In this essay, I will explore how Web3 companies monetize non-paying customers. In contrast to conventional platforms, Web3 uses partnerships, token economies, transaction fees, and community involvement to make money even from free users.

These platforms provide sustainable growth while maintaining open, decentralized, and privacy-focused access for all members of the ecosystem by converting participation, activity, and on-chain behavior into value.

Understanding the Web3 Business Model

The Main Innovation of the Web3 Model is Shift Towards Decentralization, User Ownership Through Token Systems, and Ecosystems Built on P2P Value Rather Than Subs, Centralization, and Control Models. P2P Value Co-creation Occurs Through Staking, Governance, Content, And Network Participation Rather Than Passive Consumer Models.

Trustless Transactions, Automated Revenue Shares, and Contract Enforcement Through Smart Contracts and Blockchain Intermediaries Foster P2P Value. Tokens Act as Access, Rewards, and Incentives Economies, Keeping User Communities Incentivized And Economically Aligned with Network Participation. Value is also derived from Ecosystem User Activity And Transactions Fuelling Premium Offerings, Integrated Tool Services, Value-Added Partnerships, and Ecosystem Extensions.

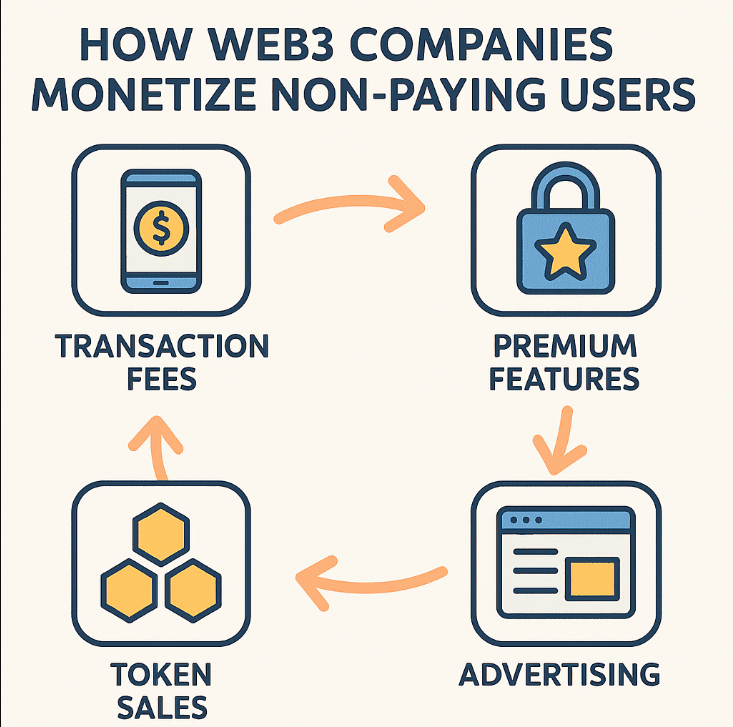

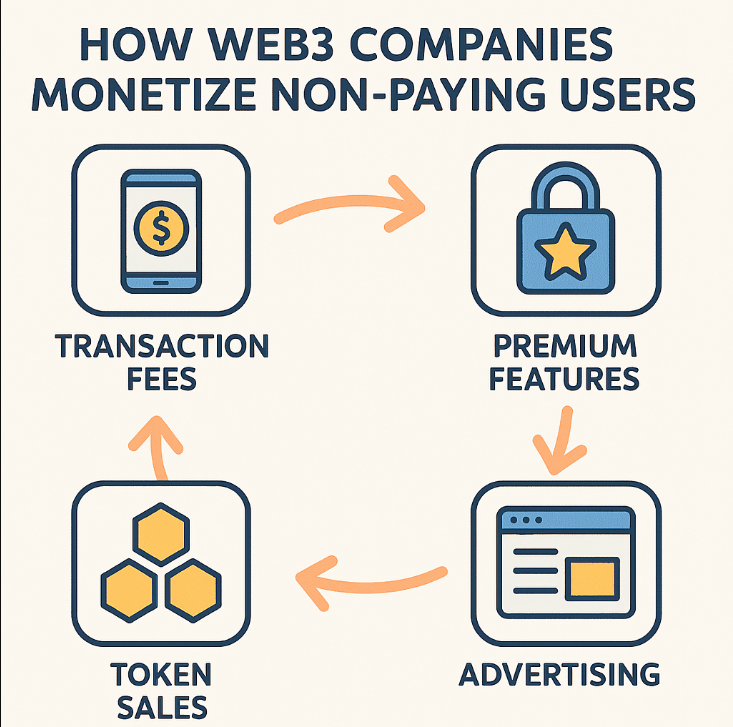

How Web3 Companies Monetize Non-Paying Users

Step 1: User Attraction

Web3 companies create free wallets, build decentralized applications (dApps), and provide basic features. This encourages blockchain-based communities, and as a result, dApps stimulate ecosystems with growing wallets.

Step 2: Action Tracking

Web3 companies are not interested in clicks; they token-gate. While dApps are decentralized, companies use blockchain-based analytics to track on-chain activities, such as swaps, mints, votes, and staking. This records true engagement.

Step 3: Tokens

Web3 companies use protocol-based reward mechanisms to stimulate dApp activities and increase the demand for the protocol’s tokens. This assists in elevating the network’s value.

Step 4: Passive Revenue Streams

Web3 companies create revenue-generating mechanisms to profit from free users. Any activity such as bridging, minting, and trading can incur a fee.

Step 5: Sponsorships

DApps and brands sponsor Web3 companies to gain a user base.

Step 6: User Incentive Upgrades

Web3 companies profit from advanced tools, analytics, governance, and exclusive NFTs being sold to power users.

Step 7: Revenue Reinvestment

Web3 companies profit from advanced tools, analytics, governance, and exclusive NFTs being sold to power users.

Data Monetization (Privacy-First Approach)

Monetization of User Data with Prioritization for Privacy: Companies in Web3 examine activity across public blockchains considering that the data is not associated with any individual and therefore is able to maintain the privacy of the user(s).

Summary of User Data and Behavioral Analysis: Companies can monetize data based on user behavioral metrics and data aggregation such as transaction volume, token volume, and data of associated decentralized applications (dApps).

Data Sharing with User Permission and Control: Users handle and decide the data that can be shared through the available smart contracts and data permissions associated with their wallets.

User Analytics and Data Insights Provided to Partner Companies for Profit: Brands and protocols sell data, dashboards, and reports that contain info on the interaction between the users and the platform, data on the utilization of the users, and metrics of the ecosystem.

Use of Privacy Technologies in Protocols: Technologies like zero-knowledge proof systems that validate data without compromising sensitive data can be used.

Data Sharing and the Reward System: Users may be rewarded with the project tokens when they share their data and become part of the data collection.

Advertising in Web3 Ecosystems

Instead of invasive surveillance or centralized ad networks, Web3 ecosystems prioritize community-driven, transparent, and value-based advertisements.

Platforms include native advertising directly into dApps, NFT marketplaces, metaverse spaces, and blockchain games, where adverts feel like a natural part of the user experience, rather than gathering personal data. Brands often fund NFT drops, virtual events, or special in-app experiences to engage consumers in more participatory ways.

While DAO governance enables consumers to accept or reject promotional content, smart contracts guarantee equitable income sharing between platforms, producers, and communities. This method establishes trust, aligns incentives, and turns advertising into a collaborative opportunity that supports ecosystem growth without compromising user privacy.

Marketplace & Transaction Fees

| Revenue Source | How It Works | Role of Non-Paying Users | Monetization Benefit |

|---|---|---|---|

| Trading Fees | Small percentage charged on token swaps or NFT sales | Create volume by browsing, listing, and trading assets | Generates steady income from high activity |

| Minting Fees | Fee charged when users create NFTs | Mint free or low-cost NFTs that increase marketplace traffic | Earns revenue per asset created |

| Bridging Fees | Fees for transferring assets across blockchains | Move assets between networks, boosting platform use | Monetizes cross-chain activity |

| Listing Fees | Cost to list NFTs or tokens for sale | Increase marketplace inventory and visibility | Supports platform maintenance |

| Liquidity Pool Fees | Earned from swaps in DeFi pools | Provide or interact with liquidity pools | Creates passive revenue for the protocol |

Freemium Models in Web3

Web3 freemium models give users free access to essential platform functions while providing paid tools and experiences for those seeking more in-depth interaction.

Basic users can explore dApps, trade limited assets, join communities, and participate in governance at an entry level without upfront expenses.

Advanced users, however, can unlock paid services such as professional analytics dashboards, priority transaction processing, special NFT memberships, greater voting power, or early access to new protocol improvements. This approach promotes decentralization and open access while yet producing sustainable business streams.

Web3 companies promote trust, long-term engagement, and natural upgrades driven by user requirements rather than forced commercialization by progressively implementing value-added services instead of paywalls.

Partnerships & Ecosystem Collaborations

Cross Protocol Partnerships

Web3 platforms work with DeFi, NFT, and Layer-2 protocols to enrich their feature set and optimize for shared transactional revenue.

Sponsorship Partnerships

Brands sponsor NFTs, metaverse experiences, and in-game assets to tap into active Web3 community.

Smart Revenue Sharing

Revenue share agreements embedded in smart contracts provide trustless and transparent distribution of revenue between partners, creators, and platforms.

Bridge Partnerships

Collaborations with bridge and multi-chain networks are effective for increasing the ecosystem’s user base and activity.

API & Grant Partnerships

Open APIs and ecosystem grants are instrumental in attracting builders to provide the additional functionality that enhances the platform’s value.

DAO Partnerships

Community-derived strategic partnership proposals are pivotal to ensure that the collaboration meets the objectives of the users and the ecosystem.

Do non-paying users still create value?

Yes, non-paying users provide tremendous value in Web3 ecosystems by increasing activity, engagement, and network effects that directly impact platform development and sustainability. Even without spending money, these users contribute by participating in transactions, minting NFTs, staking tokens, voting in governance, and interacting with dApps.

Their actions boost marketplace volume, on-chain data flow, and liquidity, which draws premium users, partners, and advertisers. Non-paying users also contribute to community growth, increased brand awareness, and improved token economies, all of which indirectly increase platform revenue.

They enhance the ecosystem as a whole by being active players rather than passive viewers, increasing the platform’s value for all users and demonstrating that Web3 monetization is not exclusively reliant on direct payments.

Challenges & Ethical Considerations

Trust Factors & Transparency

How a platform earns money, and as a result, how it uses its on-chain data is something that needs to be explained in order to preserve the trust of its community.

Privacy Issues

Regardless of being a public blockchain, being able to monitor who does what on the blockchain should never be an issue.

Legal Issues

How data collection, tokens, and digital assets laws are applied is different in every region of the world, and as a result, it can affect the strategies of how a platform can earn money.

Unbiased Token Economics

A token economy can be structured in a number of different ways, and having a bad system can result in unjust speculation.

Decentralization vs. Control

Achieving community-driven decision-making and driving change in a short period of time is an ongoing problem.

Risk Factors

The trust of the users and the reputation of platform can be compromised in the event of platform breaches, smart contract flaws, and others.

Future Trends in Web3 Monetization

Future advances in Web3 monetization will center on deeper personalization, automation, and user-owned value creation. AI-powered analytics can let platforms build smarter token incentives, forecast user behavior, and optimize transaction-based income without depending on intrusive data acquisition.

Users will be able to monetize their abilities, credibility, and contributions on many platforms thanks to tokenized digital identities and on-chain reputation systems. Through virtual real estate, branded digital assets, and immersive advertising experiences, the expansion of metaverse commerce will create new revenue sources.

Traditional logins will be replaced by subscription-style access powered by NFTs and soulbound tokens, offering community rights and special benefits. When combined, these developments will move monetization away from buying and selling and toward sustainable, community-driven ecosystems where platforms and users become economically aligned.

Conclusion

To sum up, Web3 enterprises demonstrate that users may generate significant value inside an ecosystem without having to pay directly. Platforms transform regular engagement into long-term revenue streams by utilizing token incentives, transaction-based fees, privacy-first data insights, community-driven advertising, and strategic alliances. Instead of being a cost center, non-paying users are a potent growth engine because they boost network effects, bolster token economies, and raise platform awareness.

As Web3 continues to evolve, the most successful companies will be those that balance ethical monetization with transparency, user ownership, and decentralized governance—building ecosystems where both platforms and communities thrive together through shared value creation rather than traditional paywalls.

FAQ

How can Web3 companies make money if users don’t pay?

They earn through transaction fees, token value growth, partnerships, advertising, premium features, and ecosystem collaborations rather than direct subscriptions.

Do non-paying users still create value?

Yes, they increase network activity, liquidity, and community engagement, which strengthens token demand and platform visibility.

Is user data sold in Web3 monetization?

Most Web3 platforms focus on anonymized, aggregated, and consent-based data insights instead of selling personal information.

What role do tokens play in monetization?

Tokens incentivize participation, enable governance, and drive ecosystem growth, which can increase overall platform value.

Are Web3 ads different from traditional ads?

Yes, they are community-driven, transparent, and often integrated into dApps, NFTs, or metaverse experiences.