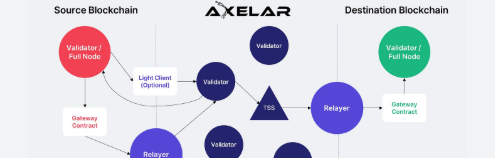

In this article, I will discuss the Best Axelar Alternatives for Cross-Chain Messaging. As blockchain ecosystems continue to grow, the ability to communicate between blockchains and transfer digital assets becomes even more important.

Although Axelar is a widely used option, several other competitors have faster speeds, cheaper costs, and support a wider range of blockchains. This article will analyze the most suitable Axelar alternatives for developers and users to find the most appropriate option for cross-chain messaging.

What Is Axelar alternatives?

Blockchain interoperability and cross-chain messaging platforms, which allow safe communication and asset transfers between several blockchain networks without depending on a single chain, are Axelar alternatives.

When developers or users look for alternatives outside of Axelar because of things like price, supported chains, degree of decentralization, security models, or performance, they employ these solutions. Protocols that concentrate on communications, token bridging, liquidity routing, or smart contract interoperability are popular Axelar substitutes.

Projects can connect several ecosystems, increase scalability, lower cross-chain risks, and select a solution that best suits their technical needs, governance preferences, and long-term blockchain infrastructure objectives by utilizing Axelar options.

Why use Axelar alternatives for cross-chain messaging

Lower Fees

Some alternatives offer cross-chain messaging at a lower price point which makes them better suited for smaller projects and high volume transactions.

Different Security Models

Different alternatives offer different security models such as oracle, validator, and liquidity-based which gives teams different options to match their risk appetitive.

Broader Chain Support

Some platforms expand upon the blockchains and Layer 2 networks that Axelar supports, improving ecosystem accessibility.

Faster Transaction Finality

Some protocols offer faster user confirmations and quicker cross-chain transactions.

Specialized Use Cases

Some alternatives use cases are tailored to specific needs such as NFT bridging, DeFi liquidity routing, and smart contract messaging.

Greater Decentralization

More decentralized networks of validators or relayers might be preferred for specific projects.

Reduced Dependency Risk

There is less reliance on a single interoperability provider, which increases overall system resiliency.

Flexible Integration Options

Most alternatives have user friendly integration options using SDKs, APIs or modular integration.

Better Governance Models

Certain platforms offer community governance that is more open and transparent.

Competitive Innovation

Newer cross-chain technologies, better performance and other improvements are more readily available to teams who seek alternatives.

Key Point & Best Axelar Alternatives for Cross-Chain Messaging List

| Platform | Key Focus | Primary Use Case |

|---|---|---|

| Wormhole Portal | Cross-chain messaging & bridging | Token transfers, cross-chain apps |

| LayerZero | Omnichain messaging protocol | Smart contract messaging |

| Chainlink CCIP | Secure cross-chain communication | Enterprise-grade messaging |

| Synapse Protocol | Cross-chain asset bridging | Fast token swaps & transfers |

| Hop Protocol | Layer 2 token bridging | L2-to-L2 transfers |

| Celer cBridge | Cross-chain liquidity transfers | Fast asset movement |

| Connext | Cross-chain messaging & transfers | Secure contract calls |

| LI.FI | Cross-chain aggregation | Best-rate bridging & swaps |

| THORChain | Native cross-chain swaps | Trustless asset swaps |

| Symbiosis Finance | Cross-chain AMM & messaging | Cross-chain swaps & liquidity |

1. Wormhole Portal

Due to versatility and real-time messaging and bridging capabilities, Wormhole Portal ranks among the best Axelar alternatives for cross-chain communication. Within a matter of seconds, Wormhole’s cross-chain communication can move any digital asset or data across Ethereum, Solana, Binance Smart Chain, and Avalanche.

Top developers can incorporate the platform’s technology to build and maintain efficient cross-chain dApps. Wormhole’s bridging technology is the fastest and most reliable on the market, and with a full suite of operational tools, developers can customize the platform to meet the needs of any interoperable blockchain project.

Wormhole Portal – Key Features

- Over 30 integrated blockchains, with both EVM and non-EVM networks

- Guardian-based security model for verification across chains

- Cross-chain transfers of tokens, NFTs and data

- Rapid finality for transactions across chains

- High ecosystem adoption with active support for developers

Pros & Cons Wormhole Portal

Pros:

- High interoperability with over 30 blockchains.

- Reliable and fast transfer of tokens between blockchains for dApps.

- Availability of strong ecosystem support for community and developer engagement.

Cons:

- Risk of trust with Guardian-based security.

- High fees may be incurred during congestion of the network.

- Not as strong with smart contract messaging as some of the other options.

2. LayerZero

This is one of the top options for cross-chain messaging while still being an omnichain messaging protocol. What LayerZero does is focus on communication across blockchains. LayerZero is reliable and has minimum trust assumptions due to the use of relayers and oracle. Developers can easily build omnichain apps without too much bridging overhead.

This is especially beneficial for DeFi use cases that require cross-chain governance, liquidity routing, atomic swaps, etc. LayerZero is highly appreciated due to their accessibility for SDKs that are developer friendly and scalable across blockchains.

LayerZero – Five Key Features

- Omnichain-messaging protocol for encrypted smart contract communication

- Architecture for Oracle and relayer-based security

- Compatible with both EVM and non-EVM blockchains

- Low infrastructure weight with minimal messaging overheads

- SDKs available for developers of omnichain dApps

Pros & Cons LayerZero

Pros:

- Provides messaging support across blockchains.

- Both EVM and non-EVM chains are supported.

- Great security and reliability with oracle and relayer model.

Cons:

- Complicated for beginner developers when integrating.

- Relayer and oracle may not always be available.

- Large scale dApps may need some added infrastructure.

3. Chainlink CCIP

Even though this is a cross-chain messaging protocol, CCIP is more on the secure side of the spectrum. Chainlink CCIP works on a decentralized oracle network to enable communication across different blockchain networks.

Their security is enterprise grade due to CCIP being tamper-proof. The protocol works on almost all major Layer 1 and Layer 2 blockchains which means that cross-chain token transfers, smart contract calls and DeFi operations can be easily carried out.

Projects that need interoperability across multiple chains while being secure, transparent, and has low trust are highly suited for this protocol.

Chainlink CCIP – Key Features

- Cross-chain communication using a decentralized oracle network

- Supports transfer of tokens, data, and smart contract execution

- Risk management and monitoring made available

- Security and reliability to the enterprise grade

- Works together with other services and data feeds from Chainlink

Pros & Cons Chainlink CCIP

Pros:

- No chance for tampering with messaging due to decentralized oracle security.

- Great for Enterprise apps as it supports all major L1 and L2 chains.

- High importance for security in DeFi is well catered for.

Cons:

- Cost is driven up by the need for oracles.

- Not as fast for small transactions as other bridging options.

- Less focus on token swapping than other AMM protocols.

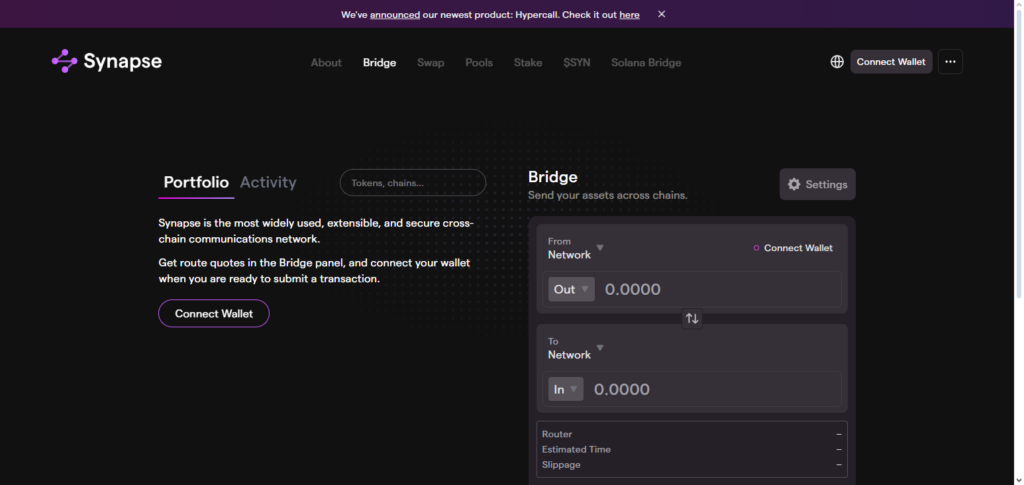

4. Synapse Protocol

Synapse protocol is the most liquid cross-chain tool and the fastest Ethereum bridge. Synapse has become ideal for cross-chain messaging.

It is automated and self-custodial with a decentralized liquidity model. It allows users to swap and transfer assets directly to each other without having to go through a validator or centralized intermediary.

With EVM-compatible chains like Ethereum, BSC, Polygon, and Avalanche, the protocol is interconnected and ideal for multi-chain DeFi solutions.

It is low-cost, fast, and has a seamless interface which is why Synapse has many users. Synapse also allows for integration with developer tools which makes it ideal for financial operations and token swaps across chains.

Synapse Protocol – Key Features

- Liquidity oriented cross-chain asset movement

- First of its kind on-chain cross-token swaps on EVM compatible chains

- Swift and economical transaction processing

- Liquidity depth for various DeFi use cases

- Comprehensive liquidity for on-chain apps

Pros & Cons Synapse Protocol

Pros:

- Tokens are transferred across chains quickly and cheaply.

- The need for validators is reduced because of decentralized of liquidity pools.

- Able to work with many EVM-compatible chains.

Cons:

- There is a lack of support for non-EVM chains for liquidity pools.

- Large transactions can cause slippage in liquidity pools.

- Developer community is smaller than competitors

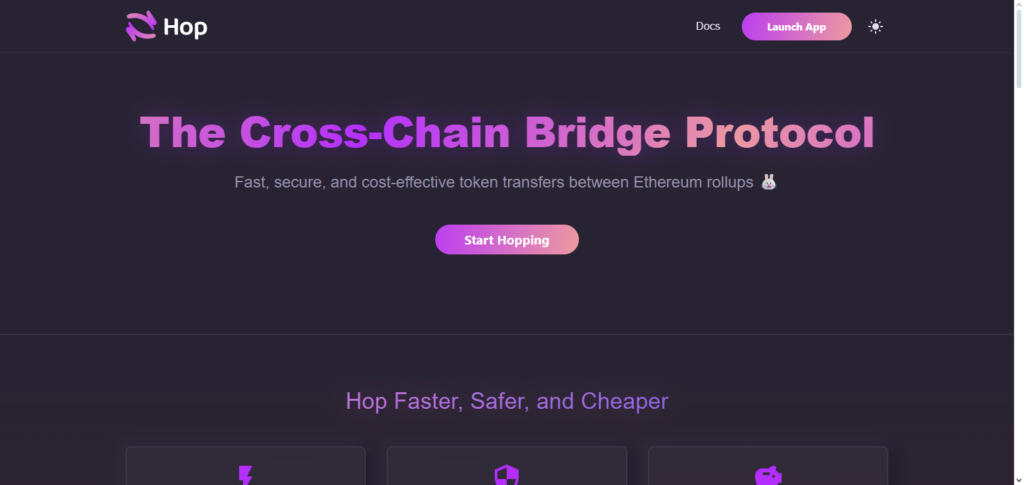

5. Hop Protocol

Hop Protocol represents another Hop Protocol alternative that focuses on layer two bridging. It is a great option for bridging Ethereum Layer 2 to Arbitrum, Optimism, Polygon, and Ethereum Mainnet. Hop has a bonder-based liquidity model that allows for quick and secure transfers of assets. Compared to conventional bridges, it decreases the time and fees for transactions.

It is one of the most optimized bridges for L2-to-L2 transfers, making it easier for DeFi users to transfer assets across different blockchains. Developers can use Hop to execute cross-chain smart contracts and perform liquidity movements. Its reputation and L2 focus make it one of the most versatile and reliable solutions for layer 2 bridging.

Hop Protocol – Key Features

- Best in class for bridging on Ethereum Layer 2

- Fast transfers via bonder liquidity model

- Cheaper gas in comparison to mainnet bridging

- Flexibility for L2-to-L2 and L2-to-L1 transfers

- Targets high demand DeFi and rollup frameworks

Pros & Cons Hop Protocol

Pros:

- The protocol is heavily optimized for bridging Layer 2 tokens which mitigates bridging fee expenses.

- Fast transfers are possible because of bonder-based liquidity.

- Provides L2-to-L2 transfers that are quick and cost-effective for DeFi products.

Cons:

- Restricted to Ethereum Layer 2 networks.

- The protocol is less flexible in chain coverage than other bridges.

- Operations become less smooth with low bonder liquidity.

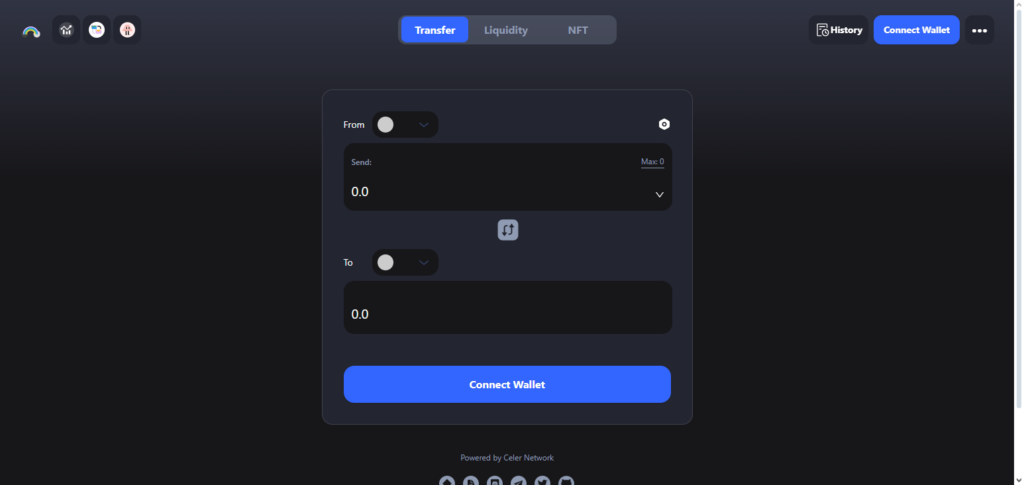

6. Celer cBridge

Celer cBridge is a rapid and flexible cross-chain bridge, and also one of the best alternatives to Axelar regarding cross-chain messaging. It is compatible with more than 40 networks, including major L1s and L2s, offering a wide range of interoperability for both developers and users.

cBridge incorporates a combination of liquidity pools and validator systems to provide secure, instantaneous, and low-cost transfers of assets. Its modular architecture facilitates integration with dApps and DeFi services, allowing users to conduct cross-chain swaps, relay tokens, and send messages.

Settlements are done in a near-instantaneous fashion, and Celer is known for its efficiency and rapidity. This platform is a good option for projects in need of seamless and efficient cross-chain communication and precise asset bridging due to its solid partitioning and mechanistic redundancy.

Celer cBridge – Features

- 40+ Layer 1 and Layer 2 network support

- Hybrid security with both validators and liquidity pools

- Cross-chain settlement in seconds

- High throughput with low transaction fees

- Integrated seamlessly with dApps and DeFi platforms

Pros & Cons cBridge

Pros:

- Broad interoperability is possible due to support of 40+ networks.

- Can have instant finality with the mixture of liquidity pools and validators.

- Fast transfers with instant settlement times.

Cons:

- Integration with some dApps may become complex.

- Slippage might occur with low liquidity pools.

- High fees can occur and are reliant on congestion of networks.

7. Connext

Connext is one of the best Axelar competitors for cross-chain messaging. Connext is cross-chain asset transfer and messaging protocol built on Optimistic verification. Optimistic verification enables secure and decentralized transfer, and communication via smart contracts on EVM compatible chains.

Connext helps developers manage cross-chain functionality and complex bridging mechanisms. Connext’s additional developer usability and interoperability focus helps develop DeFi projects, NFT programs, and other cross-chain dApps.

The protocol’s fast and low-cost transactions helps Connext provide a reliable solution for cross-chain operations. Connext is a good multi-chain blockchain application builder due to its easy-to-construct decentralized design and flexible customized SDKs.

Connext – Features

- Optimistic verified cross-chain messaging

- Secure asset transfers on EVM chains

- SDKs and APIs for developers

- Decentralized and non-custodial

- Great for cross-chain DeFi and NFTs

Pros & Cons Connext

Pros:

- Use of optimistic verification results in decentralized and secure transfers.

- Provides simple to integrate SDKs for developers.

- Works best in a DeFi ecosystem and EVM cross-chain dApps.

Cons:

- Only works with EVM-compatible chains.

- Less liquidity in swaps makes for slower bridging than other liquidity-based bridges.

- The mechanics of optimistic verification is complex and thus a proper understanding is required.

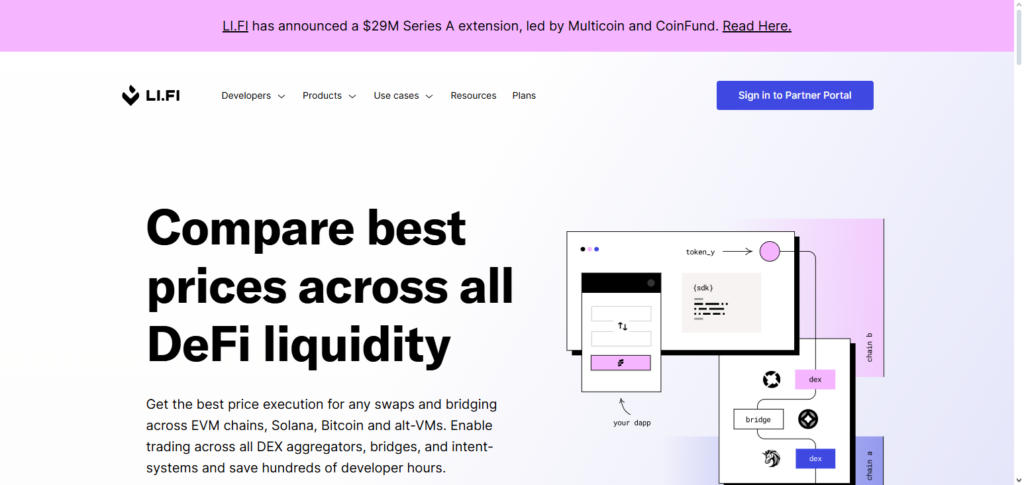

8. LI.FI

LI.FI is cross-chain aggregation protocol and one of the best Axelar competitors for cross-chain messaging. Cross-chain messaging also includes bridging, and LI.FI connects several bridging services to provide users with the best rates and fastest routes for token transfer.

LI.FI is compatible with 20 blockchain networks, including Ethereum, Binance Smart Chain, Polygon, and Avalanche. The cross-chain asset transfer LI.FI provides is one of the fastest, most efficient, and most convenient asset transfer services.

LI.FI aims to provide users with an easy-to-use and smooth cross-chain services and is ideal for projects wanting to reduce transaction fees and optimize bridging operations. Developers also benefit with LI.FI’s simplified integration to dApps through its unified SDK and API.

LI.FI – Features

- DEX aggregation and cross-chain bridging

- Smart routing for quickest path and lowest rates

- 20+ blockchains

- Developers get a single API/SDK

- Designed to provide great user experience with low slippage

Pros & Cons LI.FI.

Pros

- Best rates and routes due to bridge aggregation.

- Supports over 20 chains and is highly interoperable.

- Integration is easy due to simple SDK/API.

Cons

- Adding dependency risks as third-party bridges are used.

- Slippage is possible due to bridge liquidity variability.

- Coverage of non-EVM chains is sparse.

9. THORChain

One of the most notable rivals of Axelar in terms of cross-chain messaging is THORChain, an established cross-chain liquidity network that is decentralized. THORChain provides trustless swaps of native assets without the use of wrapped tokens on various blockchains.

The system employs node-bonded Proof-of-Stake to secure and decentralize the asset transfers. The native AMM helps to perform cross-chain swaps and provides liquidity to an array of DeFi Initiative projects.

This makes THORChain fit for applications that need trustless trading and decentralized liquidity. Users and developers are able to seamlessly move cryptos such as Bitcoin and Ethereum as well as other large market cap coins on multiple chains while maintaining control of their assets. Hence, security and interoperability is maintained.

THORChain – Features

- Cross-chain swaps natively without wrapped tokens

- Security model is Node-bonded Proof-of-Stake

- Decentralized liquidity with built in AMM

- Supports large Layer 1s

- Trustless Permissionless Transfers of Assets.

Pros & Cons THORChain.

Pros

- Swap assets trustlessly and cross-chain without wrapping.

- Decentralized security is achieved with node-bonded PoS.

- Deep liquidity is present with the native AMM for multiple assets.

Cons

- Lack of educational resources for complex integrations with THORChain.

- More expensive transactions than what simple bridges have.

- Non-asset messaging is poorly supported.

10. Symbiosis Finance

Symbiosis Finance is cross-chain AMM and messaging protocol, considered by many to be one of the best Axelar alternatives for cross-chain messaging. It is compatible with EVM and non-EVM chains, enabling the seamless exchange of assets and liquidity provision.

The platform combines AMM and validators to achieve fast and secure cross-chain transfers. Symbiosis lets developers easily embed cross-chain swaps and messaging facilities into their dApps.

Its speed, low cost and cross-chain compatibility make it ideal for DeFi, NFTs and cross-chain financial services. Symbiosis is one of the few projects providing complete infrastructures for cross-chain interoperability.

Symbiosis Finance -Key Features

- Cross-chain AMM compatible with EVM and non-EVM chains.

- Validator-based secure interoperability model.

- Effortless token swapping across several networks.

- Efficient liquidity routing for low-cost transactions.

- Provisioned for DeFi, NFTs, and multichain ecosystems.

Pros & Cons Symbiosis Finance.

Pros

- Non-EVM and EVM chains are both supported.

- Secure swaps are offered due to AMM and validator model combination.

- There is a cross-chain transfer that is low-cost and fast.

Cons

- Smaller ecosystem with a closed community as it is a newer project.

- Less popular chains may have liquidity issues.

- Beginner developers may find integrations to be complicated.

Benefits Of Axelar Alternatives for Cross-Chain Messaging

Extensive Network of Blockchains: Axelar alternatives can communicate and transfer assets across different networks than the ones Axelar supports.

Affordable Transaction Costs: Affordable bridging and messaging are alternatives that do not charge high gas fees or validator fees.

Quick Transaction Times: Some applications improve finality for cross-chain messaging. they have fewer lags in transferring tokens and calling contracts.

Diverse Security Structures: Depending on your risk preference, you can select oracle, validator, or liquidity backed security.

More Network Decentralization: More of these alternatives are available for you to rely on a single network.

Tailored Functionality: Support for specific use cases, including L2 bridging, DeFi liquidity routing, NFTs, and atomic swaps.

Simple for Developers to Integrate: Integration of cross-chain for dApps is easy with SDKs, APIs, and modulars.

Decreased Single Point of Failure; Resilience is improved by the use of different Interop platforms and not being dependant on one protocol.

Improved Management of Cross-chain Transaction Slippage: Some alternatives have better augmented liquidity routing which reduces slippage on cross-chain transactions.

Novel Functionality: Alternatives provide innovative functionality such as AMMs, omnichain messaging, and aggregated bridging that are a cut above the rest.

Conclusion

In the ever-changing Blockchain world, integration of multiple blockchain is critical. Axelar is a decent option for cross-chain messaging, however, other alternatives exist which have their own unique advantages.

Wormhole Portal, LayerZero, Chainlink CCIP, Synapse Protocol, Hop Protocol, Celer cBridge, Connext, LI.FI, THORChain and Symbiosis Finance offer their faster , more secure and efficient blockchains . Exploring these options will help the users and developers improve. Overall, more decentralization will be achieved.

The right option will be determined by the differing requirements of the projects along the the desired ecosystem. Helping multi-chain innovation, these options enhance the next generation blockchains interperability.

FAQ

What are Axelar alternatives?

Axelar alternatives are blockchain interoperability protocols that enable secure cross-chain messaging and asset transfers. They provide developers with options beyond Axelar, offering different chain support, security models, fees, and integration tools.

Why should I consider Axelar alternatives?

Alternatives can offer faster transaction speeds, lower fees, broader chain compatibility, more decentralized networks, and specialized features such as L2 bridging, DeFi routing, or NFT transfers.

Which platforms are considered the best Axelar alternatives?

Some top alternatives include Wormhole Portal, LayerZero, Chainlink CCIP, Synapse Protocol, Hop Protocol, Celer cBridge, Connext, LI.FI, THORChain, and Symbiosis Finance.

Are these alternatives secure for cross-chain messaging?

Yes, most alternatives implement robust security models such as decentralized oracles, validator networks, liquidity-backed bridges, and node-bonded PoS to ensure safe and reliable cross-chain communication.

Can these platforms support non-EVM chains?

Several platforms, such as LayerZero, Symbiosis Finance, and Wormhole, support both EVM and non-EVM chains, while some are optimized primarily for EVM networks.