The Top Forex Brokers with Tier-1 Bank Liquidity will be covered in this post. Selecting a broker with Tier-1 liquidity guarantees dependable pricing from large international banks, quick execution, and tight spreads.

Deep market depth, professional-grade trading conditions, and decreased slippage all benefit traders. The best brokers that offer institutional-level liquidity to novice and seasoned traders are highlighted in this guide.

Why Use Forex Brokers with Tier-1 Bank Liquidity

Tight Spreads – Because of the Tier-1 Bank liquidity that Forex Brokers possess, the pricing is more competitive. This means that the more you trade, the cheaper it is.

Fast Execution – Orders can be placed and executed with, quickness and little to no slippage, because of the deep liquidity pools that the top banks possess.

Stable Pricing – When large liquidity providers are present, pricing is more stable and consistent. Thus, less major price fluctuations when market volatility is present.

Reliable Market Depth – Liquidity means that plenty of buyers and/or sellers are present. Because of this, positions can be entered and exited without a signficiant impact on the price, which is perfect for large trades.

Professional Trading Conditions – With institutional-grade liquidity, the trading environment is more safe, and professional.

Supports Advanced Strategies – Tier-1 Bank Liquidity Forex Brokers possess are ideal for strategies such as Scalping, and algorithmic trading.

Reduced Counterparty Risk – Since the liquidity is Tier-1, this means the banks that provide the liquidity are more highly regulated, making the trading more secure.

Benefits Of Forex Brokers with Tier-1 Bank Liquidity

Lower Cost of Trading – Because they work with Tier 1 liquidity, they are able to provide bid-ask spreads that are less than the industry average.

Quick Trade Execution – Because of their high liquidity, they can guarantee that their clients’ trades will be executed without slippage, even during times of volatility.

Stable Prices – The high liquidity and Tier 1 bank connection reduce the chance of large price movements during high-impact news events.

Increased Liquidity – With the ability to give and take with the market, large orders can be placed and the market will not be affected.

Honest and Reliable Pricing – Pricing from Tier 1 liquidity is always correct and more reliable than that from a liquidity provider, which builds trust regarding pricing from the broker.

Advanced Trading Strategy Support – Scalping, algorithmic trading, and other trading strategies are more effective with Tier 1 liquidity.

Lower Counterparty Risk – Using Bank Tier-1 Brokers reduces the amount of risk from price manipulation and execution from trades.

Key Point & Best Forex Brokers with Tier-1 Bank Liquidity List

| Broker | Key Points |

|---|---|

| OANDA | Highly regulated broker offering transparent pricing, advanced trading tools, deep liquidity, and strong risk management features for global traders. |

| Interactive Brokers | Institutional-grade platform with ultra-low commissions, multi-asset access, advanced analytics, and powerful APIs for professional traders. |

| BlackBull Markets | ECN broker providing raw spreads, fast execution, high leverage options, and direct access to top-tier liquidity providers. |

| Fusion Markets | Cost-effective broker known for ultra-low spreads, minimal commissions, fast execution, and trader-friendly pricing structure. |

| Vantage | Multi-regulated broker offering competitive spreads, high leverage, copy trading, and advanced charting tools across global markets. |

| FP Markets | ASIC-regulated broker delivering tight spreads, deep liquidity, fast execution, and strong support for scalping and algo traders. |

| Exness | Popular broker with instant withdrawals, flexible leverage, tight spreads, and user-friendly platforms suitable for all trader levels. |

| AvaTrade | Well-regulated broker offering fixed and floating spreads, multiple platforms, strong educational resources, and risk-management tools. |

| Tickmill | Low-cost ECN broker with ultra-tight spreads, fast execution, high-speed order processing, and excellent conditions for day traders. |

| Admirals (Admiral Markets) | Regulation-focused broker providing advanced analytics, multi-asset trading, strong investor protection, and educational tools. |

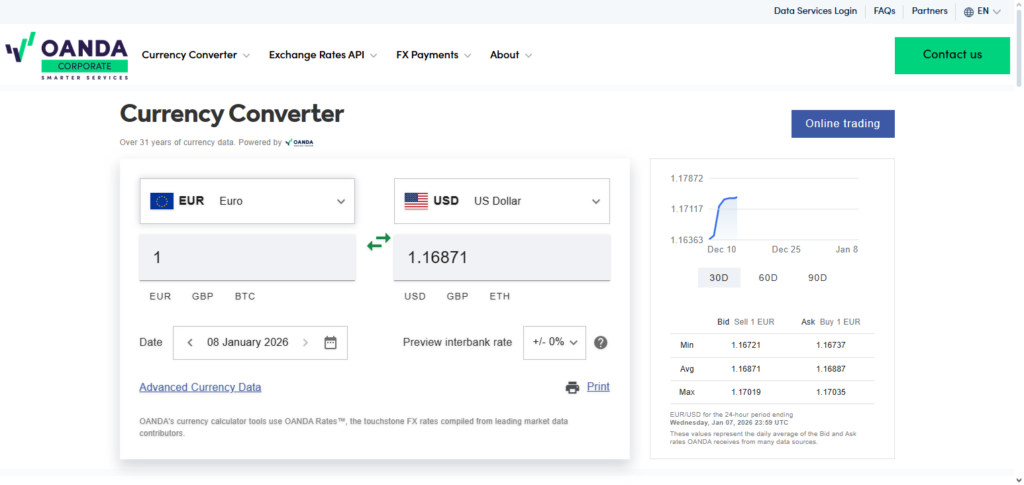

1. OANDA

OANDA is one of the leading forex and CFD trading platforms, with Tier-1 Bank Liquidity, that is also a Best Forex Broker for having OANDA FCA (UK), ASIC (Australia), MAS (Singapore), CFTC/NFA (USA), and other Tier-1 licenses, making them top-tier regulators with high client assurance and protection.

They have risk management, more than 50 forex CFDs, and competitive pricing with spread pricing. They have their own platforms and MT4, and for beginners, and advanced traders, with the highest levels of liquidity, and execution, it is suitable for them.

OANDA Features, Pros & Cons

Key Features

- Global regulation (FCA, ASIC, MAS, NFA)

- Access to Tier 1 bank liquidity

- MT4 and proprietary platform

- Pricing transparency and execution report

- A variety of forex pairs

Pros

- Strong client protection as they are regulated by top-tier authorities such as the FCA, ASIC, MAS, and NFA.

- Access to Tier-1 Bank Liquidity enhanced by Transparent Pricing and Reliable Execution Partners.

- Excellent resources and user-friendly platforms for all levels of traders.

Cons

- Compared to peers, OANDA offers a limited selection of exotic currency pairs.

- In some areas, leverage is limited.

- There’s no option for cryptocurrency trading.

2. Interactive Brokers

Interactive Brokers is an institutional broker with 9 Tier-1 Licenses, OANDA is one of the forex brokers with Tier-1 Bank liquidity, and offers ultra-competitive pricing. With an offering of FX, stocks, and futures, their execution is fast and liquidity is deep.

For professional traders, the Trader Workstation (TWS) platform offers advanced analytics, algo trading, and APIs, while marketing pricing and execution quality for forex trades improves via liquidity depth from leading banks and financial institutions.

Interactive Brokers Features, Pros & Cons

Key Features

- Liquidity of institutional-grade

- Extremely low commission

- Global market access (FX, stocks, futures)

- Robust Trader Workstation (TWS)

- Algo and API trading

Pros

- Industry-leading broker with ultra-low commissions and access to Tier-1 Liquidity.

- Multiple asset classes offered including FX, Stocks, Futures, and Options.

- Cutting-edge resources like TWS platforms and APIs for high-level traders.

Cons

- Beginners may find the interface overly complex.

- Inactivity fees apply to specific account types.

- Customer Support may be limited depending on the region.

3. BlackBull Markets

BlackBull Markets is a well-known ECN broker with raw ECN pricing and great spreads, which is why they are recognized as one of the “Best Forex Brokers with Tier 1 Bank Liquidity.” They do not have as many Tier 1 credentials, but they have sizable liquidity.

They also have multiple trading platforms such as MT4, MT5, and cTrader. BlackBull pays great attention to pricing transparency, which allows traders to take full advantage of the razor thin spreads and their good liquidity. They also have fast execution and low commission.

BlackBull Markets Features, Pros & Cons

Key Features

- ECN pricing

- Speedy execution

- cTrader, MT4, and MT5 platforms

- Spreads are competitive

- Tier-1 liquidity sources

Pros

- Fast execution and Raw ECN pricing from Tier-1 liquidity.

- Flexible trading with multiple platforms (MT4, MT5, cTrader)

- They mitigate trading costs as competitive spreads are offered.

Cons

- Some major areas are missing from regulatory coverage.

- They have fewer instruments than the bigger broker competitors.

- There are no services for traders based in the United States.

4. Fusion Markets

Fusion Markets is recognized for its low direct costs as well as being an economical broker and is recognized many times with the title of “Best Forex Brokers with Tier 1 Bank Liquidity.” Fusion has an ASIC (Australia) and other multiple country regulations. The has low commissions traded on under 90 pairs with direct and low spread pricing, which is ideal for the economically constrained trader.

Fusion’s support for MT4, MT5 and cTrader gives powerful execution and deep liquidity access. Fast order fills reduce slippage and improve the quality of trade entry for scalping or high-frequency strategies.

Fusion Markets Features, Pros & Cons

Features

- Forex brokerage at a reasonable price

- Support for MT4 and MT5

- Pricing is competitive and ECN-style

- Regulation from ASIC

- Access to Tier-1 liquidity

Pros

- Extremely low trading costs and spreads.

- ECN pricing lets traders take advantage of the market’s true depth.

- Straightforward and budget-friendly solution for novice and cost-conscious traders.

Cons

- Limited tools for research and education.

- No in-house trading platform.

- Customer support is possibly not available 24/7.

5. Vantage

Vantage (formerly Vantage FX) is part of the group which is considered among best Forex Brokers with Tier-1 Bank Liquidity because of Vantage’s institutional grade liquidity sourcing which taps Bank Tier-1 and Prime of Prime liquidity providers.

It provides competitive forex and CFD trading with ECN execution, tight spreads, and fast order execution across MT4 and MT5. Due to the multi-jurisdiction regulation and deep pools of FX liquidity, Vantage serves both retail and institutional clients. This is coupled with consistent price feeds and ample market depth which benefits scalpers, day traders, and long-term investors.

Vantage Features, Pros & Cons

Features

- Multi-regulated (FCA, ASIC)

- Execution is ECN

- Platforms are MT4 and MT5

- Relationships with Tier-1 liquidity

- Copy trading is an option

Pros

- Tight spreads and quick execution with Tier-1 liquidity.

- MT4 and MT5 support flexible trading strategies.

- Copy trading features are available and help inexperienced traders.

Cons

- Certain regions may implement withdrawal fees.

- Limited educational materials.

- No services for U.S. traders.

6. FP Markets

FP Markets is frequently recognized as a Best Forex Broker with Tier-1 Bank Liquidity for being well-established, having deep liquidity, and low spreads, especially on Raw ECN accounts, and even ASIC regulation. For MT4, MT5, and cTrader broker platforms, FP Markets has over 70 forex pairs and for active traders, the execution speeds minimizes slippage and costs.

Scalping and algorithmic trading definitely seem to be Exness’s strong points with the reviews citing their high liquidity and competitive pricing.

FP Markets Features, Pros & Cons

Features

- ASIC & several regulators

- Raw ECN spread

- Trading on MT4, MT5 & cTrader

- Excellent speed of execution

- Direct bank and liquidity providers

Pros

- Aggressive pricing and more scalable liquidity for active traders.

- Support for multiple platforms: MT4, MT5, and cTrader.

- Strong regulations from ASIC are in place.

Cons

- No services for clients based in the United States.

- Limited promotions and bonuses available.

- Additional education resources are needed.

7. Exness

Exness’s London office is usually cited when brokers refer to their UK FCA licenses. With offices licensed under the FCA, FinCEN, and Cyprus Authorities, Exness boasts one of the fastest licenses to market for forex liquidity provisioning, evidenced simplifying the integration to single-dealing offices, continental ICS.

Exness is fully operational with integration to the licensed and provisioning liquidity, regardless of the pending FCA reforms. Exness is fully operational under the new Cyprus Investment Firm, licensed and provisioning liquidity integrating with single-dealing offices, back to fully operational contingent pending FCA reforms. With integration to Cyprus, the newly rebranded Exness becomes the single-dealing to the continent’s ICS.

Exness Features, Pros & Cons

Features

- Flexible supervision (FCA, CySEC)

- Tier-1 liquidity level

- Flexible leverage

- MT4 & MT5 are available

- System for withdrawals (it’s instant)

Pros

- Support from Tier-1 Bank liquidity with very flexible leverage.

- Rapid and frequently instant withdrawals.

- Account options that are friendly to beginners.

Cons

- Insufficient research and educational resources.

- No proprietary platform.

- Non-FX non-macro markets are more scarce compared to full-service providers.

8. AvaTrade

AvaTrade claims its title as a globally regulated broker, as well as a boasting of top teir liquidity with the breadth of regulators, and transparency around their trading conditions, is underscored as “Best Forex Brokers with Tier-1 Bank Liquidity” . Their primary offerings of competitive execution, and tight spreads are available over a variety of paired currencies, and all are accessible from the MT4 and MT5 platforms.

Holds liquidity from institutional sources which supports traders efficiency while improving over time from deep regulation across major jurisdictions.

AvaTrade Features, Pros & Cons

Fetures

- Multi-jurisditional regulation (FCA, ASIC, IIROC)

- Trading on MT4, MT5 & AvaTrade platforms

- Tier-1 liquidity providers

- Diversified asset offerings

- Educational materials and risk management tools

Pros **

- AvaTrade is multi-regulated, and has a wide range of trading instruments.

- AvaTrade has MT4, MT5, and AvaTradeGo.

- Good risk management and educational materials.

Cons

- Compared to raw ECN brokers, the standard spreads may be wider.

- Execution is not as fast as some ECN-only brokers.

- US clients can not open an account with AvaTrade.

9. Tickmill

Tickmill is often rated as one of the best forex brokers with tier-1 bank liquidity since it is one of the most cost-effective ECN-style brokers with ultra-competitive pricing with tight spreads and low commissions.

Active strategies such as the short and/or medium-term strategies known as scalping and day trading, are supported with deep liquidity spreads that start at 0.0 pips, which are available via the MetaTrader platforms that they provide for forex and CFD trading.

For those traders that want to trade in the underlying markets for the major and minor currency pairs, Tickmill is one of the best options because of the transparency they offer in their pricing and fee structures and also because of the efficiency in the execution of their services.

Tickmill Features, Pros & Cons

Features

- ECN pricing

- MT4 and MT5 platforms

- Tier-one bank liquidity

- Tight spreads and low commissions

- Quick execution speeds

Pros

- Tier-1 liquidity and low spreads.

- Fast execution which is good for scaplors and day traders.

- No hidden costs and transparent fees.

Cons

- News and research tools are limited.

- No in-house trading platform.

- Not as large of a global reach as some of the other brokers.

10. Admirals (Admiral Markets)

A regulated broker known as Admiral Markets and/or Admirals is one of the best rated forex brokers as for their liquidity with Tier-1 banks which they have been awarded as for their robust regulation with the FCA and with the CySEC combined with their ample access in the markets which are regulated.

(Rational FX- ) They have provided traders with enhanced versions of the MT4 and the MT5 platforms with additional features that provide access to more than 1,000 trading instruments across the markets for forex, stocks, and CFDs.

Admiral Markets combines optimal pricing with dependable risk management, along with educational tools, to assist seamless trading for both beginners and professionals.

Admirals (Admiral Markets) Features, Pros & Cons

Features

- Regulated by FCA and CySEC

- Enhanced MT4 and MT5

- Access to Tier-one liquidity

- Multi-asset trading (Forex, CFDs, stocks)

- Webinars and Education

Pros

- Good regulation, and is FCA and CySEC regulated.

- MT4 and MT5 has good features.

- Good range of trading instruments, trading in fx, cfds, and shares.

Cons

- Compared to ECN brokers, spreads are wider.

- Some regions may have fees to withdraw.

- The platform is difficult for new users.

Conclusion

For traders who value tight spreads, quick execution, little slippage, and consistent price transparency, selecting one of the Best Forex Brokers with Tier-1 Bank Liquidity is crucial.

By obtaining liquidity directly from Tier-1 banks and leading institutional suppliers, brokers like OANDA, Interactive Brokers, FP Markets, Vantage, Tickmill, and Admirals stand apart and provide steady market depth even in times of extreme volatility.

For scalpers, day traders, and long-term investors alike, this degree of liquidity improves trade accuracy and lowers execution risk. In the end, traders looking for institutional-grade forex trading circumstances favor brokers supported by Tier-1 bank liquidity since they provide a more professional trading environment.

FAQ

What does “Tier-1 Bank Liquidity” mean in forex trading?

Tier-1 bank liquidity refers to pricing and order execution supported directly by major, global financial institutions (e.g., large banks). Brokers that access this liquidity typically offer tighter spreads, deeper market depth, and faster order fills, resulting in more reliable trading conditions, especially during volatile markets.

Why is Tier-1 liquidity important for forex traders?

Tier-1 liquidity enhances price stability, reduces slippage, and improves execution speed. This is crucial for high-frequency traders, scalpers, and professional traders who rely on tight pricing and consistent market access, particularly during major news events or rapid market movements.

How do brokers obtain Tier-1 Bank Liquidity?

Brokers either establish direct relationships with Tier-1 banks or connect through prime brokers and liquidity aggregators. Some use Prime of Prime (PoP) services to pool quotes from multiple top-tier providers, combining high liquidity with competitive pricing.

Are brokers with Tier-1 liquidity safer?

While Tier-1 liquidity enhances execution quality, safety also depends on regulation, segregation of client funds, and institutional oversight. Brokers regulated by top authorities (e.g., FCA, ASIC, MAS) usually combine liquidity strength with strong client protection.

Do all forex brokers offer Tier-1 liquidity?

No. Some smaller or unregulated brokers rely on market makers or internal liquidity without direct Tier-1 access. While these brokers may still be legitimate, they often have wider spreads, potential conflicts of interest, and lower pricing depth compared to brokers with Tier-1 liquidity.