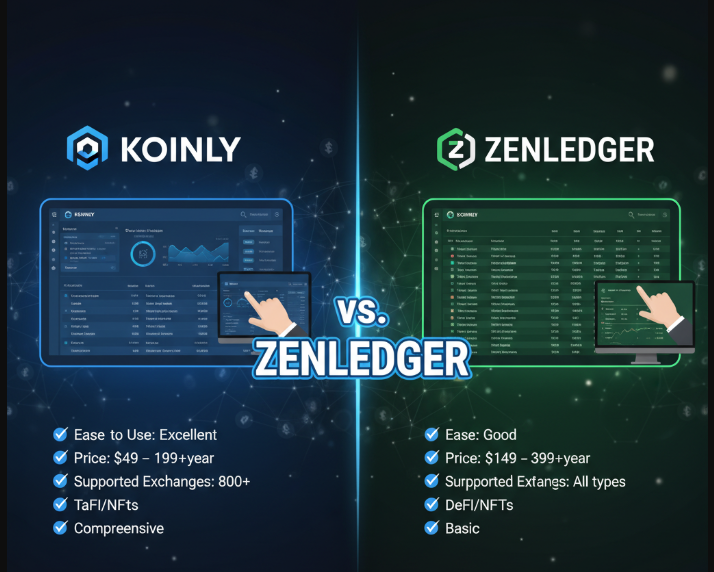

Koinly and ZenLedger are among the most popular platforms the world over for dealing with crypto taxes. Both platforms are designed to make tax reporting easy, and both handle complex transactions like DeFi and NFTs while keeping up with the latest compliance regulations.

The real differences are in their features, integrations, and user focus. This makes the choice of platform dependent on the user’s preferred trading style, tax situation, and whether their requirements are U.S. or global.

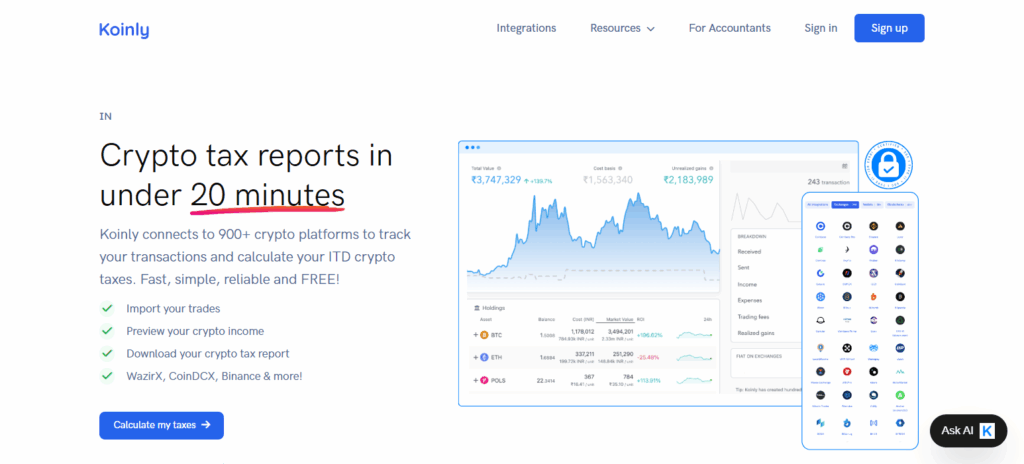

What is Koinly?

Koinly focuses on making crypto tax reporting easier for traders and investors. The software tracks your trades, income, and transactions across a variety of exchanges and wallets and compiles a tax report based on your country’s regulations.

Koinly works with numerous cryptocurrencies, Bitcoin and Ethereum, along with altcoins. Koinly’s software calculates your capital gains, losses, and income.

The interface is quite friendly, making it simple to import and categorize transactions and export data for filing. Koinly works for stress-free tax compliance, whether your a first time user or a pro.

What is ZenLedger?

ZenLedger is top-of-the-line software for cryptocurrency taxation. ZenLedger has the ability to track one’s transactions, assist in determining one’s tax obligations, and help one file compliant tax reports.

ZenLedger connects to multiple cryptocurrency exchanges and wallets, seamlessly importing trades and creating reports that meet the requirements of the IRS.

ZenLedger handles and reports transactions for Bitcoin and Ethereum, and altcoins as well as DeFi, NFTs, and other transactions. Users can track portfolios, calculate taxes, and customize tax forms, thereby offing all users—beginners and experts—good tax management.

A Comparative Table of Koinly Vs. CoinLedger

| Feature | Koinly | CoinLedger |

|---|---|---|

| Free Plan Comparison | Generous free plan with access to most features. Can import and track transactions, view portfolios, and use tax-loss harvesting tools. Cannot download the final tax report without a paid plan. | More limited free plan. Allows transaction imports and basic overview, but many features are locked behind a paywall. Requires upgrade for comprehensive tax summary and advanced tools. |

| Cheapest Plan | $49 per tax year for up to 100 transactions. | $49 per tax year for up to 100 transactions. |

| Payment Methods | Credit cards, Debit cards, Bitcoin (BTC), Ethereum (ETH), DAI, USD Coin (USDC), Polygon (MATIC). | Credit cards, Debit cards. |

| Integrations and API Support | 800 integrations, 300 API integrations. | 632 integrations, 109 API integrations. |

| Supported Platforms | Supports major platforms like Coinbase and Binance. Extensive integrations and robust API support for smoother, faster data import. | Supports major platforms like Coinbase and Binance. |

| Portfolio Tracking Features | Detailed portfolio tracker with individual holdings breakdown, ROI, real-time data, fiat held on exchanges, and dedicated NFT dashboard with image previews. | Basic portfolio tracker with fewer features. |

| Advanced Trading and Reporting | Supports DeFi transactions and NFTs with a dedicated NFT dashboard. Comprehensive support for margin trading, futures, options, CFDs, and loan transactions. | Supports DeFi transactions and NFTs but lacks a dedicated NFT dashboard. Does not support margin trading, futures, options, or loan transactions. |

| Tax Reporting and International Support | Supports IRS tax forms and provides comprehensive international tax reports for multiple countries. Generates a complete tax report PDF for global use. | Supports IRS tax forms and specialized tax reports for U.S., Australia, and Canada. Provides generic reports for other regions (capital gains, income, end-of-year positions, audit trail). |

| Usability and Customization | User-friendly interface with advanced features and settings. Extensive customization options for international tax rules, including various cost-basis methods and country-specific rules. | Beginner-friendly but lacks advanced settings. Basic customization for tax settings and supports standard cost basis methods. |

| Customer Support and Community | High customer ratings with extensive community support through forums and subreddits. Comprehensive resources including documentation, FAQs, and how-to videos. | High customer ratings but lacks strong community engagement. Offers standard support documentation and how-to videos. |

Koinly vs. ZenLedger Price

Koinly Koinly Pricing

Koinly offers plans with unlimited wallets and exchanges, tax reports, portfolio tracking, margin trades, and DeFi support. You get important features like Form 8949, tax reports integration with TurboTax, international tax reports, full audit reports, and live chat support.

Newbie Plan ($49/year): 100 transactions included and is meant for beginners.

Hodler Plan ($99/year): 1,000 transactions.

Trader Plan ($179/year): 3,000 transactions, and priority support.

Pro Plan ($279/year): 10,000+ transactions and priority support.

ZenLedger Pricing:

ZenLedger positions its plans as either Tax Professional Prepared or DIY crypto plans.

DIY Crypto Plans comprise some premium support, detailed reports (audit reports, HIFO/FIFO/LIFO), unlimited exchanges, crypto as income, mining/donations, ICOs/Airdrops, tax-loss harvesting, FinCEN/FBAR alerts, TurboTax integration, and personal consulting ($150/hr) is optional.

Free Plan: 25 transactions; no DeFi, staking, or NFT support.

Starter Plan ($49/year): 100 transactions; no DeFi, staking, or NFT support.

Premium Plan ($149/year): 5,000 transactions; includes DeFi, staking, and NFTs.

Executive Plan ($399/year): Unlimited transactions; full DeFi, staking, and NFT support.

Tax Plans Made by Professionals: ZenLedger will help you link up with a certified crypto tax expert or CPA who will complete and help you file your returns. ZenLedger Supports NFTs and DeFi.

- Consultation Plan: A 30-minute consultation at $195.

- Single-Year Plan: $3,500.

- Multi-Year Plan (2 years): $6,500.

Koinly vs Zenledger supported countries.

Koinly has got your back wherever the Average Cost, LIFO, FIFO, HIFO, etc. methods are applicable. That includes the US, Estonia, Denmark, Malta, Canada, Ireland, Australia, Italy, the UK, Finland, Germany, New Zealand, Norway, Lichtenstein, the Czech Republic, Sweden, Luxembourg, and 10 more countries!

Zenledger covers more than 140 fiat currencies, and regardless of where you are, you can utilize the crypto tax reporting app if you operate under HIFO, FIFO, or LIFO. For now, Zenledger primarily caters to US clients, while clients outside of the US can use Zenledger to figure out their tax owed. The system only pulls record-keeping documents from “crypto tax” clients filing with the IRS.

Koinly vs Zenledger exchanges and wallets

As for Koinly, it works with more than 360 exchanges, which includes Australian exchanges like Coinspot, Coinjar, Swyftx, Independent Reserve, etc., over 70 wallets, 354 DeFi, and 6000+ cryptocurrencies. Users can also scan for and delete duplicate transaction entries. All Koinly subscription plans, including the Free plan, allow DeFi, Margin, and Futures trading.

ZenLedger works with more than 400 crypto exchanges, over 40 blockchains, and 20 DeFi projects. ZenLedger’s software integrates automated exchanges via API, more than any other crypto tax tracking software. Some of the larger exchanges ZenLedger integrates with are: Binance, Bittrex, Coinbase, HitBTC, Huobi, Kraken, KuCoin, and Poloniex.

Koinly Features

Integrations

Koinly integrates with more than 800 exchanges, wallets, blockchains, and 300 API services, making it easy for traders with varied portfolios across numerous exchanges to pull in their data.

Free Plan

Koinly’s free plan is generous with up to 10,000 transactions, and while users can’t download tax reports without upgrading, they can track a portfolio and analyze a rich transaction history.

Portfolio Tracking

Koinly offers sophisticated portfolio tracking, including real-time ROI, profit/loss, fiat balances, and dedicated NFT dashboards with image previews, enhancing behavior analysis and portfolio management, with a more visual NFT awareness.

Transaction Support

Koinly is designed for advanced traders with diverse strategies, as it supports complicated transactions involving DeFi, NFTs, staking, margin trades, options, futures, and crypto lending.

Tax Reports

Koinly offers compatibility for global investors by generating IRS Form 8949, Schedule D, country-specific international tax reports, and reports for numerous countries to ease cross-border crypto compliance.

Customization

Koinly offers flexible country-specific, tax-region customization options for cost-basis FIFO, LIFO, and HIFO methods to tailor track and align country-region tax reports to country compliance.

Additional Tools

Other tools consist of audit-ready reports, TurboTax integration, priority support on higher plans, and an easy-to-use and intuitive design for all users, novices or pros.

ZenLedger Features

Integrations

Users can handle transactions across numerous crypto services as ZenLedger integrates over 400 exchanges, 100+ DeFi protocols, and other NFT platforms.

Free Plan

For beginners, the free plan which covers 25 transactions can be useful, although the more advanced DeFi, staking, and NFT tools are higher-tier paid plan only features.

Tax Reports

ZenLedger calculates IRS-compliant reports including Form 8949, Schedule D, and other audit-trail reports, as well as precise compliance reports on donations, gifts, mining, staking, and airdrop income.

Accounting Methods

ZenLedger allows users HIFO, FIFO, and LIFO methods which highly enhances one’s ability to flexibly adjust their crypto tax strategies to optimize tax liability.

Portfolio Tracking

ZenLedger offers primary portfolio tracking tools which include a profit and loss summary and tracking of all holdings.

Advanced Features

With more complex crypto activities, experienced crypto investors can use higher paid plans for tax-loss harvesting, and other advanced features like NFT and DeFi reporting.

Professional Support

For assistance on complex tax scenarios that involve crypto and non-crypto income, ZenLedger offers tax filing with CPA support which can be customized to single or multiple years as well as consultation plans.

Trust and safety

Both entities have established reliable industry relationships. Think of Zenledger’s associations as including eToro, BitPay, and MetaMask. Koinly’s partnerships include some of the industry giants like MetaMask, Nexo, and Binance. Koinly’s partnerships also include several of the world’s foremost tax software, like Tax Scouts, Clear Tax, and Wealthsimple.

Koinly has also placed a focus on security. Koinly has not had data breaches or hacks, and is also SOC 2 and ISO 27001 certified. ZenLedger has SOC 2 compliance as well, but unfortunately has had a data breach due to a third party vendor in 2023.

The data breach exposed and sold names, emails, phone numbers, and addresses in a dark web forum. ZenLedger cautioned their customers on potential phishing attacks and scams, as the data was sold.

Conclusion

Koinly and ZenLedger are both great options for crypto tax solutions although they fulfill very unique needs. With regard to outstanding free plans, advanced portfolio tracking, and tax assistance across many international regions, Koinly is best for international users and active traders with diverse portfolios.

However, because of audit-trail reports with various details, CPA-assisted filings, and strong compliance focused in the U.S, ZenLedger is better for American investors who seek tax assistance. Ultimately, the decision is based upon the degree of global flexibility or the level of tax assistance needed.

FAQ

What is the main difference between Koinly and ZenLedger?

Koinly focuses on global tax compliance and portfolio tracking, while ZenLedger emphasizes U.S.-focused reporting, audit support, and CPA-assisted tax filing.

Does Koinly have a free plan?

Yes, Koinly offers a free plan supporting up to 10,000 transactions with portfolio tracking. However, you must upgrade to download final tax reports.

Is ZenLedger free to use?

ZenLedger has a free plan covering 25 transactions, but advanced features like DeFi, NFTs, and tax-loss harvesting require upgrading to paid tiers.

Which platform supports more integrations?

Koinly supports over 800 exchanges, wallets, and blockchains, while ZenLedger integrates with 400+ exchanges, 100+ DeFi protocols, and NFT platforms.

Can both platforms handle DeFi and NFTs?

Yes, both support DeFi and NFTs. Koinly offers a dedicated NFT dashboard, while ZenLedger includes these in its premium and executive plans.