The Best Wormhole Alternatives for Secure Cross-Chain Bridging will be covered in this article, with a focus on leading solutions that facilitate secure, quick, and effective blockchain interoperability.

Selecting trustworthy substitutes is crucial as cross-chain activity increases in order to lower security risks, enhance liquidity, and enable smooth asset and data transfers between various blockchain networks.

What Is Wormhole Alternatives?

There are other alternatives to Wormhole such as blockchain interoperability and bridging solutions designed to transfer assets and messages securely across multiple blockchains without having to use the Wormhole protocol.

These alternatives seek to put to rest fragmented networks, liquidiy silos, exorbitant fees, and lack of security by providing different solutions such as lock-and-mint, and burn-and-mint models, liquidty pool and message-passing frameworks.

These Wormhole alternatives are popular due to their cirumvention of security issues, decentralized validator, faster finality of transactions, wide chain support, and cheaper bridging.

These solutions are popular among DeFi, NFT, and cross chain applications requiring secure and trusted communications across several blockchains.

Why Matters Wormhole Alternatives for Secure Cross-Chain Bridging

Other Security Models: Minimal Reliance on One Bridge Architecture – Other Wormhole Alternatives Incorporate Decentralized Validators, Liquidity Networks, and/or Oracles.

Lower Risk Exposure: Multiple Alternatives Avoid Single Points of Failure, Which Is Particularly Critical Given Cross-Chain Bridges Are Regularly Targeted.

Cost Efficiency: Alternatives Offer More Cost-Efficient Bridging With Optimized Fees, Gas, and/or Liquidity.

Enhanced UX: More Sophisticated Protocols Provide Quicker Confirmations and Near-Real-Time Cross-Chain Transfers.

Greater Blockchain Coverage: More Alternatives Support More Layer 1s and Layer 2s, Allowing Greater Freedom of Interoperability Across Varied Ecosystems.

Improved Capital Efficiency: Bridges Based on Liquidity Management Reduce Slippage for Major Transfers.

Easy-to-Use Tooling: Developers Are More Empowered to Build Secure Cross-Chain dApps With APIs, SDKs, and Smart Contract Tools.

Custom Regulatory and Compliance Solutions: More Alternatives Allow Projects to Select Opt for Solutions That Comply With Specific Regional Regulatory and Enterprise Compliance.

Optimized For Future Demand: Wormhole Alternatives Are Typically Built With Demand for Cross-Chain DeFi and Web3 Applications in Mind.

Key Point & Best Wormhole Alternatives for Secure Cross-Chain Bridging List

| Platform | Key Strength | Supported Chains | Best For |

|---|---|---|---|

| LayerZero | Ultra-light cross-chain messaging | 50+ L1 & L2 | Cross-chain dApps & messaging |

| Axelar | Programmable cross-chain communication | 60+ chains | Enterprise-grade interoperability |

| Synapse Protocol | Fast asset swaps & low fees | 20+ chains | DeFi & stablecoin transfers |

| Hop Protocol | Native L2-to-L2 transfers | Ethereum L2s | Layer-2 scalability |

| Celer cBridge | High-speed, low-cost transfers | 40+ chains | Retail & DeFi users |

| Connext | Trust-minimized cross-chain calls | 30+ chains | Cross-chain smart contracts |

| LI.FI | Best route & fee optimization | 20+ bridges | Multi-bridge swaps |

| THORChain | Native asset swaps (no wrapping) | Major L1s | Native cross-chain trading |

| Symbiosis Finance | Unified cross-chain liquidity | 15+ chains | Cross-chain DeFi swaps |

| Rango Exchange | Cross-chain swap aggregation | 60+ chains | Best price cross-chain swaps |

1. LayerZero

LayerZero is among the top alternatives to Wormhole for safe cross-chain transfers thanks to its trust-minimized message-passing model. Wormhole hinges on secure asset locking.

Crossing chains takes place via the Ultra Light Node (ULN) dual-verifying architecture relying on decentralized oracles and independent cross-chain relayers. That design effectively minimizes costly and attackable surfaces.

The system’s high end security is a bonus. LayerZero works with many Layer 1 and Layer 2 blockchains. This makes it ideally suited to enhance cross-chain DeFi, NFT and gaming applications for developers needing quick and cost-effecient ecosystem spanning communications.

Key Features of LayerZero’s

ULN (Ultra Light Nodes) Architecture Built using a lightweight messaging layer, which reduces overhead and provides lower costs and complexity, as there’s no need for expensive, heavy, on on-chain validators.

Oracle and Relayer Security Model We decouple the sequential dependencies of data verification and transaction execution to eliminate a large number of single points of failure.

Cross-Chain Message Ability We can move arbitrary data, tokens, and instructions for smart contracts across different chains.

High Security and Trust Minimization Reducing the attack surface, as is typically the case with almost all bridge systems, is a core consideration.

Strongly Multi-Chain Compatible Works across many Layer 1 and Layer 2 ecosystems.

Custom Built SDKs and APIs Building scalable cross-chain dApps and protocols is rapid and easy.

Pros & Cons LayerZero

Pros:

- Very secure ultra-light messaging architecture

- Advanced cross-chain smart contract communication

- Layer 1 and Layer 2 support

Cons:

- Oracle-relayer separation adds complexity

- Secure implementation requires understanding

- Not a pure liquidity bridge so swaps aren’t instant

2. Axelar

Axelar is unique among top alternatives to Wormhole for safe cross-chain transfers for its fully decentalized interoperatibily network with proof-of-stake validation.

It brings decentralized cross-chain communication, token transfer, and smart contract interaction to the end user via a simplified single API. It is a cross-chain enterprise security and decentralization system supporting a range of blockchains.

With Axelar’s general message-passing capability, developers get to design and run safe, complex cross-chain operational logic. This makes it a go-to system for large and mid-sized DeFi developers and systemically flexible defi cobtracts Axelar is disproportionately popular with enterprise grade DeFi.

Key Features of Axelar

- Decentralized Proof-of-Stake Network: Cross-chain functionality is trust-minimized and censorship resistant.

- General Message Passing (GMP): Governable calls on cross-chain smart contracts and token transfers.

- Universal Interoperability Layer: Access to many Layer 1 and Layer 2 blockchains on a single network.

- Developer-Friendly API & SDKs: Multi-chain applications and enterprise integration.

- Enterprise-Grade Security: Strong cryptographic and validator agreement that withstands attacks.

- Scalable Architecture: Designed to handle high demand cross-chain transactions.

Pros & Cons Axelar

Pros:

- Decentralized Proof-of-Stake validator network

- Robust General Message Passing for developers

- Top-tier interoperability support for enterprises

Cons:

- More expensive than liquidity bridges (slightly)

- Complexity for simple retail transfers can be frustrating

- Congestion can slow down validator operations

3. Synapse Protocol

Synapse Protocol has gained a reputation as one of the top Wormhole alternatives for secure cross-chain bridging as it prioritizes quick and inexpensive asset transfers through liquidity pools instead of the lock-and-mint mechanism.

This method bolsters security while improving capital efficiency and shortening transaction times. Liquidity pools instead of lock-and-mint mechanisms improve and speed up the transaction times Synapse transfers and cross-chain stablecoin swaps.

Synapse is one of the most Validator AMM systems on the market, enabling fast swap-and-bridging transactions for the DeFi user to prioritize speed and low transaction fees. Synapse is supported by dozens of Layer 1 and Layer 2 networks.

Key Features of Synapse Protocol

- Liquidity Pool Bridging – Enables faster, cheaper transactions using pooled liquidity rather than the less efficient lock-and-mint model.

- Quick Cross-Chain Transactions – Transfers assets across different chains with little to no lag.

- Cross-Chain Swap Integrations – Users can bridge assets and swap tokens in a singular action.

- Multi-Chain Connectivity – Integrates with many Layer 1 and Layer 2 networks.

- Cost Efficient – Optimized for minimal fees to be spent on transactions, bridging and gas.

- Built for DeFi – Popular for use in stablecoin transfers and decentralized finance applications.

Pros & Cons Synapse Protocol

Pros:

- Fast, cost-effective bridges with liquidity

- Cross-chain swaps integration

- Support for DeFi and stablecoins is excellent

Cons:

- Pooled liquidity can affect large transfers

- Security is a major concern with pooled liquidity

- More advanced messaging is a little limited

4. Hop Protocol

Hop Protocol is one of the best Wormhole alternatives for secure cross-chain bridging as it was designed for fast and efficient transfers to and from Ethereum Layer 2 rollups.

Users receive final funds on Layer 1 and, to improve user experience and wait times on the protocol, funds are settled Layer 1 after finalization. It has built a reputation to Ethereum DeFi users Hop Protocol has been to provide swift, low-cost, Layer 2 secure interoperability without requiring a dependency on centralized bridge operators.

Key Features of Hop Protocol

- Layer 2-Focused Bridging – The ability to move assets across various Ethereum Layer 2 rollups.

- Bonder Liquidity Model – Allows for near-instant movement of assets while keeping the final settlement of the transfer on the chain.

- Fast Transaction Finality – Substantially less wait time when compared to other, more traditional bridges.

- Low Gas Fees – Cost of cross transfer is kept low.

- Non-Custodial Design – Full control of assets is maintained with the users.

- Ethereum Ecosystem Integration – Great for all users and DeFi protocols that primarily utilize Ethereum rollups.

Pros & Cons Hop Protocol

Pros:

- Great for Ethereum Layer 2 ecosystems

- Transfers are instant with bonder liquidity

- Very low gas costs

Cons:

- Only for Ethereum rollups

- Bonder availability can be an issue

- Not a great fit for non-Ethereum chains

5. Celer cBridge

Within the framework of secure cross-chain bridging, cBridge is one of the top options owing to its speed and low fees.

Integrating the State Guardian Network of Celer, cBridge employs a liquidity pool-based bridging model, which allows for the proper confirmation of transactions and the mediation of potential problems.

cBridge is also versatile, as it allows for cross-chain messages as well as token transfers, suitable for most Defi and Web3 use cases. Popular especially for developers and retail users as a result of its excellent interface, chain coverage, and high levels of security, cBridge allows for ease of access to all users.

Key Features of Celer cBridge

- LiquidityBased Cross*Chain Transfers: Celer cBridge uses pooled liquidity to bridge assets instantly without any lock and mint delays.

- State Guardian Network (SGN): A layer of decentralised security that manages transaction validation and dispute resolutions.

- Speed and Low Cost: Celer cBridge is designed to offer almost instantaneous transfers while pocketing savings of users.

- Multi-Chain Support: Connects numerous Layer 1 and Layer 2 blockchains.

- Cross-Chain Messaging: Functionality enables both token transfers and generalized message (or call) passing for decentralised applications.

- Lightweight and Friendly: Designed for convenience of everyday users and developers.

Pros & Cons Celer cBridge

Pros:

- Fast, low fees

- Wide multi-chain coverage

- Excellent protection via State Guardian Network

Cons:

- Liquidity supply is inconsistent from one chain to another

- Less flexible than others regarding messaging features

- UI could use some improvements

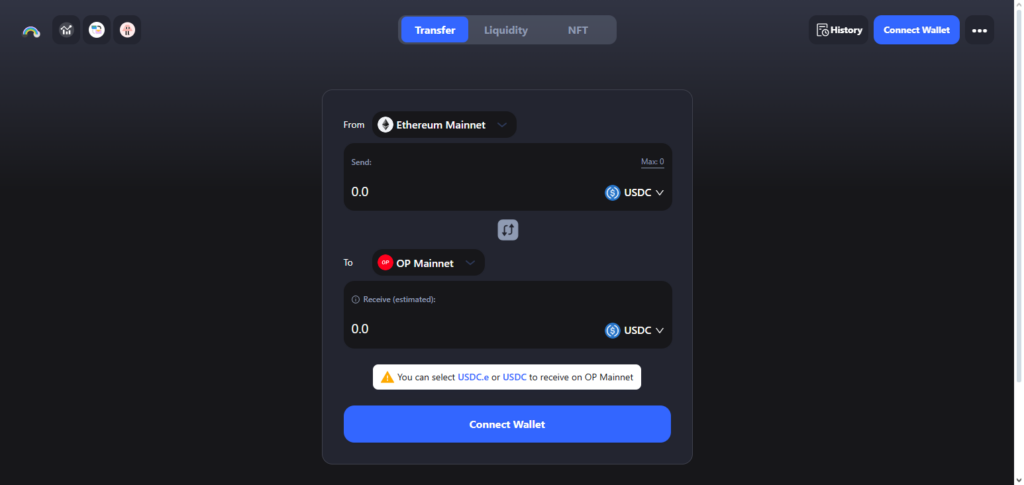

6. Connext

Connext is one of the best Wormhole competitors and is popular for secure cross-chain bridging. It employs a trustless model paired with optimistic verification for cross-chain communication, which is a unique feature of Connext.

Instead of having to use centralised validators, Connext allows transactions to be challenged over a period of time. Users are then granted additional levels of security as well as decentralised features.

Cross-chain transfer of assets is complemented with the passing of arbitrary messages, providing the potential for the use of smart contracts to perform a large number of tasks. Most suitable for dApp developers, Connext provides the required secure, censorship-resistant interoperability across multiple blockchains.

Key Features of Connext

- Optimistic Verification Security Model: Provide challenge-based authentication to achienve trust-minimized and decentralized cross-chain transactions.

- Cross-Chain Messaging: Allows smart contracts to be invoked and data to be transmitted across different chains safely.

- Non-Custodial Architecture: Users can control their assets and do not have to trust third-party custodians.

- Composable Infrastructure: Built to enable easy plug-and-play access for DeFi and dApps.

- Multi-Chain Compatibility: Works with many Layer 1 and Layer 2 chains.

- Developer-Friendly Tooling: Offers secure cross-chain application development via SDKs and cross-chain documentation.

Pros & Cons Connext

Pros:

- Design integrates trust-minimized optimistic security model

- Calls and supports cross-chain smart contracts

- Design is 100% fully non-custodial

Cons:

- Possible final settlement delays from challenge periods

- New users may find it challenging

- Native asset support is quite limited

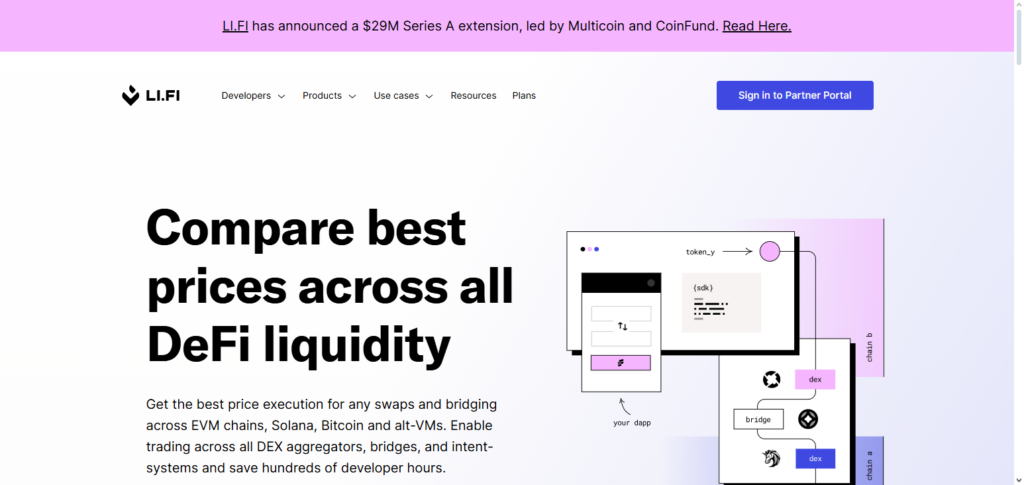

7. LI.FI

LI.FI is one of the most proficient Wormhole alternatives for secure cross-chain bridging deal to the exceptionally easy bridging of protocols and DEX aggregation.

LI.FI does not operate a single bridge. It aggregates a large number of bridges and their DEXes to identify the best one based on cost, speed, and safety. Smart routing, fallbacks, and transfer tracking to prevent failures add to the process.

It is also frequently used by wallets and DeFi applications and aggregators, providing them with the ability to offer users rapid and easy multi-chain swap functionality with no added bridging complexity on their front end.

Key Features of LI.FI

Bridge & DEX Aggregation: Aggregates a number of bridges and decentralized exchanges in order to discover the most effective cross-chain routes.

Smart Routing Engine: Automatically fine-tunes transactions to best balance for optimization speed cost and security.

Fallback & Failure Protection: Mitigates failed transactions by rerouting when a problem arises.

Multi-Chain & Multi-Bridge Support: Links a large variety of Layer 1 and Layer 2 networks.

Developer APIs & SDKs: Seamless incorporation for wallets, dApps as well as DeFi tools.

User-Friendly Experience: Simplifies cross-chain complexity to an effortless, one-click swap.

Pros & Cons LI.FI

Pros:

- Aggregates a number of other bridges and DEXs

- Smart routing optimizes for lower fee and failure rates

- Integrates effortlessly into wallets and dApps

Cons:

- Third-party bridge dependency

- Less control for users over the underlying protocols

- Not an independent bridge solution

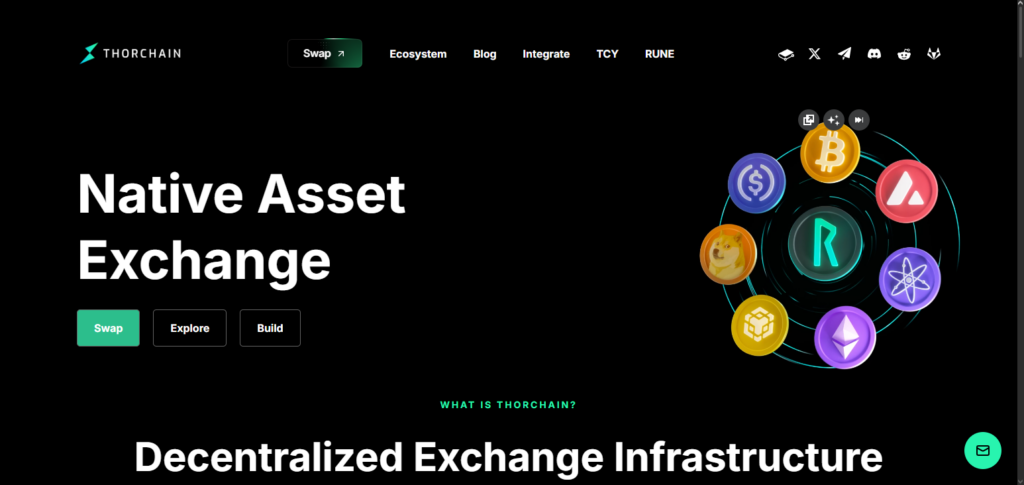

8. THORChain

THORChain is placed among the best Wormhole alternatives for secure cross-chain bridging as it provides the most trustless, decentralized, and secure way to swap any chain’s assets directly without them having to wrap or peg a token.

They do this through a decentralized pool of liquidity where tiers operate as nodes and protect the scheme with a TSS (threshold signature scheme). It also boosts transparency and further decentralizes the system by closing some potential counterparty gaps.

Gates swaps of assets directly on most of the layer 1 blockchains and custodial cross-chain transactions. It is by far the most preferable option among users seeking trustless cross-chain trading.

Key Features of THORChain

- Native Asset Swaps: Allows users to perform swaps between multiple blockchains without the need to wrap or peg the tokens decreasing counterparty risks.

- Decentralized Liquidity Network: Secured by a network of independent node operators.

- Threshold Signature Scheme (TSS): Employs sophisticated cryptography to govern a number of funds without having to utilize a unique key.

- Non-Custodial Architecture: Assets always stay under users’ control.

- Cross-Chain AMM Model: Guarantees availability of liquidity on all the interconnected Layer 1 blockchains.

- High Transparency: There is high public trust as all activities and transactions are recorded on the blockchain.

Pros & Cons THORChain

Pros:

- Native asset swaps no wrapping required

- Liquidity network is very decentralized

- High transparency and security on-chain

Cons:

- Limited number of assets and chains to use

- Involvement of less simple liquidity provider change economics

- May increase swap fees during high market volatility

9. Symbiosis Finance

Symbiosis Finance is one of the best Wormhole alternatives for secure cross-chain bridging due to its AMM-based liquidity bridging across several blockchains. What sets Symbiosis Finance apart is the ability to allow customers to swap and bridge tokens in a single transaction.

Symbiosis seamlessly abstracts the bridging complexities, and has low slippage, is capital efficient, and provides an enjoyable experience for users.

Symbiosis is great for DeFi users and protocols from several networks and cross-chain integrated smart contracts. Symbiosis is a great for protocols and users that needs a an uncomplicated liquidity pool and bridge.

Key Features of Symbiosis Finance

- Unified Cross-Chain AMM: Users can swap any token on supported blockchains with no limitation on number of blockchains in one transaction.

- Liquidity Pool Based Bridging: Users can experience fast cross-chain transfers due to our shared liquidity on each of our bridges.

- One-Click Cross-Chain Swaps: Users can now enjoy a simple streamlined experience on our bridges as we hide every complexity.

- Very Low Slippage: Users will experience better capital efficiency as price impacts are minimized.

- Multi-Chain Support: We are connected to many L1 and L2 blockchains.

- DeFi-Focused Design: We specifically support users and protocols in defied systems.

Pros & Cons Symbiosis Finance

Pros:

- Instantly achieve cross-chain swaps via one click

- Utilizes an AMM model that is capital efficient

- User experience is highly streamlined for the DeFi ecosystem

Cons:

- Liquidity is lower than that of other small, major bridges

- Not supportive of a high number of blockchains

- Less ideal for large transfers that large institutions may need

10. Rango Exchange

Rango DEX is one of the best Wormhole alternatives for secure cross-chain bridging as its a cross-chain DEX and bridge aggregator. It has the ability to access many liquidity sources and blockchains to offer customers the best swap routes in the bridge across different chains.

Rango is not limited to a single bridge due to its integration of many bridge and swap protocols. Its non-custodial DEX is customer focused and helps mitigate the issues of cost and inefficiency in cross-chain asset DEXing.

Feature of Rango Exchange

- Cross-Chain Aggregation: Synchs several blockchain, bridges and DEXs for interoperable cross-chain swaps.

- Intelligent Route Optimization: Looks for the cheapest, fastest and most efficient route for swaps.

- Non-Custodial Trading: Users do not lose custody of their assets during the trade.

- Wide Multi-Chain Support: Over dozens of Layer 1 and Layer 2 networks are supported.

- Bridge and DEX Integration: Aggregates the liquidity of a number of different Protocols to improve execution quality.

- User-Friendly Interface: Makes complex cross-chain transactions easy for retail and DeFi users.

Pros & Cons Rango Exchange

Pros:

- Extensive cross-chain aggregation span

- Secure and non-custodial exchange

- Optimized routing

Cons:

- Dependent on integrated bridges and Decentralized Exchanges (DEXs)

- Varying execution time per route

- Less control for power users

Benefits of Wormhole Alternatives for Secure Cross-Chain Bridging

Secured Multiple Diverse Models: Different Wormhole alternatives have different security models such as decentralized validators and optimistic verifications, liquidity pools, or oracle-relayer systems, which allows for the security of multiple degrees of freedom and reduced single-point-of-failure.

Decreased Exploit Vulnerabilities: Users and developers will be able to mitigate the consequences of vulnerabilities and exploits of bridges, which are an unfortunate norm of multi-cross bridges, by not being reliant on one singular bridge protocol.

Efficiency Gains and Cost Reduction: Many alternatives have better gas optimization, more efficient liquidity routing, and improved settlement speeds, which translates to higher efficiency and reduced transaction cost.

Improved Cross-Chain Transfer Speeds: More advanced architectures offer better speeds and near-instant bridging with better finality than legacy lock-and-mint bridges.

Greater Compatibility Among Chains: More Wormhole alternatives than not have support for more Layer-1 and Layer-2 networks which better the interoperability among ecosystems.

Expanded Liquidity Opportunities: Liquidity bridges and liquidity aggregators reduces slippage for larger volume transfers.

Ease of Development: Secure multi-chain dApps can be built more easily with APIs, SDKs, and cross-chain messaging systems.

Increased Ease of Use: Simple and user-friendly interfaces, with one-click swaps and automated routing, are designed for better usability for retail and DeFi users.

Prepared for Diverse Future Uses: The increased volume of transactions such alternatives can support will enable the growth of cross-chain Web3 applications. This benefits all users, as the applications will be more efficient and streamlined.

Features Of Wormhole Alternatives for Secure Cross-Chain

Advanced Security Architecture

Security from exploits when soft or hard validating integrations from decentralized or oracle–relayer models, optimistic verification, or threshold signatures.

Cross-Chain Messaging Support

Not just tokens, but also data and smart contracts instructions can securely transmit across multiple blockchains.

Multi-Chain Compatibility

Great support for Layer-1 and Layer-2 networks.

Liquidity-Based Bridging

Faster transfer and less capital lockup through utilization of liquidity pools or AMM models.

Low Transaction Fees

Gas-efficient and optimally routed bridged transfers and swaps.

Fast Finality & Settlement

Compared to other bridges, transfers are instant or confirmations are expedited.

Developer-Friendly APIs & SDKs

Cross-chain dApps and DeFi protocols scalable and easier to build and integrate.

Non-Custodial Design

No central intermediary requires custody of users assets.

Smart Routing & Aggregation

For speed, cost, and security, chooses the best bridge or liquidity route.

Scalable Infrastructure

Cross-chain Web3 applications continue to grow, it is meant to support high W3 activity and can easily accommodate the frictionless transfer of assets and tokens across blockchains.

Conclusion

Selecting the best interoperability solution has become essential for security, scalability, and efficiency as cross-chain activity grows.

The top Wormhole substitutes for safe cross-chain bridging, including LayerZero, Axelar, Synapse, Hop, Celer cBridge, Connext, LI.FI, THORChain, Symbiosis Finance, and Rango Exchange, provide a variety of topologies that lower risk, boost efficiency, and support larger blockchain ecosystems.

These substitutes offer adaptable and safe choices whether you require sophisticated cross-chain messaging, quick liquidity-based transfers, native asset swaps, or intelligent aggregation. Your use case, security preferences, and ecosystem requirements will ultimately determine which solution is best for you.

FAQ

What are Wormhole alternatives?

Wormhole alternatives are blockchain interoperability and cross-chain bridging solutions that let users and protocols transfer assets, messages, and data between different blockchain networks securely without relying on the Wormhole protocol.

Why do we need Wormhole alternatives?

Alternatives help reduce security risks, lower fees, support more networks, and improve liquidity and speed by using diverse architectures and protocols optimized for cross-chain transfers.

Which are the top Wormhole alternatives?

Some top alternatives include LayerZero, Axelar, Synapse Protocol, Hop Protocol, Celer cBridge, Connext, LI.FI, THORChain, Symbiosis Finance, and Rango Exchange.

Are these alternatives more secure than Wormhole?

Many alternatives offer enhanced or complementary security models such as decentralized validators, optimistic verification, and liquidity-based mechanisms that can reduce central points of failure and exploit risk.

Can I bridge any token across chains with these alternatives?

Token support varies by protocol, but most support widely used assets like stablecoins, popular tokens, and increasingly many native assets across multiple Layer-1 and Layer-2 networks.