This article will talk about the comparison between eToro and OANDA based on features, trading platforms, costs, and performance.

Although both brokers are reputable within the trading world, they serve different types of traders. By the end of this article, you will know which of the two matches your trading goals for 2025.

What is eToro?

Founded in 2007, eToro is an internationally recognized and regulated online trading platform that provides its users with trading opportunities across an expansive array of financial instruments such as stocks, cryptocurrencies, forex, commodities, ETFs, and indices.

eToro is regulated by the FCA, CySEC, and ASIC which provides users with a sense of comfort and security as eToro caters to millions of users around the world.

One of the platform’s most popular features is its CopyTrader which enables users to automatically copy the trades of successful investors, making the platform an excellent choice for beginner investors.

eToro’s position as a modern online investing pioneer is reflected in its intuitive interface, advanced charting capabilities, and a vibrant, collaborative, and knowledge-sharing social trading community.

What is OANDA?

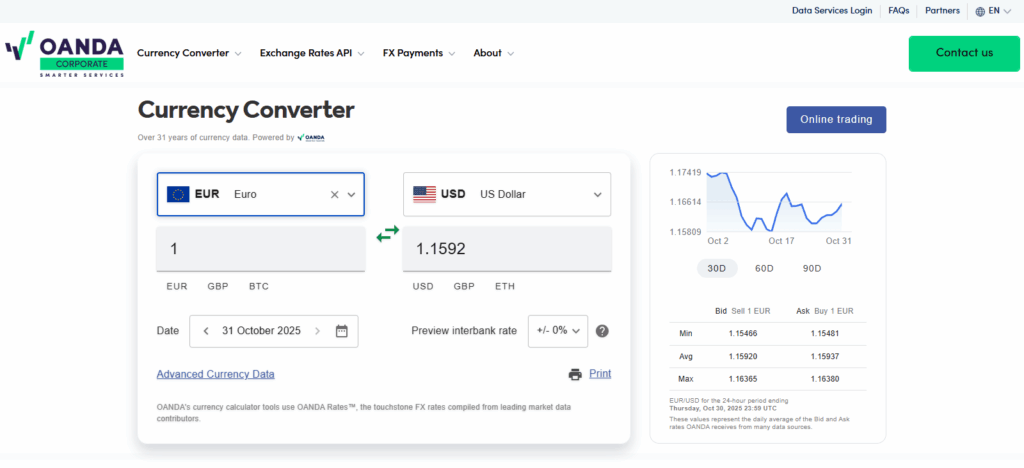

Founded in 1996, OANDA handles forex and CFD trading and has a strong international presence. They possess a dedication to transparency, which has built them a reliable reputation and strong regulatory framework.

They are regulated by the CFTC, FCA, ASIC, and IIROC which are all tier-one regulatory institutions. Having such regulators is a gold standard in the industry. Clients are sure to have a high level of protection while trading with OANDA.

Using their high tier trading platforms like MetaTrader 4 and OANDA Trade, users have access to forex, commodities, indices, bonds, and cryptocurrency. OANDA is famous in the industry for accurate pricing.

They have a reputation for competitive spreads and reliable, real-time, live data exchange rates. They have trading tools, research, and a good reputation for technology to cater to all types of traders, be they beginners or experts. This is what makes them a trusted broker.

Overview comparison eToro vs OANDA

| Feature | eToro | OANDA |

|---|---|---|

| Founded | 2007 | 1996 |

| Headquarters | Tel Aviv, Israel | New York, USA |

| Regulation | FCA (UK), CySEC (Cyprus), ASIC (Australia), FINRA (US), and others | FCA (UK), CFTC (US), ASIC (Australia), IIROC (Canada), MAS (Singapore) |

| Trading Platforms | eToro Web Platform, Mobile App | OANDA Trade, MetaTrader 4 (MT4) |

| Minimum Deposit | $10 | $0 |

| Tradable Assets | Stocks, Forex, Crypto, Commodities, ETFs, Indices | Forex, Commodities, Indices, Bonds, Cryptocurrencies |

| Social Trading | Yes (CopyTrader & Smart Portfolios) | No |

| Demo Account | Yes | Yes |

| Leverage | Up to 1:30 (retail) | Up to 1:30 (retail) |

| Customer Support | 24/5 Live Chat & Help Center | 24/5 Live Chat & Email |

| Best For | Social & Multi-Asset Traders | Forex & Professional Traders |

Which Broker Is Better for Trading in 2025

The best broker between eToro and OANDA in 2025 will depend on your priorities and trading style.

If you’re a beginner or are looking to invest in a diverse range of assets (stocks, crypto, ETFs) while engaging in a social trading community, eToro is the best option. eToro’s platform is expanding and registering a growing number of users and an expanding product range.

If you are forex focused looking to trade with a broker who is highly regulated, and offers strong data trust, integrity and professional trading tools, OANDA will work best for you. OANDA has earned a strong reputation for trust and transparency in the forex industry.

In summary: for social investing or trading a wider range of assets, choose eToro. For reliable, focused forex trading, go with OANDA.

Regulation and Trustworthiness

eToro

- Highly Regulated: eToro has global compliance and trader protection due to operating under top tier financial authorities like FCA (UK), CySEC (Cyprus), ASIC (Australia) and FINRA (US).

- Investor Protection: Extra protection is guaranteed with segregated accounts being held for client accounts.

- Transparency: eToro has transparent reporting and fee structures which is testament to their publicity of compliance targets.

- Global Presence: Having multiple licenses is proof of reliability on regulation and accountability on multiple regions.

OANDA

- Strong Regulatory Oversight: OANDA is regulated by CFTC (US), FCA (UK), ASIC (Australia), IIROC (Canada), and MAS (Singapore), which are all trusted authorities.

- Data Integrity: Exchange rate data published by OANDA is considered accurate and trusted by institutions and businesses all over the world.

- Client Fund Safety: OANDA meets all capital requirements and has client accounts that are segregated.

- Reputation for Reliability: OANDA is built upon trust and transparency which is the reason they have great reliability to almost three decades.

Trading Platforms + Tools

| Feature / Platform | eToro | OANDA |

|---|---|---|

| MetaTrader 4 (MT4) | ❌ | ✅ |

| MetaTrader 5 (MT5) | ❌ | ❌ (Varies by region, mostly not supported) |

| cTrader | ❌ | ❌ |

| TradingView | ✅ (Charting Integration) | ✅ (Full Trading Integration) |

| Proprietary Platform | ✅ (eToro Web & App) | ✅ (OANDA fxTrade) |

| Automated Trading | ✅ (via Copy Trading) | ✅ (via API & MT4 EA) |

| Social + Copy Trading | ✅ (Core Feature) | ❌ |

| Standard Stop Loss | ✅ | ✅ |

| Guaranteed Stop Loss | ✅ (Limited Availability) | ❌ |

| Demo Account | ✅ | ✅ |

Deposit & Withdrawals

| Feature | OANDA | eToro |

|---|---|---|

| Minimum Deposit | $0 | $200 |

| 💳 Payment Methods | Visa, Mastercard, ACH deposits, Bank transfer, Credit/Debit Cards, Wire Transfer, Skrill, Neteller | WebMoney, PayPal, Skrill, Wire Transfer, Credit/Debit Cards, YooMoney, Neteller, UnionPay |

Regulations and Licenses

| Feature / Regulation Authority | eToro | OANDA |

|---|---|---|

| ASIC (Australia) | ✅ | ✅ |

| FCA (UK) | ✅ | ✅ |

| MAS (Singapore) | ✅ | ✅ |

| CYSEC (Cyprus) | ✅ | ❌ |

| CIRO / IIROC (Canada) | ❌ | ✅ |

| FSA (Seychelles) | ❌ | ✅ |

| FSC BVI (British Virgin Islands) | ✅ | ❌ |

Mobile Trading Experience

| Feature | eToro | OANDA |

|---|---|---|

| App availability & platform | Fully integrated mobile app for both Android & iOS, mirroring the web platform. | Dedicated “OANDA Trade” mobile app (iOS & Android) plus mobile-responsive web platform. |

| User interface / ease of use | User-friendly, designed for beginners and easy portfolio/investment navigation. ( | Strong mobile UI with advanced tools — good for both beginners and active traders. |

| Social & copy trading features | Built-in social feed + copy-trading functionality inside the mobile app. | Not a core focus of the mobile app — more traditional trading tools rather than social features. |

| Charting & technical tools on mobile | Has charting and analysis tools, but primarily aimed at simplicity and usability. | Very advanced mobile charting: over 50 technical tools (32 overlay indicators, 11 drawing tools, 9 chart types). |

| Order management & risk controls via mobile | Offers standard order types, stop-loss/take-profit features, though the mobile priority is ease of use. | Robust mobile order placement: tap on charts, modify positions, edit stop-loss/take-profit, trailing stops. |

| Alerts, notifications & mobile-specific features | Includes notifications through the mobile app; social signals. | Fully supported alerts, price signals, mobile notifications for economic events, and chart triggers. |

| Demo / practice mode on mobile | Demo (virtual) account available and usable on mobile. | Demo account supported; mobile app supports demo trading (region-dependent) via platform. |

| Suitability: Beginners vs Active Traders | Excellent for beginners or investors wanting social/copy trading + multi-asset exposure. | Very suitable for active/trader-type users who want deeper charting/tools on the go. |

| Potential downsides on mobile | May be simpler and less “pro trading tool” heavy (for advanced technical traders) | While powerful, the advanced features may feel overwhelming for complete beginners; some users report app issues. |

Features eToro vs Oanda

eToro

Trading Instruments: eToro provides access to a diverse range of assets, including stocks, indices, ETFs, currencies, commodities, and cryptocurrencies.

Maximum Leverage: Up to 1:3000, depending on region and account type.

Minimum Deposit: Starts from $5, making it beginner-friendly.

Account Types: Offers retail (personal), professional, corporate, and Islamic accounts to suit different traders.

Trading Fees: Spreads begin from 1 pip.

PAMM/MAM: Not available, but eToro features a unique Copy Trading platform.

Scalping: Not permitted.

News Trading: Allowed.

EA/Robot Trading: Not supported.

OANDA

Trading Instruments: CFD trading is unavailable for US clients, but non-US traders can access CFDs across multiple markets.

Maximum Leverage: Up to 1:200 globally, 1:50 in the US, and 1:30 in the EU, based on regional regulations.

Minimum Deposit: No minimum deposit requirement, offering flexibility to all users.

Account Types: Two main options — Standard and Elite Trader accounts

Trading Fees: Spreads range from 0.1 to 0.6 pips, with commissions between $3.5 and $4 per lot, depending on account type.

PAMM/MAM: Not available.

Scalping: Allowed.

News Trading: Allowed.

EA/Robot Trading: Fully supported.

Pros and Cons

Pros & Cons eToro

Pros

- Wide Range of Assets: Trade stocks, forex, ETFs, commodities, and cryptocurrencies all in one place.

- Copy Trading Feature: Unique CopyTrader system lets users replicate expert traders automatically.

- User-Friendly Interface: Simple and intuitive platform suitable for beginners.

- Strong Regulation: Licensed by top-tier authorities including FCA, ASIC, and CySEC.

- Low Minimum Deposit: Start trading with as little as $5.

- Social Trading Community: Engage and learn from millions of traders worldwide.

Cons

- Limited Advanced Tools: May not satisfy professional traders who prefer MetaTrader-style platforms.

- Scalping Not Allowed: Restricts high-frequency or short-term trading strategies.

- No Support for Expert Advisors (EAs): Automated or robot trading isn’t available.

- Higher Spreads: Spreads can be slightly higher compared to some forex-focused brokers.

Pros & Cons OANDA

Pros

- Highly Regulated: Overseen by respected bodies like the CFTC, FCA, and ASIC, ensuring high trust and safety.

- No Minimum Deposit: Traders can start with any amount, ideal for beginners.

- Advanced Platforms: Supported with effective tools and analytics for MetaTrader 4 and OANDA Trade.

- Flexible Trading Strategies: Engaging in scalping, news trading, and automation trading with EAs and robots is provided.

- Spreads: Pricing is competitive with spreads from 0.1 pips.

- Reliable Data: Provides globally used accurate and reputable data for exchange rates.

Cons

- Limited Product Offering in the US: US clients cannot engage in CFD trading.

- No Social Trading: Features for copy trading and community trading are absent.

- Few Account Varieties: Only Standard and Elite accounts are available.

- Less Contemporary Interface: Platform is more technical and less sleek than eToro’s modern interface.

Customer Support and Education

eToro

Customer support at eToro is mainly provided through email and ticketing systems, and for select countries, there are phone support options.

Customer support also offers live chats, however, the live chat feature is not fully implemented for all customers and the availability is restricted based on the customer’s support tier.

eToro has a commendable range of customer education support: eToro Academy and the learning center are comprehensive, including video tutorials, webinars, and courses for both beginner and advanced traders.

Partnerships for content delivery via social channels also provide additional reach. Nevertheless, eToro reviewers consistently pinpoint a lack of advanced lessons to support learners in transitioning to more complex and structured content.

OANDA

Customer Support is available through live chat, email, phone and in some areas SMS or WhatsApp in addition to e.g. Spanish, French, and German. Customer Support operates 24/5 which is across major trading time zones.

OANDA offers customer education through market commentary, webinars, economic calendaring tools, video content, and other analytics.

Competitive analysis of these materials indicates that while the quality is satisfactory, they lack the depth and comprehensive structure of other broker resources in the market.

Conclusion

Each broker is reputable in their own right. eToro is unique in the industry for having social and copy investing features. eToro is also user friendly and has a large variety of assets which will focus on a beginner user or a user interested in social investing.

OANDA will focus on the seasoned forex trader. OANDA has low spreads and tools and options for traders who want more control over their trading.

To summarize, pick eToro if you want something simple and community trading. Pick OANDA if you want more tools and less expensive trading with a focus on forex.

FAQ

Can I use both platforms for forex and non-forex assets?

Yes — while both support forex trading, eToro offers a broader selection of markets (stocks, ETFs, crypto, commodities), whereas OANDA is more specialized in forex and CFDs.

Which broker has lower trading costs?

OANDA generally offers tighter spreads and lower total costs, especially for active forex traders.

eToro tends to have higher spreads, but may have advantages in asset variety and no commission trades for certain instruments.

Does eToro support MetaTrader / automated trading?

No — eToro does not offer MT4/MT5 or support EA/robot trading.

OANDA, on the other hand, supports MT4 and various automation tools.