With the crypto derivatives market constantly evolving, Derive.xyz Trading Platform Alternatives has opened up in order to give traders more liquid, wide ranged, and flexible custody models. These platforms have liquid custody models, trade sizes, and crypto derivatives.

These platforms have fully decentralized, non-custodial models. Some of these models have more volume, very centralized, and custodial models. In this case, we will highlight the most innovative models that will best suit the needs of both institutional and retail traders in order to make a more flexible and sophisticated crypto market.

What is Derive.xyz?

With institutional-level speed and efficiency, users can trade on-chain options, perpetual futures, and spot instruments on Derive.xyz, a self-custodial, high-performance cryptocurrency trading platform. It is based on Ethereum and combines the sophisticated order book mechanics of centralized exchanges with the transparency of decentralized finance (DeFi).

Its Rust-powered infrastructure can process up to 20 million transactions per second. Both retail and institutional traders can benefit from Derive.xyz’s support for portfolio margining, cross-asset collateral (such as stablecoins, staked ETH, and BTC), and block RFQ for big deals.

It distinguishes itself as a next-generation derivatives protocol in the DeFi ecosystem with audited, zero-trust security principles and an emphasis on capital efficiency.

Key Point

| Platform | Key Point |

|---|---|

| dYdX | Decentralized perpetual trading platform offering deep liquidity, advanced order types, and self-custodial on-chain settlement for professional traders. |

| Deribit | Leading crypto options and futures exchange known for high liquidity, tight spreads, and institutional-grade risk management tools. |

| Binance Futures | High-volume derivatives platform supporting hundreds of perpetual and futures pairs with competitive fees and advanced trading features. |

| Bybit | User-friendly derivatives exchange offering perpetuals and options with fast execution, copy trading, and strong liquidity. |

| OKX Derivatives | Comprehensive crypto derivatives platform providing futures, perpetuals, and options with multi-asset support and advanced margin systems. |

| Perpetual Protocol | Decentralized perpetual futures platform enabling on-chain leveraged trading through virtual AMMs and low-slippage liquidity pools. |

| GMX | DeFi perpetual exchange using a multi-asset liquidity pool model for low fees, real-time pricing, and non-custodial trading. |

| Aevo | Decentralized options and perpetuals exchange featuring off-chain order books with secure on-chain settlement on Ethereum rollups. |

| Bulk Trade | Solana-based decentralized derivatives platform focused on high-speed perpetual futures with low latency execution. |

| Contango | On-chain derivatives protocol enabling leveraged perpetual trading and yield-based strategies in decentralized finance ecosystems. |

1) dYdX

One of the oldest decentralized derivatives exchanges is dYdX, which offers users perpetual futures trading at 50× leverage across 220+ markets, including Bitcoin and Ethereum. dYdX started from Ethereum Layer 2 and is currently on its own Cosmos-based chain.

dYdX promotes non-custodial trading which allows traders to fully control their funds, rather than putting them at risk with a centralized exchange.

It offers Derive.xyz users deep liquidity, advanced order types, quick settlement, and low-cost trading. This is why dYdX is preferred by sophisticated traders who care about on-chain transparency and security.

dYdX Key Features:

- Decentralized perpetual futures exchange. On-chain settlement.

- Non-custodial wallet trading.

- Limit, stop, and take-profit order trading.

- Cross-margin and risk portfolio management.

- Community governance via a native token.

Pros:

- Self-custody, secure full control of funds.

- Trustless environment for trading.

- Cheap trading fees.

- Order matching has a high-performance algorithm.

Cons:

- Pairs with fewer assets than bigger CEXs.

- Less liquidity in smaller markets.

- Complex arms of Web3, discouraging new users.

2) Deribit

Deribit is also a centralized exchange, and one of the most popular crypto derivatives exchanges. It serves the global market and is well-known for its liquidity for ETH and BTC options and futures.

It serves as a Derive.xyz alternative and provides a plethora of tools for its users, which has made the exchange a popular hedging and speculating tool.

Deribit was founded in 2016 and is currently owned by Coinbase. It has diverse product offerings including futures, options, and perpetuals and provides high leverage with strong risk management and analytics for strategy development.

Deribit Key Features

- The industry’s top platform for trading crypto options.

- Futures and perpetual contracts available.

- Sophisticated risk and margin management.

- An engine for extremely rapid order execution.

- Complete trading and analytical dashboards.

Pros:

- The leading liquidity in BTC and ETH derivatives.

- Narrow spreads with low trading fees.

- High reliability with institutional traders.

- Consistent platform reliability.

Cons:

- CEXs and fund management.

- Cannot use the platform without KYC.

- Derivatives for altcoins are limited.

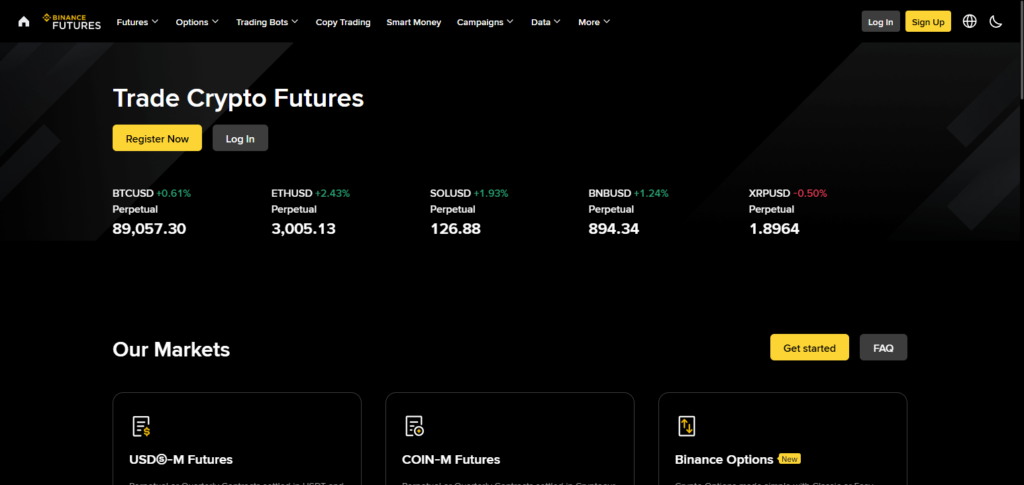

3) Binance Futures

Binance Futures serves as the derivatives division of one of the world’s biggest centralized crypto exchanges, Binance. As a Derive.xyz Trading Platform Alternative, it offers a unique selection of perpetual and futures contracts for hundreds of tradable assets. They are also known for their strong and unmatched liquidity, as well as their cheap prices.

Traders are also able to benefit from almost 125x leverage, trading tools, and other liquidity related trading services, such as copy trading and grid bots. Their liquidity and advanced trading tools are why they are known and used among retail and institutional traders.

Binance Futures Key Features:

- Countless futures and perpetual opportunities.

- Major asset high leverage options

- Copy trading and trading bots integrated

- VIP program and tiered discounts on fees

- Direct access to Binance ecosystem

Pros:

- Very high liquidity

- Broad variety of supported assets

- Solid security

- Access from anywhere and support for fiat

Cons:

- Risk of a centralized platform

- Beginners may find the platform complicated

- Varying country regulations

4) Bybit

Bybit is among the most popular centralized derivatives exchange. They have a uniform focus on ease of use and functionality, especially during periods of high volatility. Bybit is recognized as Derive.xyz Trading Platform Alternative. They provide a seamless UX, while some competitors also maintain high volatility.

In addition to solid UX, they also have high customer support responsiveness. As far as derivatives traders, they have low risk management, high financial uptime, insurance funds, and substantial use of high trading strategies. They also have a decent focus on high interactivity for newer users, along with high liquidity.

Bybit Key Features:

- Access to crypto options, futures, and perpetuals trading

- Flexible margin modes and high leverage

- Demo trading and copy trading features

- Order execution speed

- Integrated analytics and trading dashboard

Pros:

- Liquidity on major pairs is strong

- Active trader incentives and rewards

- Good customer support

- Platform is easy to use

Cons:

- Model of custodial platform

- Listed markets are less than Binance

- Full access requires KYC

5) OKX Derivatives

With the range of available crypto assets, OKX Derivatives is a centralized trading platform which combines futures, perpetuals and options.

For algorithmic trading as a Derive.xyz Trading Platform Alternative, OKX posits portfolio margining, multi-collateral support, and other institutional-grade tools, with added trading bots.

Integrated wallet, launchpad, and tools with centralized and decentralized ecosystems all enhance multi-product trading beyond basic options. OKX is adaptable for professional algo traders and active retail users as it provides a broad variety of contract types and high leverage.

OKX Derivatives Key Features:

- Options, perpetuals, and futures trading

- Professionals’ portfolio margin system

- Automated and algorithmic trading

- Web3 wallet and DeFi access

- Support for multi-asset collateral

Pros:

- Trading fee competitiveness

- Flexible platform for both web and mobile

- Advanced tools for institutional traders

- Derivative products that are extensive

Cons:

• User complexity

• Custody risks

• Trading restrictions by region

6) Perpetual Protocol

As a Derive.xyz Trading Platform Alternative, Perpetual Protocol provides users with self-custody on a decentralized futures trading platform, where they can trade perpetual contracts on-chain. It was the first to use a virtual automated market maker (vAMM).

Using Layer-2 solutions like Optimism and Ethereum, he provides leveraged trading on digital assets. In addition to being transparent, he is open to all governance models. Consensus and decision-making for the protocol can also be obtained through the staking of PERP tokens.

Perpetual Protocol Key Features:

- Trading of perpetual futures in a decentralized manner

- Non-custodial execution of smart contracts

- Virtual AMM pricing system

- Layer-2 Ethereum integration

- Staking and governance through the native token

Pros:

• Trading is completely permissionless

• Operations are transparent and on-chain

• No centralized counterparty risks

• Staking governance is community-based

Cons:

• Less liquidity than major centralized exchanges

• Risks of smart contracts

• Limited number of available trading pairs

7) GMX

With a pooled liquidity model, GMX provides a combined service of spot and leverage trading. This also allows them to use a fully decentralized system for perpetuals through non-custodial trading.

While Derive.xyz is a trading platform, GMX is a trading platform that is able to provide services on some of the same assets, such as BTC, ETH, AVAX, etc. GMX also has some additional features, such as offering ~100x leverage, low trading fees, and rewards, which are provided as incentives to liquidity providers.

GMX can be viewed as a multi-chain trading platform, since it is on multiple chains: Arbitrum and Avalanche. Therefore, GMX can provide a custodial free decentralized derivative trading experience.

GMX Key Features

- Range of decentralized spot and perpetual trading.

- Pricing model based on liquidity pools.

- Support for multiple chains.

- Real-time pricing with leveraged trading.

- Liquidity providers are rewarded.

Pros:

- Trades are non-custodial.

- The environment has low trading expenses.

- The interface is straightforward and uncluttered.

- Token holders can earn yields.

Cons:

- Restrictions on the number of sophisticated order types.

- The liquidity of the platform is reliant on the depth of the pool.

- Intermediate diversity of distinct assets.

8) Aevo

Aevo, as a Derive.xyz alternative, is a performant decentralized derivatives exchange that has been built for options and perpetuals. It features an off-chain for the matching engine and on-chain for the settlement, which is a design choice that optimizes for speed and security.

With Aevo, you can utilize a unified margin system, which empowers you to manage multiple derivative positions through a single interface. Aevo has been designed to provide low latency, deep liquidity, and a rich selection of order types for all levels from beginner to expert.

Its features even support sophisticated order types for complex trading strategies, both speculative and professional. Its staking and governance mechanisms included in the tokenomics also promote positive long-term participation in the ecosystem.

Aevo Key Features

- A decentralized exchange for perpetual and options trading.

- Off-chain order matching and on-chain settlement.

- Unified margin system.

- A trading engine optimized for high performance.

- Staking and governance.

Pros:

- Rapid execution of trades.

- Advanced options strategies.

- Control of the funds is non-custodial.

• Professional-grade trading tools

Cons:

• Steep learning curve

• Smaller user base

• Limited asset coverage

9) Bulk Trade

Using a high throughput on-chain matching system, Bulk Trade, a decentralized perpetual futures exchange on Solana, seeks to close the gap between central and decentralized finance in a performant way.

As a sub-400 ms execution time, deep liquidity, and a central limit order book (CLOB) style model competitor to Derive, Bulk Trade improves execution quality and reduces latency by directly on-chain trading.

Bulk Trade is becoming sufficient in this derivatives space as it garners attention from high-frequency and derivatives traders for Bulk Trade’s CEX (centralized exchange) like speed, transparency, and self-custody within decentralized finance (DeFi) systems.

10) Contango

Contango is a decentralized, non-custodial on-chain protocol for leveraged perpetual trading. As a Derive.xyz Trading Platform Alternative, Contango allows traders to operate freely with long and short positions on certain crypto assets.

Contango is fully automated with the use of smart contracts with certain integrations of yield-enhancement features and strategies bundled with the Contango offer in the ecosystem of DeFi (Decentralized Finance) systems.

Contango is thus able to offer a merger of hedging, speculation, and passive income through the various services within DeFi. The absence of KYC and the decentralized component drive traders to self-custody and transparency through Contango.

Contango Key Features:

- On-chain perpetual trading protocol

- Non-custodial smart contract system

- Leverage and yield-based strategies

- DeFi ecosystem integrations

- Modular trading architecture

Pros:

- • Permissionless market access

- • Transparent and trustless execution

- • Flexible trading strategies

- • Strong DeFi compatibility

Cons:

- • Low liquidity compared to CEXs

- • Technical complexity for beginners

- • Smart contract risks

Why Traders Seek Alternatives?

Here are 25-word points on Why Traders Seek Alternatives.

Alternatives for traders may provide better liquidity, tighter spreads, and faster execution which enables seamless large order fills, avoiding excess slippage and price drops.

Others use alternative platforms for higher leverage, more derivatives, and advanced trading instruments available to accommodate both aggressive tactics and professional risk management.

Some users appreciate trading platforms with lower trading costs, and funding and withdrawal rates to improve profitability in long-run, high-frequency trading.

Often traders go to platforms with more asset classes, such as emerging tokens, synthetic assets, and others for better portfolio diversification and opportunity discovery.

Traders in large part seek alternatives to improve custodial models, self-custody, and smart contracts with audit to decrease counterparty risk and reliance on CEX.

Conclusion

Market data reveals a distinct divide between decentralized platforms like dYdX, GMX, Aevo, and Perpetual Protocol, which draw users through self-custody, transparency, and on-chain settlement growth, and centralized platforms like Binance Futures, Deribit, Bybit, and OKX, which continuously lead in daily trading volume, liquidity depth, and order execution speed.

While DEXs are gradually gaining market share among DeFi-focused and privacy-conscious traders, liquidity metrics and open interest patterns show that CEXs continue to dominate high-frequency and institutional trading. The optimal Derive.xyz substitute ultimately relies on whether traders value decentralization and control of funds or liquidity and scale.

FAQ

Which Derive.xyz alternative has the highest trading volume?

Based on aggregated exchange volume and open interest metrics, Binance Futures consistently leads global derivatives markets, followed by Bybit and OKX, especially for BTC and ETH perpetual contracts.

Which platform offers the deepest liquidity for crypto options?

Deribit dominates the crypto options market, handling a majority share of BTC and ETH options open interest, making it the preferred venue for institutional and professional options traders.

Are decentralized platforms growing in market share?

Yes. Platforms like dYdX, GMX, and Aevo show steady growth in total value locked (TVL), active wallets, and on-chain volume, indicating rising adoption among DeFi-focused traders.

Which alternative is best for non-custodial trading?

dYdX, GMX, Perpetual Protocol, Aevo, and Contango are fully non-custodial, meaning users retain control of their funds via Web3 wallets instead of relying on exchange custody.

How do fees compare between CEXs and DEXs?

Centralized platforms typically offer lower maker-taker fees at high volumes, while decentralized platforms may have lower base trading fees but include network (gas) costs depending on the blockchain.