Global trade is being drastically transformed by cryptocurrency payments, which are driving companies to look for quicker, less expensive, and international settlement options.

The Best Crypto Merchant Settlement Providers assist businesses in accepting digital assets and safely turning payments into fiat, stablecoins, or cryptocurrency.

These solutions enhance cash flow, lower chargebacks, and simplify blockchain complexity. This article examines the top cryptocurrency merchant settlement companies that enable easy, safe, and scalable cryptocurrency payments for contemporary companies.

How to Choose the Best Crypto Merchant Settlement Providers?

Settlement Speed

Providers should be capable of same-day services as significantly as to settlement in order to improve cash flows, secure lower volatility exposure, and support commerce throughout the globe in real time.

Supported Cryptocurrencies and Stablecoins

Choosing platforms that support multiple major cryptocurrencies along with the stablecoins such as USDT and USDC will give needed flexibility to the customers and help merchants control price volatility.

Fees and Pricing Transparency

Merchants can evaluate mixed pricing with transaction, conversion, and withdrawal fees but long-term sustainability will be affected when there are hidden fees impacting business from poor pricing predictability.

Fiat Conversion and Payout Options

It’s best to choose providers that have automatic crypto-to-fiat conversion along with bank payouts, to facilitate settlement to local currencies without using third-party exchanges.

Regulatory Compliance and Licensing

It’s best to choose compliant providers that do appropriate KYC, AML, and other local regulations to control/remove legal risk and ensure settlement continues to be operational in multiple geographies.

Security and Fund Custody Model

Merchants should choose platforms that are secure, with audited and transparent infrastructure along with custodial or non-custodial models that will be to best protect merchant assets.

Additional Integration & Developer Support

Make sure there are no obstacles for integration via APIs, plugins, and SDKs for e-commerce providers, which streamlines development and enables crypto payments more easily.

Global & Cross-Border Support

Identify providers who are able to support multi-country handling, local payout rails, and cross-border settlements so you can increase your global footprint without the friction of banking.

Integrated Reporting & Accounting Tools

Select providers who give you integrated reporting of transactions, tax-oriented records, and data that can be exported to make things like accounting, auditing, and financial compliance less painful.

Scalability & Merchant Support

Identify providers who have the potential to scale and maintain high volumes of transactions for customer support to ensure your business will be able to grow when settlement becomes more reliable.

Top 10 Crypto Merchant Settlement Providers (2025)

| Provider | Key Features |

|---|---|

| BitPay | Oldest and most trusted crypto payment gateway |

| Coinbase Commerce | Easy integration with Shopify, WooCommerce |

| NOWPayments | Supports 200+ coins, auto-conversion |

| CoinGate | Lightning Network support, plugins for major CMS |

| OpenNode | Bitcoin & Lightning-focused |

| PayPal (Crypto Checkout) | Mainstream adoption, fiat conversion |

| Crypto.com Pay | Cashback rewards, supports stablecoins |

| Binance Pay | Zero-fee transfers, global coverage |

| AlfaCoins | Split settlements (crypto + fiat) |

| BTCPay Server | Open-source, self-hosted, no intermediaries |

1. Bitpay

Best Crypto Merchant Settlement Provider – Bitpay has been a pioneer in the industry and has been a trusted Crypto payment processor since 2011. They have a fee structure that has been reported by merchants to be around 1-2% + $0.25 per transaction.

Crypto payment support with APIs and e-commerce plugins are available to clients accepting more than 200+ cryptocurrency options. Merchants have the option to accept and settle in crypto, stablecoins or fiat (USD/EUR) with auto-conversion.

Bitpay is ideal for large e-commerce merchants that require enterprise-level reporting, invoicing, and multi-channel ecosystem integration. Major features of the model include reporting, integration, invoicing, and crypto accounting features. Optional volatility is available, however, the model requires KYC for businesses.

BitPay

- Pricing: Roughly 1% charge for each transaction.

- Accepted Payment Options: Major altcoins, stablecoins, Ethereum, Bitcoin.

- Settlement Methods: Crypto or fiat (USD, GBP, EUR, and INR).

- Additional Details: Global plugins for Shopify, WooCommerce, and Magento, as well as fraud protection and comprehensive (AML and KYC) compliance.

- Ideal Clients: Large firms and regulated companies that require a fiat conversion.

BitPay

| Pros | Cons |

|---|---|

| Strong compliance (KYC/AML) and fraud protection | Charges ~1% fee per transaction |

| Supports fiat settlement (USD, EUR, GBP, INR) | Limited altcoin support compared to newer gateways |

| Easy integration with Shopify, WooCommerce, Magento | Requires merchant verification process |

| Trusted brand with global reach | Settlement speed depends on fiat banking partners |

2. Coinbase Commerce

Best Crypto Merchant Settlement Provider – Coinbase Commerce supports the simple and easy acceptance of the major assets, BTC, ETH, USDC, etc. There is a 1% fee on gross transaction volume if the merchants are converting to fiat; however, if the merchants are settling in crypto, the transaction is free of charge.

Merchants have the option to direct payments into their wallets and have full control over them. The model is integrated with Shopify, WooCommerce, and supports.Best for small to medium online stores or freelancers who prefer direct crypto settlement rather than auto-conversion to fiat.

For the beginners, the company’s reputation and ease of use represent the best starting point, although more sophisticated analytics are not available.

Coinbase Commerce

- Pricing: 1% charge following a free threshold.

- Accepted Payment Options: Major coins, USDC, Ethereum, and Bitcoin.

- Settlement Methods: Only crypto (fiat through Coinbase Exchange).

- Additional Details: User-friendly dashboard, API support, and integration with Shopify and WooCommerce.

- Ideal Clients: E-commerce businesses and startups.

Coinbase Commerce

| Pros | Cons |

|---|---|

| Backed by Coinbase’s strong brand trust | Settlement only in crypto (fiat via Coinbase Exchange) |

| Easy integration with Shopify/WooCommerce | 1% fee after free threshold |

| User-friendly dashboard and API | Limited coin support compared to NOWPayments |

| Simple setup for startups/e-commerce | Exposure to crypto volatility |

3. NOWPayments

Best crypto merchant settlement provider – NOWPayments is the best for supported 150 to 300+ cryptocurrencies with competitive fees starting from 0.5 to 1 percent, flexible API, and instant auto-conversion to stablecoins or fiat.

Payments can be made via cryptocurrencies, wallets, checkout link, and major e-commerce platform plugins. Merchants can receive crypto or fiat payouts, which is ideal for small businesses, donations, and custom integrations.

Other features are subscription billing, donation widgets, batch payouts, and good developer tools. For extensive coin support and flexible settlement options, NOWPayments is your best bet.

NOWPayments

- Pricing: Approx. 0.5-1% per transaction.

- Accepted Payment Options: More than 200 types of coins, including stablecoins.

- Settlement Methods: Crypto to crypto or crypto to fiat.

- Additional Details: Instant payments, different billing options, auto-conversion, and features for donations.

- Ideal Clients: Businesses and non-profit organizations (NGOs) with a global reach requiring a broad array of tokens.

NOWPayments

| Pros | Cons |

|---|---|

| Supports 200+ cryptocurrencies | Slightly higher fees (~0.5–1%) for fiat conversion |

| Auto-conversion reduces volatility risk | Less mainstream brand recognition |

| Recurring billing and donation tools | Requires API setup for advanced features |

| Instant payouts and multi-coin flexibility | Fiat settlement not available in all regions |

4. CoinGate

Best crypto merchant settlement provider – CoinGate offers a 1 percent flat fee and approximately 70+ supported cryptocurrencies with plugins for Shopify, WooCommerce, and Magento.

Merchants can receive crypto and settle in crypto or fiat, with available stablecoin payouts CoinGate is best for international merchants and marketplaces needing simple wire and currency flexibility. Other features are payment buttons, invoicing, and point of sale support.

Compliance with regulations and conducting EU-licensed operations provide businesses with additional credibility for courting European clientele.

CoinGate

- Pricing: 1% charge per transaction.

- Accepted Payment Options: Over 70 types of coins, including those on the Lightning Network.

- Settlement Methods: Crypto or fiat (USD, GBP, EUR).

- Additional Details: Fast Bitcoin settlement using Lightning, compliance within the EU, and plugins for the CMS.

- Best For: European merchants and businesses seeking speedy transactions with low fees.

CoinGate

| Pros | Cons |

|---|---|

| Supports 70+ coins and Lightning Network | 1% transaction fee |

| Fiat settlement in EUR, USD, GBP | Primarily EU-focused, limited global fiat options |

| Plugins for Shopify, WooCommerce, CMS | Smaller coin coverage than NOWPayments |

| Fast Bitcoin settlement via Lightning | Requires compliance checks for fiat payouts |

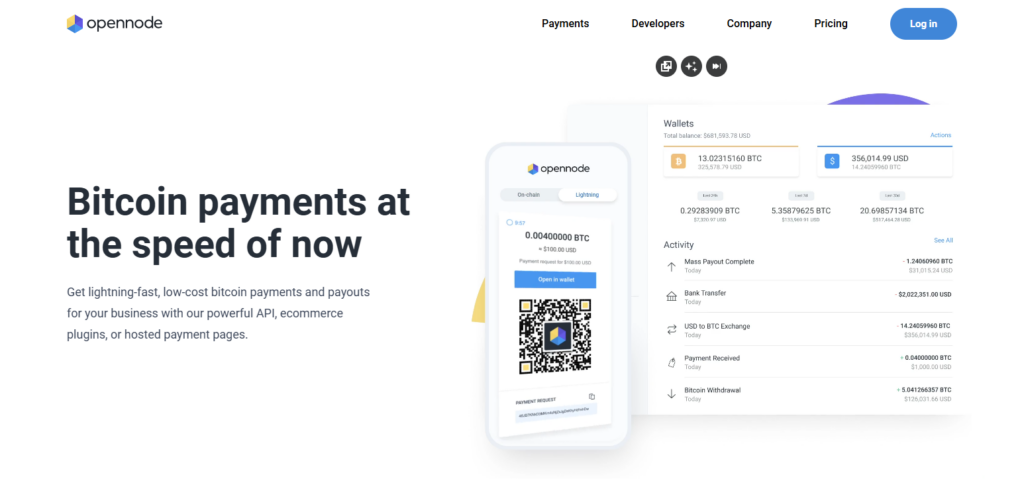

5. OpenNode

Best Crypto Merchant Settlement Provider – OpenNode specializes in Bitcoin and Bitcoin Lightning Network payments and offer a ~1% processing fee with no setup or hidden costs.

Merchants can receive Bitcoin and have the option to settle in BTC or local fiat with built-in volatility protection via auto conversion.

To make payments there are several options including a hosted checkout, API for direct integration, and in person via a QR code.

This provider is best suited for Bitcoin-based businesses and developers who value low fees and ultra-fast settlements.

Lightning payouts, bank transfer options, and programmable invoices are additional features beneficial to merchants who want to limit chargebacks and gain fast global settlements.

OpenNode

- Transaction Fee: 1%

- Supported Payment Methods: Bitcoin & Lightning Network

- Settlement Options: BTC or fiat (USD, EUR)

- Key Features: Instant lightning payments, integrated API, flexible checkout

- Best For: Tech-savvy merchants and Bitcoin-first businesses.

OpenNode

| Pros | Cons |

|---|---|

| Specializes in Bitcoin & Lightning payments | Only supports Bitcoin (no altcoins) |

| Instant, low-cost Lightning transactions | 1% fee per transaction |

| Offers fiat settlement (USD, EUR) | Limited global fiat coverage |

| Developer-friendly API integration | Best suited only for Bitcoin-first businesses |

6. PayPal (Crypto Checkout)

Best Crypto Merchant Settlement Provider – PayPal (Crypto Checkout) allows merchants to receive crypto from customers’ wallets (which may include BTC, ETH, USDT, XRP and more) for roughly 0.99% intro fee and then automatically convert that crypto to fiat or stablecoin for the merchants. This service also allows settlement via the Coinbase and MetaMask wallets.

Settlement is almost instantaneous and is done through PayPal’s payout system which is best for widespread e-commerce and conventional retailers who want to accept crypto while keeping their accounting familiar. Indeed, it is a service for which fiat-based accounting is predominant.

Key features encompass worldwide accessibility, fee structures undercutting many card processors, and seamless rollout with existing PayPal checkout integrations.

PayPal (Crypto checkout)

- Transaction Fee: ~1%

- Supported Payment Methods: Bitcoin, Ethereum, Litecoin, and Bitcoin Cash

- Settlement Options: Fiat only (USD, EUR, and local currencies)

- Key Features: Buyer protection, easy integration, and a mainstream approach to adoption

- Best For: Businesses (SME) and mainstream businesses who want to avoid volatility

PayPal (Crypto Checkout)

| Pros | Cons |

|---|---|

| Mainstream adoption and buyer trust | Settlement only in fiat (no crypto payouts) |

| Easy integration for SMEs | Limited coin support (BTC, ETH, LTC, BCH) |

| Strong compliance and fraud protection | Fees ~1% per transaction |

| Familiar checkout experience for customers | Merchants miss out on crypto holding benefits |

7. Crypto.com Pay

Best Crypto Merchant Settlement Provider – Crypto.com Pay is part of the wider Crypto.com ecosystem, giving it competitive pricing, which can even be zero and support for most assets.

Merchants can receive payments through crypto wallets and can settle in crypto, or convert it to fiat or stablecoins. It is very useful for e-commerce and loyalty-driven businesses since customers tend to receive rewards for utilizing Crypto.com Pay.

It also has Shopify and API support, worldwide reach, and additional features to promote the service. Settlements are quick and are powered by the Crypto.com ecosystem. This position it well to serve international digital merchants.

Crypto.com Pay

- Transaction Fee: 0.5 – 1%

- Supported Payment Methods: Bitcoin, Ethereum, CRO, and stablecoins

- Settlement Options: Crypto and fiat

- Key Features: QR code payments, cashback rewards, integrated ecosystem

- Best For: Customers that are retailers and target a crypto-savvy clientele.

Crypto.com Pay

| Pros | Cons |

|---|---|

| Supports crypto & fiat settlement | Fees ~0.5–1% |

| Cashback rewards for customers | Requires Crypto.com ecosystem adoption |

| QR code payments and mobile-friendly | Less widely used than PayPal/BitPay |

| Strong stablecoin support | Settlement speed depends on fiat partners |

8. Binance Pay

Best Crypto Merchant Settlement Provider – Binance Pay has support for over 300 different cryptocurrencies and charges a standard fee which is 1 USDT to process a transaction.

Merchants have the option of crypto payments with the ability to settle with crypto or convert to fiat/ local currency through the services of Binance. Payment options consist of crypto wallets and and QR code payment options.

This service is especially beneficial for globally oriented merchants and marketplaces since it provide access to Binance’s widely deployed Pay system.

Binance Pay

- Transaction Fee: No fees

- Supported Payment Methods: Multiple crypto

- Settlement Options: Crypto only

- Key Features: Instant transfers, global access, Binance ecosystem

- Best For: Merchants that are international and have a crypto-native clientele.

Binance Pay

| Pros | Cons |

|---|---|

| Zero transaction fees | Crypto-only settlement (no fiat payouts) |

| Supports hundreds of cryptocurrencies | Regulatory restrictions in some countries |

| Instant transfers via Binance ecosystem | Requires Binance account setup |

| Global reach and strong liquidity | Limited compliance features compared to PayPal/BitPay |

9. AlfaCoins

Best Crypto Merchant Settlement Provider Every AlfaCoins has a fee of 0.99%**, and major coins are supported, such as BTC, ETH, LTC, XRP, BCH, and Tether. It has APIs, payment buttons, and plugins, so it is great for small to medium stores and nonprofits (donation fees as low as 0.5%).

Settlement is done in crypto and optional auto withdrawal to merchant wallets. Other main considerations of merchant accepting crypto include global crypto support, fixed exchange rates for shorter time frames, freedom to determine who pays the fees, and crypto wallets that are safely stored.

AlfaCoins

- Transaction Fee: 1%

- Supported Payment Methods: Bitcoin, Ethereum, Litecoin, stablecoins

- Settlement Options: Split settlements (crypto + fiat)

- Key Features: volatility protection (+) multi-coin support (+) simple integration (+)

- Best For: companies hedging against crypto volatility

AlfaCoins

| Pros | Cons |

|---|---|

| Split settlements (crypto + fiat) | 1% transaction fee |

| Supports Bitcoin, Ethereum, Litecoin, stablecoins | Smaller brand recognition |

| Volatility protection | Limited fiat currency support |

| Easy integration for merchants | Less developer tools compared to BTCPay Server |

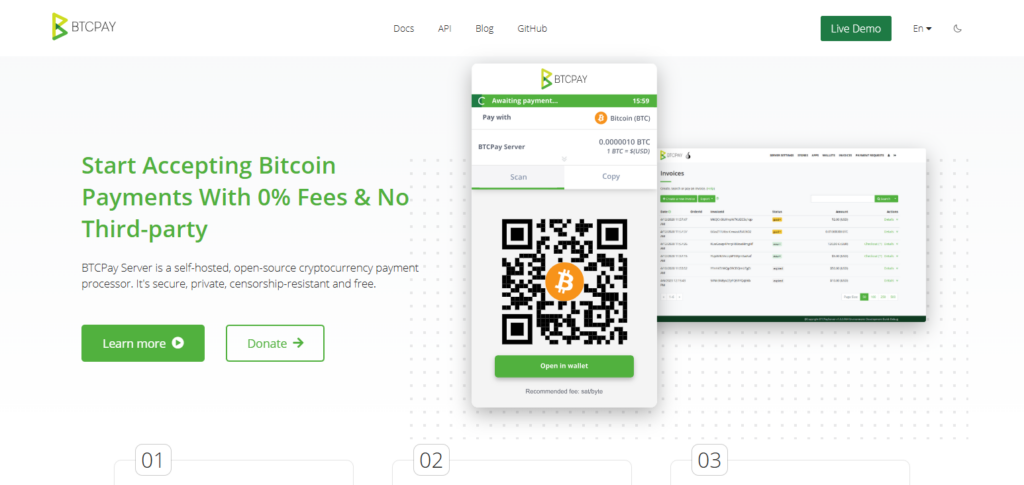

10. BTCPay Server

Best Crypto Merchant Settlement Provider – BTCPay Server is an open source, self-hosted payment processor with zero fees. It supports the fastest and most widely accepted of the cryptocurrencies, Bitcoin and Lightning for payments into merchant wallets.

Payments are also processed instantly and don’t involve to any third parties. Invoicing, point of sale, and e-commerce plugins are among the accepted payment methods.

BTCPay is best suited for privacy focused, and merchant sovereign, developers. He self custody, charge back free, and no custodian tools. He relies completely on the source and is extended on the planned schedule. ([xaigate.com][3])

BTCPay Server

- Transaction Fee: $0 (open-source, self-hosted)

- Supported Payment Methods: Bitcoin & Lightning

- Settlement Options: crypto-only

- Key Features: privacy, customizable checkout, flexible for developers, no middlemen

- Best For: developers & merchants who want independence and control

BTCPay Server

| Pros | Cons |

|---|---|

| Open-source and free (no fees) | Requires technical expertise to set up |

| Self-hosted, privacy-focused | Crypto-only settlement (no fiat) |

| Supports Bitcoin & Lightning | No customer support (community-driven) |

| Full merchant independence | Best suited for developers, not mainstream SMEs |

Conclusion

BitPay, Coinbase Commerce, and CoinGate are reliable for fiat or stablecoin, compliance, and reporting settlements, and are good for businesses of any customer base and size for crypto merchant settlement providers.

For businesses of any customer base and size for crypto merchant settlement providers, NOWPayments, Binance Pay and Crypto.com Pay offer low fees and broad asset support — ideal for international e-commerce. For businesses of any customer base and size, OpenNode and BTCPay Server offer Bitcoin merchant settlement which is censorship-resistant, quick and low cost.

PayPal Crypto Checkout and AlfaCoins are best at incorporating traditional payments with crypto. Most importantly, a crypto merchant settlement provider is directly correlation with quick settlements, low fees, low chargebacks, and global payments.

FAQ

What is a crypto merchant settlement provider?

A crypto merchant settlement provider enables businesses to accept cryptocurrency payments and settle funds in crypto, stablecoins, or fiat currency, reducing payment friction and cross-border costs.

How do crypto merchant settlement providers work?

They process customer crypto payments, confirm blockchain transactions, manage exchange rates, and settle funds to merchants’ wallets or bank accounts based on chosen settlement options.

Are crypto merchant settlement providers safe to use?

Yes, reputable providers like BitPay, Coinbase Commerce, and Binance Pay use strong security measures, compliance standards, and encryption, though merchants should assess custody and KYC requirements.

What fees do crypto settlement providers charge?

Fees typically range from 0% to 2% per transaction, depending on the platform, settlement method, and whether crypto is converted to fiat or stablecoins.

Can merchants settle payments in fiat currency?

Yes, many providers such as BitPay, CoinGate, OpenNode, and PayPal Crypto Checkout allow automatic conversion and settlement into local fiat currencies.

Which crypto settlement provider is best for small businesses?

Coinbase Commerce, NOWPayments, and AlfaCoins are popular for small businesses due to easy setup, low fees, and broad crypto support.