The Best Liquid Staking Protocols to Increase Solana Yields will be covered in this article, emphasizing how Solana investors can maintain the liquidity of their assets while generating passive income.

You’ll find clever ways to optimize profits, lower risk, and actively engage in Solana’s rapidly expanding DeFi ecosystem right now, from reliable platforms like Marinade and Lido to cutting-edge options like Jito and Socean.

Why Use Best Liquid Staking Protocols to Boost Solana Yields

Passive Income – While your staked SOL appreciates in value, you earn staking rewards.

Liquidity – With liquid staking, you receive liquid derivatives such as stSOL or mSOL which can be traded or used in DeFi, even during your staked SOL’s unbonding period.

Yield Optimization – Some protocols have auto-compounding and optimal validator selection which can increase your overall yield.

More DeFi Opportunities – When your SOL is staked, you can also use it in lending, yield farming, or in a liquidity pool to earn additional rewards from DeFi.

Staking Distribution – The majority of protocols allow you to stake to several different validators to minimize the chance of downtime or slashing.

Beginner-Friendly – The majority of protocols have simple dashboards allowing beginners to understand how to stake quickly.

Security You Can Afford – There are rewards for staking, and you are also providing liquidity to secure the Solana blockchain.

Unbonding Flexibility – During the unbonding period, you can sell or trade your liquid derivatives to access your funds.

Reward Transparency – You can see your rewarded and unbonded liquidity in real-time, as well as the Solana validators’ status.

Current and Future Value – The DeFi ecosystem is growing, and Solana as a layer-1 blockchain will capture more of its value. You win by staked SOL plus future staked rewards too.

Key Point & Best Liquid Staking Protocols to Boost Solana Yields List

| Protocol | Key Point |

|---|---|

| Marinade Finance (mSOL) | Offers non-custodial liquid staking with instant mSOL tokens for flexibility. |

| Jito (JitoSOL) | Optimizes staking rewards by bundling transactions for higher validator efficiency. |

| Sanctum | Focuses on secure, decentralized liquid staking with user-friendly interfaces. |

| Lido (stSOL) | Popular liquid staking platform with strong ecosystem support and stSOL liquidity. |

| Socean (scnSOL) | Enables scalable staking with automatic compounding and liquidity on Solana DEXs. |

| Everstake | Provides professional validator services with competitive staking yields. |

| BlazeStake (bSOL) | Combines liquid staking with yield optimization and fast token swaps. |

| SolBlaze | Simplifies staking for retail users with minimal fees and instant liquidity. |

| Quarry Protocol | Integrates liquid staking into DeFi for additional yield farming opportunities. |

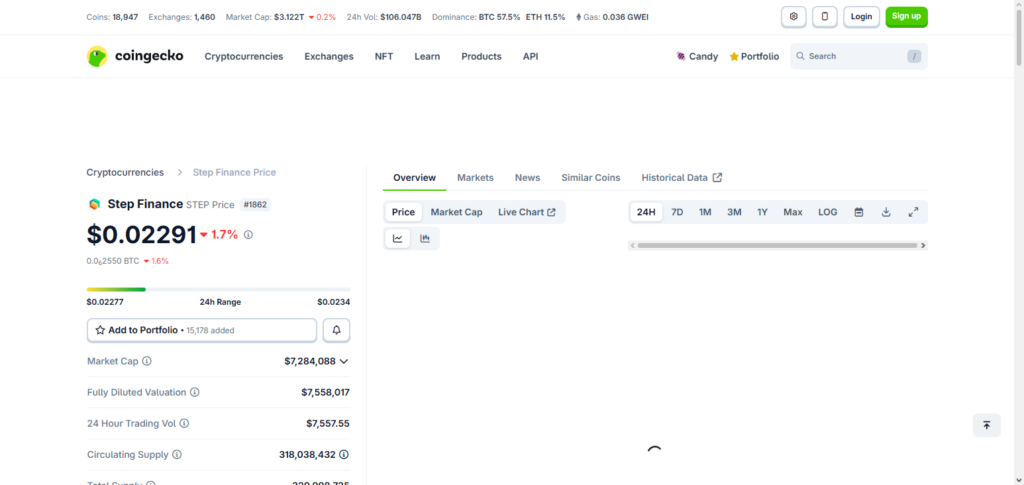

| Step Finance | Aggregates staking rewards and portfolio tracking across multiple Solana protocols. |

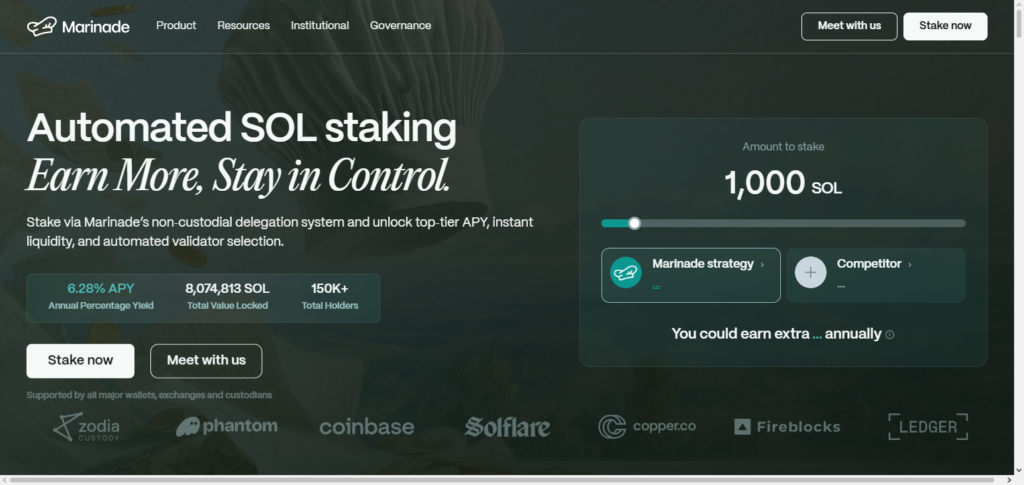

1. Marinade Finance (mSOL)

Marinade Finance is a liquid staking service that is non-custodial. Marinade Finance props up a service on the Solana blockchain that allows the staking of SOL, after which mSOL tokens are issued to the staker.

Users then have the option to trade the mSOL tokens or utilize them in DeFi. When they do this, they will simultaneously earn rewards. Minting mSOL gives users the capability of using the mSOL on the DeFi ecosystem without losing the SOL that they staked. Liquid staking is one of the best liquid staking protocols to boost Solana yields because it enables the users to stake SOL without losing liquidity.

Marinade Finance (mSOL) Features, Pros & Cons

Features:

- mSOL is a non-custodial staking derivative solution.

- Real-time minting of mSOL derivative tokens.

- mSOL is integrated with the broader Solana DeFi ecosystem.

- mSOL is compounded with a variety of top-performing Solana validators.

- mSOL offers a simple and user-friendly web console.

Pros:

- Redeemable for mSOL, liquid collateral is elevated.

- Heightened security and decentralization is prevalent.

- Support from various wallets and applications.

- Every validator’s selection is explicitly discerned.

- Validators instant reward compounding.

Cons:

- Solana validator performance fluctuates ApY.

- mSOL is confined to the Solana ecosystem.

- Delay in transactions due to network congestion.

- Derivative tokens subject to market price risk.

- Users wanting non-custodial staking may be unsatisfied.

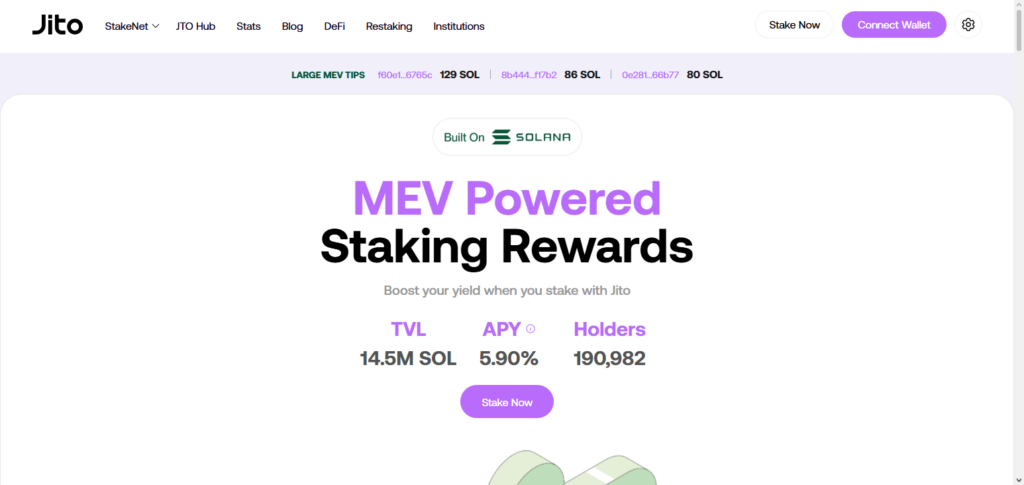

2. Jito (JitoSOL)

Jito is the first liquid staking service that efficiently utilizes the service of Jito on the Solana ecosystem. Users earn the highest staking rewards while using the Jito platform. He provides liquidity for DeFi in the ecosystem while staking using JitoSOL tokens. With the Jito platform, users are able to maximize the efficiency of DeFi. Jito is one of the top liquid staking platforms on the Solana blockchain.

Users will seamlessly stake with jito and earn potential rewards without sacrificing speed or access to tokens. In addition, Jito provides the ability to earn on Solana paired with DeFi. He provides the ability to earn on Solana paired with DeFi. He provides the ability to earn on Solana paired with DeFi while using the Jito service is seamless.

Jito (JitoSOL) Features, Pros & Cons

Features:

- For each batch, a single validator performs the best.

- For each batch, a single validator performs the best.

- JitoSOL provides liquidity with derivative tokens.

- Integration with the Jito high-speed Solana network.

- Sole focus on validator performance.

Pros:

- Gain a higher Staking reward ApY.

- JitoSOL provides liquid collateral.

- Perfect for DeFi-centric users.

- Managed validated switching to professional.

- Expansion of the SOL ecosystem.

Cons:

- Advanced users will find the interface geared toward them.

- Network congestion fluctuates reward distribution.

- Derivative tokens subject to market price risk.

- Needs comprehension of how staking works on Solana.

- Less popular community adoption compared to Lido or Marinade

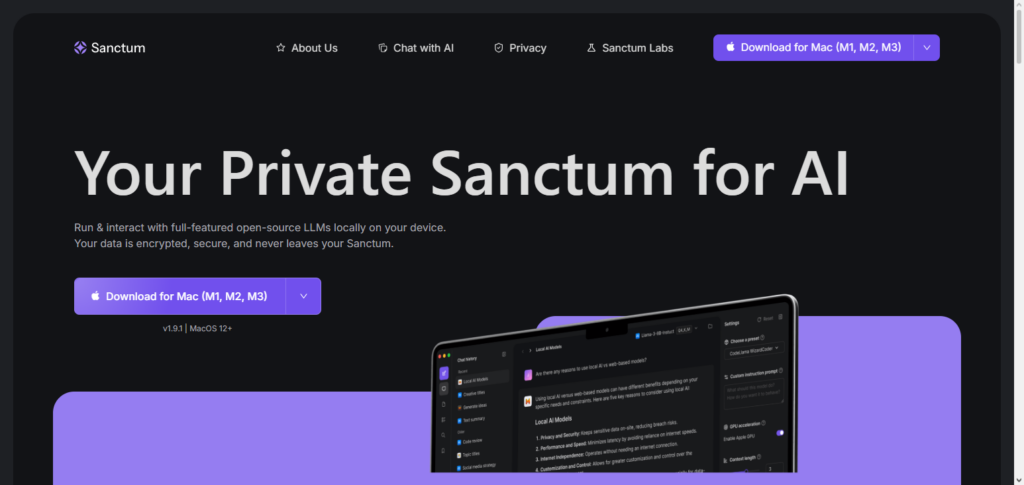

3. Sanctum

Sanctum offers a secure and decentralized liquid staking solution for users. Built on the principles of safety, transparency, and simplicity, users can stake SOL and receive liquid staking derivative tokens.

These tokens can then be used to participate in DeFi activities, or be traded at any time, and users will not lose the yield. Sanctum applies strict management tools when it comes to the selection of validators and the overall systemic risk management, therefore user funds are safeguarded.

Sanctum is recognized as one of the best liquid staking protocols to boost Solana yields and it is applicable to both users new to cryptocurrency as well as users very familiar with the cryptocurrency ecosystem. Sanctum offers an easy-to-use platform, compounding capabilities, and the use of liquid and fully decentralized staking. It also offers very attractive yield farming rewards.

Sanctum Features, Pros & Cons

Features:

- Liquid staking that is secure and decentralized.

- Derivative tokens from staked SOL.

- Interface is user friendly.

- Validator selection is transparent.

- Staking is safe and has a focus on it.

Pros

- High decentralization and secure liquid staking.

- Simple staking that is accessible for both beginners and pros.

- Works with DeFi applications on Solana.

- Staking rewards are competitive.

- There is liquid flexibility

Cons

- Lesser-known relative to Marinade or Lido.

- Rates of rewards are subject to change.

- There are integrations that are limited with third-party wallets.

- Longer-term reliability is possibly unknown.

- Derivative token usage may have a slight learning curve.

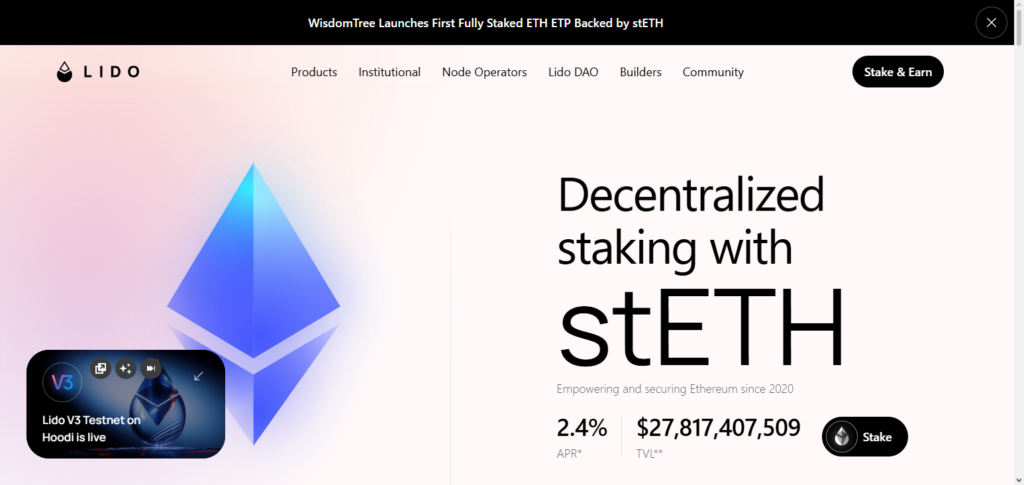

4. Lido (stSOL)

Lido liquid staking provides one of the most trusted solutions in the market, issuing users stSOL tokens to represent assets staked SOL. Lido has built one of the most powerful ecosystems, but the integration across wallets and DeFi protocols value users the most through earning rewards using stSOL in trading, lending, or farming.

Risk Lido’s wide, professionally managed, and powerful validator network gives users stSOL maximized yield. Edging on the best liquid staking protocols to boost Solana yields, Lido possesses the holy trinity of liquidity, reliability, and rewards placings them on the top on the market for stake and DeFi use on Solana.

Lido (stSOL) Features, Pros & Cons

Features

- Well-known liquid staking protocols.

- For liquidity, there are stSOL derivative tokens.

- There is a wide selection of validators.

- There is wallet and DeFi integration.

- There is professional management of validators.

Pros

- This is a secure and trusted platform.

- There is a smooth Lido DeFi compatibility.

- The rewards are consistent and stable.

- The risk of staking is lowered.

- There is solid ecosystem support.

Cons

- The fees of the platform may lower net yield.

- The risk of centralization due to the number of validators is present.

- The price of the derivative token is subject to change and leads to risk.

- For new users, it is overwhelming.

- There is a focus on SOL holders that are large.

5. Socean (scnSOL)

Socean is one of the most liquid staking providers. They allow users to stake SOL and receive scnSOL tokens. These tokens can be used in the Solana DeFi ecosystem to provide liquidity and for yield farming. They provide auto-compounding of staking rewards in order to maximize users returns and offers transparent selection of validators.

Socean combines liquid staking with ecosystem integrations to offer users the ability to earn the best yields without having to lock their funds. Socean is also noted to be one of the best liquid staking protocols to boost Solana yields. They provide users with flexibility to stake their funds and earn high returns. Users can also easily access the growing DeFi ecosystem on Solana for greater convenience and efficiency.

Socean (scnSOL) Features, Pros & Cons

Features:

- Automated reward compounding.

- Derivative tokens of scnSOL.

- Involved with Solana DeFi.

- Infrastructure to scale staking.

- Predictable selection of validators.

Pros:

- Compounding of rewards maximization.

- DeFi rewards flexible on staked assets.

- System of staking proven efficient.

- Reward levels economically competitive.

- Platform uncomplicated in usability.

Cons:

- Performance dictated by the Solana network.

- Liquidity of derivative tokens is variable.

- Beginner users may become puzzled by features.

- Lack of variety in staking offline.

- Unpredictable rewards based on validators.

6. Everstake

Everstake is one of the professional staking services which also offers liquid staking for SOL and other tokens. Everstake leads with institutional-grade validator management with a strong focus on staking security and rewards. Users receive liquidity by Derivative Tokens which enable them to participate in DeFi and earn staking returns.

Everstake offers competitive rates and performs to all validator’s expectations which allows them to cater to both individual and institutional investors.

Providing users with one of the best liquid staking protocols to boost yields on Solana, Everstake creates great ease of use, provides solid technical assistance, and offers clear and transparent reward distribution keeping in mind flexibility for reinvestment and liquidity.

Everstake Features, Pros & Cons

Features:

- Services of professional validators.

- Staking liquidity with tokens as derivatives.

- Security-centric platform.

- Staking rates with competitiveness.

- Multiple cryptocurrencies including SOL supported.

Pros:

- Validator management you can trust.

- Reward potential is elevated.

- Platform easy to use.

- Operation clarity in administration.

- Users institutional as well as retail.

Cons:

- Fees of the platform somewhat increased.

- Performance of the validator determines rewards.

- DeFi is less integrated than Lido.

- Market value of derivative tokens is an exposure.

- Compared with large platforms has few users.

7. BlazeStake (bSOL)

BlazeStake provides users with simplified liquid staking using bSOL. It focuses on optimizing yield strategies and providing rapid access to the liquidity of staked SOL. Users can stake SOL while accessing DeFi protocols and earning higher rewards via smart selection of validators and compounding strategies.

The platform’s user friendly interface and compatibility with the entire Solana ecosystem enables smooth staking experiences. It is considered one of the best liquid staking protocols to enhance Solana yields. BlazeStake is perfect for users needing high operational efficiency, immediate liquidity, and uninterrupted reward inflow. It offers users all-in-one staking, DeFi active portfolio growth, and reward compounding.

BlazeStake (bSOL) Features, Pros & Cons

Features:

- Derivative tokens for bSOL.

- Yield optimization focused.

- Liquidity for staked SOL is instant.

- DeFi applications integration.

- Selection of smart validators.

Pros:

- More efficient staking leads to maximized rewards

- SOL holders will appreciate rapid liquidity

- Streamlined for ease of use

- Operates within the Solana DeFi ecosystem

- Users earn rewards continuously

Cons:

- Limited adoption due to being a newer platform

- Market risk associated with derivative tokens

- Novices may find advanced features to be too complicated

- Fewer long-term metrics available

- Relies on the consistency of the validators

8. SolBlaze

By providing quick liquidity through derivative tokens and low fees, SolBlaze streamlines the staking process for individual investors. While keeping access to liquid assets for trade or DeFi use, users can bet SOL and receive competitive incentives. The protocol prioritizes effective validator management, security, and user experience.

SolBlaze, one of the best liquid staking protocols to increase Solana yields, is perfect for consumers looking for easy staking, quick payouts, and integration with the Solana ecosystem. It combines accessibility, profitability, and ease of usage into a single solution for expanding SOL assets.

SolBlaze Features, Pros & Cons

Features:

- Minimal fees for staking

- Derivative tokens that offer instant liquidity

- Targeted toward retail customers

- Rewards are highly competitive

- Staking is hassle-free

Pros:

- For those new to staking, this is a great spot to start

- Low fees with a highly productive platform

- You may use derivative tokens as you see fit

- Rewards are distributed rapidly

- Operates within the Solana ecosystem

Cons:

- Yield optimization can be improved

- The scope of DeFi integrations is limited

- Since this is a newer platform, the user base is not extensive

- Rewards are contingent on the performance of the validators

- A risk is associated with the pricing of the token derived

9. Quarry Protocol

Quarry Protocol is one of the few platforms that have integrated liquid staking with DeFi. Users can stake SOL and receive derivative tokens that can be used to farm yields or provide liquidity. Quarry Protocol’s platform features focus on maximized returns, liquidity, and safety. Pairing staking with DeFi liquidity mining, Quarry Protocol is able to provide SOL holders with additional revenue-streaming opportunities.

As one of the best liquid staking protocols to boost Solana yields, Quarry attracts sophisticated users looking to efficiently leverage staked assets, optimize revenue earning, and actively participate in the DeFi ecosystem on Solana while keeping full access to their funds.

Quarry Protocol Features, Pros & Cons

Features:

- Integrated DeFi with liquid staking

- Derivative tokens can be used for yield farming

- Maximized returns with optimized staking

- Unencumbered liquidity

- Multi-strategy rewards

Pros:

- Staking and DeFi are blended with earnings

- Levels of yield that are highly attainable

- A variety of uses for the assets

- Tailored for advanced users

- High transparency and security

Cons:

- Difficult for novices.

- There are dangers involved with DeFi protocols.

- Rewards vary depending on the fluctuations of the network.

- Less popular than Lido and Marinade.

- Value of derivative tokens can change.

10. Step Finance

Step Finance is a portfolio analytics and management tool that tracks staking yields across several protocols on Solana. It empowers users to evaluate and reinvest their yields. Step Finance manages derivative tokens by integrating multiple liquid staking solutions, enabling users to engage in DeFi and optimize their liquid stake.

Step Finance is, therefore, one of the best liquid staking protocols to boost Solana yields due to the extensive value it offers savvy clients who desire transparency, real-time metrics, and reward optimization analytics, all coupled with portfolio collection and management on the Solana blockchain.

Step Finance Features, Pros & Cons

Features:

- Aggregator for staking rewards and portfolios.

- Integration across multiple protocols.

- Optimization of yields and analytics tools.

- Management of liquid staking.

- Dashboard that’s easy to use.

Pros:

- Portfolio access with tracking in real time.

- Enhanced staking yields with optimization analytics.

- Multiple platforms for liquid staking.

- Participation in DeFi that’s easy.

- Excellent for managing portfolios on advanced levels.

Cons:

- It’s not a protocol for staking.

- Lacking analytics tools might not be familiar.

- Performance of external protocols is what it relies on.

- Not the best option for novices.

- There is optimization an tendency for continuous monitoring.

Conclusion

To sum up, the Solana ecosystem provides a wide variety of liquid staking choices, all of which are intended to optimize profits while preserving flexibility and liquidity.

While Everstake, BlazeStake, and SolBlaze concentrate on optimum yields and user-friendly experiences, platforms like Marinade Finance, Jito, Lido, and Socean offer smooth staking with derivative tokens.

Step Finance and Quarry Protocol combine staking with DeFi tactics to increase earning possibilities. Investors can effectively increase their SOL holdings without compromising access to their funds by utilizing these methods.

These platforms combine security, effectiveness, and profitability for all users, making them the finest liquid staking techniques to increase Solana yields overall.

FAQ

What is liquid staking on Solana?

Liquid staking allows SOL holders to stake their tokens while receiving derivative tokens (like mSOL or stSOL) that can be used in DeFi or traded. This provides liquidity without sacrificing staking rewards, making it one of the most flexible ways to grow SOL holdings.

Which are the best liquid staking protocols for Solana?

Top protocols include Marinade Finance (mSOL), Jito (JitoSOL), Sanctum, Lido (stSOL), Socean (scnSOL), Everstake, BlazeStake (bSOL), SolBlaze, Quarry Protocol, and Step Finance. Each offers competitive yields, liquidity, and integration with Solana’s ecosystem.

How do derivative tokens work?

When you stake SOL on a liquid staking platform, you receive derivative tokens (e.g., mSOL, stSOL) representing your staked SOL. These tokens earn staking rewards and can be used in DeFi or traded, giving flexibility alongside traditional staking.

Are liquid staking platforms safe?

Most reputable platforms use professional validators and robust security protocols. Platforms like Lido, Marinade Finance, and Everstake are well-established, but users should always research validator performance, fees, and risks before staking.

Can I unstake my SOL instantly?

Liquid staking allows easier access to funds through derivative tokens, but full unstaking may still require a Solana network epoch to finalize. However, derivative tokens can be traded or used in DeFi immediately, offering functional liquidity.