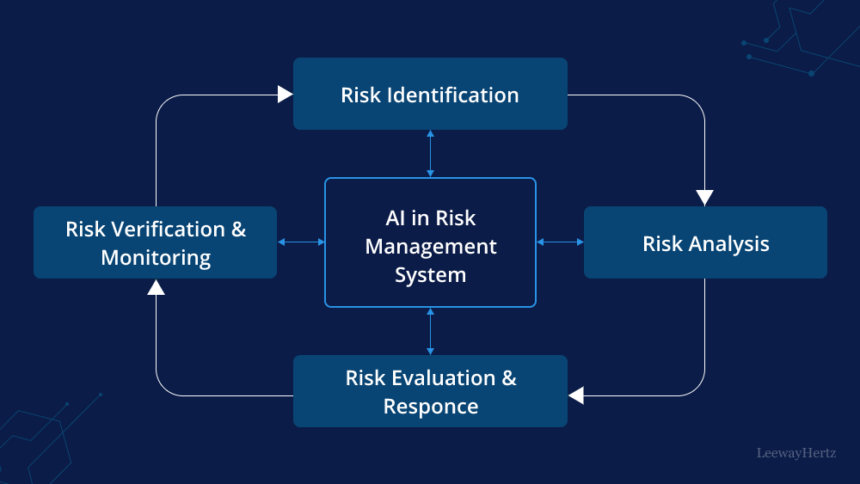

I’ll go over the top AI risk management platforms for digital asset companies in this post. Managing risks including fraud, market manipulation, and regulatory compliance has become essential with the growth of digital assets and blockchain technology.

AI-powered solutions enable businesses protect assets, guarantee compliance, and effectively make data-driven decisions by offering real-time monitoring, predictive analytics, and smart contract security.

Why Use Best AI Risk Management Platforms for Digital Asset Firms

Better Fraud Protection

- Fintech fraud is a burgeoning evil. Users and firms lose money. Automated fraud detection tools mitigate financial losses and protect the firm through self-service fraud detection tools.

Ease In Regulatory Compliance

- Digital asset firms are legally required to comply with a multitude of regulations. Digital asset firms have to comply with legally required Anti Money Laundering and Know Your Customer regulations. Digital asset firms use platforms to comply with global regulations.

Risk Prediction

- The firms use the tools to mitigate losses by predicting mart volatility, risk of wallets, exposure with counter parties and wallets.

Lower Costs and Increase Operational Efficiency

- Risk reporting, monitoring and automation will reduce operational costs and the need for numerous employees in compliance. The employees will have the opportunity to focus on strategic tasks.

Real Time Monitoring Across All Fintech Ecosystems

- Digital asset firms operate on multiple ecosystems exchanges, wallets. AI platforms offer seamless integration. This holistic integration provides multi fraud threat.

Key Point & Best AI Risk Management Platforms for Digital Asset Firms List

| Platform | Key Points / Features |

|---|---|

| Chainalysis KYT | Real-time transaction monitoring, AML compliance, fraud detection, alerts on suspicious activity. |

| Elliptic Navigator | Risk scoring of crypto wallets and transactions, regulatory compliance support, due diligence for counterparties. |

| Solidus Labs HALO | Market surveillance, trade manipulation detection, automated compliance monitoring, anomaly detection. |

| TRM Labs | Blockchain analytics, transaction monitoring, financial crime risk assessment, regulatory reporting tools. |

| AnChain.AI | AI-driven fraud detection, smart contract monitoring, AML compliance automation, risk scoring for wallets. |

| Forta Network | Real-time threat detection for DeFi protocols, smart contract monitoring, anomaly alerts, security analytics. |

| Scorechain | Crypto compliance and analytics, transaction monitoring, portfolio risk assessment, regulatory reporting. |

| Merkle Science | Transaction risk scoring, anti-money laundering monitoring, real-time blockchain analytics, investigative tools. |

| Quantstamp AI | Smart contract security audits, vulnerability detection, risk mitigation for decentralized applications. |

| Blocktrace AI | AI-powered crypto risk scoring, fraud detection, real-time monitoring, enhanced compliance reporting. |

1. Chainalysis KYT

Chainalysis KYT is one of the best AI risk management platforms for digital asset firms. Chainalysis is able to provide tailormade transaction monitoring for every client in real time. Their systems are able to suspend fraudulent transactions and identify scam risk assoscitations in real time for several digital currencies.

They have automated anti-money laundering compliance systems with automated alerts. They provide a multitude of data with intersedtional analytics which aid risk and finances and compliance in an optimal fashion. Their systems detect threats with a far superior success rate than other systems in the industry.

Chainalysis KYT Features

- Real-time suspicious transaction tracking: Can identify concerning transfers cross-chain.

- AML & compliance requirements: Firms can automate legal obligations to avoid money laundering.

- Wallets receive risk scores & alerts: Unusual activities are fraud alerted to those wallets.

2. Elliptic Navigator

Firms in the digital asset cryptocurrency market have chosen Elliptic as the top provider of AI risk management services. Elliptic Navigator has expanded the understanding of risk in the digital asset market, with a focus on score transactional risk, and regulatory compliance.

Companies involved in the financial cryptocurrency space can evaluate business entities and counter parties, identifying flagged wallets, and perform automated due diligence. This seamless integration of services provided by Elliptic combines AI analytics with the digital ledger technology of blockchain.

It allows financial institutions to mitigate the risk of exposure to fraud and other activities deemed by government regulators and banks as illegal.

Elliptic Navigator has provided financial institutions and cryptocurrency exchanges the ability to protect their digital assets from financial crime while providing the ability to perform custom, real-time, automation of their AML/KYC compliance activities.

Ellptic Navigator Features

- Wallet & transactions risk scores: Counterparties & transactions range risk scores.

- Wallet & crypto due diligence: Legitimacy insights crypto filed wallets.

- Automated compliance: Exchanges & institutions can use automation to comply with AML/KYC.

3. Solidus Labs HALO

Solidus Labs HALO is second to none AI risk management solution for digital asset firms that provide market surveillance and market manipulation detection. Its AI systems track trading behavior on different exchanges and detect anomalies and wash trading as well as other questionable trading behaviors.

HALO also streamlines and automates regulatory compliance workflows by providing alerts and other regulatory compliance compliance automation.

The platform refinements digital asset firms analytics to pedagogically articulate and forecast risk so that they are able to ‘see’ risks so that they do not lose risk’ so they are able to ‘see’ risks and articulate risks so that they do not lose risks. The risks from digital firm computations that exceed crypto digital assets. The product is Solidus Labs HALO. crypto markets.

Solidus Labs HALO Features

- Surveillance: Manipulation suspicious trades & activity patterns are integrated.

- Automated compliance support: Alerts to compliance directive requirements to avoid breaches.

- Crypto trading: Unusual liquidity activities can operational risks.

4. TRM Labs

TRM Labs stands as the best AI risk management platform for digitalasset firms, with the most complete suite for blockchain analytics and financial crime prevention. The AI system tracks and analyzes suspicious transactions, assesses counterparty risk, and maintains compliance with regulations across many blockchains.

With TRM Labs, firms can produce and issue investigative reports, complete and field threat analyses, and issue threat mitigation. The system’s predictive analytics identify and mitigate fraud in real time. Exchanges, custodians, and financial institutions use TRM Labs AI to manage operational risk and gain operational confidence in digital asset management.

TRM Labs Features

- Cross-chain transaction tracking: Analytics provide blockchain insights across multiple.

- Fraud: Financial crimes can range from laundering & transactions to fraud.

- Compliance & risk management: Investigative reports are created for audits, and management.

5. AnChain.AI

AnChain.AI is one of the best AI risk management platforms for digital assetfirms with the most focus on fraud detection, AML automation, and smart contract monitoring. Its AI system scans wallets, transactions, and DeFi protocols in order to detect and mitigate risk to the firm.

AnChain.AI issues real time risk scores and alerts on compliance for institutions to be able to mitigate risk and manage compliance in real time.

The platform is particularly adept at spotting transactional and operational phishing scams and abnormal behavior in transactions. AnChain.AI supplies operational digital asset firms with the ability to integrate compliance with evolving global regulatory standards seamlessly into operational workflows.

AnChain.AI Features

- Fraud detection: AnChain.AI provides monitoring and detection of scams, phishing, and fraudulent transactions.

- Contract monitoring: Potential security threats from decentralized applications are being evaluated.

- Automated AML Solutions: AnChain.AI provides compliance automation and risk reporting notifications for more regulatory efficient processing.

6. Forta Network

Forta Network is one of the best AI risk management platforms for digital asset companies focusing on real-time security and risk anomaly detection in DeFi protocols. Forta monitors deployed smart contracts and blockchain transactions and notifies DeFi firms of potential security threats due to exploits or malicious activity.

Forta’s on-chain real-time monitoring and notifications allow DeFi firms to quickly address security issues and mitigate risks to user funds and institutional security.

Forta’s AI real-time analytics and monitoring help firms to detect and address security issues to safeguard user trust and sustain asset protection in decentralized networks. Forta Network firms in high-frequency and decentralized finance trading, risk management, and real-time security monitoring focus in use case unique for Forta.

Forta Network Features

- Real-Time Threat Detection: Monitors threats, vulnerabilities, and attacks in blockchain and decentralized finance (DeFi) protocols.

- Smart Contract Security: Contract security for detection of exploits, anomalies, and harmful behavior in contracts.

- On-Chain Analytics: Analytics for risk alerts and reporting.

7. Scorechain

Scorechain is viewed as one of the top AI risk management platforms in the digital assets sector** having large scale compliance and transaction monitoring capabilities.

Scorechain has risk scoring ai for wallets, transactions, and counterparties, enabling institutions more effective identification of fraudulent activity. Scorechain assists in the AML reporting, and due-diligence compliance requirements of exchanges, custodians, and financial institutions.

The system processes complex and simple blockhain transactions, reducing the institutions chances of being targeted for financial crime. The platform’s user-friendly system, Scorechain, enables the firm to remain vigilant in the management of assets of a digital nature securely. **7. Scorechain.

Scorechain Features

- Transaction monitoring: Scorechain provides analysis of crypto transactions and provides alerts to discover fraudulent and suspicious behavior.

- Portfolio Risk Assessment: Scorechain provides risk and threat scoring to wallets, transactions, and counterparties.

- Regulatory reporting: Scorechain simplifies AML compliance reporting for exchanges, custodians, and institutional clients.

8. Merkle Science

Merkle Science is among the leading AI risk management platforms in the digital asset industry. The company specializes in transaction risk scoring and anti-money laundering (AML) surveillance. The company utilizes machine learning to track and manage risk in wallets and activities that are suspicious and fraudulent across multiple blockchains.

Merkle Science is able to provide clients with compliance workflows and operational efficiencies by offering proactive alerts and digital investigation tools. The platform assists in money laundering and financial crime surveillance and risk proactive mitigation.

Merkle Science utilizes its dashboards to provide clients in the digital asset industry with the analytical and operational tools to manage their clients’ assets and funds while remaining compliant with the industry regulations.

Merkle Science Features

- Transaction Risk Scoring: Identifies risky transactions and wallets across multiple blockchains.

- Real-Time Alerts: Sends suspicious activity notifications for prompt reactive measures.

- Compliance & Investigative Tools: Supports AML compliance and investigation reporting for institutions.

9. Quantstamp AI

For digital asset firms focusing on smart contract security and vulnerability assessment, Quantstamp AI is one of the top AI risk management platform.

Quantstamp AI’s algorithms detect vulnerabilities and coding issues by auditing dApps and blockchain protocols. Automating risk assessment allows firms to deploy smart contracts without operational and financial exposure.

Quantstamp AI’s monitoring and reporting systems ensure firms are compliant and user safety is upheld. Digital asset firms working with DeFi, NFT platforms, and other blockchain integrations require the safe and risk averse AI framework that Quantstamp AI offers.

Quantstamp AI Features

- Smart Contract Security Audits: Analyzes for vulnerabilities and sequencing issues in decentralized applications.

- Risk Mitigation: Quantstamp offers recommendations to protect smart contracts prior to deployment.

- Automated Analysis. Leverages Artificial Intelligence technology to review contracts in bulk and to perform analysis in an efficient and accurate manner.

10. Blocktrace AI

Blocktrace AI is among leading AI risk management tools that help digital assets firms mitigate risks, automate compliance, monitor transactions in real-time, and detect fraud. Its AI engine monitors wallets, transactions and network activity to detect risk and mitigate threats.

Blocktrace AI provides firms with actionable dashboards, alerts, and reports to manage risk and mitigate exposure to financial losses. It automates existing operations to improve efficiency and mitigate risk across multiple blockchains. Predictive analytics help digital assets firms to mitigate risks, protect client and market abuse. Blocktrace AI is predictive to market abuse.

Blocktrace AI Features

- Fraud Detection. Tracks activities in the blockchain to detect fraud and to identify and monitor wallets that pose potentially high-risk threats.

- Real-Time Monitoring. Provides immediate notifications when there are unusual activities or when there are activities that demonstrate the presence of a threat.

- Regulatory Compliance Support. Streamlines the generation of reports and documents pertaining to customer insights in relation to the policies of Money Laundering and Know Your Client.

Conclusion

Risk management is crucial in the quickly changing world of digital assets. Chainalysis KYT, Elliptic Navigator, Solidus Labs HALO, TRM Labs, AnChain.AI, Forta Network, Scorechain, Merkle Science, Quantstamp AI, and Blocktrace AI are some of the top AI risk management platforms for digital asset companies.

These platforms offer cutting-edge tools for fraud detection, transaction monitoring, and regulatory compliance. These solutions enable businesses to protect assets, lower operational risks, and make data-driven decisions by utilizing AI-driven analytics, predictive risk assessment, and real-time monitoring. Investing in these solutions is essential to preserving the digital asset ecosystem’s resilience, security, and confidence.

FAQ

Why do digital asset firms need AI-based risk management?

The crypto ecosystem is fast-paced and susceptible to fraud, hacks, and regulatory scrutiny. AI-based platforms enable real-time monitoring, predictive risk detection, and automated compliance, helping firms prevent losses, maintain trust, and operate efficiently.

Which are the best AI risk management platforms for digital asset firms?

Some of the top platforms include Chainalysis KYT, Elliptic Navigator, Solidus Labs HALO, TRM Labs, AnChain.AI, Forta Network, Scorechain, Merkle Science, Quantstamp AI, and Blocktrace AI. Each specializes in areas like transaction monitoring, smart contract security, anomaly detection, and regulatory compliance.

How do these platforms improve compliance?

They automate AML/KYC checks, generate audit-ready reports, and flag suspicious transactions. By doing so, firms can comply with global regulations more efficiently while minimizing human error and manual reporting efforts.