I’ll go over the Best Programmable Stablecoin APIs for Fintech Developers in this post, emphasizing the most potent instruments that make digital payments safe, quick, and scalable.

You’ll learn how these APIs assist fintech teams in creating cutting-edge products, automating transactions, and providing smooth financial experiences in today’s dynamic blockchain ecosystem, from USDC and USDT interfaces to decentralized and cross-border solutions.

Key Point & Best Programmable Stablecoin APIs for Fintech Developers

| Stablecoin API | Key Point |

|---|---|

| Circle API (USDC) | Seamless USDC issuance, transfer, and wallet integration for developers. |

| Tether API (USDT) | Reliable USDT transactions with broad blockchain support and real-time balance tracking. |

| MakerDAO DAI API | Enables creation and management of decentralized DAI stablecoins on Ethereum. |

| Stellar Anchor API | Facilitates stablecoin issuance, redemption, and cross-border payments on Stellar. |

| Ripple XRP Ledger Stablecoin API | Fast, low-cost stablecoin transfers with XRP Ledger security and scalability. |

| Algorand ASA API | Supports stablecoin issuance and transfers with Algorand’s high-speed blockchain. |

| Solana SPL Token API | High-throughput stablecoin operations with low fees on Solana’s network. |

| Binance Pay API (BUSD) | Instant stablecoin payments and wallet services for merchants and apps. |

| Tron USDT API | Fast, low-fee USDT transactions on the Tron network for global payments. |

| Polygon USDC API | Scalable and cost-efficient USDC transfers using Polygon’s Layer 2 solution. |

1. Circle API (USDC)

Circle API is the most complete API for integrating USDC stablecoin into a fintech solution. USDC wallets can be created and managed by developers. It provides full compliance features, and, for financial apps, payment platforms, and marketplaces, it provides instant settlement, along with transparency and security.

From the Best Programmable Stablecoin APIs for Fintech Developers, it is the best choice because of its easy sandbox testing, great developer documentation, and fast and complete integration with legacy banking systems. With global support, real-time transaction tracking, and compliance features, it will be able to help fintechs provide scalable stablecoin payments.

Circle API (USDC) Features, Pros & Cons

Features:

- Issuance and redemption for USDC

- Wallet and transaction management in real-time

- Testing in API sandboxes

- Reporting for compliance

- Integrations with various financial institutions

Pros

- Dependable and good from a regulation standpoint

- Able to do fast and safe transactions

- Documentation for developers is good

- Able to scale with financial technology applications

- Able to use from anywhere in the world

Cons

- They only support USDC

- There may be fees for certain actions

- They do not support a lot of countries outside of the US

- You have to do KYC to use all the features

- They rely on Ethereum and a few other blockchains

2. Tether API (USDT)

Tether API, one of the most popular applications among Fintech developers, allows for the integration of USDT, the most used stablecoin, into apps centered on payments, trading, and remittances. It has the ability to function on multiple blockchains (Ethereum, Tron, and Solana), providing developers with ample versatility.

Tether is one of the most commonly used stablecoins, offering liquidity and interoperability to financial technology solutions. As such, developers can utilize the Tether API to craft stable, value-preserving, fast, borderless, and low-cost digital transaction solutions for their end users in the form of crypto payment systems, wallets, and trading apps.

Tether API (USDT) Features, Pros & Cons

Features:

- Supports USDT on multiple blockchains (Ethereum, Tron, Solana)

- Can keep track of balance in real-time

- Can retrieve transaction history

- Can integrate wallets

- Networks for payments and trading are reliable

Pros

- It is highly liquid and widespread

- Transactions are fast

- They have multiple chains

- You can easily integrate it to financial technology

- There is a good ecosystem in DeFi and on Exchanges

Cons

- A lot of people do not trust it because it is centralized

- There are not many options for compliance

- Transactions have fees, and different fees depending on the chain

- Some countries do not allow it for regulatory purposes

- You cannot write your own code for it.

3. MakerDAO DAI API

With MakerDAO’s DAI API, developers are enabled to programmatically create and control DAI, one of the most popular stablecoins in the crypto space that is backed one to one with the US Dollar. This API also allows developers to interact with smart contracts to mint, burn, and move DAI among Ethereum ecosystem apps.

MakerDAO’s DAI API is one of the most prominent APIs among Fintech developers to construct decentralized finance (DeFi) frameworks, lending ecosystems, and payment systems.

The distributed nature of DAI fosters trust, transparency, and decentralization, allowing developers to provide end users with programmable money. This paves the way for sophisticated financial technology innovations, including automated payments, savings mechanisms, and lending solutions backed by crypto.

MakerDAO DAI API Features, Pros & Cons

Features

- Minting and burning of DAI stablecoins.

- Integration with Ethereum smart contracts.

- Automated management of lending and collateral.

- Full decentralization.

- History of transactions on the blockchain.

Pros

- Decentralization and transparency in full.

- Customizable programmability for decentralized finance (DeFi) use cases.

- USD-backed stablecoins.

- Automation and smart contract functionality.

- Increased security associated with the Ethereum blockchain.

Cons

- Transactions take longer if Ethereum is congested.

- Fees for gas on Ethereum can be very high.

- Additional complexity for inexperienced developers.

- Knowledge of collateralized debt positions is required.

- Less appropriate for payments in traditional fiat currencies that are not cryptocurrencies.

4. Stellar Anchor API

Stellar Anchor API supports stablecoin issuance, redemptions, and cross-border transactions on the Stellar blockchain. Anchors are gateways where users can deposit and withdraw fiat that backs stablecoins like USDC or other custom tokens. Stellar Anchor API is among the best programmable stablecoin APIs for fintech developers primarily due to its speed, low-cost transactions, and built-in compliance tools.

It is especially useful for remittance and micropayment applications and other services that require a global financial infrastructure. Developers who use the Stellar Anchor API can offer their end users the ability to perform instant settlements, facilitate multi-currency liquidity, and transfer stablecoins safely. Stellar also has a robust network that is capable of high throughput which makes it an excellent option for cross-border payments in fintech applications.

Stellar Anchor API Features, Pros & Cons

Features

- Issuance and redemption of stablecoins.

- Gateway from fiat to cryptocurrencies.

- Support for payments across borders.

- Anchors that are ready to comply with regulations.

- Transfers on the Stellar Blockchain at High Speed.

Pros

- Transactions are inexpensive.

- The time required for settlement is minimal.

- This is perfect for small payments and remittances.

- Integration of fiat currency is simple.

- The application can be expanded in scope for use on a global scale.

Cons

- The stablecoins offered are few.

- Conversion of fiat currencies is dependent on Anchors.

- Less use is seen than with Ethereum-based stablecoins.

- The requirement of anchor partners for fully functional use.

- There is little that can be done with Decentralized Finance (DeFi).

5. Ripple XRP Ledger Stablecoin API

With Ripple’s XRP Ledger Stablecoin API, fintech developers can issue, transfer, and manage stablecoins on a highly scalable blockchain. The XRP Ledger offers near-instant settlements, low costs, and great security.

For Fintech Developers, this is one of the Best Programmable Stablecoin APIs. It is best suited for cross-border payments, corporate treasury management, and high-demand fintech applications. It is also great for maintaining high transaction speeds.

Developers can use XRP Ledger’s decentralized exchange and liquidity grid to make global value transfers with minimal friction. By powering their applications with Ripple’s API, firms access a refined blockchain ecosystem that can be used for scale programmable stablecoins, all while remaining legally compliant and operationally streamlined.

Ripple XRP Ledger Stablecoin API Features, Pros & Cons

Features

- Transfers of stablecoins that are backed by XRP.

- Settlements that are instant.

- There are very low transaction costs.

- Transparency in the Ledger.

- Multi-currency Support and Liquidity

Pros:

- Strong cross-border payments.

- Large volume scalability.

- Fast transaction speeds.

- Low costs.

- High enterprise adoption.

Cons:

- Centralized control of Ripple Labs.

- Little focus on DeFi.

- Operational restraints in certain countries.

- Smart contract options are limited.

- Transaction costs in XRP.

6. Algorand ASA API

The Algorand ASA (Algorand Standard Asset) API makes it possible for developers to construct, release, and control the distribution of various types of stablecoins on the Algorand blockchain.

Due to the network’s speed and low latency, it can support rapid transactions and scalable solutions for fintech. Among the For Fintech Developers Most Programmable Stablecoin APIs, the Algorand ASA API is regarded as the more dependable, blockchain design coupled with smart contracts, and low energy consumption.

Developers can create applications for DeFi, payment systems, and stablecoin wallets with The Algorand ASA API at little to no charge. The API facilitates the provision of fintech applications with programmable, stable, and digital currencies (fast and stable) for users anywhere in the world using atomic transactions, other stablecoins, and multi-asset holders.

Algorand ASA API Integration Features, Pros & Cons

Features:

- Smart contract support.

- Transfer and creation of ASAs.

- Multi-asset control.

- Low-cost, high-speed transactions.

- Automation with atomic transfers.

Pros:

- Energy and cost-efficient.

- Supports DeFi solutions.

- Flexible and simple API and SDK options.

- High scalability within blockchain.

- Low costs.

Cons:

- Minor trade volume with merchants.

- Minor trade volume with other networks.

- Less Ethereum-like ecosystem.

- Digging into some of the features requires some technical skill.

- Less developed network.

7. Solana SPL Token API

The SPL Token API from Solana enables developers in fintech to create and control the distribution of stablecoins on their blockchain while utilizing the great performance of Solana. It offers the fastest transactions, along with the lowest fees, making it the optimal choice for scalable projects in the fintech arena. In the For Fintech Developers Most Programmable Stablecoin APIs,

Solana SPL Token API is recognized for its unmatched speed and reliability with various integrations of DeFi. He (or she) can integrate stablecoins with payment systems, trading solutions, and microtransaction systems. The network facilitates real-time programmable currencies.

API for Solana SPL Tokens Features, Pros & Cons

Features:

- Automation for token transfers.

- Program on-chain functionalities.

- Smart contract support.

- Low-cost transactions.

- High-volume token issuance.

Pros:

- Simple blockchain with quick transactions.

- Flexible S DK for big application s in fintech.

- Lowered costs throughout the network.

- Large growing ecosystem for DeFi.

Cons:

- The system does have some downtime on occasion.

- The network does experience some downtime.2. Lower liquidity than Ethereum.

- Difficult for beginners.

- Minimal tools for regulation.

- Ecosystem is newer.

8. Binance Pay API (BUSD)

Developers can use the Binance Pay API to include BUSD stablecoin payments on their apps, wallets, and merchant systems. It offers instant settlements, multi-currency wallets, and easy onboarding for merchants. With low and seamless payments and high security, it is among the Best Programmable APIs for Fintech Developers in Global Payments.

Developers gain access to all of Binance’s programmable features, such as Automated Recurring Payment (ARP) and transaction monitoring, allowing them to build fully compliant fintech apps. It allows seamless digital payments with high efficiency and low complexity. With the ability to extend stablecoin payment solutions across various geographies and customer segments, Binance Pay API is perfect for fintech applications.

Binance Pay API (BUSD) Features, Pros & Cons

Features:

- Processing payments with the BUSD stablecoin.

- Onboarding for merchants.

- Management of wallets.

- Instant payments.

- Support for multiple currencies.

Pros:

- Binance ecosystem is reliable.

- Transactions are inexpensive.

- Simple integration with fintech applications.

- Transactions are settled quickly.

- It is safe and regulated.

Cons:

- Transactions are only available with BUSD.

- Ecosystem is centralized.

- Binsze platform dependence.

- Compared with DeFi APIs, it is less programmable.

- It is possible for there to be restrictions in some geographies.

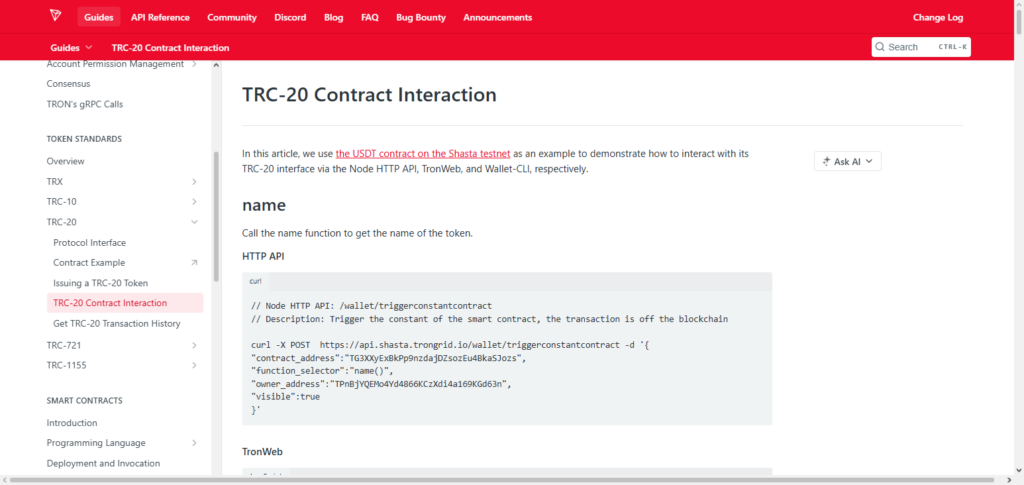

9. Tron USDT API

Developers creating fintech solutions on the Tron network may find Tron’s USDT API ideal for fast and inexpensive stablecoin transfers. It features real-time balance inquiry, automated transfers, and instant blockchain confirmations. Regarding fintech developers, Tron USDT API may very well be the Most Programmable Stablecoin API for Fintech Developers due to excellent transaction volume and low transaction fees.

Developers can build solutions for rapid and stable cross-border payments, cryptocurrency wallets, and trading. It also offers programmable features like automated payments and smart contract functionalities due to its integration with widely used DeFi protocols. Tron’s network is perfect for fintech applications that require stablecoin functionalities with high efficiency and low costs.

Tron USDT API Features, Pros & Cons

Features:

- Transfers of the USDT token on Tron.

- Tracking of balances in real-time.

- Transactions at a low cost.

- Support of smart contracts.

- Networks with high throughput.

Pros:

- The cost is very low.

- There is a quick confirmation time.

- It is trustworthy for international payments.

- It is programmable with contracts.

- It works with different wallets.

Cons:

- Governance of the network is centralized.

- There are fewer developers than Ethereum.

- There are not many integrations for DeFi.

- Some nations have regulatory issues.

- There are not many ways to exchange fiat.

10. Polygon USDC API

Developers can utilize the Polygon USDC API to integrate USDC stablecoins on Polygon’s Layer 2 Ethereum solutions. It also features low-cost transactions and high scalability. It helps to manage wallets, and smart programmable contracts for fintech solutions, along with transfers. Among fintech developers, Polygon USDC API is one of the best programmable stablecoin APIs for fintech developers due to its Ethereum compatibility and reduction of gas fees.

Fintech applications like payment gateways, DeFi applications, and automated solutions for stablecoins can be built by developers. The network of Polygon offers and great reliability and rapid confirmations so developers can build applications that can introduce stablecoins to users in a programmable manner without compromise on safety, scalability, or speed.

Polygon USDC API Features, Pros & Cons

Features:

- Transfers of the USDC stablecoin on the Polygon Layer 2 network.

- Gas fees are low.

- Support of smart contracts on Ethereum.

- There are quick settlement times.

- Integration of multiple wallets.

Pros:

- Scalable and cost efficient.

- Fully compatible with Ethereum Ecosystem.

- Supports DeFi and programmability.

- Transactions are fast and cheap.

- Good developer support.

Cons:

- For Layer 2 security, it relies on Ethereum.

- It has less adoption than Ethereum Mainnet.

- Few merchant integrations.

- It is a new network for some fintech applications.

- It can be quite technical for Layer 2 integrations.

Conclusion

Stablecoins are now crucial for creating safe, quick, and scalable financial apps in today’s quickly changing fintech environment.

Developers may easily include programmable stablecoins into wallets, payment systems, and DeFi platforms with the use of APIs from Circle, Tether, MakerDAO, Stellar, Ripple, Algorand, Solana, Binance, Tron, and Polygon.

These solutions, which are among the Best Programmable Stablecoin APIs for Fintech Developers, provide flexibility, affordable fees, quick settlements, and strong security, enabling cutting-edge fintech products that satisfy the needs of users worldwide.

With reliability, efficiency, and programmability at their fingertips, developers may fully realize the potential of digital finance by utilizing these APIs.

FAQ

What are programmable stablecoin APIs?

Programmable stablecoin APIs allow developers to integrate stablecoins like USDC, USDT, or DAI into fintech applications. They provide functions for issuing, transferring, and managing stablecoins programmatically, enabling automated payments, wallets, and DeFi solutions.

Why should fintech developers use stablecoin APIs?

Stablecoin APIs offer fast, low-cost transactions, programmable automation, and seamless integration with financial platforms. They help maintain value stability while allowing innovative fintech solutions such as instant payments, remittances, and smart contract-based financial products.

Which are the best programmable stablecoin APIs?

Some of the top APIs include Circle (USDC), Tether (USDT), MakerDAO (DAI), Stellar Anchor, Ripple XRP Ledger, Algorand ASA, Solana SPL Token, Binance Pay (BUSD), Tron USDT, and Polygon USDC. Each offers unique features, speed, and blockchain compatibility for developers.

Are stablecoin APIs secure for fintech applications?

Yes. Reputable APIs like Circle, Tether, and Ripple follow strict security protocols, including encryption, compliance with regulations, and audit-ready reporting, ensuring safe and reliable transactions for fintech apps.

Can stablecoin APIs be used globally?

Most leading APIs support global transfers and multi-chain networks, allowing fintech apps to offer cross-border payments, wallet services, and international transactions with low fees and instant settlement.