I’ll go over the top ten banks that allow remote account opening in this post. These banks offer easy, safe, and paperless ways to open accounts at any time and from any location as digital banking becomes more and more important.

These options, which range from cutting-edge digital banks like Kotak 811 to multinational behemoths like HSBC and Citibank, guarantee quick onboarding, smooth transactions, and accessible banking for people, NRIs, and enterprises.

What is Remote Account Opening?

Remote account opening allows customers to open bank accounts digitally without the need to visit bank branches in person. Customers can submit their information and identity verification documents via their banking app or website.

Customers can even complete bank required Know Your Customer verification (KYC) digitally. Secure technologies such as electronic signatures (e-signatures), encryption, and video verification are used to protect the account opening process.

Customers, especially tech savvy individuals, Non-Resident Indians (NRIs), expatriates, and busy professionals, appreciate the convenience, speed, and accessibility the process offers. Customers can start their banking processes without the need to complete traditional, time-consuming paper processes and without visiting the bank in person.

Why Use Banks Offering Remote Account Opening

Time Efficient – Open bank accounts whenever you want and from wherever you are without having to travel to a bank.

Fully Digital – Remote account opening saves time on manual procedures. Everything is online, including the forms, KYC, and document verification.

Quick Account Opening – Compared to regular banks, online banks are able to activate accounts instantly or same-day.

International Clients Welcome – Clients who live abroad, including Non-Resident Indians (NRIs) and expatriates, can open bank accounts without having to travel.

Safety and Regulation – Remote bank accounts are not regulated against risk-avoidance, fraud, or anything else. Every process of online onboarding is individually encrypted.

Banking with Digital Services – Remote opened accounts are instantly linked to digital wallets, online payments, and banking apps.

Banking Flexibility – Remote accounts can be opened to offer more banking services, including savings accounts, current accounts (checking), fixed-d deposit accounts, and investment options, without having to go to a branch.

Key Point & Best Banks Offering Remote Account Opening List

| Bank Name | Key Point / Notable Feature |

|---|---|

| DBS Bank | Leader in digital banking and innovation in Asia. |

| HSBC | Global presence with strong international banking services. |

| Citibank | Specializes in corporate banking and wealth management. |

| Standard Chartered | Focus on emerging markets and trade finance. |

| ICICI Bank | Major Indian private bank with extensive retail and digital services. |

| HDFC Bank | Strong retail banking and fast-growing digital solutions in India. |

| Axis Bank | Diversified banking services with focus on SME lending. |

| Kotak Mahindra Bank (811 Digital) | Pioneer in digital-only banking in India with app-based savings. |

| Bank of America | Large US bank with robust consumer and investment services. |

| Chase Bank (JPMorgan) | Leading US bank with strong retail, corporate, and investment banking. |

1. DBS Bank

DBS Bank of Singapore is recognized for its advancements in digital banking. Its banking services can be accessed through its award winning mobile banking application and it’s online services platform.

Customers can perform banking functions online and can do their KYC from anywhere, thus, not having to visit a bank branch.

DBS has strong partnerships with Fintech firms which is aimed at creating custom solutions for each customer, thus retaining its position as a leader in digital banking for both individual and corporate customers. Best Banks Offering Remote Account Opening: Customers can open a bank account online with very little documentation.

DBS Bank Features, Pros & Cons

Features

- Mobile app and digital banking solutions.

- e-KYC and account opening solutions.

- Wealth management and other investments.

- Banking services for Asia-Pacific.

- AI-based fraud detection and banking security.

Pros

- Digital banking is seamless for business and retail customers.

- Accounts can be opened quickly and without paperwork.

- DBS Bank has a regionally established reputation for reliability and is Asia’s leading bank.

- Customers can hold multiple currencies in an account.

- Fraud is minimized with AI security.

Cons

- There are not many physical locations outside of Asia.

- The services some customers want may not be available in their region.

- International wire transfers can be expensive.

- Customers in the United States are not very familiar with the bank.

- There can be high costs for customers who want to use premium services.

2. HSBC

HSBC is an international bank with a presence in over 60 countries. It has a wide range of services including retail, corporate, and investment banking. Clients can manage their accounts cross border because of HSBC’s international banking platform.

Customers can open select accounts remotely and complete registration, document submission, and verification online.

HSBC has a strong record for regulatory compliance, which enhances the security of digital transactions. Best Banks Offering Remote Account Opening: HSBC provides services that are specially catered to expats and international clients, simplifying international banking.

HSBC Features, Pros & Cons

Features

- Operations in more than 60 countries.

- International account opening available for some account types.

- Investment, retail, and business banking.

- Global clients receive bank accounts in multiple currencies.

- Mobile app and online banking services are high quality.

Pros

- Global business customers and customers relocating to other countries are the main target audience.

- There is a high level of security and compliance among the services offered digitally.

- Global financial services, including loans and wealth management, are offered in the banking system.

- Trusted global brand.

Cons:

- For NRIs, account openings can take longer.

- International services may incur higher fees.

- In some areas, there is not as much personalized help.

- Depending on your location, the mobile app may not have as many features.

- Some services may only be available in branch locations.

3. Citibank

Citibank is one of the largest banks in the United States and offers corporate banking, wealth management, and global consumer services. It provides extensive mobile and online banking services through its digital platforms including funds transfer, bill payment, and investment services.

Customers of Citibank can open accounts remotely in selected countries for both individuals and businesses.

Citibank allows customers to submit identity documents and complete account verification digitally without having to visit a bank branch. Best Banks Offering Remote Account Opening: Citibank is a top choice for international banking primarily because of its digital services and extensive reach.

Citibank Features, Pros & Cons

Features:

- Offers services in corporate and retail banking.

- In some areas, you can remotely open an account.

- Investment and wealth management globally.

- Mobile and online banking is very good.

- Offers credit cards and loans.

Pros:

- Offers accessibility in global banking.

- Digital banking and mobile apps work very well.

- Accounts for NRIs and international accounts are available.

- Good credit card options.

- The online platform is secure.

Cons:

- In some countries, there are not many branches.

- Compared to local banks, the account fees are not low.

- Not every country has remote account opening.

- Some investment opportunities have a high minimum balance requirement.

- Customer support is different in every location.

4. Standard Chartered

Standard Chartered has its headquarters in the UK, and focuses on Retail, Corporate, and Private Banking in the other regions mentioned – Asia, Africa, and the Middle East. Apart from the traditional banking methods, i.e. branch banking, Standard Chartered focuses on new-age banking methods like digital banking, which allows customers to monitor their banking operations via mobile banking applications and online banking platforms.

Additionally, Standard Chartered is also able to allow customers to open accounts remotely in certain markets. Digital banking is also supplemented with KYC (Know Your Customer) options, allowing customers to complete the KYC requirements online and therefore open accounts remotely.

Best Banks Offering Remote Account Opening: Standard Chartered is most suitable for international travelers and businesses, as its banking services provide the most consistent and comprehensive remote banking services across different geographical locations, which is rare compared to traditional banking methods.

Standard Chartered Features, Pros & Cons

Features:

- Focus on developing regions including Asia, Africa, and the Middle East.

- Digital banking for retail and corporate clients.

- Online KYC and remote account opening.

- Corporate banking and trade finance solutions.

- Payment apps and mobile banking.

Pros:

- Good coverage in emerging markets.

- Convenience of online and mobile banking.

- Provides solutions for corporate and trade finance.

- Accounts in multiple currencies.

- Safe digital systems.

Cons:

- Small contact in North America.

- High fees for overseas transfers.

- Mobile app functionality varies by country.

- More expensive services need higher balances.

- Remote account opening restricted to certain areas.

5. ICICI Bank

ICICI Bank has the most comprehensive banking services in India. As part of its comprehensive services in retail and digital banking, ICICI Bank has Internet Banking Solutions, a Banking App, and a Video KYC method that customers can use to open accounts in real time.

ICICI Bank allows their customers to open savings accounts, current accounts, and fixed deposit accounts with a very limited amount of documents. Additionally, ICICI Bank has services for customers to apply for loans, transfer funds, and even invest, all online.

Best Banks Offering Remote Account Opening: ICICI Bank has made remote banking services very easily accessible across the country and for people from outside the country who wish to use its services, which is fastest of any private sector bank in India.—

ICICI Bank Features, Pros & Cons

Features:

- Top private Indian bank.

- Internet banking and mobile banking.

- Video KYC for remote account opening.

- Services in banking for retail, corporate & NRI.

- Cards, loans and investments.

Pros:

- Account opening can be done over the internet.

- Good digital banking for India.

- Services for NRIs are good.

- Internet and mobile banking systems are good.

- Available in cities and villages.

Cons:

- Few branches overseas.

- Some online functions need Aadhaar or PAN documents.

- Expensive services can have high fees.

- Support can be inconsistent.

- More expensive services need higher balances.

6. HDFC Bank

HDFC Bank excels in customer service and digital banking in India. It has banking apps and online platforms that allow customers to do transactions, pay bills, and make investments. Customers can remotely open accounts with online KYC, and they can easily open and upgrade their accounts to savings or salaried accounts.

The bank’s services include UPI, cards, and investment services. Best Banks Offering Remote Account Opening: HDFC Bank is committed to the digital banking experience, allowing customers to do all banking safely and efficiently, including setting up accounts digitally.

HDFC Bank Features, Pros & Cons

Features:

- Retail banking services are all present.

- Platforms for banking are online and mobile.

- KYC online for remote account opening.

- Services include investments, loans & credit cards.

- Integration of UPI and Digital Payments:

Pros:

- Streamlined and quick digital onboarding

- Extensive and reliable customer reach in India

- Feature-rich digital banking application

- Comprehensive financial solutions

- Adequate service to customers in metropolitan regions

Cons:

- Presence is limited to India

- Premium accounts are subject to balance requirements

- Some services are branch-dependent

- Digital transactions may incur service charges

- NRI services are more limited in scope than ICICI and DBS

7. Axis Bank

Axis Bank also provides digital banking services for its customers, including apps and online banking. Customers can also do online KYC for paperless account opening. Customers can now open and upgrade their account types to savings accounts and also enroll for cards, all digitally.

Best Banks Offering Remote Account Opening: Both urban and rural customers benefit from Axis Bank’s account management services, making it highly rated for its online banking capabilities.

Axis Bank Features, Pros & Cons

Features:

- Retail, SME, and corporate banking services

- Digital app and net banking services

- e-KYC-based remote account opening

- Wealth and investment services

- Credit card and loan services

Pros:

- Online account opening is hassle-free

- Comprehensive services for both retail and corporate banking

- User-friendly mobile application

- Accessible for SMEs and small businesses

- Quick and easy digital onboarding

Cons:

- Global banks have more branches than Axis

- Some features of the app are laggy

- Premium accounts have minimum balance stipulations

- International transfer fees apply

- Multi-currency accounts are available in limited quantities

8. Kotak Mahindra Bank (811 Digital)

Kotak Mahindra Bank 811 Digital Bank became the first fully digital bank in India, allowing customers to open accounts instantly through mobile devices. Customers need only a mobile number, Aadhaar, or a PAN card, enabling them to open accounts without the need to go to a physical bank.

Users can perform online banking, money transfers, investments, and bill payments. With an emphasis on speed and convenience, Kotak 811 targets tech-focused customers who desire a completely digital banking experience.

Best Banks Offering Remote Account Opening: Thanks to its digital banking system, Kotak 811 is one of the best banks for fully remote and digital banking services.

Kotak Mahindra Bank (811 Digital) Features, Pros & Cons

Features:

- Digital banking service (811 Digital) that has no physical branches.

- Mobile app that allows for instant and remote account opening.

- KYC without paper using Aadhaar or PAN.

- Investment and payment (bills/ transfers).

- Integration with digital wallets and UPI.

Pros:

- Fully digital paperless account opening.

- User-friendly, fast, and convenient services.

- Perfect for digital natives.

- Less paperwork.

- Modern banking services available online.

Cons:

- Very few physical branches.

- Advanced services may need branch visits.

- Less diverse investment services than traditional banks.

- Banking services outside the country limited.

- Not ideal for people who want to bank in person.

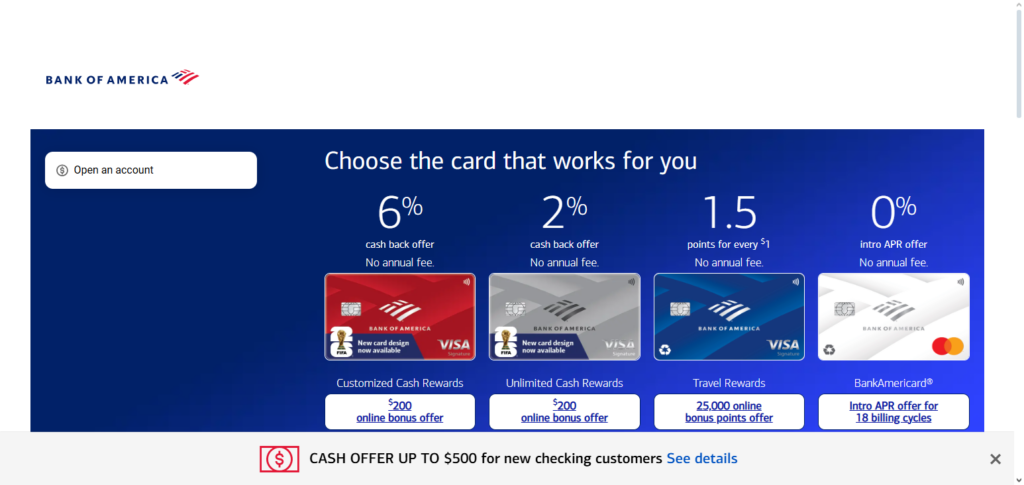

9. Bank of America

Bank of America is one of the largest banks in the United States. It provides a wide range of services, including consumer, corporate, and investment banking. Its online banking services offer customers account management, transfers, payments, and investments.

Customers can even bank remotely for some account types, as Bank of America allows account opening without a physical visit to the bank. Best Banks Offering Remote Account Opening: Bank of America is a leading bank for distance digital account opening, with a strong digital platform and wide coverage for remote banking services.

Bank of America Features, Pros & Cons

Features:

- Banking and online services available country wide in US.

- Account opening via digital banking for select accounts.

- Investment services, credit cards, and loans.

- Banking and investment services VIP.

- Mobile app and digital banking. Corporate banking and wealth services.

Pros:

- Banking system for the whole US is developed.

- Digital banking also developed.

- Banking services via newly developed secure system.

- Many services: digital banking, wealth management, credit services, etc.

- Digital services to all accounts.

Cons:

- Digital account opening is available only for some accounts.

- Some services are expensive.

- Offering of accounts outside country is limited.

- Some options of the app available only with branch banking.

- During busy hours, support is slow.

10. Chase Bank (JPMorgan)

Chase (JPMorgan Chase) is one of the largest banks in the US, providing retail, corporate, and investment banking services.

Through their mobile app and website, customers are able to handle their checking, savings, and investment accounts, as well as their credit cards. Customers (individuals and small businesses) are able to open accounts remotely, and Chase provides online identity verification and application submission.

Best Banks Offering Remote Account Opening: Because of the level of security and convenience Chase Bank provides, customers are able to open accounts and remote access banking services.

Chase Bank (JPMorgan) Features, Pros & Cons

Features:

- Retail, corporate, and investment banking.

- Opening of accounts remotely for individuals and small businesses.

- Mobile banking and Online banking.

- Investment, Loans, and Credit cards.

- Fraud protection and other security features.

Pros:

- Digital banking available for all US customers.

- Very diversified vertical banking.

- Mobile and online banking are reliable.

- Small business and personal banking are supported.

- Digital account management is secure.

Cons:

- Poor international banking.

- Some bank accounts require you to visit a branch.

- Extra expensive accounts and transactions.

- Premium accounts require you to have a large minimum balance.

- Features of the banking app are region dependent.

Conclusion

The option to open a bank account remotely has become crucial in selecting the best banking partner in today’s fast-paced digital environment. By providing safe, practical, and fully digital account opening services, banks including DBS Bank, HSBC, Citibank, Standard Chartered, ICICI Bank, HDFC Bank, Axis Bank, Kotak Mahindra Bank (811 Digital), Bank of America, and Chase Bank have raised the bar.

Customers can begin banking at any time and from any location thanks to these banks’ strong online platforms and easy KYC procedures. These banks are the future of adaptable, easily available, and effective banking services for people, companies, and clients around the world.

FAQ

What is remote account opening?

Remote account opening allows customers to create a bank account without visiting a physical branch. The process is completed online or via mobile apps using digital KYC verification.

Which banks offer the easiest remote account opening?

Banks like DBS Bank, Kotak Mahindra Bank (811 Digital), ICICI Bank, HDFC Bank, HSBC, Citibank, Standard Chartered, Axis Bank, Bank of America, and Chase Bank provide seamless remote account opening with minimal paperwork.

Is remote account opening secure?

Yes. These banks use secure encryption, identity verification, and digital KYC procedures to ensure your data and funds remain safe during the online account opening process.

Can NRIs or international clients open accounts remotely?

Yes, several banks, including HSBC, Citibank, Standard Chartered, and DBS Bank, support remote account opening for NRIs and international clients with proper documentation.

What documents are needed for remote account opening?

Typically, banks require a government-issued ID, proof of address, PAN or tax ID (for India), and sometimes a selfie or video verification to complete KYC digitally.