This article talks about AquaFunded. AquaFunded is a leading proprietary trading firm in 2025. It offers traders funded accounts and flexible evaluation programs with high profit splits.

It enables beginner and experienced traders to trade Forex, Indices, Commodities, and Cryptocurrencies with little personal risk. Here, we will look at its features, what account types it offers, and what makes it one of the best prop firms.

What is AquaFunded?

AquaFunded is a top proprietary trading firm who risks allowing talented traders to keep a majority of their earnings while taking less of their own capital to trade.

AquaFunded seeks to empower novice and expert traders alike and therefore has a range of funded accounts for traders as well as flexible evaluation programs that are designed to fairly assess their skills.

Users can trade a variety of asset classes, including forex, commodities, and cryptocurrencies, as well as trade indices and cfd’s on well known platforms like cTrader and MetaTrader.

Prop traders at AquaFunded also get a considerable percentage of the profits which is a huge incentive to trade as well as resources to aid in mentorship and education in addition to active and prompt support.

With the focus on consistent of growth, fast payouts, and quick KYC, AquaFunded has established trust and reliability which has made it a preferred option for prop trading in 2025.

Key points

| Category | Details |

|---|---|

| Firm Name | AquaFunded |

| Founded | 2022 |

| Headquarters | Online / Global |

| Type | Proprietary Trading Firm (Prop Firm) |

| Target Traders | Forex, Indices, Commodities, Cryptocurrency traders |

| Funding Programs | Multiple account sizes with evaluation and instant funding options |

| Leverage Offered | Up to 1:100 depending on the account type |

| Profit Split | Up to 80% for traders |

| Evaluation Process | Step-based program with clear rules and targets |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Withdrawal Frequency | Fast and flexible, multiple withdrawal options |

| KYC Requirements | Minimal, streamlined process |

| Support & Education | Dedicated support, mentorship, and educational resources |

| Unique Selling Point | Combines high funding, flexible rules, and trader-friendly profit sharing |

Challenge & Get Instant Funding

AquaFunded allows traders to meet theirProfit goals within their drawdown limits. That is why different traders find their different account types suitable.

1-Step Challenge

This option is the fastest route to funding. As long as you abide by the drawdown rules, trade the stipulated minimum days, and dismantle your plan within the timeframe, you get funded. As you only need to demonstrate one profit target, this is ideal for traders with a straightforward strategy.

2-Step Challenge

This more traditional route splits your evaluation into phases. In the first stage, you achieve one goal, and the target for this step tests your discipline and edge. The second stage ensures your methodology is scalable, as your profit target is set for the second goal. This option is preferred by those who like milestone progress.

3-Step Challenge

This option encourages steady progress as you work within three smaller steps. This route is ideal for those who like and need structure. The total limit controls your position sizing.

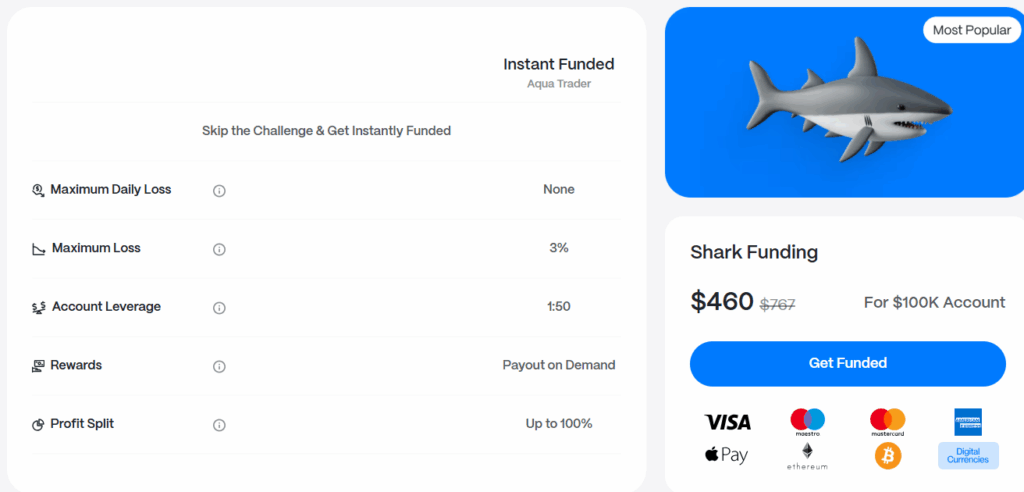

Instant Funding – Standard & Pro Plans

Instant Funding allows you to bypass evaluations by immediately starting with a funded demo account. With a Standard plan, you receive a demo account with a lower initial profit split. The Pro plan has a higher profit split. All plans have consistency rules to ensure profits are not attained and accounted for in a single day, thereby fostering a healthy, scalable equity growth curve.

How to Get Started with AquaFunded

Step 1: Visit AquaFunded Website.

- Visit the official website.

- Funded programs overview and the account options overview.

Step 2: Sign up / Create an account.

- Click on the “Sign Up” or “Register” button.

- Enter few basic informations like name, email and country.

- Finish the minimal verification KYC (id and proof of address)

Step 3: Choose a Funding Program.

- Opt the account size and the type which suits your trading experience.

- Account leverage, profit split and profit rules overview.

Step 4: Start the Evaluation Phase.

- Evaluation program completion to get to profit and loss limitations.

- Full trading rules must be adhered to get complete funding.

Step 5: Receive Funded Account.

- Funded account activation when you finish evaluation.

- Start trading with the capital AquaFunded provides.

Step 6: Trade and Grow Your Account.

- Execute the trading strategy you have set up and respect your risk rules.

- Account performance overview through internal platform dashboard.

Step 7: Withdraw Profits.

- Withdrawals must be requested as per AquaFunded’s flexible payout policy

- You can take advantage of a high profit split and still reinvest or scale your account.

How It Works

Step 1: Registration – Obtain minimal KYC info in order to register on AquaFunded’s website.

Step 2: Choose a Funding Program – Pick an account size/type that’s appropriate for your level of trading experience for funding programs.

Step 3: Evaluation Phase – Demonstrate trading on a demo account while attaining profit goals and observing the rules of risk management.

Step 4: Get Funded – Once you have passed the evaluation stage successfully, AquaFunded will issue you a live account which is funded and you will be able to access the capital.

Step 5: Trade with Capital – Under the risk and trading rules stipulated, you will be able to make trades with the capital of the firm.

Step 6: Profit Sharing & Withdrawals – Withdraw the profits you make through multiple payout options while keeping the majority.

Step 7: Account Scaling – Based on your performance, your account will grow over time and you will have access to higher levels of funding.

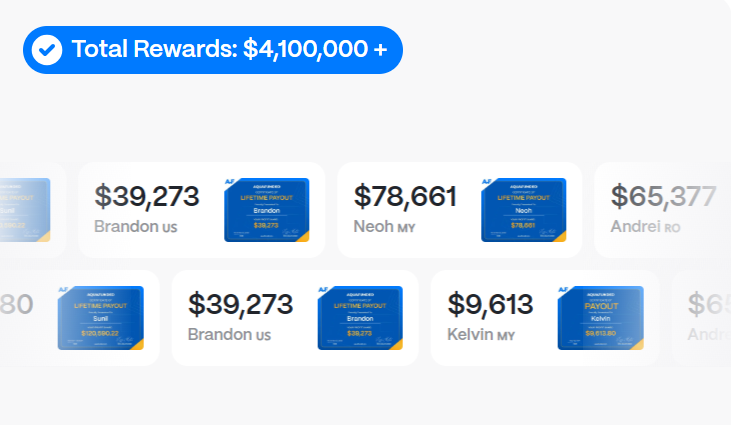

Fast & Reliable Rewards

Standard

- 90% Profit Split

- Bi-Weekly Rewards

Upgrades

- 100% Profit Split

- First Reward 7 Days

Benefits and Considerations

Benefits of AquaFunded

- Access to Capital – Trade larger positions without risking personal funds.

- High Profit Split – Keep up to 80% of profits depending on your account plan.

- Flexible Evaluation Options – 1-Step, 2-Step, 3-Step challenges, or Instant Funding.

- Minimal KYC – Super smooth and quick account setup.

- Multiple Markets & Platforms – Trade Forex, Indices, Commodities, and Cryptos on MT4, MT5, or cTrader.

- Educational Support – Mentorship aids traders in refining their strategies.

- Scalable Accounts – Improved account levels and funding are attainable with sustained performances.

Considerations of AquaFunded

- Strict Risk Rules – Daily and total withdrawal limits are in place.

- Profit Targets – Requirements of some account types involve disciplined fixation on achieving trading targets.

- Learning Curve – Evaluation challenges may take time for some beginners to effectively adjust to.

- Online Only – All communication is online; no in-person administrative assistance is available.

- Consistency Rules – Instant Funding plans restrict daily profit withdrawal to 50% to allow continuous growth.

Key Features of AquaFunded

Flexible Funding Programs

Multiple account sizes to suit beginners and professional traders.

High Profit Split

Traders can keep up to 80% of their profits depending on the plan.

Evaluation Options

1-Step, 2-Step, 3-Step challenges or Instant Funding to match different trading styles.

Low Risk Requirements

Daily and overall drawdown limits to protect both trader and firm capital.

Multiple Trading Platforms

Supports MetaTrader 4, MetaTrader 5, and cTrader.

Wide Market Access

Trade Forex, Indices, Commodities, and Cryptocurrencies.

Quick Onboarding

Minimal KYC and fast account setup.

Fast Payouts

Flexible and quick withdrawal options.

Educational Support

Mentorship, resources, and tools to help traders succeed.

Scalable Accounts

Opportunity to grow funding levels based on consistent performance.

Trading Platforms

Pros and Cons of AquaFunded

| Pros | Cons |

|---|---|

| Multiple funding programs to suit different trading styles | Some account types may have strict profit targets for beginners |

| High profit split of up to 80% | Advanced trading strategies may be needed to consistently meet targets |

| Flexible evaluation options (1-Step, 2-Step, 3-Step, Instant Funding) | Instant Funding has stricter consistency rules for profits |

| Minimal KYC and fast account setup | Limited physical office support as it is primarily online |

| Supports multiple platforms (MT4, MT5, cTrader) | Leverage varies depending on the account, which may be lower than some competitors |

| Access to Forex, Indices, Commodities, and Cryptocurrencies | Requires discipline and risk management to avoid hitting drawdowns |

| Fast and flexible withdrawal options | Traders must follow strict risk and drawdown rules |

| Educational support and mentorship available | Some advanced features may require a learning curve |

| Scalable accounts with higher funding potential over time | Not suitable for traders seeking full autonomy without rules |

Fast & Professional Support

AquaFunded takes pride in offering quick and professional support to every step of a trader’s journey. Be it when registering, choosing a funding program, or working through the evaluation, their responsive customer service representatives are trained to resolve every concern. Support is available to traders via live chat, email, and a detailed help center.

To help traders hone their skills and better understand the relevant concepts, AquaFunded provides ample educational and mentorship support. Encouraging traders with funded accounts is a systematic approach to resource investment. This unique approach of AquaFunded combines support with respect for trader autonomy.

Conclusion

To sum up, AquaFunded is among the leading proprietary trading firms as of 2025, as it presents traders with flexible funding programs, profit splits, and an array of evaluations suited to different trading styles.

With little KYC, rapid payouts, diverse market access, and market professional assistance, it gives novice and fully fledged traders alike an unambiguous moneymaking pathway. The firm also integrates educational materials to accompany its well formulated and systematic risk management policies to help traders grow and scale their accounts, responsibly trading as they do so.

AquaFunded is the top recommendation for traders looking for a prop firm with predictable policies that prioritizes their development.

FAQ

What is AquaFunded?

AquaFunded is a proprietary trading firm that provides traders with funded accounts, allowing them to trade various markets such as Forex, Indices, Commodities, and Cryptocurrencies without risking personal capital.

What are the account types available?

AquaFunded offers 1-Step, 2-Step, 3-Step challenges, and Instant Funding (Standard & Pro) to cater to different trading styles and experience levels.

What is the profit split?

Traders can earn up to 80% of profits, depending on the account type and plan chosen.

How long does the evaluation take?

It varies based on the account type. 1-Step is fastest, while 2-Step and 3-Step challenges take longer but spread risk over multiple milestones.

What trading platforms does AquaFunded support?

MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.