expensive vehicle and a loan on a term which is comfortable to you. Negative equity can be a difficult situation, however with planning and focus, trading in a vehicle can be a lot less stressful and Financially responsible.

FAQ

What is negative equity on a car?

Negative equity occurs when you owe more on your car loan than the vehicle’s current trade-in value, also called being “upside down” on your loan.

Can I trade in a car with negative equity?

Yes, you can trade in a car with negative equity, but the leftover balance may be rolled into your new auto loan, increasing your monthly payments.

How do I calculate my negative equity?

Subtract your car’s trade-in value from your loan payoff amount: Trade-in Value – Payoff Quote = Negative Equity. This shows how much you owe beyond the car’s value.

Should I get preapproved before trading in?

Yes. Preapproval from multiple lenders helps you secure the best loan rates and terms, even when rolling negative equity into a new car loan.

How can I minimize the impact of negative equity?

Consider a less expensive or used vehicle, make a larger down payment, or choose a shorter loan term to reduce the total interest paid and avoid rolling too much debt into your new loan.