The world of cryptocurrency has become more popular recently; however, the potential of hacks, frozen assets, and poor management of centralized exchanges is worrying.

Investors seeking more private and secure investment options are turning to decentralized exchanges, peer-to-peer exchanges, and non-custodial crypto solutions.

These methods are particularly useful for crypto investors seeking more private and secure transaction methods, as they provide ownership of funds and low counterparty risk.

Key Points & Alternatives To Centralized Exchanges for Secure Trading

| Alternative | Key Points |

|---|---|

| Decentralized Exchanges (DEXs) | No central authority, user retains control of funds. |

| Peer-to-Peer (P2P) Platforms | Direct trading between users, often with escrow services. |

| Atomic Swaps | Cross-chain trades without intermediaries. |

| Hardware Wallet Trading | Trades signed offline, minimizing hacking risks. |

| Non-Custodial Wallets with Swap Features | Users trade directly from wallets without custody. |

| Decentralized Finance (DeFi) Protocols | Automated liquidity pools and smart contract trades. |

| Decentralized Aggregators | Aggregate liquidity from multiple DEXs for better prices. |

| Off-Chain Trading Platforms | Use off-chain order books, on-chain settlement. |

| Decentralized Marketplaces | Peer-to-peer markets with decentralized escrow and reputation systems. |

| Trustless Custodial Services | Custody with multi-signature or smart contract control. |

10 Alternatives To Centralized Exchanges for Secure Trading

1. Decentralized Exchanges (DEXs)

Users can trade cryptocurrencies directly from their wallets on decentralized exchanges (DEXs), which function without a central authority. The blockchain’s smart contracts facilitate trades, guaranteeing transparency and lowering the possibility of fraud or hacking.

Security is improved because users maintain complete control over their private keys. PancakeSwap, SushiSwap, and Uniswap are well-known DEXs. However, in contrast to centralized exchanges, DEXs might have slower transaction speeds and less liquidity.

Notwithstanding these difficulties, they provide increased privacy, resistance to censorship, and a decreased dependence on outside middlemen, which makes them a safe substitute for trading cryptocurrencies.

Features Decentralized Exchanges (DEXs)

- User custody: Users are still in charge of their money and private keys.

- Transparency: Every transaction is publicly verifiable and recorded on the chain.

- Lower risk: Compared to centralized exchanges, it is less vulnerable to hacks and platform outages.

2. Peer-to-Peer (P2P) Platforms

Peer-to-peer (P2P) trading platforms allow transactions to take place directly between buyers and sellers, eliminating the need for middlemen. Individual users bargain over costs and modes of payment, and many platforms provide escrow services to safeguard money until transactions are confirmed.

P2P platforms such as Paxful and LocalBitcoins accept a variety of payment methods, such as digital wallets, bank transfers, and cash. Accessibility is improved by this model, particularly in areas with few exchange services.

Escrow and reputation systems are crucial for safer trades because, despite the increased privacy and control they provide, P2P trading necessitates close attention to counterparty trust and security procedures in order to prevent scams.

Features Decentralized Exchanges (DEXs)

- Escrow services: Money is kept safe until the trade is confirmed by both parties.

- Flexible payment options: Accepts cash and bank transfers, among other local payment methods.

- Reputation systems: Reviews and ratings from users lower the risk of fraud.

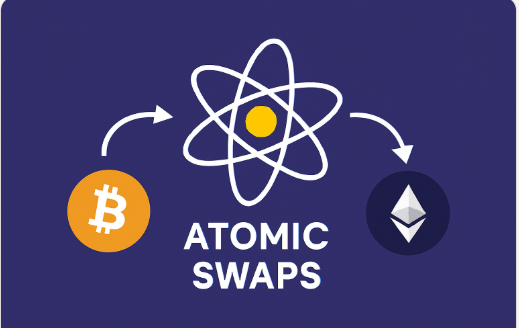

3. Atomic Swaps

Direct cryptocurrency transactions between two distinct blockchains are made possible by atomic swaps, which eliminate the need for middlemen or centralized exchanges.

In order to prevent money loss, this trustless technology uses smart contracts to make sure that either both parties complete the trade at the same time or neither does.

Atomic swaps give users greater control over their assets and improve cross-chain liquidity. They promise smooth, safe trading across several blockchains without depending on custodial platforms, despite being less popular and still in the early stages of development.

This invention is a crucial instrument for decentralized, safe trading in the cryptocurrency ecosystem since it lowers counterparty risk and boosts privacy.

Atomic Swaps Features

- Secure transaction signing: To avoid unwanted access, users must physically approve trades on the device.

- Compatibility: Supports a wide range of wallets and decentralized trading platforms.

- Lower danger of hacking: More resilient to phishing and malware assaults that target software wallets

4. Hardware Wallet Trading

Signing cryptocurrency transactions offline with a physical device that safely stores private keys away from online threats is known as hardware wallet trading.

To avoid being vulnerable to malware or hacking, users confirm and authorize trades on the hardware wallet itself after initiating them on a connected platform.

A robust security layer is added to trading activities by well-known hardware wallets like Trezor and Ledger, particularly when combined with decentralized exchanges or wallets that support swap functionality.

This approach greatly lowers the possibility of key theft and illegal transactions, which makes it a great option for safe cryptocurrency trading while keeping complete asset custody.

- User control: The user retains custody of the private keys.

- Built-in swaps: The wallet interface allows users to trade tokens directly.

- Link to liquidity pools: Trades made using DEXs, or decentralized liquidity providers.

- Enhanced privacy: Less exposure because there is no need to deposit money on an exchange.

5. Non-Custodial Wallets with Swap

Users can maintain control and security over their assets by holding their private keys and money in non-custodial wallets. Nowadays, a lot of wallets have swap capabilities built in, allowing users to trade cryptocurrencies straight from the wallet interface without transferring money to an exchange.

Because money never leaves the user’s control, this lessens vulnerability to hacks or platform failures. MetaMask, Trust Wallet, and Exodus are a few examples.

These wallets combine ease of use and security by connecting to decentralized liquidity pools, or DEXs, for smooth swapping. This method lessens dependency on centralized trading platforms while increasing user autonomy and privacy.

Non-Custodial Wallets with Swap Features

- Built-in swaps: The wallet interface allows users to trade tokens directly.

- Link to liquidity pools: Trades made using DEXs, or decentralized liquidity providers.

- Enhanced privacy: Less exposure because there is no need to deposit money on an exchange.

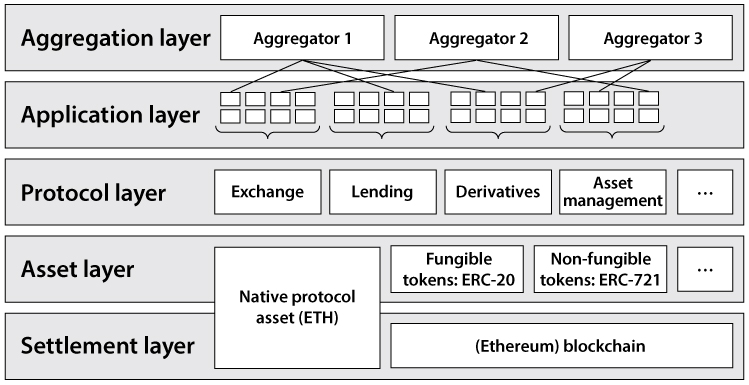

6. Decentralized Finance (DeFi) Protocols

DeFi protocols allow smart contracts on blockchains such as Ethereum to facilitate safe, permissionless trading.

They provide automated liquidity pools that allow users to exchange tokens without the need for middlemen. Instead of using order books to match buyers and sellers, platforms such as Uniswap, Curve, and Balancer use algorithmic pricing to enable instant trades.

This lowers counterparty risk and gets rid of centralized control. By offering liquidity, DeFi protocols also enable users to receive fees.

Despite DeFi’s innovation, users should be aware of the risks of impermanent loss and smart contract vulnerabilities. All things considered, DeFi encourages accessible, safe, and transparent trading within the decentralized ecosystem.

Decentralized Finance (DeFi) Protocols Features

- Automated trading: Order execution and liquidity management are managed by smart contracts.

- Anyone with a compatible wallet can trade without authorization thanks to permissionless access.

- Users can add assets to liquidity pools and receive fees from trading.

- Transparent operations: On-chain, all trades and liquidity information are accessible to the general public.

7. Decentralized Aggregators

To provide users with the best trade prices and the least amount of slippage, decentralized aggregators pool liquidity from several decentralized exchanges.

These platforms optimize for cost and execution speed by distributing orders among multiple venues rather than utilizing a single DEX.

Matcha and 1inch are two examples. They increase trading efficiency and lessen price impact, particularly for large orders, by pooling liquidity.

Users keep custody of their money during trades because they use smart contracts, which improves security. By combining the advantages of several DEXs while maintaining the decentralized and secure trading principles, aggregators enhance the user experience.

Decentralized Aggregators Features

- Several sources of liquidity: Aggregators extract liquidity and prices from a number of DEXs.

- Trades that are optimized: Divide orders to reduce slippage and raise the price of execution.

- Non-custodial: Smart contracts facilitate trades while protecting user cash.

- Easy to use: Condenses intricate decentralized trade into a single interface..

8. Off-Chain Trading Platforms

Off-chain trading platforms settle trades on-chain but manage order matching and negotiation off-chain. By restricting on-chain activity to final settlement, this method expedites transactions and lowers blockchain fees. Loopring and the 0x protocol are two examples.

While maintaining decentralized custody and settlement transparency, users gain from quicker trade execution and reduced costs. Off-chain order books can improve liquidity and lessen blockchain congestion.

Even though smart contracts enforce final trade settlements and maintain a safe trading environment, users still need to have some faith in the off-chain order matching system.

Off-Chain Trading Platforms Features

- Faster trades: Orders are matched off-chain to cut down on latency and congestion on the blockchain.

- Reduced fees: Transaction expenses are reduced by restricting on-chain activity to settlement.

- Until the final settlement, funds remain in user wallets, maintaining decentralized custody.

- Smart contract settlement: Guarantees verifiable and trustless on-chain deal completion.

9. Decentralized Marketplaces

Peer-to-peer digital asset trading platforms known as decentralized marketplaces use smart contracts or on-chain escrow and reputation management.

By cutting out middlemen, these marketplaces enable safe, direct trading between users. OpenSea for NFTs and specialized cryptocurrency marketplaces for token exchanges are two examples.

Decentralized dispute resolution procedures and transparent transaction records are essential to security and trust. This model lowers centralized risks while improving privacy and control.

In contrast to centralized exchanges, decentralized marketplaces typically offer a more secure and censorship-resistant environment, though users must still use caution when dealing with counterparties.

Decentralized Marketplaces Features

- Peer-to-peer sales: Without the need of middlemen, buyers and sellers exchange assets directly.

- On-chain escrow: Smart contracts retain money until certain requirements are fulfilled.

- Reputation systems: Reviews and ratings increase credibility and lower fraud.

- Censorship-resistant: Platform intervention or shutdowns are avoided by the decentralized architecture.

10. Trustless Custodial Services

In order to lower the risk of theft or fraud, trustless custodial services provide custody solutions that use smart contracts or multi-signature wallets to require multiple approvals for withdrawals or trades.

These services strike a balance between security and usability by not having complete control over users’ money like traditional custodians do. Fireblocks and Gnosis Safe are two examples.

These platforms enable more flexible trading while providing institutional and retail traders with improved security. Trustless custodians reduce single points of failure by dividing control among several parties or code, making cryptocurrency trading safer without compromising usability.

Trustless Custodial Services Features

- Wallets with multiple signatures: Increase security by requiring several approvals before transactions can be completed.

- Smart contract control: Uses preset rules to automate fund management.

- By sharing control, shared custody lowers the possibility of a single point of failure.

- Institutional-grade security: Made to be traded and stored securely without being totally dependent on outside parties.

Conclusion

Traders looking for safety, transparency, and self-governance no longer have to stick to centralized exchanges only. Decentralized Exchanges (DEXs), Peer-to-Peer (P2P) exchanges, and other non-custodial trading options allow users to retain self-custody while also limiting the counterparty risk.

These alternatives also enhance privacy, reduce the reliance on the intermediaries, and increase financial sovereignty. Although liquidity and usability are still challenges, the continuous growth of technology persists to solve these issues.

For traders who value self-custody, secure trading, and long-term sustainability of the blockchain financial ecosystem, researching alternatives to centralized exchanges is crucial.

FAQ

What are alternatives to centralized exchanges?

Alternatives include decentralized exchanges (DEXs), peer-to-peer (P2P) platforms, and non-custodial wallets. These options allow users to trade cryptocurrencies without relying on a central authority, giving traders full control of their funds.

Why choose alternatives over centralized exchanges?

Alternatives reduce counterparty risk, enhance privacy, and provide greater control over assets. They also minimize the risk of hacks, theft, or platform mismanagement common in centralized exchanges.

Are decentralized exchanges safe?

DEXs are generally secure since users retain control of their private keys. However, risks like smart contract vulnerabilities and low liquidity still exist, so it’s important to choose reputable platforms.

Can I trade major cryptocurrencies on alternatives?

Yes. Most alternatives support popular coins like Bitcoin, Ethereum, and stablecoins. Some platforms also offer cross-chain swaps, expanding trading possibilities.

How do transaction fees compare?

Fees on alternatives can vary. DEXs may charge network gas fees, while P2P platforms usually have minimal trading fees. Overall, fees are often lower than centralized exchanges, depending on the network congestion.