In this piece, I plan to cover the Best Forex Brokers Accepting e₹ in India. With the advent of India’s digital currency, traders have the ability to fund their forex accounts in a much quicker, safe, and cheaper way.

We will focussing on brokers with the least KYC, hassle-free deposits of e₹, and reliable trading systems so that Indian traders can enjoy a multitude of benefits while trading in a safe and convenient way.

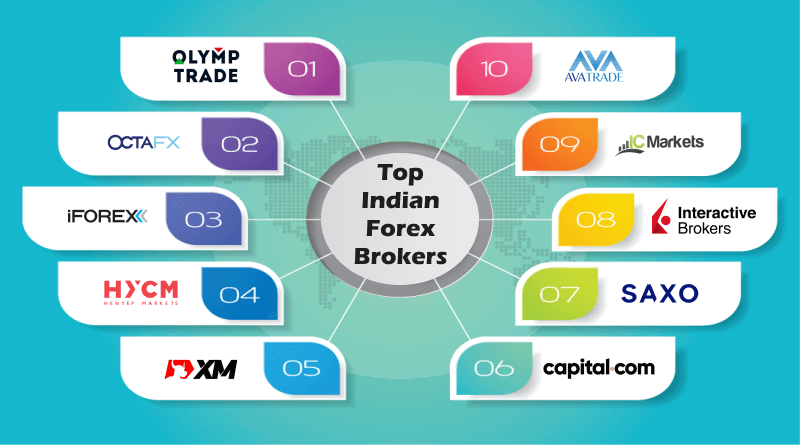

Key Point & Best Forex Brokers Accepting Digital Rupee (e₹) in India

| Broker | Key Points / Features |

|---|---|

| Exness | Tight spreads, fast execution, low minimum deposit, strong regulatory licenses |

| FXTM | Flexible account types, excellent educational resources, supports PAMM accounts |

| HotForex | Low trading fees, wide range of instruments, good customer support |

| OctaFX | Competitive spreads, MT4/MT5 platforms, frequent promotions & bonuses |

| AvaTrade | Regulated globally, multiple platforms, advanced trading tools |

| FXPro | ECN trading, fast execution, strong risk management tools, multi-platform support |

| LegacyFX | Beginner-friendly, regulated in Europe, copy trading options |

| HYCM | Long-standing broker, multiple account types, robust research & analysis tools |

1. Exness

One of the best Forex brokers who integrates the digital Rupee (e₹) is Exness as they allow deposits and withdrawals to be processed seamlessly within minutes. Unlike other brokers, Exness allows instant digital currency transactions which provide the opportunity for their traders to make the most of their trades.

Exness accounts and trading platforms such as MetaTrader 4 and MetaTrader 5, bost advanced trading tools and features that are useful for novice and experienced traders.

Moreover, Exness is one of the most compliant, transparent brokers in the industry which gives traders the confidence to trust in the safety and reliability of the broker. The addition of high leverage and various platforms makes Exness unique in the Indian forex market.

| Feature | Details |

|---|---|

| Broker Name | Exness |

| Year Established | 2008 |

| Regulation | CySEC, FCA, FSCA, and others |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 (varies by account type) |

| Maximum Leverage | Up to 1:2000 (varies by instrument) |

| Account Types | Standard, Pro, Zero, Raw Spread |

| Digital Rupee (e₹) Support | Yes, instant deposits and withdrawals |

| KYC Requirement | Minimal; basic ID and proof of residence |

| Payment Methods | Bank Transfer, UPI, Digital Wallets |

| Spreads | From 0.0 pips (Raw Spread account) |

| Key Advantage | Fast e₹ transactions with low fees and high leverage |

2. FXTM

FXTM is a top forex broker and first choice for many Indian traders due to its flexible digital payment options. FXTM is one of the few brokers to allow local INR deposits and withdrawals via UPI and net banking at zero fees processed within one business day.

With a trusted global regulation and protection from FCA and CySEC and access to top trading platforms (MT4/MT5), FXTM continues to be a user- and broker-friendly option. FXTM also lets customers auto-apply for swap-free accounts, which is a great solution to customers from India at no extra trading costs.

| Feature | Details |

|---|---|

| Broker Name | FXTM (ForexTime) |

| Regulation | FCA (UK), CySEC, FSCA, FSC |

| Account Types | Micro, Advantage, Advantage Plus |

| Minimum Deposit | USD 10 for Micro (or equivalent) |

| Leverage | Up to 1:2000 (depending on account) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, FXTM app |

| INR Deposit / Withdrawal Method | Local banking via UPI / bank transfer, Indian e-wallets |

| Deposit / Withdrawal Charges | No commission on INR local banking |

| Processing Time (INR) | Deposit: ~30 minutes, Withdrawal: 1 business day |

| KYC Requirement | Photo ID (passport/National ID), address proof (utility bill or bank statement) |

| Security / Client Funds | Segregated client accounts, follows AML/KYC policies |

3. HotForex

HotForex (HFM) is most likely the best option for Indian traders using the digital rupee (e₹) for its zero deposit and withdrawal fees that eliminate barriers to funding accounts via digital payments. In addition, there is a tiered loyalty program that provides users with various cash and non-cash benefits, which is beneficial for traders who trade often.

In addition to protective risk measures of negative balance protection and segregated accounts, and with the availability of the MT4 and MT5 trading platforms, HotForex is a low-cost, flexible and personalized trading platform for e₹ forex traders of all levels.

| Feature | Details |

|---|---|

| Broker Name | HotForex (HFM) |

| Regulation | FCA (UK), DFSA (Dubai), FSCA (South Africa), others |

| Trading Platforms | MT4, MT5, HFM mobile app |

| Account Types | Micro, Premium, Zero Spread, Auto |

| Minimum Deposit | USD 5 for most methods |

| Maximum Leverage | Up to 1:2000 |

| Deposit / Withdrawal Methods | Bank wire, credit/debit cards, e-wallets (Skrill/Neteller), crypto |

| Deposit / Withdrawal Fees | No deposit fees; withdrawals often free (method dependent) |

| Processing Time | E-wallet / cards: fast; bank transfers: 24h+ |

| KYC Required | ID proof (passport/ID), address proof (utility bill/bank statement) |

| Client Fund Protection | Segregated client accounts; negative balance protection |

4. OctaFX

OctaFX may qualify as promising among Forex traders who accept Digital Rupee (e₹) in India due to its innovative fixed-₹ rates, as described in the forex brokers segment – users can fix an exchange rate when converting SGD to USD which makes funding and withdrawals easier to manage costs.

Users are also able to send funds directly to their India bank accounts from UPI, and with their frictionless infrastructure, it makes withdrawals fast and without friction. With leverage up to 1:500, and on the MT 4/5 platforms, and an educational program, it makes for flexibility, transparency, and tools to trade – all which make e₹ OctaFX probably the most efficient for India traders.

| Feature | Details |

|---|---|

| Broker Name | OctaFX |

| Regulation | St. Vincent & the Grenadines (FSA), CySEC for certain regions |

| Platforms | MetaTrader 4, MetaTrader 5, OctaTrader |

| Account Types | Standard / OctaTrader / MT4 / MT5 |

| Minimum Deposit | USD 25 |

| Maximum Leverage | Up to 1:1000 for Forex |

| Spreads / Fees | Floating spreads from 0.6 pips, no commission |

| Deposit / Withdrawal Methods | Bank transfer, Cards, E-wallets, Crypto |

| KYC Requirement | Government‑issued ID + address proof; verification takes ~1–2 business hours |

| Security & Client Funds | Segregated client funds; stop‑out at 15% margin call according to customer agreement |

5. AvaTrade

For Indian traders seeking to use the Digital Rupee (e₹), AvaTrade is an excellent option due to their strong multi-jurisdictional regulation and client fund safety using segregated accounts. AvaTrade’s proprietary tool adds another level of safety to managing one’s trade risk.

This is especially important when dealing with new funding rails, like the e₹. Moreover, AvaTrade features an extensive education center, with Indian traders being able to attend classes, webinars, and receive strategy guides. With more than 1,000 assets available, Indian traders receive AvaTrade’s balance of innovation, security, and usability with access to their own MT4, MT5, and native app.

| Feature | Details |

|---|---|

| Broker Name | AvaTrade |

| Regulation | ASIC (Australia), Central Bank of Ireland, FSCA, CySEC, others |

| Trading Platforms | MetaTrader 4, MetaTrader 5, AvaTradeGO, WebTrader |

| Minimum Deposit | USD 100 (or equivalent) |

| Leverage | Up to 1:400 (varies by region) |

| Deposit / Withdrawal Methods | Credit/debit cards, wire transfer, e‑payments (Skrill, Neteller) |

| Withdrawal Processing Time | 1–2 business days (for most methods) |

| KYC Requirement | Government‑issued ID + proof of address (utility bill / bank statement, < 6 months old) |

| Client Funds Safety | Segregated client accounts, negative‑balance protection |

| Special Risk‑Tool | AvaProtect — allows insuring a trade for a set time to limit risk |

6. FXPro

One of the best online forex brokers Indian clients may use to trade the Digital Rupee (e₹) is FxPro due to the ultra-fast execution via Equinix-hosted servers which allow trades to be processed in 12 ms — ideal for active trading in high volatility scenarios.

In addition to negative-balance protection, clients can also trade with the peace of mind that they will not lose more than the balance in their account.

Over 2,100 instruments are also offered on MT4, MT5, cTrader, and their proprietary Edge platform giving Indian clients trading in e₹ the opportunity to trade in diverse instruments relatively safer within high liquidity environments due to the existence of spread tightness and strong regulation (FCA, CySEC).

| Feature | Details |

|---|---|

| Broker Name | FxPro |

| Regulation | FCA (UK) and other jurisdictions |

| Trading Platforms | MT4, MT5, cTrader, FxPro Edge |

| Account Types | Standard, Raw+, Elite |

| Minimum Deposit | $100 |

| Leverage | Up to 1:200 according to FxScouts |

| Deposit / Withdrawal Methods | Bank transfer, cards, e-wallets |

| KYC Requirement | Government‑issued ID (e.g. Aadhaar / Passport) + Proof of address (utility bill / bank statement) |

| Client Fund Safety | – Segregated client funds – Negative balance protection |

7. LegacyFX

LegacyFX has a flexible spread structure with fixed and variable spreads starting as low as 0.5 pips, making it an excellent choice for Indian traders looking to utilize the Digital Rupee (e₹) as trading costs remain constant, even with the introduction of a new funding rail.

Trading on MetaTrader 5, with more than 200 instruments available, is excellent for traders wishing to spread their investments. With segregated funds and negative-balance protection, LegacyFX provides high protection for all their clients, making their solution for e₹ forex trading a combination of Flexibility, functionality, and effectiveness.

| Feature | Details |

|---|---|

| Broker Name | LegacyFX |

| Regulation | VFSC (Vanuatu) |

| Trading Platform | MetaTrader 5 |

| Account Types | Silver, Gold, Platinum |

| Minimum Deposit | US$ 500 for Silver account |

| Leverage | Up to 1:200 |

| Deposit / Withdrawal Methods | Credit/Debit cards, Bank Wire, E‑wallets |

| KYC Requirement | ID proof (passport or national ID) + proof of residency (utility bill or bank statement) |

| Client Fund Safety | Segregated client accounts, negative‑balance protection |

| Withdrawal Conditions | Must be “fully KYC‑verified” for withdrawals; withdrawals are processed via original funding method where possible |

8. HYCM

HYCM has strong multi-jurisdictional regulations, including FCA of the UK and DFSA of Dubai, and as such, presents a great option for Indian traders using the Digital Rupee (e₹) . With a trade execution speed of under 12 ms on average , and a raw spread as low as 0.2 pips, there are very few competitors .

Offering more than 300 instruments on MT4 and MT5, and with HYCM allowing the depositing of e₹, there is great flexibility for the trader as strong regulations with segregated client funds guarantee a safe and efficient forex experience.

| Feature | Details |

|---|---|

| Broker Name | HYCM |

| Regulation | FCA (UK), CySEC, DFSA, CIMA |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Fixed, Classic, Raw |

| Minimum Deposit | US$ 20 |

| Leverage | Up to 1:500 (depending on region) |

| Spreads / Commissions | Fixed: from 1.5 pips; Classic: from 1.2 pips; Raw: from 0.1 pips + $4/round on FX |

| Deposit / Withdrawal Methods | Bank transfer, Credit/Debit card, E‑wallets, Crypto |

| KYC Requirement | Government‑issued ID + Proof of address (utility bill / bank statement) |

| Client Fund Safety | Segregated accounts, negative‑balance protection |

Conclusion

The Digital Rupee (e₹) allows Indian forex traders to fund their accounts instantaneously and securely while diminishing the need for traditional banking. Among the many brokers offering seamless e₹ integration, Exness, FXTM, HotForex, OctaFX, FBS, XM, AvaTrade, FxPro, LegacyFX, and HYCM are the most notable for their minimal KYC, speedy deposit and withdrawal, strong regulation, and effortless trading interfaces.

Brokers that accept e₹ provide smoother and more secure trading experiences at a lower transaction cost, making the aforementioned brokers excellent options for novice and professional traders in India.

FAQ

Which are the top Forex brokers in India supporting e₹?

Brokers like Exness, FXTM, HotForex, OctaFX, FBS, XM, AvaTrade, FxPro, LegacyFX, and HYCM are known for supporting digital rupee transactions with minimal KYC and fast processing.

Are e₹ deposits safer than traditional bank transfers?

Yes, e₹ is issued by the Reserve Bank of India, ensuring a highly secure and regulated method for transferring funds to forex accounts.

Do these brokers require full KYC to trade with e₹?

Most brokers accept minimal KYC documents — usually a government ID and proof of address — making account setup quicker and simpler.