I’ll go into how authorities monitor on-chain cryptocurrency transactions in this post. Because of blockchain’s openness, authorities can keep an eye on the movement of digital assets, spot suspicious activities, and make sure that tax and anti-money laundering laws are being followed.

Regulators can trace assets, connect wallets to real-world identities, and uphold a safer cryptocurrency ecosystem by utilizing advanced analytics, AI tools, and KYC data from exchanges.

Understanding On-Chain Transactions

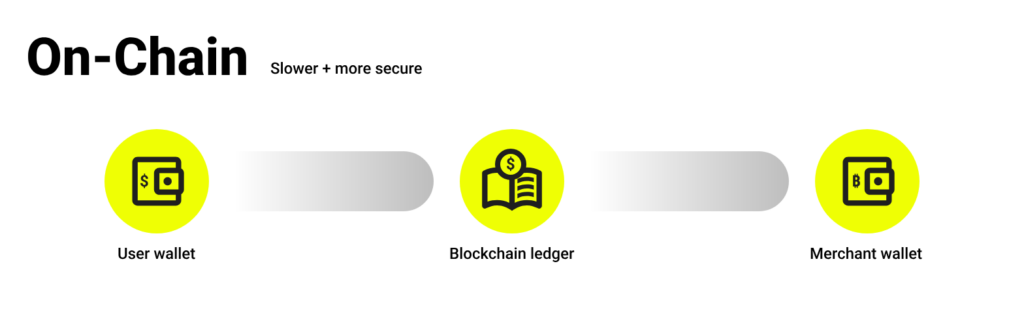

On-chain transactions represent one of the most fundamental activities one can do on the blockchain. They represent the transfer of digital assets from one wallet to another. They are verified through cryptographic hashes and added to the books.

This offers a fully distributed, and immutable ledger that is verified and accessible by everyone in the network. They will include the wallet addresses of the transacting parties, the amount of the digital asset transferred, the date a time, and the transaction fee.

These transactions also differ from off-chain transactions, which occur in private ledgers or intermediate platforms which makes them fully visible on the blockchain which ensures full traceability.

This also ensures auditors, regulators, and blockchain analytic companies monitoring asset movement, identifying red flags, and ensuring compliance with anti-money laundering and tax compliance.

Crime is regardless of the digital assets being transferred. The digital assets being transferred are still visible, the wallet addresses and the transactions themselves are linked. This won’t be a straightforward task and will require a thorough bridge analytic and heuristic.

How Regulators Track On-Chain Crypto Transactions

Example: Analyzing Potential Illegal Bitcoin Transactions

Example: Regulators have been notified by a law enforcement agency of a significant Bitcoin transfer suspected of being involved in money laundering.

Step 1: Placing and Analyzing Transactions

- Regulators use analytics firms on the blockchain such as Chainalysis and Elliptic to find the transaction on the public ledger and analyze it using transaction hash (TXID).

- Using the TXID, Regulators can analyze the sending and receiving wallets, the amount exchanged, and the time of transaction.

Step 2: Analyzing the Wallets in the Transaction

- Regulators use address clustering to analyze the transaction and see whether the wallets belong to a person, an exchange, or a service.

- Numerous wallets and blockchains analytics firms have the data to analyze and detect interconnections of wallets and relations to a person or an organization.

Step 3: Analyzing the Transaction

- Regulators analyze the transaction to see how the money flowed on the chain.

- If money is exchanged to multiple wallets, passing through a chain of mixers or cross-chain bridges, the analytics system would flag it as something high-risk.

Step 4: Cross-referencing On-Chain and Off-Chain data

- Regulators analyze the KYC records on the exchanges or on custodial services where the money has been received or sent.

- This step is also used to associate pseudonymous wallet addresses with actual identities.

Step 5: Pattern Recognition for Potential Malicious Activity

- Blacklist, co-occurrence, and other heuristics methods are used to determine the presence of possible suspicious splitting of funds, interaction with privacy coins, or blacklisted addresses.

- A transaction is given a “risk score” if such heuristic methods are used.

Step 6: Possible Enforcement Action

- Confirming illegal activity, regulators will contact law enforcement, place a subpoena, or freeze funds on the given exchanges.

- These transactions will then build the basis of the evidence for the case.

Why Regulators Monitor On-Chain Activity

Prevent Money Laundering (AML Compliance)

- On-chain surveillance aids in identifying unnecessary/blocking changes to conceal virtual currencies in sanctioned wallets.

- Flagged transactions and further examine subsequent transactions for additional case development.

Combat Terrorism Financing (CFT Compliance)

- In an effort to fund and financial terrorism, funding and financial terrorism are closely monitored.

- It is possible to follow certain finances about to be lost to terrorism because finances are traceable and open for all.

Ensure Tax Compliance

- Concealed transactions, possible capital gains, or other taxable incidents within a given period.

- Based on KYC, authorities can order exchanges to submit lists for a given period and/or entity, or for a specific corporate or personnel level.

Protect Retail Investors

- Fraudulently claimed on-chain activity to capture or create fraudulent actors, chains, or schemes.

- Unanticipated investors are limited in how much they can lose.

Maintain Financial System Integrity

- Protecting the system (enhancing the system) from digitally created values).

- Trust in a financial system is more likely to promote the system to be used.

Track Cross-Border Transfers

- Rule and regulation objectives are objectively observed on the international movement of funds.

- Regulation is necessary for the nation to avoid the use of crime to determine the level of a region’s funding policies.

Recognizing New Threats in DeFi & Smart Contracts

- Sophisticated fraudulent activities can sometimes be concealed by complex on-chain activities in decentralized finance (DeFi) platforms.

- Regulators can track the changes in crypto ecosystems by monitoring them continuously.

Tools and Techniques Used by Regulators

Blockchain Analytics Software

- Companies like Chainalysis, Elliptic, TRM Labs show visual representations of how different wallets or exchanges transact with one another.

- These companies track the movement of funds, identify potentially suspicious behaviors, and provide risk assessments for different addresses.

Address Clustering & Heuristics

- Regulators unify different wallet addresses under the assumption that they belong to the same user.

- Heuristic analysis detects behavior that includes, but is not limited to, multiple payments, odd divisions of payments, and/or payments to blacklisted addresses.

Monitoring Exchanges & On-Ramps

- Regulators can associate blockchain addresses with actual people using the KYC (Know Your Customer) documents that exchanges collect.

- When there are large or irregular transfers, suspicious transaction reports (STRs) are created.

Smart Contract & DeFi Monitoring

- On-chain monitoring is the process of monitoring interactions with decentralized applications (dApps) and smart contracts.

- Potentially suspicious behaviors like inordinate token swaps, flash loans, or suspicious movements of liquidity are generally monitored.

Cross-Chain & Wallet Analysis

- Regulators track the flow of funds on different blockchains and cross-chain bridges.

- This is to catch money launderers or other criminals who try to escape detection by switching to different chains or by using privacy coins.

Artificial Intelligence and Machine Learning

- Fraud, laundering, and hacking patterns are often detectable by advanced analytics.

- Investigating the most risky address becomes automated and less labor intensive with the assistance of AI.

Data Sharing and Collaboration

- The international collaboration of the cross border tracking of the illicit funds is often done by the regulators.

- More effective collaboration is seen with the blockchain companies, custodians, and exchanges.

Challenges in On-Chain Tracking

Privacy Coins and Mixing Services

- Monero and Zcash are examples of currency examples that can hide transaction information.

- Services that mix various users’ funds limit the ability to track and trace transactions.

Pseudonymous Wallets vs Real Identities

- A wallet address does not inherently expose who the owner is.

- In order to associate someone’s on-chain activities with their real-world identity, cooperation from the exchange is needed, which may involve subpoenas.

Cross-Chain Transactions

- Obstacles to conventional monitoring techniques can be found when funds are transferred across different blockchains and bridge technologies.

- This is done through sophisticated analytics ways in order to track the assets between disparate networks.

Complexity of Decentralized Finance (Defi)

- Automated market makers, smart contracts, and intricate liquidity pools are capable of concealing, swiftly transferring, or obfuscating funds.

- In comparison to centralized exchanges, the underlying technology is generally more complicated, and detecting such patterns in DeFi systems is also more difficult.

High Volume of Transactions

- In just one blockchain, such as Bitcoin or Ethereum, thousands of transactions are made each minute.

- To track each transaction as they occur is extremely expensive and would require sophisticated Artificial Intelligence technologies.

Gaps in Regulations Between Jurisdictions

- There is a different set of regulatory frameworks governing the monitoring and enforcement of cryptocurrencies for each country.

- Rapid and complete cross-border coordination is required. Unfortunately, this is frequently slow and incomplete.

False Positives in Risk Detection

- Routine Monitoring leads to legitimate activity being perceived as risk.

- There is a need for human review which delays action and adds to the coût operational.

Future of On-Chain Monitoring

On-chain monitoring is expected to grow increasingly complex in the future due to developments in machine learning, artificial intelligence, and regulatory technology (RegTech). Regulators will be able to quickly track suspicious transactions across several blockchains, identify intricate trends, and anticipate new threats in real time thanks to AI-powered analytics.

Linking pseudonymous wallets to actual identities will be made easier with integration with international KYC databases and cross-border data-sharing programs. Additionally, regulators are creating specific tools to keep an eye on token swaps, smart contracts, and liquidity movements as decentralized finance (DeFi) and cross-chain protocols continue to expand.

Innovations that enable efficient oversight without compromising blockchain’s fundamental transparency will be prompted by the ongoing problem of striking a balance between user privacy and compliance obligations. All things considered, the development of on-chain monitoring promises a more proactive, accurate, and internationally coordinated approach to cryptocurrency regulation.

Pros & Cons

| Pros | Cons |

|---|---|

| Transparency and Traceability: Regulators can monitor transactions publicly recorded on the blockchain. | Privacy Concerns: Users’ pseudonymous wallets may raise privacy issues when linked to identities. |

| Fraud and AML Prevention: Helps detect money laundering, scams, and illicit activities. | Limited Coverage for Privacy Coins: Transactions using Monero, Zcash, or mixers are harder to track. |

| Enhanced Investor Protection: Identifies suspicious activity in exchanges and DeFi, protecting retail investors. | Cross-Chain Complexity: Funds moving across multiple blockchains or bridges complicate tracking. |

| Tax Compliance Enforcement: Authorities can trace unreported income or capital gains. | High Resource Requirements: Monitoring thousands of transactions in real-time requires sophisticated tools and manpower. |

| Global Coordination: Collaboration between exchanges, custodians, and regulators improves compliance worldwide. | False Positives: Automated alerts may flag legitimate transactions, slowing investigations. |

| Future-ready with AI & RegTech: Machine learning improves detection and efficiency over time. | Jurisdictional Gaps: Regulatory differences across countries may limit enforcement effectiveness. |

Conclusion

To sum up, authorities monitor on-chain cryptocurrency transactions by combining blockchain transparency with sophisticated analytics, artificial intelligence capabilities, and exchange collaboration.

These initiatives, which range from tracking wallet addresses and transaction flows to examining DeFi activity and cross-chain transfers, aid in the prevention of fraud, tax evasion, money laundering, and terrorism financing.

Ongoing technological developments and regulatory cooperation are improving on-chain monitoring, guaranteeing a safer and more compliant cryptocurrency environment despite obstacles like privacy coins, pseudonymous wallets, and cross-border complications.

FAQ

What is an on-chain transaction?

An on-chain transaction is a transfer of cryptocurrency recorded directly on a blockchain. It includes sender and receiver addresses, amount, timestamp, and transaction fees, making it publicly traceable.

Why do regulators monitor on-chain activity?

Regulators monitor on-chain activity to prevent money laundering, combat terrorism financing, ensure tax compliance, protect investors, and maintain financial system integrity.

What tools do regulators use to track transactions?

Regulators use blockchain analytics software (Chainalysis, Elliptic, TRM Labs), address clustering, KYC data from exchanges, smart contract monitoring, and AI-driven risk analysis.

Can all crypto transactions be tracked?

Most transactions on public blockchains like Bitcoin and Ethereum are traceable. However, privacy coins, mixing services, and cross-chain transfers can make tracking more difficult.

How do regulators link wallets to real identities?

Regulators often rely on KYC data from exchanges and custodial services, combined with on-chain analytics, to connect pseudonymous wallet addresses to real-world individuals or entities.