I’ll go over how to borrow cryptocurrency with 0% liquidation risk in this post. This way, you can get money without having to liquidate your digital assets.

Borrowers can minimize market volatility, prevent forced liquidation, and keep portfolio control by utilizing fully collateralized or stablecoin-backed loans. Safe tactics, platforms, and risk management advice will all be covered in this tutorial.

What is Borrow Crypto?

Crypto borrowing is defined as using one’s own cryptocurrency as collateral in order to obtain digital assets, or in certain cases, fiat-backed stablecoins, through a lending platform or protocol. Rather than selling your assets, you temporarily lock them into a smart contract or custodial service, and in return, you receive a loan.

This loan can be used for trading, and other financial activities for which one may want to reinvest. The loan will begin to accrue interest, and the borrower will need to repay the loan based on the terms outlined in the lending agreement in order to have the collateral released.

The primary reasons for borrowing crypto are to obtain more liquidity, leverage the portfolio, and obtain capital in a more tax-efficient way than having to make the sale in a way which would trigger a tax.

How to Borrow Crypto with Zero Liquidation Risk

Example: Borrowing USDT Using Ethereum Without Liquidation Risk

Step 1: Choose a Trusted Platform

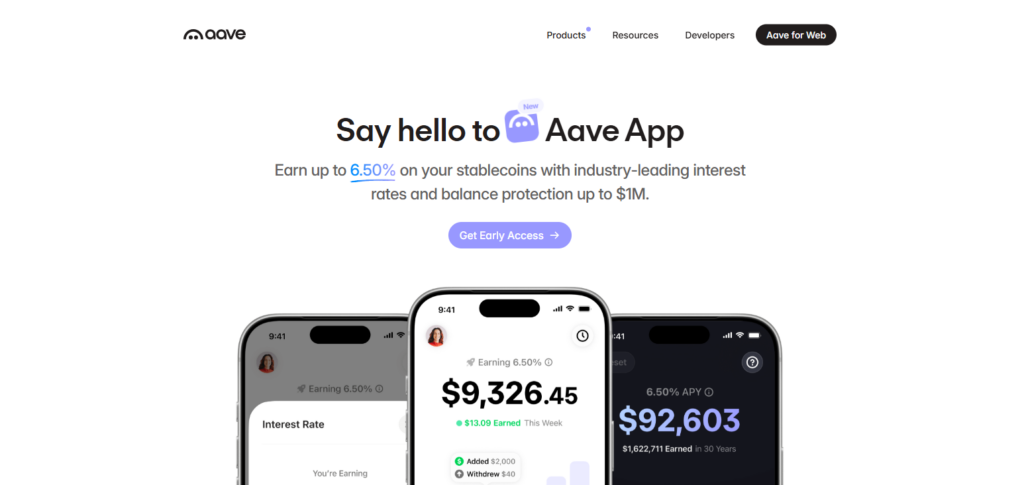

- Look for a crypto lending platform that offers fully collateralized loans, for example, Celsius, BlockFi, or Aave (DeFi).

- Check if you can choose a fixed term length for the loan, and if the loan is offered at a transparent interest rate.

Step 2: Deposit Collateral

- Deposit an asset to the platform, for example, Ethereum (ETH).

- In order to have zero liquidation risk, make sure to over collateralize (i.e. deposit more than 100% of the loan value).

Step 3: Select Loan Amount and Terms

- Take a look at the terms and choose the amount you want to borrow. You will be borrowing in USDT.

- Before you take the loan, make sure the value of the crypto asset you collateralized is equal to or greater than the loan value.

Step 4: Lock the Collateral

- Allow the smart contract or the platform to lock your Ethereum as a collateral.

- You will not have access to the collateral until the loan is paid in full.

Step 5: Receive the Loan

- Borrowed USDT became available in your wallet via the platform.

- These funds can be used for trading, payments, or any other activities if you want to keep your Ethereum.

Step 6: Repay the Loan

- Repay borrowed USDT and interest before the deadline.

- When repayments are complete, collateral ETH is unlocked and sent back to your wallet.

Step 7: Monitor Loan Health (Optional)

- Even if fully collateralized, keep an eye on your collateral to stay updated.

- A stablecoin-backed loan is protective, as ETH value changes won’t cause liquidation.

Key Borrowing Models That Avoid Liquidation

Fully Collateralized Loan Models

- The borrower is required to place an asset deposit that is equal to or larger than the loan amount.

- The borrower is protected from liquidation events because there is guaranteed debt the collateral can cover.

- This is commonly found in CeFi (BlockFi, Celsius) and DeFi (Aave, Compound) platforms.

Loans Backed by Stablecoins (USDT, USDC, etc.)

- Loans issue from the borrower to the lender in stablecoins.

- Loans remain collateralized, but the value can be subject to fluctuation.

- No stablecoins = no collateralized loan, and no collateralized loan = market volatility will not be a concern if the loan is a long-term loan.

Loans with Fixed Terms

- The borrower is offered a loan with a Fixed Term (which includes payment schedule and interest amount).

- Such a term can be a guarantee against margin calls and liquidation without notice.

- This is a common service found in centralized lending platforms.

Peer-to-Peer (P2P) Lending

- There is direct lending from one user to another, and this can be structured to provide all the collateral required to cover the loan amount.

- If all agreements are followed, there will be no liquidation events caused by the platform.

Credit-Based Loans

- If the borrower has a good reputation in the platform, then the borrower will not have to over-collateralize.

- This is offered by platforms like Maple Finance or Goldfinch, and it is done with a carefully structured risk management.

- It is not risk disengaged completely, but this will minimize the chance of liquidation.

Risk Management Strategies for Borrowers

Diversify Collateral Assets

- You shouldn’t rely on just one crypto asset as collateral.

- Use a variety of collateral crypto assets to prevent undue losses from drastic market changes.

Use Stablecoins for Borrowing

- It is advisable to borrow using USDT or DAI (stablecoins) to insulate your debt from market fluctuations.

- This increases the predictability of your repayment which is a favorable outcome.

Maintain Over-Collateralization

- Always ensure that the collateral is valued at higher amounts than the debt you take, despite what other platforms say.

- This ensures that you have adequate overs to counter any drastic price movements on the collateral crypto assets.

Set Alerts and Automated Safeguards

- Set up liquidation avoidance tools, and price alerts, and automated tools on the platform for Liquidation.

- This helps you to collateralize or repay your loan beforehand if the platform provides this feature.

Monitor Loan Health Regularly

- Check the value of your collateral and the loan to value (LTV) ratio to ensure that you don’t lose on any of your assets.

- This prevents liquidation that is out of your control to ensure that your assets are safe.

Keep Liquidity Reserves

- Always set aside some crypto or stablecoins to service the interest payments or do a mid-term top-up.

- This increases your ability to act on any changes to market conditions which would happen out of nowhere.

Recognize Risks with Different Platforms

- Look into the lending platform’s security, smart contracts, and systems.

- Stay away from platforms with a history of hacks or poor management.

Costs, Fees, and Hidden Trade-Offs

Interest Rates

- One of the fewer common elements of any borrowing situation is paying interest and this is the same for most platforms and for most assets.

- The financing rate, whether it be fixed versus variable, will play a huge role in determining your costs in the long run. High volatility will most likely push the variable interest to increase.

Platform Fees

- Different crypto lending platforms have their own sets of fees. Some can charge origination fees, while others can charge admin, and other platforms can charge a withdrawal fee.

- Fees are most definitely a secondary cost in the long run. When one is taking out several large loans, even a fee of a few dollars can be a huge cost.

Collateral Lock-Up

- When one places assets on collateral, they are locked in and cannot be withdrawn. This can be a situation where the assets are only illiquid for a short amount of time and cannot be sold.

- When the crypto value is locked, there is a loss of an opportunity to make a great amount of profit.

Hidden Liquidation Risk

- When a platform is trying to convince a potential customer of a lending service, they may say it is a ‘low risk’ platform. This is an example of how a platform may hide risk; with the loss of partial collateral, the risk of losing your collateral also increases. The risk of losing your funds will also increase for any unpredicted market crash.

- The market is ever changing, and this is most definitely applicable for the LTV and the margins on any crypto lending platform.

Exchange Rate Risk

- With collateral that is in a different crypto than the crypto that is used for the borrowing, there is an issue of potential dollar conversion losses.

- The value of the collateral can shift in more than one way. The collateral can decrease on a scale (collateral goes less in value than the crypto borrowed) and/or it can represent more than one borrowed asset.

Tax Implications

- Taxes may be incurred on borrowed funds with some jurisdictions (countries). The funds can be classified for crypto lending purposes.

- In some cases, interest repayments to a lending platform can also be taxable.

Risk related to SMART Contracts and Platforms

- DeFi Loans depend on Smart contracts that may have bugs and vulnerabilities

- CeFi platforms may become insolvent or have Regulatory issues that restrict access to collateral

Legal, Tax, and Compliance Considerations

Regulatory Compliance

- As for compliance with regulations on borrowing, all crypto lending firms are obligated to comply with applicable local regulations, KYC (Know Your Customer), and AML (Ant-Money Laundering) guidelines.

- This means that your loans can be recorded and will lower the chances of your account getting frozen.

Tax Considerations

- While borrowing in crypto may not trigger taxes, tax obligations may arise from interest payments, collateral swaps and liquidation events.

- Always check the crypto tax laws in your country to avoid tax penalties.

Jurisdiction Rules

- The legality of crypto lending is largely dependent on the country. The lending/borrowing of crypto is restricted and/or banned in certain jurisdictions.

- Always check if the platform is legal in your country.

Reporting Requirements

- When filing tax returns, borrowers may be required to report crypto loans and/or interest payments.

- Some platforms provide tax reporting documents to simplify the process.

Smart Contract & Legal Risks

- Decentralized finance (DeFi) loans are executed on smart contracts. If the contracts are poorly designed, hacked, or infiltrated, your assets may be at risk.

- Unlike traditional lenders, you do not have legal protections in decentralized finance.

KYC/Identity Verification

- Most platforms will require you to verify your identity to comply with the lender’s regulations.

- Safeguards from fraud, although may impact some users’ privacy.

Cross-Border Restrictions

- Due to local laws, some platforms restrict users’ access from particular countries.

- Before securing an international loan, borrowers need to confirm their eligibility.

Pros and Cons of Zero-Liquidation Borrowing

| Pros | Cons |

|---|---|

| No Risk of Forced Liquidation | Fully collateralized loans require locking more assets, reducing liquidity. |

| Predictable Repayment | Interest rates may be higher compared to risky, under-collateralized loans. |

| Safe from Market Volatility | Opportunity cost if the collateral value increases while locked. |

| Ideal for Long-Term Borrowing | Less flexible than margin or leverage-based loans. |

| Peace of Mind for Beginners | Platform risk (CeFi) or smart contract risk (DeFi) still exists. |

| Access to Funds Without Selling Assets | May require stablecoin conversion, leading to minor exchange risks. |

Future Trends in Risk-Free Crypto Borrowing

By technological and regulatory advancements the future of risk-free crypto borrowing is more secure, efficient, and inclusive. Future AI risk management systems will adjust collateral in real time to prevent liquidation. With fully decentralized credit scoring, verified borrowers could access safe under-collateralized loans, making over-collateralization unnecessary.

The combination of industry standards, legal clarity, and insurance backing, will further institutionalize the practice of zero-liquidation borrowing to make it safer for retail consumers. Finally, hybrid CeFi-DeFi systems will pair the best attributes of centralized and decentralized systems to provide borrowers with a flexible and secure borrowing experience.

Conclusion

Users can access funds without selling their assets by borrowing cryptocurrency with zero liquidation risk, which minimizes exposure to market volatility and offers financial flexibility. Borrowers can safely traverse the cryptocurrency lending landscape by utilizing fully collateralized or stablecoin-backed loans, keeping an eye on loan health, and implementing efficient risk management techniques.

Zero-liquidation borrowing is a feasible alternative for both novice and seasoned cryptocurrency holders, however charges, fees, and platform risks are still factors to take into account. In the end, this strategy allows you to manage funds wisely while maintaining the value of your cryptocurrency holdings.

FAQs

What does zero-liquidation borrowing mean?

Zero-liquidation borrowing refers to taking a crypto loan in a way that eliminates the risk of forced liquidation, usually by fully collateralizing the loan or borrowing in stablecoins.

Is borrowing crypto completely risk-free?

While zero-liquidation loans minimize liquidation risk, other risks remain, such as platform insolvency, smart contract vulnerabilities, fees, and tax implications.

Which platforms offer zero-liquidation borrowing?

Reputable platforms include Aave, BlockFi, Celsius, Compound, and MakerDAO (DeFi and CeFi), where loans can be fully collateralized or stablecoin-backed.

Can beginners safely borrow crypto without liquidation risk?

Yes, beginners can safely borrow by using fully collateralized loans, choosing stablecoins, and monitoring collateral-to-loan ratios regularly.

How do I prevent liquidation when borrowing crypto?

Use stablecoin-backed loans, maintain over-collateralization, monitor loan health, and leverage alerts or automatic safeguards offered by platforms.