In order to protect users and protocols from value extraction by opportunistic bots and transaction reordering, MEV-Protection Infrastructure is at the core of transparent, equitable blockchain markets.

In order to maintain pricing integrity, minimize front-running, and enhance execution quality, we examine in this paper how private mempools, encrypted transactions, relay networks, and builder-neutral architectures collaborate.

Developers and traders can implement more intelligent protections that improve long-term sustainability, efficiency, and trust in decentralized ecosystems by comprehending these systems.

What Is MEV Protection in Crypto Trading?

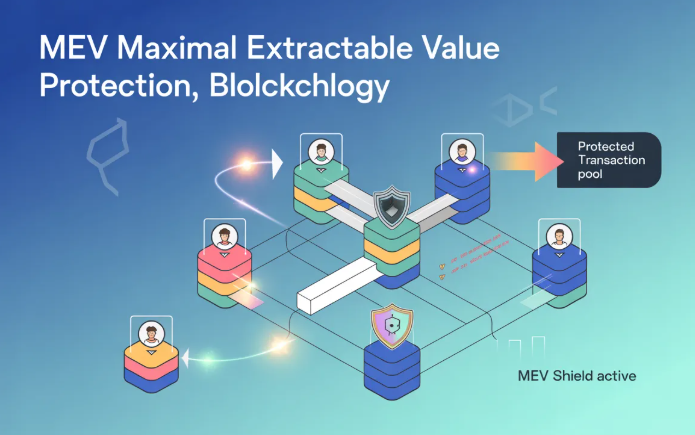

The term “MEV protection” describes tactics and resources intended to prevent Maximal Extractable Value (MEV) abuse of cryptocurrency transactions.

By adjusting the order of transactions within blocks, miners or validators can extract MEV. In addition to preserving market efficiency and avoiding unfair benefits, this protection guarantees transaction integrity, price fairness, and network stability.

MEV protection protects against common exploitation techniques like sandwich attacks, which combine both strategies to profit from price movements, backrunning, which involves placing transactions right after known transactions, and frontrunning, which involves placing transactions ahead of known future transactions.

Why MEV Protection Is Becoming Core Trading Infrastructure

Due to malicious actors making use of mempool visibility, latency differential, and validator incentive exploits, it’s safe to say that almost every single transaction of significance can and will be drained for value.

The increasing volumes of DeFi and participation from institutions means that small slip losses from sandwich attacks can be cumulatively large.

Despite best-effort broadcast models, Private transaction relays, block builder coordination, and MEV aware RPCs will improve execution.

The safe routing of transactions will become just as important as custody, compliance, and risk management in the crypto trading systems of the preseThe term “MEV protection” describes tactics and resources intended to prevent Maximal Extractable Value (MEV) abuse of cryptocurrency transactions.

By adjusting the order of transactions within blocks, miners or validators can extract MEV. In addition to preserving market efficiency and avoiding unfair benefits, this protection guarantees transaction integrity, price fairness, and network stability.

MEV protection protects against common exploitation techniques like sandwich attacks, which combine both strategies to profit from price movements, backrunning, which involves placing transactions right after known transactions, and frontrunning, which involves placing transactions ahead of known future transactions.nt.

MEV-Protection Infrastructure

MEV-Protection Infrastructure is the technical systems which stop bad actors from taking advantage of transaction ordering, visibility, and validator incentives to extract value from users’ trades.

These solutions do not broadcast trades to public mempools, but rather reroute orders to private order-matching RPCs and encrypted relays and block builders who will deliver the trades directly to the validators.

By controlling which participants can see a trade and when, MEV protection reduces the likelihood of sandwich attacks, fronts running, and toxic order flow and increases the likelihood of price improvement, execution certainty, and institutional grade reliability.

How MEV Protection Works?

MEV protection builds upon multiple levels of infrastructure that work to decrease exposure to transactional events, combat ordering manipulation, and reduce adversarial profit extraction at the network layer. Most high-value swaps within Ethereum and Solana ecosystems are targeted within milliseconds of entering the public mempool. Because of this, the ability to execute and control visibility is important.

Transaction Privacy is achieved by routing trades through private RPC endpoints or encrypted relays (as opposed to public mempools). By doing this, searchers and bots are unable to see the parameters of the trades and lack the ability to attempt sandwich attacks.

MEV protection by Fair Ordering Mechanisms attempts to preserve the sequencer’s user intended position of execution, and as such, they are based on first-come or commitment based ordering models. COs can also prevent block builders or validators from ordering moves purely based on profit, thus increasing the predictability of execution.

Decentralized Sequencing is the partitioning of block building/ ordering of transactions across multiple entities that operate independently. This design choice eliminates the use of a single relay or builder and therefore decreases collusion and increases the ability to sustain censorship with the added benefit of maintaining enough healthy inclusion markets.

Anti-Frontrunning Controls use a combination of prioritized fee management, private order flow, and commitment at the validator level to keep third parties from inserting transactions in front of a protected trade. This is crucial for automated trading strategies and institutional-sized swaps, where even a small change in price can significantly alter the result.

Security Guarantees and Trust Assumptions

Using MEV-protection protocols shifts risk from open adversarial mempools to transaction delivery networks. However, the use of transaction delivery networks shifts risk to trust, which the user needs to assess.

The principal trust assumption is that the transaction is kept privately until it is included, which means that the trade parameters remain unknown to searchers, bots, and passive validators. This trust assumption is meant to reduce the likelihood of sandwich and front-running attacks and is especially true for large and/or time-sensitive trades.

A second assumption is known as inclusion integrity, where the relays and block builders commit to the submission of the protected transaction to the validators without any reordering or selective censorship. This is generally upheld by some reputation or competitive builder market as an enforcement mechanism, or through some cryptographic commitment of these parameters.

There is an implicit trust of the RPC provider, the relays, and the builders, as there is no clear way to trust them to not leak the order flow, collude with the validators, or implement their MEV strategies.

The dominance of centralized relays can create single points of systemic failure and censorship. While decentralized builder and sequencing frameworks may lower that risk, it may come with worse latency or lower certainty of inclusion.

Lasty, operational limits are characterized by the trade-off between transparency versus privacy. Robust privacy increases the fairness of the execution, but diminishes on-chain auditability, which in turn can negatively affect compliance, the resolution of disputes, and the reporting of regulatory issues.

Therefore, organizations frequently use multi-RPC methods, fall back on public mempools in failure situations, and watch inclusion metrics to manage the trade-off between security and operational flexibility.

Economic Incentives: Who Gets Paid and Why It Matters

With respect to value distribution among traders, RPC providers, block builders, and validators, MEV-protection systems reconfigure value flow and convert transaction execution into an explicit economic market.

Rather than having MEV extracted exclusively by searchers through antagonistic approaches, MEV-protected transaction systems redistribute value via protected transaction systems through systematized fees, tips, and revenue collection sharing.

Traders: Prior to payment routing trade relays, they may pay priority fees or relay tips to obtain trade execution certainty and lower costs than those triggered by sandwich attacks.

RPC Providers and Relays: Revenue from premium routing, MEV auctions, and enterprise tiered pricing, it justifies the premium on low latency, privacy, and reliable uptime to meet the SLA.

Block Builders: Fastest MEV-determined proposer selection plus revenue share to validators from publicizing blockspace auction MEV differentiates descent. It can also increase layer-1 utilization from consolidated market dynamics.

Validators: Incentives provide base reward, transaction fees, and MEV share. It’s the incentive structure that makes small operators less competitive or MEV concentrations power to the large staked.

Designing Cross-Chain and Multi-RPC Strategies

Instead of depending on a single mempool gateway, cross-chain and multi-RPC solutions diversify transaction routing across several networks and providers to lower execution risk.

Traders and programs can improve reliability and censorship resistance by dynamically choosing the lowest-latency, highest-inclusion path for each transaction by integrating multiple MEV-aware RPC endpoints.

This method enables protected swaps, liquidations, and treasury operations to maintain comparable security guarantees in cross-chain contexts by supporting uniform execution requirements across Ethereum, Solana, and emerging L2s.

While parallel submission mechanisms provide a compromise between privacy, inclusion likelihood, and compliance requirements for institutional-grade transaction execution, automated health checks, regional failover, and performance-based routing guarantee continuity during outages.

Regulatory and Compliance Implications

The introduction of MEV-protection tools presents issues with transaction privacy versus regulatory transparency. For instance, the use of Private Relays and Encrypted Routing obscures pre-trade data.

While this can protect the fairness of the market, it can also create challenges for institutions regarding Auditable Trail Compliance, Best Execution Reporting, and Post-Trade Surveillance, given that these practices are part of the regulatory framework governing the financial industry.

Are custodians, exchanges and/or funds using MEV-aware RPCs in compliance with the illicit funds and ‘clean money’ issues, the integrity of the marketplace, and keeping the records of compliance in the industry?

The centralization of projections reinforces the regulatory ‘intermediaries’ of the system, and may be subject to reporting, licensing and, in certain cases, the retention of the data, and these issues are compounded by the geography of the system in question.

In terms of policy, the authorities in charge may evaluate the MEV-protection tools as alias market fairness and manipulation, especially under the conditions of order flow auctioning and/or order flow manipulation.

To combat this, Institutions are increasingly maintaining execution logs, utilising multi-RPC fallback strategies, and using compliance reporting and transparency tools from their selected providers.

Future of MEV-Protection Infrastructure

The next phase of MEV protection is still in early development. It consists of from reactive protection (shields) evolving into intent based execution. Users will only need to submit high-level objectives of trades, as opposed to the raw transactions.

These intents will be paired and optimized and settled by the decentralized solvers, making the settlement period zero, and internalizing MEV to the differential auction mechanism.

Encrypted Delayed Mempools is gaining traction as a potential solution to address the premature visibility of transactions in the validators, while maintaining decentralization. The goal is to prevent frontrunning in any form without having to use a centralized relay.

With the emergence of roll-up, sequences, and bridges, we will start to see cross-chain MEV as a new market. In this model, unified execution layers will be created.

MEV aware infrastructural elements will coordinate the Order and Execute model across disparate networks, and this will give service provision of Irrespective protection to complex cross-chain MEV.

We will see a baseline Standardization of MEV-safe RPC APIs, as more compliance tools are creating the baseline for infrastructure.

This will provide wallets, custodians, and institutions, within, integrated privacy, execution certainty, and audibility, in a single, segregated, interoperable transaction system.

Conclusion: Choosing the Right MEV-Protection Stack

Private RPC routing and MEV-aware relays significantly lower the frequency of sandwich attacks and enhance efficient price execution, particularly for big trades and low-liquidity pools, according to on-chain execution metrics. Performance benchmarks, however, also highlight trade-offs between decentralization, latency, and inclusion assurance.

While decentralized construction and sequencing models provide infrastructure resilience and censorship resistance, centralized relays frequently produce faster confirmations and higher inclusion rates.

Multi-RPC tactics are becoming more and more important to data-driven traders, who monitor parameters like confirmation time, inclusion likelihood, and execution price divergence between providers.

As a result, the ideal MEV-protection stack is dynamic, adjusting privacy, performance, and trust assumptions in response to network conditions, transaction volume, and compliance needs.

FAQ

How do I know if I need MEV protection?

On-chain studies show that high-value swaps, low-liquidity pools, and volatile token markets experience significantly higher sandwich attack rates and slippage without private routing.

Which metrics should I track?

Key indicators include inclusion probability, median confirmation time, effective execution price versus quoted price, and failed or reordered transaction frequency across different RPC providers.

Is one provider enough?

Performance data suggests multi-RPC strategies improve uptime and execution reliability, reducing dependence on a single relay and lowering censorship or outage risk.

Does MEV protection affect fees?

Yes. Priority tips or relay fees often increase nominal costs, but data shows net execution costs are frequently lower than losses from adversarial trading.