In this post we will Discuss the SpectroCoin Card Alternatives is a well-liked choice for spending digital assets in today’s rapidly expanding cryptocurrency ecosystem, but a number of substitutes now provide improved features, better rewards, and more flexibility.

These cards offer useful options for regular cryptocurrency use, from cashback schemes and multi-crypto support to non-custodial security and worldwide acceptance.

Users can choose a card that best suits their financial lifestyle, minimize costs, and optimize advantages by investigating the best options.

What is the SpectroCoin Card?

Cryptocurrencies can be spent anywhere that accepts Visa using SpectroCoin Card, a prepaid card that is linked to users’ crypto accounts. The card enables users to spend Bitcoin, Ethereum, and other supported stablecoins as they spend and allows them to spend and make crypto conversions to fiat at the point of sale.

Users can manage SpectroCoin Card funds using the SpectroCoin wallet, and can top the card up with crypto. The card enables users to spend globally and to withdraw cash from any supported ATM, making it a solid crypto card to use in day-to-day life.

Key Point

| Card Name | Key Point / Feature |

|---|---|

| Nexo Card | Hybrid crypto card: spend crypto or borrow against holdings, earn up to 2% cashback in crypto. |

| Coinbase Card | Visa debit card linked to Coinbase wallet; earn crypto rewards on purchases; widely accepted. |

| Bybit Card | Crypto debit card with high cashback rewards; supports multiple cryptocurrencies; global use. |

| Wirex Card | Visa/Mastercard card; supports 20+ fiat & crypto; up to 8% cashback; multi-currency spending. |

| Cypher Card | Non-custodial Visa card; supports 1000+ tokens; full control until conversion at checkout. |

| MetaMask Card | Mastercard debit card linked to MetaMask wallet; spend stablecoins and tokens globally. |

| KAST Card | Multi-chain card; low conversion fees; staking rewards; standard to premium tiers available. |

| Gnosis Pay Card | Self-custodial Visa card; zero FX fees; rewards; ideal for DeFi users wanting full control. |

| SORA Card | Crypto debit card integrated with wallet and DEX; secure, private, and flexible spending. |

| Crypto.com Card | Prepaid Visa card; tiered rewards up to 10% CRO cashback; subscription perks; global acceptance. |

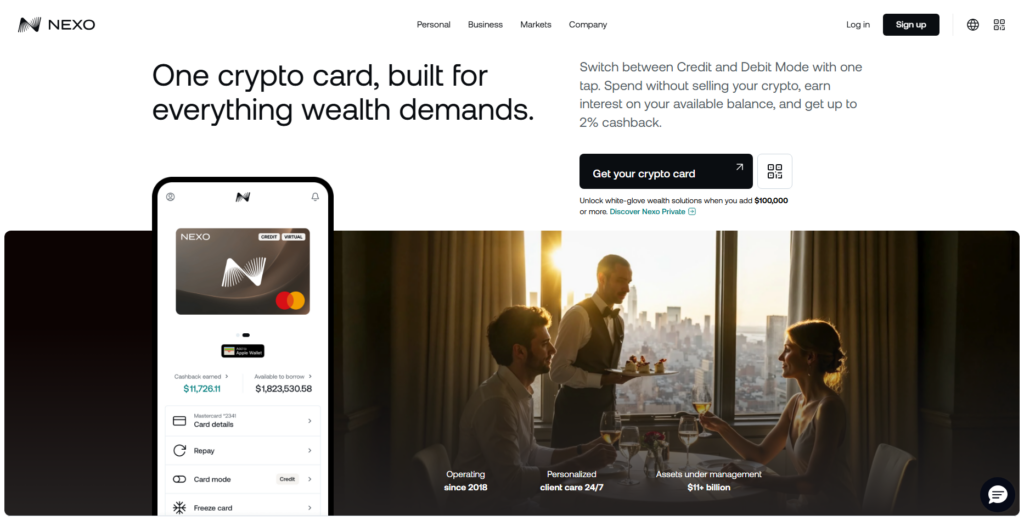

1) Nexo Card — SpectroCoin Card Alternative

Nexo Card has both credit and debit card options. You can use the card to purchase items using crypto, and you can also borrow money against your cryptocurrencies.

You are able to put money on the card using cryptocurrencies, and in Credit Mode, you are allowed to borrow a certain amount of money based on your crypto currency collateral.

You can then spend your money with the card and earn rewards of about 2% in Nexo tokens and 0.5% in Bitcoin based on your loyalty. The card is supported by the major cryptocurrencies.

Nexo Card Features

- Combining the debit and credit card feature, you can either spend or borrow.

- Receive crypto cashback rewards for each purchase.

- Major crypto support (BTC, ETH, and stablecoins).

- No debit mode monthly fees.

- Free ATM withdrawal (within a monthly limit).

Nexo Card Pros & Cons

Pros:

- Functions as a credit card and a debit card.

- Crypto cashback that does not require you to sell your coins.

- Crypto borrowing service available.

- Crypto support for BTC and ETH, as well as stablecoins.

- Manage card through mobile app.

Cons:

- Credit mode interest will accrue if payment is missed.

- Monthly limits apply for ATM cash withdrawal.

- Nexo token is the main contributor to your cashback, and its value changes frequently.

- Not all regions offer this card.

- The card might have a short-term conversion fee when you buy currency.

2) Coinbase Card — SpectroCoin Card Alternative

You can use the Coinbase Card, a debit card that is connected directly to the Coinbase account, to spend money directly on your cryptocurrencies. You don’t pay any annual fees, but there is a crypto-to-fiat and a currency exchange fee in addition to the Coinbase fees.

These fees can reduce the amount of money that you earn on the card rewards. You can also spend the card to withdraw money in Bitcoin, Ethereum, Bitcoin Cash, and other Coinbase supported cryptocurrencies.

Users can receive up to ~4% cashback in any cryptocurrency of their choosing for everyday purchases, and spending is done automatically by converting assets during checkout. There is regional variation in limits and spreads, and Coinbase integration is helpful for current customers.

Coinbase Card Features

- Access to instant crypto from a Coinbase wallet linked to the card.

- Major crypto support: BTC, ETH, and USDC.

- Everyday purchases receive crypto rewards.

- Virtual card and plastic card are both available.

- Auto-transfers from crypto to fiat (supports most countries).

Coinbase Card Pros & Cons

Pros:

- Card easily connects with the Coinbase exchange.

- Winning crypto rewards in a variety of coins.

- There is no yearly membership.

- Customers can receive a virtual card immediately.

- Cards are accepted in most countries.

Cons:

- There are fees for converting crypto to cash.

- Customers earn a lower cash back percentage than that of other cards.

- Supports only a few niche tokens.

- Not all countries can use this card.

- There are no additional perks like a higher cash back for premium card holders.

3) Bybit Card — SpectroCoin Card Alternative

The Bybit Card is a debit card that is linked to a Mastercard and is geared towards Bybit exchange users. Accepted cryptocurrencies include BTC, ETH, USDT, USDC, and XRP, and crypto is automatically converted at checkout.

There is no annual fee for most countries, and cashback rewards are tiered at up to ~10% for most customers depending on their VIP status and applicable promos.

Transaction fees are low (including for FX, conversion, and ATM withdrawals). It is well-suited for traders for whom crypto spending is a seamless option, given the high degree of integration with Bybit trading accounts.

Bybit Card Features

- Linked to a Bybit Mastercard crypto debit card.

- Major crypto support: BTC, ETH, USDT, USDC, and XRP.

- 10% cashback rewards on select tiers.

- Low fees to access ATMs.

- Sell & buy from Bybit through the card.

Bybit Card Pros & Cons

Pros:

- Cash back levels are high, 10%.

- There are no problems with accessing ByBit trading platforms.

- Supports major crypto coins.* Annual fee waived in most areas.

- Accessible ATMs.

Cons:

- ATM fee schedules apply.

- Higher tiers or trading may unlock cashback and rewards.

- Foreign exchange and conversion fees apply.

- More appropriate for committed users within the Bybit ecosystem.

- Physical cards may take a while to be delivered in certain areas.

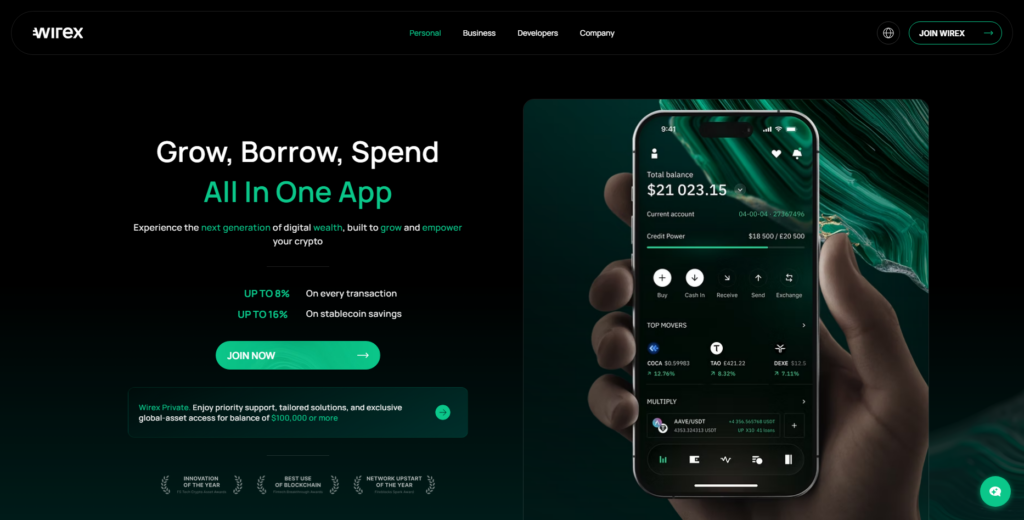

4) Wirex Card — SpectroCoin Card Alternative

The Wirex Card allows users to spend in crypto or fiat and real-time conversion is available at the point of sale. Wirex supports the spending of 20+ different fiat and crypto currencies and offers cryptoback rewards which can total ~8% on their token, WXT (Wirex’s native token). Although, in most case, total rewards are less than this.

There are no annual fees, but top-up and FX fees can vary based on location. Wirex also offers passive yield on select crypto balances and Apple/Google Pay. It’s accepted globally wherever Visa/Mastercard are accepted.

Wirex Card Features

- Multiple fiat wallets & 20+ crypto wallets.

- 8% cashback rewards on the WXT card.

- Supports both Apple Pay & Google Pay.

- At checkout, instant crypto to fiat conversion.

- With a single card, you can manage several different currencies.

Wirex Card Pros & Cons

Pros:

- Support for multiple currencies (crypto + fiat).

- 8% cashback in WXT token.

- Accepted worldwide.

- Compatible with Apple/Google Pay.

- Yield earning on some crypto holdings.

Cons:

- Rewards in crypto available when the price of the native token is high.

- After a monthly limit, ATM fees apply.

- Effective cashback may be decreased with an FX spread.

- Limited support in some countries.

- The app can behave weirdly, especially after an update.

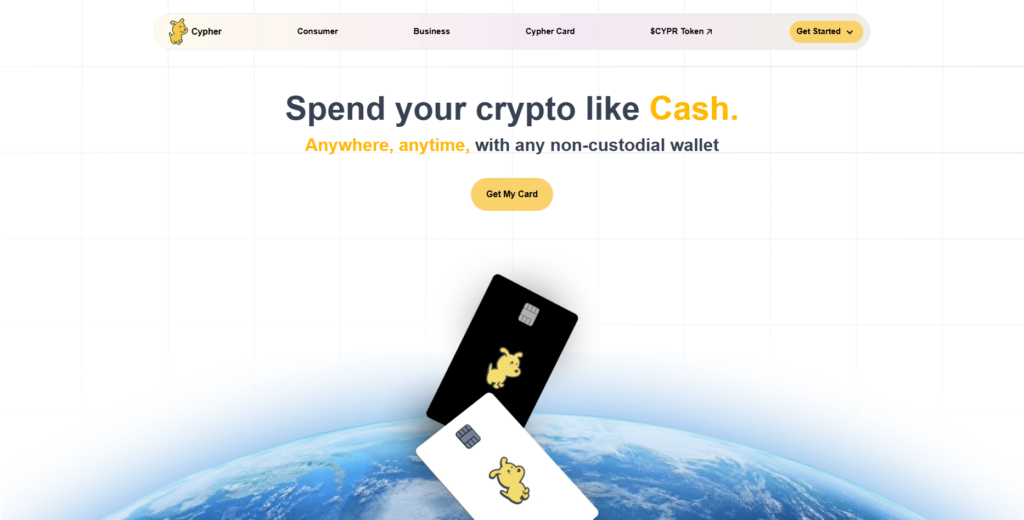

5) Cypher Card — SpectroCoin Card Alternative

Cypher Card is a non-custodial Visa prepaid crypto card that enables spending on over a million merchants. It’s a non-custodial crypto card that supports 500+ crypto assets across various blockchains.

Users retain control of their assets until conversion at the point of sale. Customers also receive a CYPR token and additional merchant rewards. There is usually a nominal top-up fee (~0.5–1%) when crypto is uploaded to the card and a forex markup fee (~1.75% standard).

Premium plans are available to reduce some of the fees. This card is primarily designed for advanced users due to the amount of flexibility it provides and extensive token support.

Cypher Card Features

- Non-custodial cards featuring over 500 currencies on different chains.

- Control of assets is retained by users until they execute a spend.

- CYPR-linked cards come with rewards.

- Benefits are enhanced and fees are reduced under premium plans.

- Both physical and virtual cards are options.

Cypher Card Pros & Cons

Pros:

- 500+ tokens on multiple chains.

- Non-custodial: users maintain control until they spend.

- CYPR tokens for the rewards program.

- Reduced fees in premium plans.

- Options for both virtual and plastic cards.

Cons:

- Fees for topping up (~0.5-1%).

- Foreign exchange fees (~1.75%).

- Rewards are often based on market volatility.

- Not suitable for beginners. Set up in an advanced manner.

- Certain blockchains may lack support.

6) MetaMask Card — SpectroCoin Card Alternative

With the MetaMask Card, users can link their MetaMask wallet and spend crypto directly from their wallet using Layer 2 solutions like Linea, Solana, and Base. Supported crypto assets include USDC, USDT, wETH, EURe, and others.

There are no annual fees for the virtual card (metal card available for subscription), and it provides 1–3% cashback (1% for virtual, up to 3% for metal) in mUSD or other tokens along with MetaMask Rewards points.

ATM and cross-border fees may apply depending on the tier. There is self-custody, and full control is given until payment.

MetaMask Card Features

- Linked to self-custody MetaMask wallet.

- Holders may use various networks and tokens such as USDC and wETH.

- Cash back rewards on virtual and metal cards.

- Buy with instant fiat conversion.

- Card tier determines spend limit.

MetaMask Card Pros & Cons

Pros:

- Linked to self-custody wallet, complete fund control

- Cashback on virtual + metal cards

- Multi chain support

- Instant fiat conversions on crypto

- Spend limits vary by tier

Cons:

- Fees on card, global ATMs, & cross border payments

- Metal card needs a plan

- Not for beginners, wallet must be setup

- Rewards Range is limited outside metal card

- Limited availability for physical cards in some areas

7) KAST Card — SpectroCoin Card Alternative

The KAST Card is a multi-chain crypto card that specializes in stablecoins like USDC, USDT, and USDe, enabling users to spend cross-chain without a bank account.

It has staking features and may offer high rewards especially with SOL staking and other perks, though some tiers can have annual fees that differ.

There are ATM fees and foreign exchange fees for cross-border spending. KAST is designed for high-volume and DeFi-oriented users with Apple/Google Pay integration, high spending limits, and frequently enabling crypto payments.

KAST Card Features

- Support of multi-chain for stablecoins and main tokens.

- Incentives are tiered over staking rewards.

- Generous monthly limits for spending.

- Compatibility with Apple Pay and Google Pay.

- Considerate of privacy and with security present.

KAST Card Pros & Cons

Pros:

- App support for various crypto assets

- Tiers for Staking rewards & additional bonuses

- Spend cap is high

- Apple/Google Pay compatibility

- Focused on user`s privacy

Cons:

- Plan dependent annual fees

- fees for ATMs & foreign exchanges

- Staking levels control Cashback rewards

- Limited presence

- May have a steep learning curve for those new

8) Gnosis Pay Card — SpectroCoin Card Alternative

The Gnosis Pay Card is a self-sovereign crypto card linked to a Gnosis Safe wallet. This means you have complete control over your assets until you choose to make a payment.

Ideal for users who care about decentralization and privacy, transaction fees vary by supporting token and wallet holdings, with cash back and rewards changing based on governance and token holdings (e.g., GNO).

Uplimits on spending and ATMs and card fees are adjusted based on network status and Safe settings, minimal card fees exist. This card fits Web3 users who want to keep full custody until convert.

Gnosis Pay Card Features

- Gnosis Safe wallet linked to self-custodial Visa card.

- Complete control of crypto before a payment.

- Fewer card fees and more adjustable limits.

- Wallet tokens support.

- Visa network supports worldwide merchants.

Gnosis Pay Card Pros & Cons

Pros:

- Self-custodial means full crypto control

- Low card fee

- Gnosis Safe wallet integration is secure

- Spend limits are adjustable

- Validity anywhere Visa is accepted

Cons:

- Not beginner friendly, must know wallet web

- Rewards are tiered by token quantity

- Fees for conversions & ATMs may be applied

- Mobile app is less robust than competitors

- In some areas, the issuance of physical cards may be delayed.

9) SORA Card and SpectroCoin alternative

Sora Card brings together self‑custody crypto wallet, built‑in DEX, and debit card that enables users to spend crypto. Fees are network and fiat conversion dependent, and privacy. Supports stablecoins and major assets.

Integrated DeFi rewards or partner incentives may provide cashback, but not always. At checkout, spending entails converting to fiat, and limits are wallet config and on-chain liquidity dependent. DeFi users who want wallet, trading, and card integration will be pleased with this option.

SORA Card Features

- Combines wallet, DEX, and debit card.

- Offers support for stablecoins and other major crypto assets.

- Design focuses on privacy and security.

- Spending limit is determined by liquidity in the wallet.

- Available partner rewards and DeFi incentives.

SORA Card Pros & Cons

Pros:

- Combines wallet, DEX, and debit card.

- Focused on privacy and security.

- Spend limits are adjustable based on liquidity.

- Supports stablecoins and major cryptocurrencies.

- Users receive DeFi rewards.

Cons:

- Rewards are variable and dependent on partner programs.

- Spendability is affected by network liquidity.

- Users may be charged ATM fees.

- Price structure is variable, which may be confusing.

- Users must understand DeFi concepts.

10) Crypto.com Card and SpectroCoin alternative

The Crypto.com Visa Card is a prepaid crypto card that has support for a variety of crypto currencies.

Rewards are tiered and, depending on your stake level, are eligible to earn up to ~5% CRO back on everyday spend, plus stake, spend and subscription (Spotify/Netflix) travel perks. Rewards are tiered.

There’s no annual fee, but there are top rewards, s tak ing or subscription Fees required. There are monthly limits on free ATM withdrawals.

Spend can be used with BTC, ETH, CRO, stablecoins and others. It’s accepted worldwide. Great for users who want a lot of merchant coverag e and perks.

Crypto.com Card Features

- Visa cards on the cryptocurrency side are prepaid and secure cards, that support Bitcoin, Ethereum, CRO, and stablecoins.

- Up to 10% CRO cashback with tiered rewards.

- Netflix and Spotify subscription rebates.

- No annual fees for lower tiers; higher tiers have CRO staking requirements.

- Spend tracking and cards management features are integrated into the mobile app.

Crypto.com Card Pros & Cons

Pros:

- Up to 10% reward cashback and tiered rewards.

- Subscriptions to Netflix, Spotify, and others offer rebated cards.

- Accepted by merchants across the globe.

- Spend tracking offered in the mobile application.

- No fee cards exist for tier 1.

Cons:

- Staking of CRO tokens is required for higher rewards.

- There are limits on ATM withdrawals.

- Rewards reduce as the value of the CRO token decreases.

- Rewards for higher-tier cards are limited.

- Some regions incur fees to top up the card.

Criteria for Choosing Good SpectroCoin Alternatives

Extensive Cryptocurrency Support

More cryptos gives you greater flexibility in spending, converting, and earning rewards. Support for top altcoins and stablecoins is preferable, in addition to Bitcoin and Ethereum.

Value-added Service Fees

These are the service fees of more concern to the cardholder. Value is determined by the level of the monthly/annual fees, currency conversion, ATM fees, and other service fees.

Crypto Rewards and Promotions

Consider cards that provide add-ons for spending, especially if the offerings are in the form of crypto rewards or cash back. Other incentives include tokens and staking rewards.

Card Network Coverage

A card with international acceptance within the Visa or Mastercard networks has the most spending options. Coverage at ATMs and online merchants is the most important.

Crypto Protection and Privacy

Look for cards that incorporate the most robust crypto protective features, including freezing the card, 2FA, and custodial/non-custodial wallet options.

Spending & ATM Limits

Make sure your transaction limits are flexible enough to not block your needs. Frequent or high-volume users should always be able to withdraw money without limits being too restrictive.

Mobile App & Management

The mobile app must be able to provide more than just transaction history. Users should be able to control their cards, receive instant notifications about their spending, balances, rewards, and to manage their cryptocurrencies.

Ease of Conversion

To be able to do instant crypto-to-fiat conversions is important so that customers do not have to worry about manually doing this if they do not want to or are not able to do so.

Staking & Loyalty Benefits

Increased cashback offers, rewards, or other benefits based on your token holdings for cards offered through a loyalty program’s tiers or for staking create additional motivation for users to keep a card longer.

Customer Support & Reliability

The more a customer is offered support, the more they will experience confidence in the product. Being able to have support from the company when they are using their product globally is very important.

Conclusion

In conclusion, SpectroCoin Card substitutes offer a variety of choices for cryptocurrency users looking for rewards, flexibility, and convenient international spending.

While non-custodial options like Cypher, MetaMask, and Gnosis Pay guarantee complete control over assets, cards like Nexo, Coinbase, Bybit, and Crypto.com offer a variety of benefits like cashback, multi-crypto support, staking rewards, and cheap fees.

Fees, supported cryptocurrencies, security, rewards, and worldwide acceptance all play a role in selecting the best option, which facilitates consumers’ effective usage of cryptocurrency in day-to-day activities.

FAQ

What is a SpectroCoin Card alternative?

A SpectroCoin Card alternative is a crypto debit or prepaid card from other providers that allows users to spend cryptocurrencies like Bitcoin, Ethereum, or stablecoins globally, often with additional rewards, lower fees, or better features.

Which are the best SpectroCoin Card alternatives?

Top alternatives in 2026 include Nexo Card, Coinbase Card, Bybit Card, Wirex Card, Cypher Card, MetaMask Card, KAST Card, Gnosis Pay Card, SORA Card, and Crypto.com Card, each offering unique rewards, crypto support, and features.

What cryptocurrencies are supported?

Most alternatives support major coins like BTC, ETH, USDT, USDC, and stablecoins. Some cards, like Cypher and KAST, support hundreds of tokens across multiple blockchains for flexible spending.

Do these cards charge fees?

Yes, fees vary by card and tier. They can include ATM withdrawal limits, FX conversion fees, and subscription or staking requirements for higher rewards. Many have no monthly or annual fees for basic tiers.

Can I earn rewards or cashback?

Yes, many alternatives provide crypto cashback, loyalty rewards, or staking incentives. The rate varies by card, user tier, and sometimes the amount of staked tokens or native card cryptocurrency held.

Are these cards globally accepted?

Most alternatives operate on Visa or Mastercard networks, allowing worldwide use at stores, online merchants, and ATMs, making them suitable for travel and daily transactions.