By 2026, Best Tokenized Silver Assets to Invest will be revolutionizing the industry of precious metal investing, silver will be digitally owned, and investors will have contol. Investors have the ability to trade, transfer or redeem real silver, combining the stability of silver bullion with modern tech.

With options that range from fractional ownership to ESG focused, selecting the optimal tokenized silver asset will provide liquidity, diversification of the portfolio and exposure to one of the most trusted commodities.

What are Tokenized Silver Assets?

Silver assets on the blockchain represent actual physical bullion. Each token gives you ownership of a legal claim of a specific quantity of the metal, usually one ounce. These assets offer a combination of the reliability of silver and the efficiency of distributed ledger technology.

The tokens in question are controlled by smart contracts guaranteeing that the process is safe and transparent for every investor. Providers can enable fractional ownership and instant settlement by employing blockchain technology. No costly middlemen or the burdens of physical transport are required for trading.

There has been significant growth in commodity tokens recently, with a total market cap that has exceeded four billion dollars. Investors looking for a hedge against inflation and wishing to trade silver any time of the day can now trade digital silver. The analytics of the market show that digital silver is becoming a top option for the diversified portfolios of the new generation.

Key Point

| Token Name | Key Features |

|---|---|

| Kinesis Silver (KAG) | 1:1 backed by physical silver in audited, insured vaults |

| iShares Silver Trust (SLVON) | Tokenized SLV ETF representation |

| Silver Token (XAGX) | Pegged to physical silver |

| Gram Silver (GRAMS) | Gram-denominated fractional silver ownership |

| Wealth99 Silver Token | Backed by one troy ounce per token |

| STBL Silver | Asset-backed token with redemption options |

| Carbon-Neutral Silver Token (BlockApps CNS) | Backed by real silver bars on Ethereum |

| Silver rStock (SLVR) | Tracks silver price exposure |

| Comtech Silver / AGS Token | Fractional ownership of physical silver |

| Emerging Exchange-Listed Silver Tokens (WEEX, etc.) | New tokenized silver products |

1. Kinesis Silver (KAG)

One of the most Kinesis Silver (KAG) is among the most trusted tokenized silver assets. Each of the KAG tokens is backed 1:1 by physical, investment-grade silver stored in insured and audited vaults globally.

KAG offers legal ownership of the underlying bullion, with transparent reserves due to regular audits. KAG holders, unlike most competitors, are paid monthly passive yields in silver from a share of the platform transaction fees.

KAG has been trading in the range of $109 and $116, which is attributable to the movements of the physical silver market. KAG holders can redeem physical silver (with minimums), which strengthens KAG for both long-term and diversified investment portfolios.

Kinesis Silver (KAG) Key Features:

- Backed with 1:1 physical silver which is insured and audited in vaults.

- Monthly passive yield from platform fees.

- Low latency on-chain transfers.

- Card spend and physical redemption options supported.

Pros:

• Silver token yield is uncommon and this one offers it.

• Audit reporting provides great transparency.

• Kinesis ecosystem and major exchanges offer strong liquidity.

Cons:

✧ There may be redemption minimums.

✧ There is some counterparty risk with the custodial model.

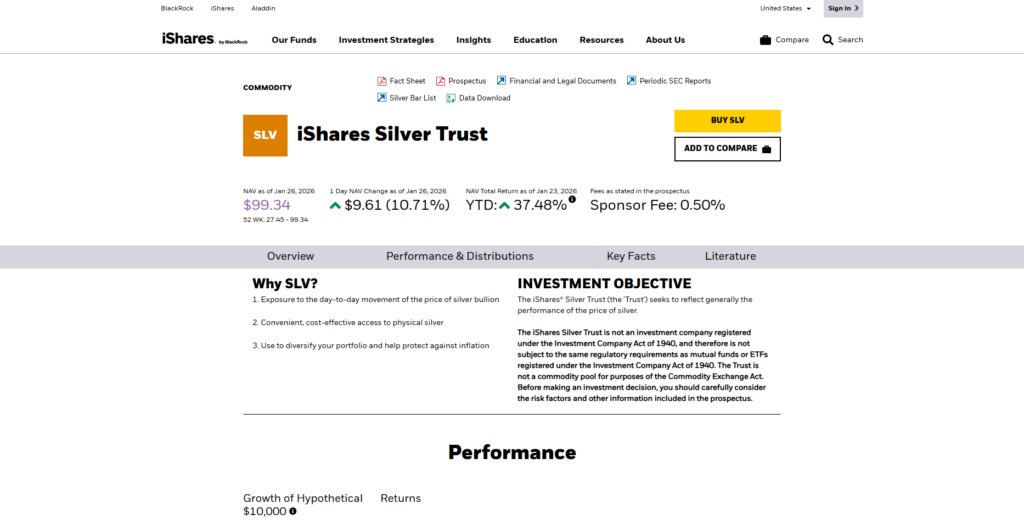

2. iShares Silver Trust (SLVON)

iShares Silver Trust (SLV) Tokenized as SLVON is the iShares Silver Trust ETF, a classic investment vehicle in the silver market, and is a widely used investment vehicle in the silver market.

SLVON holders benefit from real world ETF like exposure with price and liquidity proximity to silver market (trading at approx $96 – $98 per token). SLVON integrates traditional asset trust structure with blockchain, offering mainstream silver exposure in a digital format.

The benefits of redemption and trading are dependent on support from the trading platform, while the regulatory structure and global liquidity pool add to the trustworthiness of the asset. This asset suits investors who prefer ETF like exposure with liberal trading hours.

iShares Silver Trust (SLVON) Key Features:

- Tokenized shares of the SLV ETF.

- 24/7 trades on blockchain networks.

- Silver institutional holds.

- Investment structure is regulated.

Pros:

• Digital accessibility with ETF security.

• Liquidity is deep with tracking of the price.

• Regulation provides trust.

Cons:

✧ There is little on-chain utility aside from trading.

✧ Operations of the SLV ETF are a dependence.

3. Silver Token (XAGX)

XAGX is a blockchain-based silver-pegged asset that mirrors the price of one physical silver oz. XAGX is trading between $96 – $125 based on the exchange and listing. It is issued on the Avalanche C-Chain with smart contracts and liquidity on a few selected exchanges.

unlike fully allocated vault bullion-backed tokens, XAGX focuses on chain, unrestricted trading, and price exposure. Although there is no extensive vault redemption, yields and monthly issued tokens.

XAGX provides a better cost of entry and better liquidity on decentralized trading platforms, compelling it as an option to traders and speculators interested in silver with less complexity. Investors need to analyze smart contracts and liquidity risks.

Silver Token (XAGX) Key Features:

- Physical silver price pegged.

- Decentralization through blockchain issuance.

- Accessible trading with low entry cost.

- DeFi protocols integrations.

Pros:

• There is pretty on-chain liquidity.

• Cheaper than other physically backed tokens.

• Rapid settlements.

Cons:

✧ Lack of yields distributed.

✧ Lack of physical tokens.

4. Gram Silver (GRAMS)

Each GRAMS token gives a holder the right to a supply of one gram of physical silver backing. GRAMS provides a great opportunity for retail investors that prefer investing in smaller amounts as they are priced between $3.24 and $3.72 per token. They keep investing simple as compared to ounce-based tokens.

They were launched on EVM-compatible chains (Avalanche/Polygon) allowing for 24/7 trading. They provide rapid settlement, smart contracts that manage reserve collateralization, and seamless border transfers. They are a great option for beginners and smaller trading investors because of their fractional exposure and simplicity.

Although their market cap and liquidity are lower than options like KAG, they are still a great option for those looking to invest in silver tokens and not having to worry about their minimum holdings.

Gram Silver (GRAMS) Key Features:

- Physical backing of gram denomination.

- Fractional ownership.

- Inclusive of small value investors.

- Can be transferred on the blockchain.

Pros:

• Available to small investors.

• Easy to see value linked to gram silver.

• Settlement on the blockchain.

Cons:

✧ Less liquidity of tokens compared to other gram ounce denominated tokens.

✧ Less listings on exchanges.

5. Wealth99 Silver Token

Wealth99 Silver Token is a vault‑backed digital silver asset secured with institutional custody (like BitGo) and a secure 2FA and AES-256 encryption. Each token represents real silver that is secured in insured vaults with free professional storage and buy-back support at market rates. This is appealing to investors that value simplicity, and security.

There token’s benefits include KYC/AML compliance, a low minimum investment, and simplicity to use. They are great for the diversified conservative investor looking for a secure and reliable option. Their regulated custody and simple verification makes them great for conservative and diversified investors.

Wealth99 Silver Token Key Features:

- Silver backing tokens with insured physical custody.

- Transparent market rates for buy backs.

- Custody at the institutional level.

- Platform custody at the user level.

Pros:

• Custody and protection is secure.

• Exiting the investment is made easier with buy backs.

• Customers are onboarded easily.

Cons:

✧ Advanced trading is not possible.

✧ There is no self custody because of the level of custody.

6. STBL Silver

STBL Silver is an example of a modern, simple digital token. Each STBL Silver token is backed with 1:1 physical silver, with direct ownership, quick redemption, and on-chain utility. Every STBL Silver token is backed by 1 troy ounce of silver that is LBMA-accredited and allocated to insured vaults that can be verified on the blockchain.

They can also be integrated with DeFi and custodial environments, which provides secure ownership and programmable transparency of your assets. Although market prices and silver rates change daily, STBL Silver will offer the combined stability of a physical metal and the digital liquidity and payment options with a linked wallet and possibly a card.

For these reasons, STBL Silver is great for investors looking for liquid, programmable, and spendable tokenized silver exposure.

Silver STBL Key Features:

- Silver backing of the allocated proven LBMA.

- Transfers and issuance on-chain.

- Can be redeemed for metal.

- Redemption chains with DeFi.

Pros:

• Real world value with metal redemption.

• Good liquidity on blockchain.

• Transparency and accountability.

Cons:

✧ There are no simple instructions for use.

✧ There is a potential for redemption fees.

7. Carbon‑Neutral Silver Token (BlockApps CNS)

The Carbon-Neutral Silver Token by BlockApps (CNS) is a new token on the Ethereum blockchain that is backed by physical silver from a certified carbon-neutral source. He token is designed for sustainable investing and provides proof of carbon-neutral sourcing.

The token adds an eco-friendly shield to the silver it tokenized while also providing real silver exposure with a lesser environmental impact, suitable for ESG investors.

Pricing data for the CNS is not yet available on the major aggregators for tokenized silver due to its novelty, but he made it a desirable alternative to the typical tokenized silver.

Investors looking to diversify and wanting exposure to digitally represented green commodities will appreciate this blend of physical asset security, accessibility through blockchain, and environmental sustainability.

Carbon‐Neutral Silver Token (BlockApps CNS) Key Features:

- Physically allocated, fully (1:1) backed by silver.

- Carbon neutral.

- Ethereum based.

- Focus on sustainable commodities.

Pros:

• Complies with ESG investing.

• Great for environmentally conscious investors.

• Transparent on the blockchain.

Cons:

✧ Larger premium than other tokens.

✧ Less established, so it’s more illiquid.

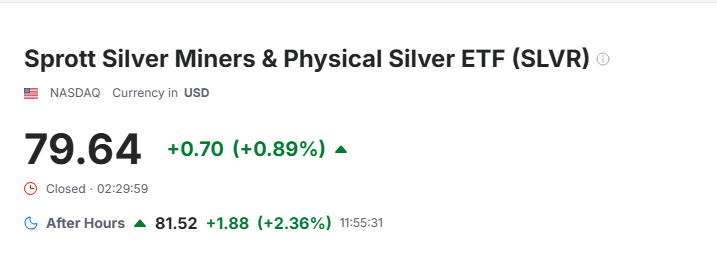

8. Silver rStock (SLVR)

Silver rStock (SLVR) is designed for people seeking exposure to silver prices via a tokenized stock framework. Current SLVR pricing data indicates it is trading approximately $96 on tokenized markets and has limited liquidity.

SLVR offers a different solution for direct bullion tokenization by simulating SLVR price movements within a tokenized securities ecosystem.

SLVR is designed to provide price exposure to silver and is ideal for people who want a stock-linked exposure and tokenized convenience and who prefer to trade on decentralized or hybrid platforms. Investors are encouraged to evaluate liquidity and exchange availability for SLVR.

Silver rStock (SLVR) Key Features:

- Silver price tracking via a tokenized stock structure.

- Simple integration into your portfolio.

- Correlates with silver market pricing.

- Can be traded on certain digital asset exchanges.

Pros:

• Provides stock-like exposure.

• Works well for portfolio diversification.

• Very easy to do price tracking.

Cons:

✧ Possible that there is no direct physical silver backing.

✧ Dependent for support on the trading venue used to create the token.

9. Comtech Silver / AGS Token

Comtech Silver and AGS Token provide users with fractional ownership of silver bullion with tokens typically backed by grams of silver in accredited vaults. Investors wanting to own small units of silver on a decentralized network find these tokens provide convenient and affordable silver ownership.

While tokens backed by silver may be perceived to have small market caps and limited audiences, there is strong demand for these tokens in emerging markets and for portfolios that require diversification.

Physical silver tokens, like AGS and Comtech Silver, are valued through a direct correlation with the price of silver, and token holders are encouraged to monitor prices in real-time.These tokens are ideal for holders wanting a low barrier to entry for acquiring tokenized precious metals.

Comtech Silver / AGS Token Key Features:

- Partial bullion backing.

- Built on fully decentralized networks.

- Small denomination investment opportunities.

- Transfers available peer-to-peer.

Pros:

• Provides a low investment threshold for access by small investors.

• Completely on the blockchain.

• Flexible exposure on the fractional side.

Cons:

✧ Comes with niche market appeal and is more illiquid.

✧ Limited integration with larger trading platforms.

10. New Exchange-Listed Silver Tokens (WEEX, etc.)

New Exchange-Listed Silver Tokens—such as soon to be available assets on WEEX—are the first of what will be many tokenized silver products aimed at improving liquidity and trading. This type of asset diversifies the tokenized silver space by offering regulated, exchange-traded, and transparently backed tokens that may be linked to silver or silver ETFs.

Depending on the exchange and the token, prices will typically be a little over silver’s spot price due to additional trading features on both centralized and decentralized exchanges. These tokens are characterized by better access, greater liquidity, and integration with more complex financial systems, thus ideal for investors that want liquid, tokenized silver for the future.

Newly Listed Silver Tokens on Exchanges (WEEX, etc.) Key Features:

- Listings on exchanges.

- Compliant with regulations.

- Potential for a strong order book.

- Available for trading on multiple markets.

Pros:

• Liquidity is enhanced with trading on an exchange.

• Streamlined user onboarding.

• Generally connects to actual assets or ETF exposure.

Cons:

✧ Still developing with changing criteria.

✧ Could potentially incur higher exchange fees.

How to Choose a Tokenized Silver Asset?

Physical Backing & Audits – Each of the token audits should verify that the allocation is fully backed and the silver is stored in insured vaults.

Regulatory Compliance – Select platforms that are compliant are legally recognized and follow KYC and AML to reduce the chance of legal issues and ensure the platform is here to stay.

Blockchain Network Reliability – To ensure tokens are reliable, choose blockchains that are secure, well known, low fees, decentralized, and have a strong developer community.

Liquidity & Exchange Listings – Assess the accessibility to central and decentralized exchanges to guarantee fair buying and selling in the market without causing too much slippage.

Redemption Options – Choose assets that provide the option to redeem tokens for silver or cash in order to guarantee the token has a metal value.

Storage & Insurance Coverage – Confirm vault locations, insurance details, and custodians to ensure the underlying silver is safe and is covered in the case of any operational issues.

Fee Structure Transparency – Analyze the fees related to custody, transactions, and redemption to ensure that the overall return of investments are not eroded.

Issuer Credibility & Track Record – Evaluate the credibility, operational soundness, and long-term dedication of the issuing firm to tokenized commodities by analyzing its history, partnerships, and prior ventures.

How to Buy Tokenized Silver?

Below, you will see a step-by-step guide using Kinesis Money (KAG) as an example:

Creating an Account: Sign up for Kinesis Money, verify your KYC, and enable two-factor authentication to open trading, earning, and paying out features.

Adding Money: Load your Kinesis wallet with a supported Fiat, cryptocurrency, and the funds to complete transactions.

Acquiring Tokenized Silver (KAG): Go to the trade window, select KAG, your desired order type, complete the trade, and, to receive, trade silver for tokens your on-screen wallet.

Storing or Moving Tokens: Keep KAG in your Kinesis wallet or move to an external wallet in full control and ownership your digital silver assets (from Kinesis).

Physical Silver Redemption: Pay fees and select your delivery or settlement preference to complete the platform’s insure redemption to initiate cash or silver delivery.

What are the Risks Associated with Digital Silver Assets?

Investors considering the risks related to digital silver should take the time to familiarize themselves with the risks involved in investing in this early-stage asset class in decentralized finance.

Counterparty Risk. The investor must trust with the issuer of the digital tokens to keep physical silver reserves that are equal to the silver tokenized.

Regulatory Risk. The dynamic nature of the global regulatory environment may result in the loss of legal permissibility of these 1:1 backed commodities which will have an impact on access to the market and liquidity of the asset.

Smart Contracts. Exploit of the protocol and the minting by an adversarial actor may result in a loss of funds due to the vulnerabilities in the underlying smart contract code.

Price Risk. Silver is a highly volatile commodity, and its price will drop significantly during times of high market stress and dollar strength.

Access to Physical Silver. A digital token may have to be redeemed for 1 kilogram of silver, which may be subject to high minimums and / or large cross-border shipping vault fees.

Centralization Risk. A lot of these tokenized projects have centralized control over the minting of the tokens, which is in opposition to philosophies of fully decentralized investing.

Liquidity Risk. Smaller tokens that represent an equivalent value of silver may suffer from a lack of volume that results in slippage of a percent or more when a trader attempts to execute large market orders.

Cyber Security: vigilance is needed at all times when it comes to the 24/7 protection of digital assets. This is especially true with phishing attacks and compromised wallets aimed at inexperienced retail precious metals investors.