This article will highlight Polymarket Supported and Restricted Countries, detailing legal and illegal access to the platform by the users.

It is vital users understand Polymarket’s enforcement of geo-blocks as well as restrictions due to local gambling, derivatives, and other regulatory laws.

It is also vital users understand the scope of the restrictions for safe participation. This guide attempts to offer as much clarity as possible regarding global access.

What is Polymarket?

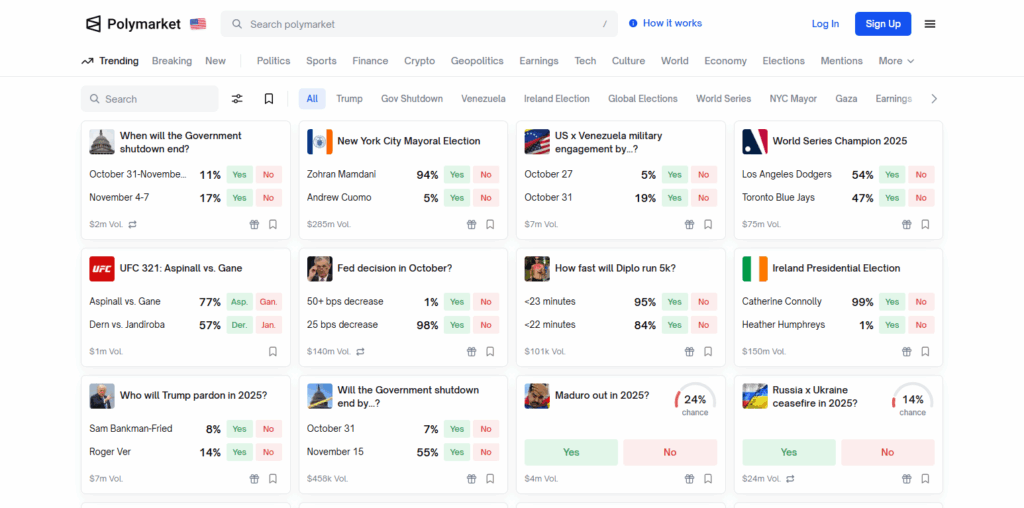

Polymarket is a blockchain-based prediction market, meaning customers can trade on the results of actual events. In contrast to centralized exchanges or betting services, its prediction markets are created and maintained by smart contracts, providing a trustless and transparent marketplace where customers can buy and sell “shares” on different event outcomes which are pegged to real-world outcomes.

Transactions on the markets are quick and inexpensive because the platform uses USDC (USD Coin) and operates mostly on the Polygon network.

Polymarket customers can predict outcomes of a myriad of events, including markets on global events, politics and sports, or even on technology. Every prediction market employs a binary system, where players obtain shares on “Yes” or “No” outcomes, and profits are handed out based on actual, verified results.

Polymarket has been praised for its ability to accurately predict outcomes based on market data. It accurately predicts outcomes far more reliable than traditional polling data.

To avoid illegal market prediction laws, Polymarket has implemented geo-restrictions. In summary, Polymarket is a decentralized finance (DeFi) prediction market that gives customers a transparent and uncensored system to predict outcomes of real events.

Polymarket Supported Countries

Polymarket caters to over 180 countries around the globe, aside from a few restricted regions. Most of Europe, Asia (minus restricted countries), Africa, and all of Latin America contain the bulk of its service offerings.

This means users in these jurisdictions can engage in the event markets for situations where local laws around gambling and derivatives do not apply.

Users can transfer USDC using Polygon network and coming from exchanges like Coinbase. As for blockchain preferences, users can pick between Ethereum, Base, Arbitrum, Polygon, and Solana for the integrations and interoperability.

In some of the regions, MoonPay allows cards and bank payments, but the availability of this service in some locations comes with restrictions to the payment method and the service itself.

Polymarket is estimated to receive a few million visits every month, hosted and accessed from all over the world. Similarweb reports about 6.3 million visits a month, with the bulk coming from United States (~31%), Germany (~7%), Canada (~5%), Vietnam (~4%), and the United Kingdom (~3%).

Polymarket Restricted Countries

The Terms of Use state that Polymarket has limited access from around 15 restricted countries and regions. Below are the key restricted areas and how access is regulated:

United States: As a result of a CFTC settlement, the platform is blocked for U.S. residents. U.S. users are restricted from registering, depositing funds, and trading on Polymarket’s main platform.

United Kingdom: Without a license from the UK Gambling Commission, Polymarket restricts British users and employs geofencing to block access and settlement activities.

France: Due to national gambling regulations, residents are restricted from viewing, trading, depositing, or settling outcomes on Polymarket, which the French law considers as an unlicensed gambling service.

Belgium and Poland (EU): These EU countries regard Polymarket as an unauthorized gambling site and have blacklisted the platform’s domains. Both countries warn their residents against using the service.

Canada (Ontario): Ontario’s iGaming laws require official registration and approval. Polymarket blocks Ontario-based users and access in the other Canadian regions depends on local regulations.

Singapore: The Remote Gambling Act in Singapore prohibits Polymarket and, as a result, authorities block the website and restrict residents from taking part in prediction markets.

Australia: Due to the Interactive Gambling Act, Polymarket doesn’t operate or advertise in Australia. The platform and Australian internet service providers restrict access to Australian users.

Sanctioned Territories: Polymarket adheres to OFAC, EU, UN, and UK sanctions which in turn disallow users from sanctioned regions access. Compliance checks and user attestations are in place to ensure this is enforced.

Why Country Restrictions Exist

Compliance with Local Laws and Regulations

Each country has its own rules relating to online trading, gambling, and financial activities. Polymarket has to block access in jurisdictions where predictive markets are deemed to be gambling or where gambling markets need to be licensed or regulated.

Financial and Securities Regulations

In some jurisdictions, predictive markets might be deemed to fall within the scope of securities or derivatives regulations. To avoid breaching complex financial regulations, Polymarket has to restrict access to jurisdictions where the predictive market is legally allowed.

Anti-Money Laundering (AML) and KYC Requirements

Digital asset regulatory authorities impose Polymarket with AML and KYC compliance risk and operational restrictions regulatory requirements. Global restrictions compliant with KYC AML and Polymarket’s business risk of operational illicit financial flows.

Government Sanctions and Trade Restrictions

Due to sanctions issued by OFAC, the UN, and the EU, Polymarket is also required to block users from sanctioned or high-risk countries from accessing the platform.

Protection of Users and Platform Integrity

Whenever country restrictions are enforced, Polymarket is protecting itself and its users from possible legal penalties and enforcement actions. This also helps keep a platform trustworthy, open, and, in the long run, sustainable.

Licensing and Jurisdictional Limitations

Certain areas, such as the United States or United Kingdom, have specific gambling or trading license requirements which Polymarket does not currently possess. Consequently, in order to remain compliant, the platform self-restricts users from these areas until the necessary licenses may be secured.

Polymarket Licenses and Regulation

Operates as a Decentralized Platform

Polymarket uses blockchain technology and smart contracts. As a result, there is no need for a centralized operator to oversee trades.

Because of the decentralized structure, the need for issuing financial licenses, gambling licenses, or any combination of the two is extremely limited. However, compliance within the scope of international law is still necessary.

Regulatory Oversight and Compliance

Polymarket remains a decentralized crypto gambling site. However, expectations, especially from the U.S. and EU regulators, are that DeFi will remain compliant as well. Following a 2022 settlement with the U.S. Commodity Futures Trading Commission (CFTC), Polymarket restructured to comply with the prediction market regulations and also avoid unregistered event-based contracts.

Restricted Access in Regulated Jurisdictions

In compliance with local laws, Polymarket imposes geo-blocking and self-restriction in the United States, United Kingdom, and France. In those regions, in the case of online prediction markets, gambling or derivatives licenses are required, and as a result, Polymarket has legalized ‘no-risk’ trading for those customers. Users from these countries cannot legally trade or deposit on the platform.

AML and KYC Compliance Standards

Polymarket applies Anti-Money Laundering (AML) and Know Your Customer (KYC) policies to stop fraud and other financial misconduct. This safeguards transparency and ensures the legitimacy of the users on the platform.

Licensing Status

Presently, Polymarket does not possess the conventional licenses for gambling or derivative trading in the majority of jurisdictions. It runs on decentralized governance where the focus is on transparency concerning blockchain verification, rather than obtaining government licenses.

Commitment to Legal Transparency

The platform reputably stays legally compliant as and updates its Terms of Use and user restrictions to meet the demands of different jurisdictions.

Conclusion

Polymarket’s global presence as a seamlessly decentralized prediction market is remarkable. Polymarket is prediction market. Users from over 180 countries to transparent and blockchain-based event trading.

Polymarket is able to provided legal, regulatory and compliance frameworks. Compliance frameworks are the reasons users from the united states. United states, united kingdom, and other regulated or sanctioned regions are because of the compliance of the frameworks for the aml, kyc, and gambling or derivatives laws.

For users wanting to join Polymarkted it is important to check and legal and regulatory necessary. Users Polymarkted check and legal and regulatory necessary because for the remaining compliance Polymarkted adds market access and compliance to the Trust.

FAQ

In how many countries is Polymarket available?

Polymarket is accessible in over 180 countries worldwide, covering most regions in Europe, Asia, Africa, and Latin America, except for those on its restricted list due to legal or regulatory reasons.

Which countries are restricted from using Polymarket?

Polymarket restricts users from around 15 countries and territories, including the United States, United Kingdom, France, Belgium, Poland, Singapore, Australia, and other sanctioned regions such as Iran, North Korea, and Cuba.

Why does Polymarket restrict certain countries?

Restrictions are mainly due to local gambling, derivatives, and financial regulations. Some countries require licenses Polymarket doesn’t currently hold, while others are restricted by international sanctions and compliance laws.

Can I use a VPN to access Polymarket from a restricted country?

No, using a VPN or proxy to bypass geo-blocks violates Polymarket’s Terms of Use and could lead to account suspension. It may also breach your country’s financial or internet laws.