The Best Forex Brokers for Money Managers will be covered in this article, with an emphasis on regulated platforms that provide affordable trading fees, sophisticated multi-account tools, dependable execution, and expert assistance.

For professional and institutional-level money managers, these brokers are perfect for effectively managing client funds while guaranteeing transparency, risk management, and scalable trading conditions.

Why Use Forex Brokers for Money Managers

Tools for Managing Multiple Client Accounts: Money managers are able to handle several client accounts with ease because forex brokers provide tools like PAMM, MAM, or copy trading.

Regulations & Safety of Funds: Client fund safety, transparency, and compliance are guaranteed when top brokers are regulated by FCA, ASIC, and CySEC.

Cost of Trading: Brokers that cater to money managers offer lower commissions and tighter spreads which maximize profits when trading in larger amounts.

Execution that is Quick and Reliable: For professional trading and large volume strategies with deep liquidity and ECN, there is less slippage which is key.

Superior Platforms For Trading: More robust versions of trading platforms also offer advanced analytics and automation like MT4 and cTrader.

Support Services that are Professional: Complex trading activities are supported and high account managers prioritize resolving problems swiftly.

Flexibility and Scalability: Money managers can easily scale their strategies as their assets under management increase during their growth.

Reporting That is Clear: Managers can account for transparency and trust with clients because of detail in the reports during performance and fee analysis.

Why Forex Brokers for Money Managers Matter

Protecting Client Funds: Money managers are able to instill confidence and safeguard client trust when working with regulated forex brokers who ensure the protection and segregation of client funds.

Multi-Account Execution Made Easy: Money managers have the ability to seamlessly execute trades for several client accounts at once through PAMM and MAM solutions with specialized brokers.

Cost of Trading Is Reduced: An essential component for managing large volumes of trading is the importance of tight spreads and low commissions, therefore minimizing the overall costs.

Liquidity of an Institutional Grade: Execution quality and reduced slippage are created with the access to large liquid pools which is beneficial for strategies that are more professional.

Sophisticated Risk Management Tools: Risks with margin, stop-out, and real-time monitoring are the successfully managed areas with the help of professional brokers.

Credibility of the Regulation: Serious investors are attracted to money managers because of the improved professional reputation that comes with the use of well-regulated brokers.

Flexible Trading Infrastructure: The ability to not compromise performance while increasing the assets under management is what many managers need for growth, and these brokers provide that.

Accountability and Expectation Management: Accountability is maintained for money managers through adequate reporting and performance data, and this ensures the client’s expectations are met.

Key Point & Best Forex Brokers for Money Managers List

| Broker Name | Key Point |

|---|---|

| FXTM (ForexTime) | Strong regulatory oversight with flexible account types, offering competitive spreads and excellent educational resources for beginner and intermediate traders. |

| HotForex (HF Markets) | Multi-asset broker known for high leverage options, diverse account structures, and solid risk management tools suitable for global traders. |

| OANDA | Industry-trusted broker featuring transparent pricing, no minimum deposit, and advanced proprietary trading platforms with strong regulatory compliance. |

| Eightcap | ASIC-regulated broker offering tight spreads, fast execution, and seamless integration with MetaTrader platforms for active forex traders. |

| XM | Globally regulated broker providing zero-requote execution, extensive educational support, and flexible lot sizing for traders of all experience levels. |

| Exness | Known for ultra-fast withdrawals, deep liquidity, and transparent trading conditions with high leverage under selected regulatory entities. |

| Pepperstone | ECN-style broker delivering institutional-grade liquidity, low latency execution, and competitive spreads ideal for scalpers and algorithmic traders. |

| Tickmill | Cost-efficient broker with ultra-low commissions, fast execution speeds, and strong regulation, making it suitable for high-volume traders. |

| Fusion Markets | Offers some of the lowest trading costs in the industry with tight spreads, low commissions, and a simple, transparent pricing model. |

| BlackBull Markets | New Zealand-based broker providing ECN execution, deep liquidity access, and advanced trading tools for professional-level forex traders. |

1. FXTM (ForexTime)

FXTM (ForexTime) began its business in 2011 and within a short period of time, it became one of the well-known forex brokers in the world with its clients in every part of the world and is regulated with top-tier regulatory bodies like the UK’s FCA, Cyprus’ CySEC, and South Africa’s FSCA, offering forex brokers for money managers safety and compliance.

Along with offering multiple accounts with ECN and Standard accounts with flexible leverage and differing fee structures, the broker also provides competitive spread offerings. MetaTrader 4 and MetaTrader 5, and also provides educational resources and market analysis. Multilingual customer service is available, and it is responsive, offering help with emails, phone calls, and live chat.

FXTM (ForexTime) Features, Pros & Cons

Features

- Regulations by FCA, CySEC, FSCA

- Platforms MT4 and MT5

- Account options (Standard, ECN)

- Reasonable educational tools

- Adjustable leverage

Pros

- Excellent international regulation

- Good platform for novice and intermediate traders

- Variety of account options

- Great educational resources and market analysis

- ECN account fast order execution

Cons

- Fees can be country specific

- Advanced trading features are limited

- Not recommended for frequent trading

- Limited trading instruments

- Negative rollover policies on some accounts

2. HotForex (HF Markets)

HF Markets (Hotforex) began its operations in 2010 and with more than 10 years of experience, CySEC, FSCA, and CMA, along with several other authorities, offer regulation, providing one of the best forex brokers for money managers Along with a significant variety of trading instruments, they also offer multiple accounts along with MetaTrader 4 and MetaTrader 5.

Fees include low commission on some account types and spread costs, although this differs from region to region. Support is bolstered by account managers, and educational materials, as well as customer care via phone, email, and 24/7 live chat.

HotForex (HF markets) Features, Pros & Cons

Features

- Global multi-tiered regulation

- MT4 and MT5

- PAMM/MAM accounts

- Passive trading risk management features

- Support 24 hours 5 days a week

Pros

- Comprehensive coverage of market regulations

- Multiple account options

- Low average spreads

- Support channels for multiple accounts

- Exceptional broker support and service

Cons

- Average spreads are variable and can change

- No exclusive trading platform

- Limited tools to perform analysis and trade execution

- Not ideal for scalping strategies

- Account withdrawals may take time

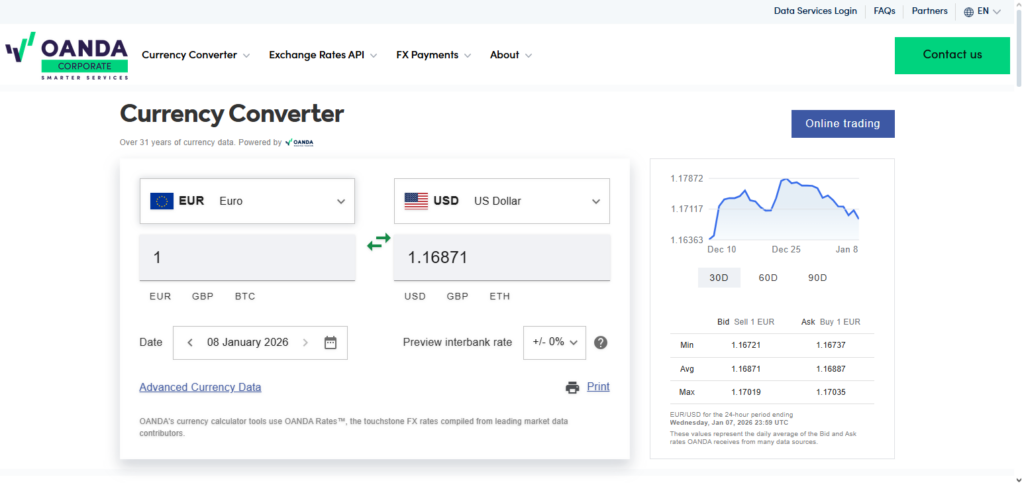

3. OANDA

With regulation from the U.S. CFTC and NFA, UK FCA, and Australia ASIC, among others, OANDA has been in operation since 1996 and is recognized for its compliance OANDA is among the Best forex brokers for Money Managers and is known for its compliance and the trust institutional OANDA offers its OANDA Trade platform and the MetaTrader 4 and TradingView integration at competitive rates, and there are no deposit/withdrawal charges for some regions.

There is a spread, some account types, and a commission, as well as redeposit/withdraw and a no- deposit/withdraw fee OANDA’s customer service, educational tools, and supportive market research are all well rated, as are OANDA’s many customer contact methods.

OANDA Features, Pros & Cons

Features

- FCA, CFTC/NFA, ASIC regulation

- Custom platform + MT4

- No hidden fees

- no minimum account balance requirement

- Available APIs

Pros

- Highly Trusted Regulation: OANDA has multiple top-tier regulators (e.g. FCA, CFTC, ASIC) which helps OANDA gain the trust of institutional clients.

- Transparent Pricing: Clients appreciate the compliance and trust with the transparent and fair pricing.

- Flexible Platform Integration: For advanced traders, OANDA offers MT4, an API, and their own platform.4. No Minimum Deposit: Simple onboarding process for newly established capital managers and smaller funds.

- Strong Research Tools: Helps in making decisions with daily analysis and economic data.

Cons

- Higher Spreads Sometimes: Increased costs during volatile sessions due to wider spreads.

- Limited Asset Range: Compared to some competitors, there is a smaller offering of exotic Forex pairs and CFDs.

- Commission Occasional: Applied in certain regions or account types.

- Complex API Learning Curve: Algorithmic trading requires excess technical knowledge.

- MT5 Availability: Restricted in several regions, limiting choice of platforms.

4. Eightcap

Globally, Eightcap has been active in the Forex, and CFD industries since 2009. As a broker, it is fully regulated by ASIC, and FCA, and is supported by other authorities in the field. For having a good regulatory structure, it is listed as a Forex Brokers for Money Managers, along with a good variety of assets.

Standard and Raw accounts offer competitive spreads (even Raw spreads can be 0.0 pips and have a commission) and trade on MetaTrader 4, MetaTrader 5, and TradingView.

Payments are clear and there are no hidden deposit or withdrawal fees, but account type determines spread variation. Customer support through live chat, phone, and email is multilingual and is accessible to traders who need flexible support and communication.

Eightcap Features, Pros & Cons

Features

- ASIC, FCA, CySEC Regulated

- MT4 & MT5 Supported

- Standard and Raw accounts

- Tight spread

- Free Withdrawals and Deposits

Pros

- Tight Raw Spreads: Unencumbered low spread environments perfect for scaling strategies.

- Strong Regulation: Professional credibility provided by ASIC, FCA, and CySEC.

- MetaTrader Support: Quick execution MT4 & MT5 facilitate efficient trading for money managers.

- Low Fees: Trading costs are easily the best in class which serves to maximize the returns for the clients.

- Multilingual Support:** Beneficial for clients and money managers with international operations.

Cons

- Limited Advanced Tools: Advanced analytics are more limited than what’s available on proprietary institutional grade platforms.

- Market Research: Compared to larger brokers, not as comprehensive.

- Customer Support Hours: Limited support hours in certain regions.

- Asset Variety: Less top tier range of financial instruments as compared to brokers in the top tier.

- No Proprietary App: Lacks bespoke tools for advanced portfolio managers.

5. XM

XM offers a very secure basis for operating with money managers. This is because covers regulations from ASIC, CySEC, and the IFSC. In addition, the company offers a very low starting minimum deposit of $5, with a variety of flexible spread options.

The customer service is responsive. They also do a good job of offering account managers, webinars, and live support in multiple languages. Overall, the breadth of support they offer, along with the access to MetaTrader 4/5 is a good offer for money managers in the foreign exchange markets.

XM Features, Pros & Cons

Features

- ASIC, CySEC, IFSC Regulated

- MT4 & MT5 supported

- Standard and Ultra Low accounts

- Webinars

- No min. deposit

Pros

- Regulated in Multiple Regions: Strong compliance due to ASIC, CySEC, and IFSC.

- Lowered Entry Barrier: No minimum deposit attracts new money managers.

- Account Choice: Different client needs are met by Standard and Ultra Low accounts.

- Webinars: Good for strategic refinement and professional skill advancement.

- No Hidden Costs: Client trust is reinforced by a straightforward fee structure.

Cons

- Wider Standard Spreads: Standard accounts can be unaffordable for frequent traders.

- No Advanced Proprietary Platform: MT4/MT5 is the only option.

- Less Institutional Characteristics: Does not have PAMM/MAM for multi-account management.

- Research is Quite Basic: Lacking in-depth analysis is less than what an institutional broker provides.

- Speed of Execution: Not as fast as true ECN brokers in times of high volatility.

6. Exness

Exness, like many of the best brokers for money managers, began operations in 2008. They are well known especially because of the praise they have gained due to the many layers of compliance they have (such as FCA UK and Cyprus Sec) along with the deep market liquidity and excellent competitive pricing.

They also have multiple account forms including standards, Raw spreads, and zero. This along with zero deposit and withdrawal fees and good service.

A myriad of customer service is accessible 24 hours a day, 7 days a week, in multiple languages, accompanied by detailed FAQs and various educational materials. Extensive support, high leverage, and flexible trading terms are key aspects that institutional and retail traders appreciate about Exness.

Exness Features, Pros & Cons

Features

- FCA and CySEC regulation

- MT4 & MT5

- Deep liquidity

- Ultra-fast withdrawals

- High leverage

Pros

- Good Pricing: Ultra-low spreads and clear fee schedules.

- Rapid Withdrawals: Quick payout processing is a plus for client satisfaction.

- High Leverage: With good risk management, traders can use varied strategies.

- Greater Depth of Liquidity: Professional traders can execute bigger orders without slippage.

- 24/7 Support: Excellent service is ideal for money managers across the globe.

Cons

- Limited Research Tools: Research capabilities not as deep as dedicated research platforms.

- Complicated Fee Table: Pricing structure can be confusing to newcomers.

- No Institutional-grade Platform: Only MT4/MT5 services available.

- Not Beginner Friendly: Focused on seasoned monetary managers.

- Region-filtered Features: Some features offerings are based on local regulations.

7. Pepperstone

Founded in 2010 in Australia, Pepperstone is known for being one of the best brokers for money managers. This is due to their institutional-grade execution and solid regulatory trust, as they are governed by the main regulators, such as ASIC, FCA, CySEC, and DFSA.

They offer MetaTrader 4, MetaTrader 5, cTrader, and TradingView platforms, where traders can easily receive spreads of 0.0 pips on the Razor accounts and low commissions.

They also have great customer service, with multilingual capabilities and educational materials for all execution award resources. Relatively to their competitors in the industry, they have low fees and high execution Pepperstone’s focus on high technology and low pricing is a huge attraction for professional and active traders.

Pepperstone Features, Pros & Cons

Features

- Regulated by ASIC, FCA, CySEC & DFSA

- MT4, MT5, cTrader

- ECN pricing

- VPS support

- Trading APIs

Pros

- Institutional-Grade Liquidity: Superb execution and very low latency.

- Multiple Platforms: Flexibility across MT4, MT5, and cTrader.

- Low Costs: Competitive commissions and tight spreads.

- VPS Support: Great for automated trading strategies.

- Regulated Globally: ASA, FCA, CySEC, and DFSA add professional credibility.

Cons

- Higher Costs for Small Accounts: Best suited for large volume trading.

- No Proprietary Platform: Only reliant on other services.

- Complicated Fee Structure: It can seem contrived on the surface.

- Less Local Support: Some areas they are limited.

- No Built-in Social Trading: Must use external services.

8. Tickmill

Tickmill was established in 2014 and is known to have the best compliances across the industry. Unlike most of the competition, they are in great standing with the best regulators worldwide, including FCA (UK), CySEC (EU), FSA (Seychelles), and FSCA (South Africa).

They are widely regarded as one of the best brokers for money managers due to their great spread and low rate offerings. They offer their traders the chance to use any of their MetaTrader 4, MetaTrader 5, and WebTrader platforms.

Tickmill’s fee structure is appealing to traders who are on a budget. Customers can reach support by phone, email, and live chat. Support is available in multiple languages, and account managers provide personalized support. They also appreciate Exinity’s execution and transparency.

Tickmill Features, Pros & Cons

Features

- FCA, CySEC, FSCA, FSA regulation

- MT4 & WebTrader

- Raw, Classic, Pro accounts

- Low commissions

- Fast execution

Pros

- Ultra-Low Trading Costs: Great for cost-efficient strategies.

- Strong Regulation: FCA, CySEC, FSA, and FSCA oversight.

- Speed of Execution: Particularly beneficial for scalping and other professional strategies.

- Account Type Clarity: Classic, Pro, and VIP have straightforward tiers.

- MT4 & WebTrader: Access and use without needing large software.

Cons

- Limited Range of Assets: A small range of options than bigger brokers offer.

- No MT5 Desktop Everywhere: Choices of platforms are different by location.

- Limited Research Functions: More than sufficient but not at the institutional level.

- No Proprietary Advanced Platform: Such as cTrader or anything like it.

- Basic Support: Not as comprehensive as larger international brokers

9. Fusion Markets

Fusion Markets is one of the Best Forex Brokers for Money Managers because of its ultra-low cost trading and tight spread trading. Fusion Markets was established in 2017 in Australia and is regulated by ASIC and VFSC (offshore).

MetaTrader 4, MetaTrader 5, cTrader, and TradingView are some of the platforms offered. There is a no minimum account deposit requirement and spread begin at 0.0 pips with some commission. They also provide 24/7 customer service and withdrawals are fast and free. High frequency traders and professionals are drawn to their low cost and fast execution .

Fusion Markets Features, Pros & Cons

Features

- Regulation by ASIC & VFSC

- Use of MT4, MT5 & cTrader

- Zero/Classic accounts

- Low commission structures

- Low spread offerings

Pros

- Very Low Cost: Spreads and commissions are very low which helps with the costs of active trading.

- MT4/MT5 & cTrader: More options for software with complex functions.

- ASIC Regulation: The compliance and support of money managers is fully covered.

- Free Withdrawals: Client operations have no extra costs.

- Fast Execution: It allows for fully professional and high frequency trading.

Cons

- Smaller Global Presence: Less global coverage compared to larger brokers.

- Limited Research Tools: There is very little available in the way of market studies.

- Limited Support Hours: Customer service is only available during a few hours.

- No Proprietary Tools: All platforms are 3rd party.

- No Institutional Features: Lack of features like PAMM/MAM.

10. BlackBull Markets

BlackBull Markets was founded in 2014 in New Zealand. He is regulated by the Financial Markets Authority (FMA) and the Financial Services Authority (FSA) in Seychelles. They are one of the Best Forex Brokers for Money Managers as he is known for providing ECN style trading and being able to trade with over 26,000 instruments which include forex, indices, stocks, and crypto.

Support is global and 24/7 across all platforms including MetaTrader 4 and 5, cTrader, TradingView, and their own proprietary software, BlackBull Trade. Spreads are low, beginning at 0.0 pips for ECN accounts, and BlackBull boasts prompt service, fast executions, and institutional liquidity.

BlackBull Markets Features, Pros & Cons

Features

- FMA & FSA regulations

- Integration of MT4, MT5, cTrader & TradingView

- ECN pricing

- Integration of advanced liquidity

- Advanced trading tools

Pros

- Institutional Liquidity: Deep ECN pricing with tighter spreads.

- Several Platform Options: Integration with MT4, MT5, cTrader, and TradingView.

- Fast Execution: Very low latency, ideal for professional trading.

- Global Regulation: Trust is added because of FMA and FSA oversight.

- Diverse Assets: Access to forex, indices, commodities, stocks, and crypto.

Cons

- Commissions Add Up: Cost for accounts with high turnover.

- Regional Restrictions: Not dispersed everywhere.

- Limited Research Suite: Not as extensive as bigger brokers.

- Support Hours Regional: Varying depending on location.

- Not Ideal for Beginners: More for seasoned money managers.

Conclusion

Choosing the Best Forex Brokers for Money Managers requires a careful balance of regulation, cost efficiency, advanced platforms, and reliable execution.

Strong regulatory coverage, clear fee structures, and professional-grade trading tools make brokers like FXTM, Pepperstone, Exness, OANDA, and Tickmill stand out.

Features like ECN pricing, quick withdrawals, PAMM/MAM support, and attentive customer service are essential for money managers managing numerous accounts or high volumes.

Long-term success is ensured by putting trust, technology, and scalability first, but the ideal broker ultimately depends on your strategy, clientele, and risk tolerance.

FAQ

What makes a broker suitable for money managers?

A broker suitable for money managers must offer strong regulation, transparent pricing, institutional-grade execution, multi-account management tools (like PAMM/MAM), deep liquidity, and responsive support. These features help protect client funds, streamline trade execution, and manage multiple portfolios efficiently.

Do money managers need special account types?

Yes. Money managers often require PAMM, MAM, or multi-account management platforms to oversee multiple client accounts under a single interface, execute bulk orders, and allocate profits or losses fairly.

Why is regulation important for money managers?

Regulation ensures client protection, segregation of funds, reporting standards, and financial transparency. Brokers regulated by authorities like FCA, ASIC, CySEC, and NFA are considered more reliable by institutional traders and professional money managers.

Are spreads and fees important for money managers?

Absolutely. Tight spreads and low commissions reduce trading costs, especially for high-frequency or high-volume strategies. Brokers such as Pepperstone, Exness, and Tickmill are known for competitive pricing that supports professional trading.

Which platforms are best for money managers?

MetaTrader 4, MetaTrader 5, cTrader, and proprietary platforms with multi-account features are ideal. These platforms provide advanced analytics, custom indicators, automation options, and efficient order handling suitable for institutional workflows.