Because of its increasing adoption as an everyday digital currency, Bitcoin is becoming more than just a ‘store of value’. However, while Bitcoin is a revolution in its own right, its base layer is still limited in speed, scalability, and costs. This is where new and innovative ‘scaling’ networks fill in the gaps.

This guide will analyze the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments. We will focus on platforms that offer near instantaneous transactions, very low costs for processing and securing the transactions, and comprehensive trading solutions for the Bitcoin network. This will enable global commerce, micro payments, and real time payments on the Bitcoin network.

What Are Bitcoin Layer-2 Solutions?

Secondary networks created on top of the Bitcoin blockchain that enhance its speed, scalability, and cost-effectiveness without compromising the fundamental security of the base layer are known as Bitcoin Layer-2 solutions.

By moving the majority of transactions off-chain or onto sidechains, they enable users to send and receive Bitcoin virtually quickly at much reduced costs. In order to maintain Bitcoin’s decentralization and trust model, final transaction states are finally settled back on the main chain.

Micropayments, decentralized finance, tokenization, and regular digital payments on a global scale are all made possible by well-known Layer-2 systems like payment channels, rollups, and smart-contract sidechains.

Key Point

| Layer-2 Solution | Key Point |

|---|---|

| Lightning Network | Enables near-instant, ultra-low-fee Bitcoin payments using off-chain payment channels, making BTC practical for everyday spending and micropayments. |

| Liquid Network | A federated Bitcoin sidechain designed for fast settlement, confidential transactions, and efficient asset transfers between exchanges and institutions. |

| Rootstock (RSK) | An EVM-compatible Bitcoin sidechain that brings smart contracts and DeFi to BTC through merged mining and RBTC for faster, cheaper transactions. |

| Stacks Protocol | A Bitcoin-anchored Layer-2 using Proof of Transfer (PoX) to enable smart contracts, NFTs, and apps that settle securely on Bitcoin. |

| Merlin Chain | A zk-Rollup-based Bitcoin Layer-2 focused on high throughput, low fees, and EVM compatibility for scalable BTC applications. |

| Satoshi VM | A zero-knowledge Bitcoin Layer-2 that batches transactions off-chain to reduce costs while enabling EVM-style smart contract functionality. |

| Dovi (Bitcoin Layer-2) | An EVM-compatible Bitcoin scalability layer designed to support DeFi, tokenization, and multi-asset smart contracts with lower fees. |

| Ark Protocol | A Bitcoin scaling solution using virtual UTXOs to enable fast, low-liquidity payment flows without traditional channel management. |

| Mintlayer | A Bitcoin-anchored sidechain focused on token issuance, DeFi, and atomic swaps, enabling faster and cheaper BTC interactions. |

| Mezo | An EVM-compatible Bitcoin economic layer that allows users to secure the network with BTC while enabling scalable, low-cost applications. |

1. Lightning Network

Because of its popularity, the Lightning Network is the best off-chain scaling solution for Bitcoin. The Lightning Network allows users to send and receive Bitcoin for very little cost and allows for near-instant BTC transactions through its bi-directional payment channels.

To alleviate congestion and reduce fees, users must lock their funds in a smart contract and make off-chain transactions, which only require the settlement of on-chain final balances.

As one of the best bitcoin layer-2 solutions for fast & cheap BTC payments, Lightning facilitates micro payments and is adopted by merchants and used in global remittance services.—

Lightning Network Features

- Instant Payment: Payment channels enable BTC transactions to be processed instantly.

- Low Fees: Transactions have virtually no costs and micropayments can be made.

- Global Adoption: Wallets, exchanges, and merchant platforms have integrated it.

- Scalability: Settlement off the chain helps congestion on the base layer of Bitcoin.

Lightning Network Pros & Cons

Pros:

- Bitcoin payments are almost instantaneous and very cheap.

- Accepted everywhere, including many wallets and exchanges.

- Can be used for microtransactions and daily payments.

- Active developers and community support.

Cons:

- Difficult to keep enough liquidity.

- Big payments are likely to fail during the routing process.

- Need to open and close channels on the blockchain.

- Not the best option for smart contracts, or decentralized finance.

2. Liquid Network

Liquid Network is one of the first Federated Bitcoin sidechains, created by Blockstream, that offers users the ability to settle transactions faster, pay lower fees, and improve privacy when moving large amounts of Bitcoin.

They offer their customers the ability to conduct Private Transactions, Issue Digital Assets, and provide Tokenized Equity services which makes it an attractive solution for Exchanges and large volume Bitcoin traders.

Liquid Network is positioned among the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments. Within Liquid, customers are able to transfer Bitcoin to different exchanges in under 2 minutes without the need for on-chain confirmations.

Liquid Network offers an operationally solid two-way peg mechanism to reference and transfer Bitcoin (BTC) to and from the main chain and sidechain.

Liquid Network (Blockstream) Features

- Confidential Transactions: Sending and receiving crypto with no amounts shown and participants are privy to the transaction.

- Token Issuance: Liquid Network supports digital assets and includes stablecoins and securities.

- Fast Settlement: More than Bitcoin’s 10-minute block time, there is a block produced per minute.

- Federation Model: Liquid Network is secured by specially trusted functionaries and does not have miners.

Liquid Network (Blockstream) Pros & Cons

Pros:

- Privacy through Confidential transactions.

- Can add tokens (stablecoins, securities).

- One minute faster blocks.

- Settlement for institutions.

Cons:

- Trust assumptions due to convent system.

- Retail adoption is noticeably less than Liquid.

- Specialized wallets are necessary.

- Less decentralized than the Bitcoin network.

3. Rootstock (RSK)

Rootstock (RSK) is a sidechain to Bitcoin that offers the same services as an EVM compatible sidechain, the ability to provide Smart Contracts and Decentralized Applications (DApps) to the Bitcoin network.

Through merged mining, RSK utilizes Bitcoin’s enormous hash power for enhanced network security, and achieves faster and cheaper transactions with a Bitcoin pegged asset, RBTC. RSK is one of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments.

RSK offers support for DeFi, Lending, and Tokenization, all of which operate in an uncrowded space that does not clog the Bitcoin main chain.

Furthermore, RSK offers Ethereum tool compatibility, which allows developers to bring DApps to the network efficiently while preserving the security of the Bitcoin main chain.

Rootstock (RSK) Features

- EVM-Compatible: Smart contracts on Bitcoin that are Ethereum styled run on RSK.

- Merge-Mined Security: It’s secured by Bitcoin miners via merged mining.

- RBTC Peg: For using dApps, there is a 1:1 peg for BTC and RBTC.

- DeFi Ecosystem: It allows Bitcoin to have lending, borrowing, and decentralized exchanges.

Rootstock (RSK) Pros & Cons

Pros:

- Smart contracts compatible with the EVM.

- Bitcoin miners secure the chain through merged mining.

- DeFi on Bitcoin is now possible.

- dApps that require BTC are made possible by an RBTC peg.

Cons:

- The Pegging of BTC to RBTC is extra complicated.

- The Ethereum Ecosystem is relatively larger.

- Merge mining engagement is inconsistent.

- Smart contracts are still risky like Ethereum.

4. Stacks Protocol

Stacks is a Layer-2 Blockchain and allows you to use smart contracts and build dApps on top of Bitcoin’s base layer, while also ensuring Bitcoin’s security. Stacks also anchors its transactions to Bitcoin using a unique method called Proof of Transfer (PoX).

Stacks is also one of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments. With Stacks, you can use Bitcoin in a more advanced manner and send and receive payments at low fees with faster transaction times.

The network’s native cryptocurrency, STX, is used to drive network activity and power smart contracts on the network. Developers in the ecosystem can build solutions in areas like Web3, identity, and DeFi (Decentralized Finance) directly on Bitcoin’s trust layer.

Stacks Protocol Features

- Smart Contracts: Using the contract language called Clarity, contracts are secure and predictable.

- Anchored to Bitcoin: For security purposes, Bitcoin’s transactions is where it is settled.

- sBTC Integration: sBTC is Stacks’ synthetic BTC for dApps and DeFi.

- Expanding Use Cases: It also provides for other decentralized applications, NFTs, and DAOs.

Stacks Protocol Pros & Cons

Pros

- Bitcoin-anchored smart contracts.

- Expanding ecosystem (NFTs, DAOs, DeFi).

- sBTC integration for BTC-backed dApps.

- Clarity language reduces contract bugs.

Cons:

- Transaction speed slower than Lightning.

- Adoption still growing.

- sBTC peg introduces complexity.

- Competes with Ethereum and Solana ecosystems.

5. Merlin Chain

Merlin Chain is an upcoming Layer-2 Bitcoin network that uses zero-knowledge rollup technology to enhance performance and scalability. This technology allows it to bundle off-chain transactions and relay them to Bitcoin with cryptographic proofs that attest to their validity, thereby lowering fees and increasing performance.

Merlin Chain is also part of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments since it is EVM-compatible and allows developers to build and run Ethereum applications with Bitcoin’s security.

Merlin Chain is suitable for developers and fast transaction users. It also supports DeFi, Gaming, and token ecosystems. It is cross-chain interoperable with Bitcoin as the trust anchor.

Merlin Chain Features

- High Throughput: 2000-3000 TPS

- Low Fees: ~$0.01 per transaction

- EVM Compatibility: full support for Ethereum-based dApps

- Bitcoin Native: Bridges BTC into scalable DeFi ecosystems.

Merlin Chain Pros & Cons

Pros:

- High throughput (2,000–3,000 TPS).

- Very low fees (~$0.01).

- Full EVM compatibility.

- Bridges BTC into scalable DeFi.

Cons:

- Newer ecosystem, adoption still early.

- Security model less proven than Lightning.

- Relies on bridging infrastructure.

- Regulatory risks with tokenization.

6. Satoshi VM

With the help of zero-knowledge proof technology, Satoshi VM has become the world’s first fully operational Layer-2 Bitcoin Virtual Machine. Partnered with the Bitcoin network, Satoshi VM processes transactions off-chain before transferring them to the main network for valid proof, making the channel extremely fast.

As one of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments, Satoshi VM emphasizes scalability on Bitcoin network tokenized assets, NFTs, and DeFi. Their rollup-based framework allows for optimum performance.

Additionally, it is one of the few networks that offers state-of-the-art cryptographic protection and scalability, making it one of the most secure networks on which to develop performance-driven apps.

Satoshi VM Features

- ZK Rollup Architecture: zero knowledge Scalability and security via rollups.

- BTC as Gas: pay transaction fees in Bitcoin.

- EVM-Compatible: Ethereum smart contracts on Bitcoin.

- Cross Ecosystem Bridge: Bitcoin and Ethereum DeFi bridge.

Satoshi VM Pros & Cons

Pros:

- ZK Rollup architecture for scalability.

- BTC used as gas for transactions.

- EVM-compatible smart contracts.

- Strong interoperability with Ethereum DeFi.

Cons:

- ZK tech is complex and resource-heavy.

- Ecosystem adoption still limited.

- Bridging risks between BTC and Ethereum.

- Early-stage project with evolving security.

7. Dovi (Bitcoin Layer-2)

As one of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments, Dovi is a Bitcoin Layer-2 with a rapid processing time, low transaction fees, and strong Bitcoin base-layer security.

Dov’s provides tools to facilitate cross-chain transactions and multi-asset transfers. Consistent with other Bitcoin Layer-2 solutions, Dovi integrates smart contracts, tokenization, and decentralized finance to the Bitcoin blockchain.

Dovi provides a robust financial network and transforms Bitcoin into more than a simple store of value. Users can create applications, trade, and lend on Bitcoin-based assets.

Dovi (BTC Layer-2) Features

- Scalability Focus: to facilitate increased BTC transaction throughput.

- Off Chain Processing: relieving congestion on Bitcoin’s base chain.

- Programmability: smart contract-like features.

- Early Stage: still emerging, adoption curve and ecosystem development.

Dovi (Bitcoin Layer-2) Pros & Cons

Pros:

- Focused on scalability and efficiency.

- Off-chain processing reduces congestion.

- Programmability for BTC-based apps.

- Potential for innovation in payments.

Cons:

- Very early-stage, adoption minimal.

- Limited documentation and ecosystem.

- Security model not fully tested.

- Competes with more established L2s.

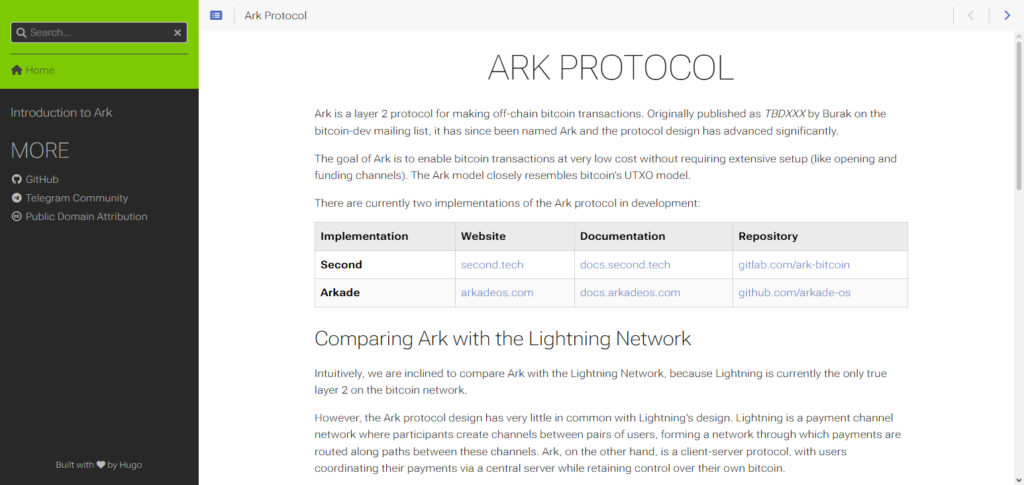

8. Ark Protocol

Ark Protocol is a novel Bitcoin scaling method that incorporates the use of virtual UTXOs for quick and versatile off-chain payment options. Unlike other systems that use channels, Ark solves the problem of channel liquidity and helps users avoid having to manage complex liquidity by using dynamic transaction routing.

Ark is designed to be user-focused and ease the Bitcoin payment experience for participants in daily transactions.

Ark ensures that wallets and payment systems that want to problem-solve with instant settlement are not burdened with the headaches of traditional Lightning channel complexities. Ark’s design emphasizes construction that is private, efficient, and with a low, on-chain footprint.

Ark Protocol Features

- No Channels Needed: Payments without Lightning-style channel requirements.

- ASP Model: Ark Service Providers batch transactions off-chain.

- Low-Cost Payments: BTC transfers that are efficient and scalable.

- Unilateral Exit: Independent user exit for security.

Ark Protocol Pros & Cons

Pros:

- Payments with no requirements like channels (simpler than Lightning network).

- ASPs improve transactional efficiency.

- BTC transfers are inexpensive.

- Users are able to leave on their own for security reasons.

Cons:

- Dependent on Ark Service Providers (semi-trusted).

- Ecosystem uptake is still minimal.

- Still not widely incorporated into wallets.

- ASP centralization risks.

9. Mintlayer

Mintlayer is a Bitcoin-anchored sidechain that is focused on tokenization, decentralized finance, and secure asset exchange. It offers BTC-related transactions that are faster and more cost-effective while being able to support atomic swaps, NFT issuance, and decentralized markets.

Considering it as one of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments is accurate. Mintlayer’s design also accommodates developers who wish to create financial services applications while maintaining Bitcoin’s core security principles.

Its design also facilitates free movement of assets between the sidechain and Bitcoin’s main chain, fostering innovation in payments, trading, and the management of digital assets.

Mintlayer Features

- Tokenization: issue tokens directly on Bitcoin.

- DEX Support: built-in decentralized exchange functionality.

- Smart Contracts: programmable Bitcoin-native DeFi.

- Proof-of-Stake: energy efficient consensus mechanism.

Mintlayer Pros & Cons

Pros:

- Enables tokenization on Bitcoin.

- Built-in DEX support.

- Bitcoin-native DeFi smart contracts.

- Energy-efficient Proof-of-Stake consensus.

Cons:

- Competes with Ethereum and other DeFi chains.

- Still early-stage adoption.

- Less security compared to Bitcoin’s PoW with PoS.

- Needs specialized wallets.

10. Mezo

Mezo is developing as a network for economic activities on Bitcoin’s Layer-2, allowing users to stake and secure the network with BTC, earning fees and accessing dApps. Mezo focuses on scalability, low fees, and EVM compatibility, which allows developers to implement smart contracts and additional financial services.

Mezo is recognized as one of the Best Bitcoin Layer-2 Solutions for Fast & Cheap BTC Payments. Mezo is creating an ecosystem of sustainable use for BTC within DeFi, lending, and yield generation. It is designed to combine the advanced programmability of modern blockchains with Bitcoin’s unparalleled security.

Mezo Features

- Proof of HODL: consensus based on holding Bitcoin.

- Bitcoin DeFi: lending, borrowing, and liquidity provision.

- Yield Generation: Make BTC work for you.

- Economic Layer: Claims to be the financial spine for Bitcoin.

Mezo Pros & Cons

Pros:

- Proof of HODL is incentivizing for BTC holders.

- Facilitates lending, borrowing, and liquidity.

- BTC is made into a productive asset.

- Claims to be Bitcoin’s “economic layer.”

Cons:

- Very new and adoption is limited.

- Smart contract exploits are a yield farming risk.

- Lending/borrowing attracts regulatory scrutiny.

- Consensus model unproven at large scale.

Why Bitcoin Needs Layer-2 for Everyday Payments?

Because its base layer is optimized for security and decentralization rather than high transaction volume, Bitcoin requires Layer-2 solutions for regular payments. During network congestion, on-chain transactions may be delayed and fees may increase, making simple, everyday purchases unfeasible.

Higher transaction throughput, ultra-low fees, and fast or nearly instantaneous confirmations are made possible by Layer-2 networks, which shift the majority of activity off the main chain.

Because it settles final balances on the main chain to maintain Bitcoin’s robust security and trustless design, this makes it appropriate for real-world use cases including retail payments, remittances, subscriptions, and micropayments.

Key Benefits of Using Bitcoin Layer-2 for Payments

Below are the Key Benefits of Using Bitcoin Layer-2 for Payments that are semantically clear for blogs and guides.

Instant Transactions: It takes seconds or even milliseconds to confirm payments. This makes Bitcoin usable for purchases in-store, online, and for real-time digital payments.

Lower Fees: Since Layer-2 networks shift transactions to off the main chain, the associated costs decrease significantly. This is excellent for transactions that are small and occur often.

Higher Scalability: Layer-2 networks are able to add thousands of transactions to the Bitcoin network without clogging the base layer.

Improved User Experience: Simple wallet integrations and faster confirmations smooth out the payment process for customers and sellers.

Enhanced Privacy: Certain Layer-2 products keep transactions off the main blockchain, restricting on-chain information to only the parties involved.

Global Accessibility: Cross-border payments and remittances are possible without banks or intermediaries, and can be done at a lower cost.

Micropayments Support: Support for very small transactions, subscription services, and pay-per-usage services.

Maintained Security: Transactions are secured using the Bitcoin main chain for a final settlement ensuring that the Bitcoin network stays decentralized and secure.

FAQ

How fast are Bitcoin Layer-2 payments compared to on-chain transactions?

Bitcoin’s base layer processes about 7 transactions per second with confirmation times ranging from 10 minutes to over an hour during congestion. Layer-2 networks like Lightning enable near-instant payments, often settling in seconds.

How much cheaper are Layer-2 transaction fees?

On-chain Bitcoin fees can rise to several dollars during peak usage. Layer-2 fees are typically fractions of a cent, making micropayments and everyday purchases economically viable.

Are Bitcoin Layer-2 solutions secure?

Yes. Most Layer-2 systems settle final transaction states back on Bitcoin’s main chain, inheriting its hash power, decentralization, and cryptographic security.

Can Layer-2 handle high transaction volume?

Yes. Layer-2 networks can process thousands of transactions per second, compared to Bitcoin’s limited base-layer throughput, enabling global-scale payment adoption.

Where are Bitcoin Layer-2 payments most commonly used?

They are widely used for retail payments, online commerce, gaming, subscriptions, and cross-border remittances, especially in regions where traditional banking is slow or expensive.