Many traders in Canada’s developing cryptocurrency market look for platforms that provide secrecy and less verification. The Best Crypto Exchanges in Canada With No KYC access to well-known cryptocurrencies while enabling them to trade digital assets without undergoing stringent identification verification.

These services, which range from local possibilities like Bull Bitcoin to decentralized exchanges like Uniswap, strike a compromise between anonymity, convenience, and security, appealing to consumers who value independence above conventional verification processes.

Key Points Table

| Platform | Available to Canadians | Legal Status in Canada |

|---|---|---|

| Bitunix | Yes (not regulated locally) | Not FINTRAC-registered |

| MEXC | Limited access | Not registered in Canada |

| LBank | Yes | Not Canadian regulated |

| BYDFi | Yes | Not FINTRAC-registered |

| Uniswap | Yes (wallet-based) | Legal to access (self-custody) |

| Hyperliquid | Yes | Decentralized protocol |

| Bisq | Yes | Decentralized software |

| HodlHodl | Yes | Non-custodial |

| Bull Bitcoin | Yes (Canada-based) | Complies with Canadian law |

| RoboSats | Yes | Decentralized protocol |

1. Bitunix

Canadians can trade at Bitunix without having to provide any KYC other than an email. There is a 0.08% maker and 0.10% taker fee for spot trading, and higher VIP tiers can get discounts. The exchange has many crypto assets and hundreds of trading pairs.

There are also KYC withdrawal limits, but because the exchange holds an MSB license and is listed with Canada’s FINTRAC, no KYC trading is somewhat compliant. There are no CAD on‑ramps, and the exchange is a crypto only as far as NO KYC trading is concerned.

Bitunix key Point

- Established: ~2020

- Type of Platform: Centralized offshore exchange

- Method of Deposit: Crypto only — no CAD deposit support

- Method of Withdrawal: Crypto withdrawals (limits if no KYC)

- Available Cryptocurrencies: 500+ tokens and trading pairs

- Trading Fees: Maker Fees 0.08%, 0.10% taker

- KYC Requirement: Yes

- Canada Legal Status: Not registered with FINTRAC; use carries regulatory risk

Bitunix

Pros:

• Trading at this exchange does not require full KYC.

• Spot trading fees are low (approximately 0.08% and 0.10%)

• Number of crypto trading pairs = more than 500.

Cons:

• Canadian dollars (CAD) cannot be used as a funding method — the only method crypto funding can be used.

• With no KYC there is a withdrawal credit limit.

• This platform is not regulated in Canada — so, ignores FINTRAC regulations.

• Canadian users are exposed to regulatory risks.

2. MEXC

MEXC is a public global exchange with Canadian clients being able to make trades without KYC but with KYC withdrawal limits (e.g. no more than 10 BTC can be traded per unverified user). The exchange offers KYC on spot, futures, margin, and P2P trading with the exchange offering the best trading fees.

The trading fees are on average a 0% fee as a maker and a 0.05% fee as a taker. The fees get lower as the trade volume increases and gets even lower if the user holds the exchange’s native token.

Although MEXC is based in Canada, it is not a FINTRAC registered exchange, meaning it likely has terms that could restrict Canadian residents from using it. Therefore, using a Canadian IP to access this website could violate your country’s anti-money laundering laws.

MEXC key Point

- Established: 2018

- Type of Platform: Centralized global exchange

- Method of Deposit: Crypto, fiat via partners

- Method of Withdrawal: Crypto; limits if not verified

- Available Cryptocurrencies: 1000+ assets

- Trading Fees: ~0.05% taker / lower maker possible

- KYC Requirement: Yes

- Canada Legal Status: Not CE‑regulated; region restrictions possible

MEXC

Pros:

• Supported trading assets are in the thousands.

• Low trading fees (approximately 0.05% for takers).

• KYC is not required for basic trading.

Cons:

• Unverified users have withdrawal limits.

• This is not a Canadian registered exchange.

• Some of these features may be restricted or limited.

3. LBank

Like LBank, LBank is an offshore centralized platform that provides a lot of crypto trading pairs and has a tiered system that allows users to trade pre KYC enforcement. Spot fees are about 0.10% for makers and takers, and even derivatives fees are good.

KYC exempt users are subject to a withdrawal limit (e.g., ~10 000 USDT), and higher limits come with more verification. LBank has a wide variety of altcoins, but it does not have direct CAD on-ramps or local support for Canadian dollars.

LBank also being an offshore exchange means that Canadian users can access it without being compliant with Canadian laws, so they need to be careful.

LBank key Point

- Established: 2015

- Type of Platform: Centralized global exchange

- Method of Deposit: Crypto only

- Method of Withdrawal: Crypto; limits

- Available Cryptocurrencies: ~400+ assets

- Trading Fees: ~0.10% maker/taker* KYC Requirement: Not required for some features

- Legal Status in Canada: Offshore; local regulation not applicable

LBank

Pros:

• Numerous cryptocurrencies are available for trading.

• Simple spot trading is available at average fees of 0.10%.

• KYC is not required for basic trading.

Cons:

• There are no CAD deposits available.

• There are withdrawal limits for unverified users.

• This exchange is offshore and does not have Canadian regulations.

4. BYDFi

BYDFi is a global centralized exchange that has spot, derivatives, margin, and copy trading and supports over 800 assets. Allowing users to trade and withdraw cryptocurrency with no KYC required, and offering significantly lower trading fees and maker fees on spot and derivatives.

BYDFi provides no KYC trading at no KYC trading at no KYC trading at no KYC trading at no KYC trading at no KYC trading at no KYC trading at BYDFi is not registered with Canadian regulators, and with no KYC access to the trading fees, BYDFi offers no KYC trading at no KYC trading fees no KYC trading fees at their own regulatory risk.

BYDFi key Point

- Founded: 2021

- Platform Type: Centralized crypto exchange

- Deposit Methods: Cryptocurrency and some fiat through partners

- Withdrawal Methods: Cryptocurrency

- Cryptocurrencies Available: approx 800

- Trading Fees: 0 maker / ~0.10% taker

- KYC Requirement: Not required at lower tiers

- Legal Status in Canada: Not registered with FINTRAC

BYDFi

Pros:

• There is no KYC for basic trading accounts.

• The fees are quite competitive. (approximately 0% for maker fees and 0.10% for takers).

• Backed by partners for fiat & multiple crypto assets.

Cons:

• Limitation on withdrawals until verified.

• Not registered with FINTRAC in Canada.

• If policies change, there is risk involved.

5. Uniswap

Uniswap is a decentralized exchange on Ethereum, making it possible for Canadians to swap tokens without setting up an account, and without the need to KYC. Users pay fees, which include liquidity pool fees averaging about 0.3% for each trade, Ethereum gas fees, and thousands of Ethereum gas fees.

As a decentralized exchange (DEX), Uniswap does not hold tokens, and users maintain control of their private keys. Furthermore, there is no central organization to target for KYC data. Uniswap is operated without a license, which Canadians are free to use, but are responsible for paying taxes in Canada.

Uniswap key Point

- Founded: 2018

- Platform Type:** Decentralized exchange (DEX)

- Deposit Methods: Wallet only crypto

- Withdrawal Methods: Wallet only crypto

- Cryptocurrencies Available: Thousands

- Trading Fees: ~0.3% pool + Ethereum fees

- KYC Requirement: Not required

- Legal Status in Canada: Legal, no exchange registration

Uniswap

Pros:

• Genuine decentralization — no KYC.

• 1000s of different tokens (ERC-20).

• Self custody retention.

Cons:

• Ethereum gas fees.

• No fiat on-ramps & no support.

• Trading is not easy for novices.

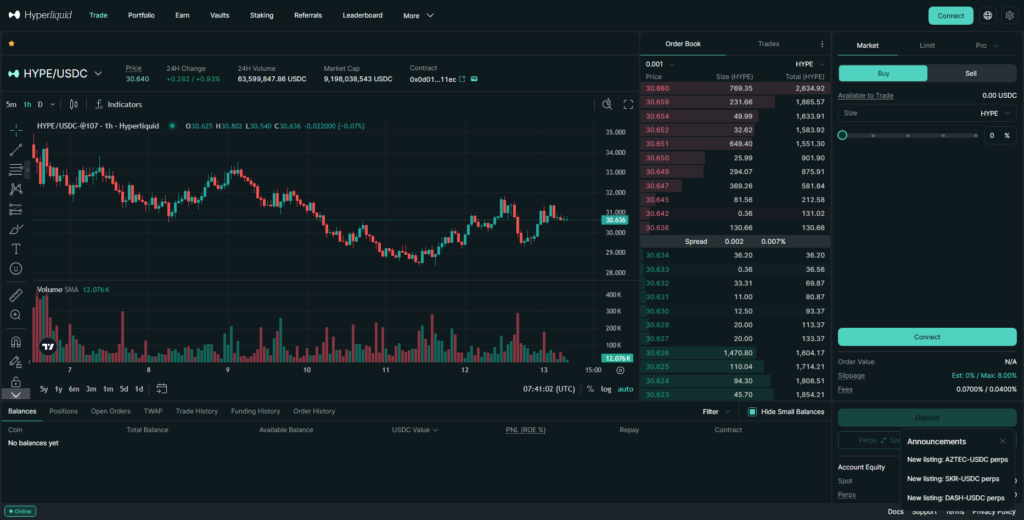

6. Hyperliquid

Hyperliquid offers a decentralized Layer-1 exchange that mixes a fully on-chain order book with low-cost high-speed trading. They provide spot, margin, and perpetual trading with advanced order types, and with no KYC required you can trade with a connected wallet.

Trading volume can also include incentives and give-backs depending on your trading activity. They also have many assets that can be deposited via 30+ chains and are trying to provide CEX-like features with decentralized custodial and transparent trading.

As a decentralized exchange, Canadians can legally trade on it, although the lack of a direct CAD on-ramp means users will have to use external bridges or swaps to trade.

Hyperliquid key Point

- Founded: 2022

- Platform Type: Decentralized order book exchange

- Deposit Methods: Wallet crypto only

- Withdrawal Methods: Wallet crypto only

- Cryptocurrencies Available: Multi-chain assets

- Trading Fees: Incentive based / volume scaled

- KYC Requirement: No

- Legal Status in Canada: Legal access, decentralized

Hyperliquid

Pros:

• Experience with an order book that is decentralized.

• No KYC with wallet-to-wallet.

• Low latency, with trading and rewards.

Cons:

• No support for fiat deposits.

• Varying liquidity dependent on the asset.

• Some Defi knowledge is needed.

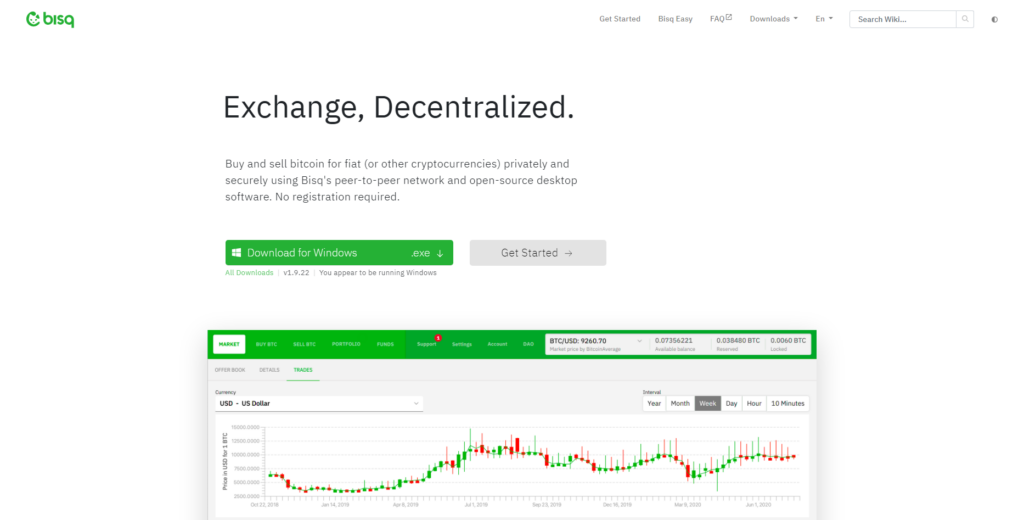

7. Bisq

Bisq is a decentralized, peer-to-peer exchange that is fully non-KYC and is in fact developed around privacy and non-custodial trading principle. Fees are also privacy based therefore, depending on your chosen payment method, can be quite low (often below 1%). Offers set by peers and can vary quite a bit. When trading, Bisq will connect you with buyers in a Tor friendly network. They have escrow and multisig.

For the time being, customers can legally use Bisq if they are Canadian residents, as they may still be able to use it. If they’re expecting to trade with high volumes, they should turn to other options, as Bisq’s: Limited liquidity, high trading fees, and non-CAD decentralized on-ramps will be too costly for most high-volume trades.

Bisq key Point

- Founded: 2014

- Platform Type: P2P decentralized exchange

- Deposit Methods: Fiat/crypto depending on offers

- Methods for Withdrawal: Fiat/crypto P2P

- Available Cryptocurrencies: BTC & P2P-listed altcoins

- Fee Structure: ≈0.1-1% varying offer-based

- KYC Policies: ❌ None

- Status in Canada: Legal; privacy-focused non-custodial

Bisq

Pros:

• No KYC & fully decentralized P2P.

• Privacy focused and non-custodial.

• Numerous payment methods are supported.

Cons:

• Centralized exchanges have more liquidity.

• Trade execution may take longer.

• Beginners may find the interface challenging.

8. HodlHodl

HodlHodl is an example of a peer-to-peer Bitcoin trading platform that operates with *no KYC (know your customer) policy, and no centralized account verification. Trades are facilitated through a multisig escrow account, meaning that the buyer, seller, and platform hold a signature, and each participant can set their own price and payment method.

Platform fees are typically around *0.3%*, and affiliate programs exist that can reduce fees. There are no KYC requirements, and no payment method is specified (as it can be anything from a bank transfer to an escrow payment).

Since the platform is non-custodial, Canadians can use it for fiat and crypto. While using it as a decentralized marketplace is legal, Canadian users still have to *report and pay taxes on their trades.

HodlHodl key Point

- Inception: 2017

- Type of Platform: P2P Bitcoin market

- Deposit Options: Fiat / Crypto (peer offers)

- Withdrawal Options: Fiat / Crypto

- Available Cryptocurrencies: BTC (plus some P2P trades)

- Fee Structure: ~0.3% flat (split)

- KYC Policies: ❌ No

- Status in Canada: Legal to use as marketplace

HodlHodl

Pros:

• No centralized KYC for P2P trading.

• Interface is clean & easy to use.

• Assets are not held in custody, only multisig escrow.

Cons:

• Limited assets (mostly Bitcoin).

• Price negotiations may be required.

• Liquidity is dependent on peer offers.

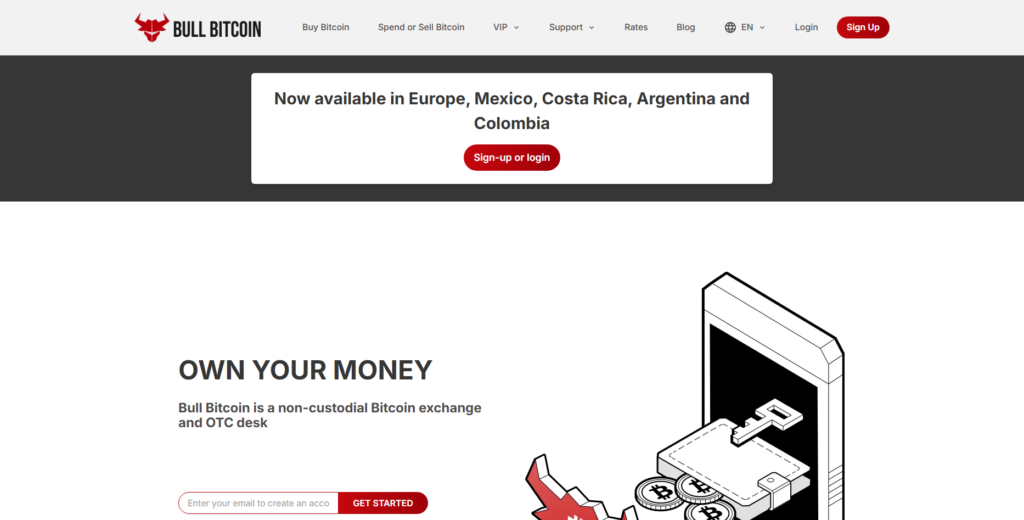

9. Bull Bitcoin

Bull Bitcoin is a complaint Canadian exchange and wallet provider that operates in Montreal, prioritizing customer privacy. It allows Canadians to purchase Bitcoin easily and without KYC, and for small amounts of cash it is possible to use a mail service, Bitcoin voucher system, or Bitcoin ATM with little to no identification.

Instead of standard maker/taker fees, it charges spread‑based fees, so a small markup is included in the buy/sell price.

Being a Canadian company, it is bound by regulations, but it still offers accessible privacy-friendly methods to obtain crypto, making it one of the best options legally available locally for minimal-KYC crypto acquisition.

Bull Bitcoin key Point

- Inception: 2019

- Type of Platform: Canadian Bitcoin exchange & wallet

- Deposit Options: CAD bank, cash-by-mail, Bitcoin voucher, ATMs

- Withdrawal Options: Bitcoin to self-custody wallet

- Available Cryptocurrencies: Bitcoin only

- Fee Structure: Spread-based (market price + margin)

- KYC Policies: Minimal for small buys

- Status in Canada: Canadian regulated & compliant

Bull Bitcoin

• Legally compliant, Canada-based.

• No verification for small buy (KYC) transactions

• Easily deposit Canadian Dollars through (CAD) banks, vouchers, or ATMs

Cons:

• Altcoins are not accepted, only (BTC)

• Fees are not clear regarding spreads.

• More tools are required for advanced trading.

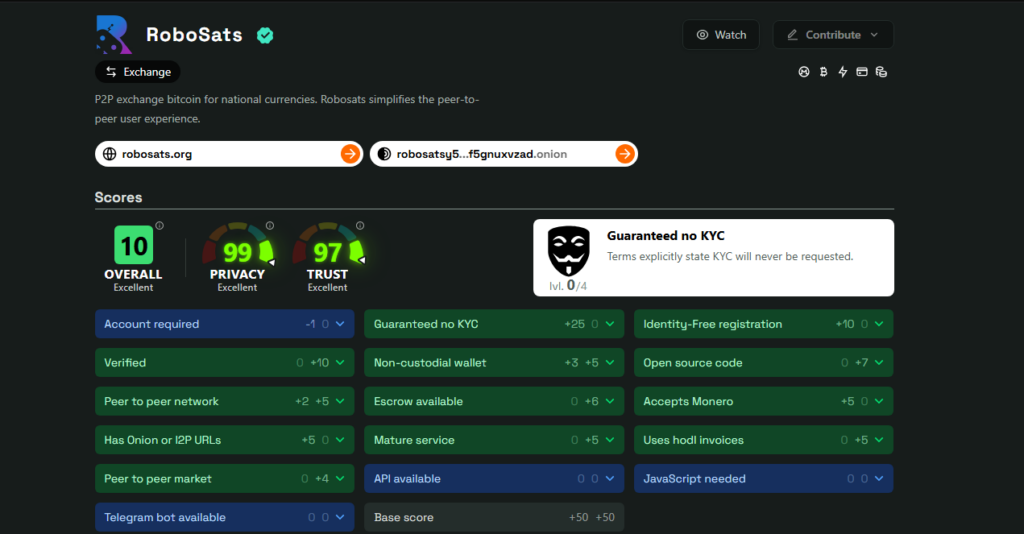

10. RoboSats

RoboSats is an exchange for the Bitcoin peer-to-peer Lightning Network that prioritizes user privacy. Users trade BTC for fiat without accounts or identity verification on Tor and similar services.

It has a total fee of ~0.2% of trade value, with trades settled via Lightning escrow and hodl. It is decentralized and non-custodial, so Canadians can use it legally as a P2P marketplace.

However, the technical setup and reliance on Lightning wallets may be barriers for less sophisticated users compared to other exchanges.

RoboSats key Point

- Inception: 2021

- Type of Platform: P2P Lightning Network trading

- Deposit Methods: BTC via Lightning

- Withdrawal Methods: BTC via Lightning

- Available Cryptocurrencies: Bitcoin only

- Fee Structure: ~0.2% total (maker + taker)

- KYC Policies: ❌ None

- Legal Status in Canada: Legal as distributed P2P

RoboSats

Pros:

• No KYC required for trading on Lightning Network.

• Funds are settled quickly on the blockchain.

• Advanced anonymization.

Cons:

• Only bitcoin.

• You need to set up a Lightning wallet.

• Not very user-friendly.

How to Choose the Right Exchange in Canada?

Following are the most important aspects to review for narrowing down the best crypto exchange options in Canada.

Regulatory Compliance

To choose the safest exchange, identify the regulation FINTRAC has put trade protective guidelines in place for the exchange. Compliance with KYC, and AML regulations, trade protective, and financial protective risks are lowered.

Trading Fees

Analysts, takers, and withdrawal fees. Although maker, taker, and withdrawal fees may be lower, measuring the trade costs for each exchange will include hidden spreads and net costs.

Supported Cryptocurrencies

Available cryptocurrencies vary among exchanges and will include altcoins and or stablecoins to trade in, and long term invest to diversify, so be selective for yours.

Deposit & Withdrawal Options

Choose platforms with bank/ATM/Interac e-transfer CAD deposit and withdrawal options. Options with fewer fees and quicker transaction times are more beneficial to other exchange users.

Security Features

To lower risk when exchanges with crypto hacks, theft, or unauthorized access, choose crypto exchanges with good security, cold storage, and insurance 2FA.

KYC & Privacy

If limited trading without KYC is permitted by the exchange, be comfortable with this, but be prepared for full regulation KYC verification for cash and crypto withdrawal deposits.

Liquidity & Trading Volume

High liquidity ensures that your orders can be filled quickly without large variances in price. Check the daily volume traded and the depth of the order book; the bigger the number and the more depth, the less slippage and the more efficient execution of orders.

User Experience & Support

For trading, platforms that provide an easy to use their platform (such as having a mobile app), and provide help quickly and easily, will improve your trading significantly as the more streamlined the process, the less time that will be lost and the more time that can be spent on trading.

Reputation & Reviews

Reliability can be gauged by the reputation of the exchange within the community, the reviews of the exchange, and the handling of the exchange over time. Have a well known reputation in the community for giving the funds the honest, clear, and trustworthy handling of the funds.

Additional Features

If your trading style involves staking, lending, derivatives, or P2P trading, be sure to consider these additional features as they can increase your potential earnings but also add additional complexity and possible fees.

How to Choose the Best No ID Verification Crypto Exchange?

Legitimate Access

Check if the exchange allows no ID verification (no KYC) for basic trading or withdrawals.

Wallet Security

Choose exchanges that have cold storage and 2FA for your convenience and security. Also consider ensuring your own keys (via DEX or P2P) for added security.

Total Cost

Trading fees, withdrawal fees, and network fees can be hidden costs. Ensure you are aware of the total cost before trading, as visible fees can be offset by high network costs.

Listed Assets

Select exchanges or services that list the cryptos you wish to trade (BTC, ETH, and others). Having a larger list of cryptos enables better trading and diversification.

Trading Volume

Having high liquidity means that your orders fill more quickly and at better prices which helps to decrease slippage. This is important on unregulated platforms that trade without verification.

Trustworthiness of the Exchange

Even if the exchange has no ID, if most reviews and feedback to the exchange are positive, it’s likely the exchange is trustworthy.

Withdrawal Limits

Frequently, accounts that do not verify KYC, have restrictions on how much can be withdrawn on a daily basis. Make sure that this limit will be enough for your needs, especially if you are intending on a lot of trading or moving of funds.

Legal Compliance Risks

Understand your local laws: no KYC exchanges may sit in gray areas of the law — make sure you are okay with the possibility that there may be some regulatory issues in your country.

Decentralized Alternatives

If you value privacy, consider DEXs and P2P platforms. Uniswap, Bisq and HodlHodl do not keep accounts, but this means you will have to have much better self-custody skills.

Ease of Use

If you are new to crypto or privacy-focused trading, you’ll want to choose an exchange that is simple and offers good customer support, as well as thorough and clear guides.

Conclusion

Exchanges that don’t require KYC in Canada involve trade-offs between privacy, safety, and legality. Research shows that anonymous centralized exchanges, like Bitunix, MEXC, LBank, and BYDFi, are offshore and unrulated.

They provide limited trading and withdrawal options that don’t require verification. On the contrary, some decentralized P2P platforms like Uniswap, Hyperliquid, Bisq, HodlHodl, and RoboSats offer non-KYC trading but require self custody and have reduced liquidity with no direct CAD onramps.

A prime example is Bull Bitcoin which shows that Canadians can legally acquire bitcoin with little to no ID verification and uses CAD-deposits while abiding by FINTRAC regulations. Research shows that when choosing a no-KYC platform, users consider security, features, trading fees, the range of trading assets, and withdrawal limits.

FAQ

Is it legal to use no-KYC exchanges in Canada?

Using fully anonymous centralized exchanges is generally not regulated in Canada and may fall into a legal gray area. Canadians must still comply with tax and reporting obligations. Decentralized exchanges (DEXs) and P2P platforms are legal to use.

Which platforms allow Canadians to trade without ID?

Platforms like Bitunix, MEXC, LBank, BYDFi allow limited trading without KYC. For decentralized options, Uniswap, Hyperliquid, Bisq, HodlHodl, RoboSats provide full non-KYC trading. Bull Bitcoin allows minimal ID for small trades legally.

Are there withdrawal limits on no-KYC accounts?

Yes. Most no-KYC platforms impose daily or monthly withdrawal caps. For example, offshore exchanges like MEXC and LBank restrict unverified accounts, while P2P and DEXs typically have no formal limits but rely on counterparty liquidity.

Are no-KYC exchanges safe?

Safety depends on platform type:

Centralized offshore exchanges carry regulatory and counterparty risk.

DEXs and P2P platforms are non-custodial, reducing hacking risk but requiring careful wallet management.

Security features like 2FA, cold storage, and multisig escrow improve safety.

Which is the best option for privacy in Canada?

For maximum privacy, use DEXs or P2P platforms (Uniswap, Hyperliquid, Bisq, HodlHodl, RoboSats), as they do not require accounts or KYC.

Which is the best legal option for Canadians?

For a legal and compliant choice, Bull Bitcoin is recommended. It allows small transactions with minimal ID, supports CAD, and follows Canadian regulations.