AMarkets is a universal Forex and CFD broker where traders have a variety of account types, platforms, and trading instruments at their disposal.

AMarkets prides itself on its supportive client service and is a great option for novice, intermediate, and experienced traders because its spreads are very competitive, leverage starts at 1:1000, and traders have 24 hour access.

AMarkets has MT4, MT5, cTrader, and one of their own applications. Worldwide, customers practicing different trading strategies feel safe because of AMarkets combined trading tools and transaction security.

What Is AMarkets?

AMarkets has been providing impeccable service in the industry since 2007. While the focus of the company is the development of new services, innovative technologies, and new trading solutions, they strive to tailor services to every client.

This broker has created the perfect trading and investment conditions which is evidenced by their customer loyalty and numerous industry awards. AMarkets provides various financial instruments for online trading. This includes Forex instruments, CFDs, metals, and more.

Key Details

| Broker Name | AMarkets |

|---|---|

| Minimum Deposit | $100 USD |

| Fund Withdrawal Fee | None |

| Spreads From | 0.0 pips (ECN accounts) |

| Commissions | From $3 per lot (ECN accounts) |

| Swap Fees | Yes (varies by instrument) |

| Leverage | Up to 1:1000 |

| Regulation | 🇲🇺 MISA, 🇲🇺 FSC, 🇸🇨 FSA |

Opening an Account with AMarkets

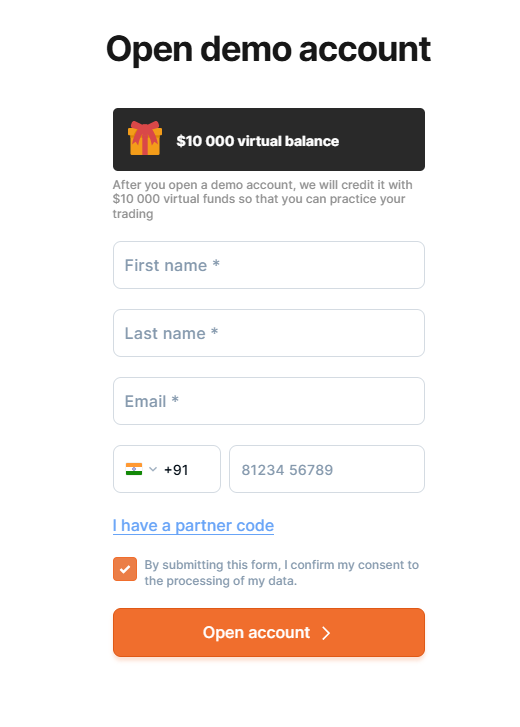

To open an account with AMarkets follow this uncomplicated sequence of actions:

Check Out the AMarkets Website: Navigate to the official AMarkets website and hit “Open Account”.

Register Your Details: Input your personal data such as full name, email, phone number, and country of residence.

Select Account Type: Based on your trading preferences, choose from Standard, Zero, ECN, Crypto, or Islamic (swap-free) accounts.

Define Account Currency and Leverage: Pick your base currency to be USD, EUR, or crypto and choose your leverage of 1:1000.

Agree to Terms and Conditions: Go over the policies of the broker, and the risks that you will be assuming, and confirm your agreement.

Identify Verification Processing: To satisfy AML/KYC legislation, you will be required to submit an ID document (passport or ID card) and proof of your residence.

Fund Your Account: Your AMarkets account will be credited with your deposit fee as a reimbursement. Use a payment method of your choice: credit/debit cards, e-wallets or crypto.

Start Trading: Log into your AMarkets account on MT4, MT5, cTrader, or the AMarkets App and start trading.

Accounts

1. Standard Account

This account has floating spreads starting at 1.3 pips and features no commission on metals and Forex, and supports Instant and Market execution. You can trade for $100/€100 within 1:3000 leverage and a deposit of $100/€100. Trading hours are Monday 00:00 to Friday 23:00 EET where the account is denominated in EUR or USD. Negative balance protection is in effect.

2. Zero Account

This account is perfect for scalpers and day traders. It boasts zero spreads on major currency pairs and metals 90% of the time, thus incurring low costs to trade. It is of Market Execution and requires a starting balance of $200 where it too is under 1:3000 of total leverage. The stop-out level is 40%, 50% buffer for margin on hedged positions.

3. ECN Account

The ECN account provides direct execution through a Prime broker which is ideal for scalping. The ease of execution makes it incredible for quick trades. The minimum required deposit is $200/€200.

The spreads start at 0 pips, execution commisions are $2.5/€2.5 per lot per side, and it works with all trading instruments. This account type also comes with negative balance protection, a 40% stop-out level, and 50% margin for hedged positions.

4. Islamic (Swap-Free) Account

The Islamic account may be linked to Standard, Fixed, or ECN accounts which have had swap and additional fees removed in order to be compliant with Sharia law. The Islamic account excludes trades with crypto, stocks, indices, commodities, and bonds.

This account type also needs to be activated in a supported account from which the user may request this directly from their Personal Area. The system will adjust to provide the necessary accounts.

Bonuses and Promotions

In addition to the volume-based cashback rebate and VIP programs, AMarkets has a promotion which lets traders earn money that can be moved as a bonus to live trading accounts.

There is a 100% deposit bonus to a maximum of $10,000. AMarkets pays a bonus as well for traders switching from another broker and for transferring open positions.

Fees Overview

When profitability is concerned, trading costs are the two most important deciding factors when picking a broker. AMarkets has three account types depending on trading costs. These are two commission-free accounts, and one commission ECN account.

Fixed-Spread Account: Minimum spread of 3.0 pips, equivalent to $30 cost per 1 standard lot.

Standard (Floating) Account: Minimum spread of 1.3 pips, or $13 cost per 1 standard lot.

ECN Account (Commission-Based): Raw spreads from 0.0 pips, and a $5 commission per lot is the most competitive option.

AMarkets also offers competitive swap rates on overnight, leveraged positions and is thus a broker that fits most trading strategies, particularly of the ECN account is used.

AMarkets Minimum Trading Costs (EUR/USD):

| Account Type | Minimum Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|---|

| Fixed | 3.0 pips | $0.00 | $30.00 |

| Standard | 1.3 pips | $0.00 | $13.00 |

| ECN | 0.0 pips | $5.00 | $5.00 |

No deposit or withdrawal fees are charged, further enhancing AMarkets’ cost-effectiveness for active traders.

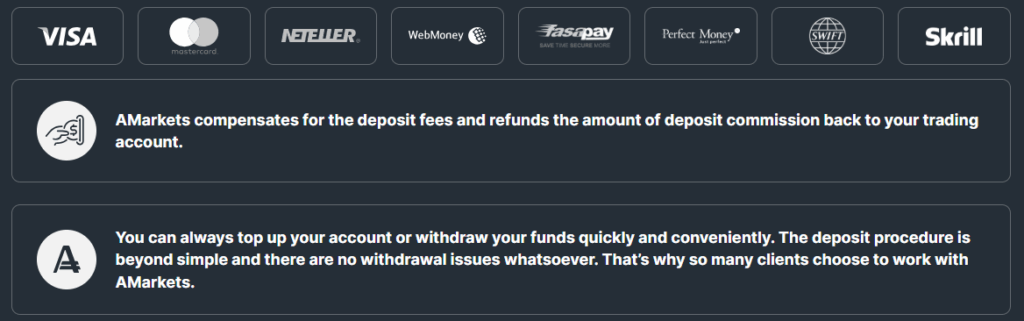

AMarkets Deposits and Withdrawals

During deposits and withdrawals, AMarkets back office ensures all transactions are safe, especially for verified users. AMarkets also ensures safe and speedy deposits and withdrawals as Bank wires are not enabled.

Deposits: All deposits apart from crypto, which takes one hour for crypto deposits, are processed instantly. To further ensure clients are saving as they are funding, AMarkets reimburses 100% of deposit fees.

Withdrawals: Once again, the payment processor defines the fees. All withdrawal requests are processed within 24 hours. The minimum withdrawal restrictions are quite lenient, with the exception of $3,000 daily for credit/debit cards.

Currency’s Supported: USD, EUR, and all accepted cryptocurrencies.

Client Compliance: For all AML payments, the account holder’s name on the payment processor should be the same as the AMarkets account to ensure security and compliance.

AMarkets Trading Platforms

AMarkets also has different offerings for all types of traders, whether they use desktops, the web, or mobile devices. Depending on their mode of preference, traders can use MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or the proprietary AMarkets App. MT4 and MT5 also provide options for copy trading and algorithmic trading and have a wide range of technical analysis tools.

MT4: The industry standard trading platform. It has easy access to 25,000 custom indicators and an assortment of plugins and Expert Advisors (EAs). The EAs and some plugins have advanced MT4 features with premium access that needs purchase. MT4 MultiTerminal is available for asset managers and for traders who manage multiple accounts.

MT5: In comparison to MT4, it has better charting features, more timeframes, and market instruments. It also enables automated and copy trading.

cTrader: It is for ECN accounts where it has a quick order execution, advanced charting, and customizable trading features.

AMarkets App: Proprietary mobile app that provides a user-friendly interface for on-the-go trading with account management and order execution features.

Additional Tools & Features:

Autochartist: Helps traders realize and take advantage of opportunities in the market by automating the scanning of chart patterns and the generation of trading signals.

Guaranteed Stop Loss: Ensures trades can be closed at exact stop levels to manage risk.

Scalping & Hedging: Supported on all platforms.

OCO Orders: Trade management with One-Cancels-the-Other orders.

Interest on Margin: Relates to leveraged positions.

All these platforms cater to all trader profiles, from novices to professional asset managers and offer automated, technical, and strategic trading tools.

AMarkets Pros & Cons

Pros:

Minimal Initial Deposit: For traders at AMarkets, the initial deposit requirement is relatively modest at just $100 USD, allowing novice traders to enter the trading market.

Leverage: AMarkets provides high leverage of up to 1:1000, which increases the potential for profit even with low account balances and small investments.

Various Account Types: AMarkets provides Standard, Zero, ECN, and Islamic accounts, allowing traders to choose the account that fits their trading style.

Multiple Trading Software Options: AMarkets traders can choose from a wide selection of trading software which includes the famous MT4, MT5, cTrader, and the proprietary AMarkets app which supports algorithmic and copy trading.

Free Withdrawals: AMarkets does not charge for withdrawals. This is beneficial for traders wanting to minimize transaction costs.

Cons:

Few Bank Transfer Options: AMarkets does not accept bank wire deposits and does not offer bank wire withdrawals which some traders may find inconvenient.

Overnight Swap Fees: AMarkets does charge overnight swap fees which may be a disadvantage for longer-term traders.

Crypto Offering is Limited: AMarkets does offer cryptocurrency trading, however the number of cryptocurrency trading pairs is limited compared to some other brokers.

Specific Accounts Have No Negative Balance Protection: During extreme market conditions, some account types may pose a risk due to the lack of negative balance protection.

Is AMarkets Legit and Safe?

Has AMarkets, operational since 2007, stood the test of time and kept a clean record? AMarkets holds a license from the Mwali International Services Authority and since it is unregulated, it also holds duly registered offices in the Cook Islands, registration number LLC14486/2023, and St. Vincent and the Grenadines, registration number 22567 BC 2015.

As a member of the Financial Commission based in Hong Kong, AMarkets has a compensation fund of up to €20,000 per client. AMarkets has access to monthly audits and verification of order execution provided by Verify My Trade and Autochartist.

Customer Support

AMarkets has great customer support. They are available 24/7 via e-mail, telephone, Telegram, and live chat. They describe their services very well, and I suggest that you look through the FAQ section before contacting support. still miss a direct line to the finance department, seeing that most issues arise from there. Nevertheless, the overall approach to customer support is very good.

Conclusion

AMarkets caters to a broad spectrum of clients, whether novice or expert, and offers multiple account types, competitive spreads, and leverage of up to 1:1000. Trade with confidence using one of the several powerful terminal options available: MT4, MT5, cTrader, or the proprietary AMarkets App, as well as automated and copy trading features.

AMarkets strives to provide the best customer experience with instant deposits, no withdrawal fees, and attentive customer service. Although there are no bank transfer options or negative swap fees, similar to the other brokers, AMarkets is still one of the best options in the market for traders who focus on efficiency and a wide range of trading possibilities.

FAQ

What is AMarkets?

AMarkets is an online Forex and CFD broker offering trading on currencies, metals, indices, cryptocurrencies, and other instruments through multiple account types and platforms.

What account types does AMarkets offer?

AMarkets provides Standard, Zero, ECN, Crypto accounts, and an Islamic (swap-free) account option, catering to beginners and professional traders.

What is the minimum deposit at AMarkets?

The minimum deposit starts at $100 USD for the Standard account. ECN and Zero accounts require $200 USD.

Which trading platforms are available?

AMarkets supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and its proprietary AMarkets App, including mobile and web versions.

Are there deposit or withdrawal fees?

Deposits are free, and AMarkets reimburses deposit fees. Withdrawals have no broker fees, but fees may apply depending on the payment processor.