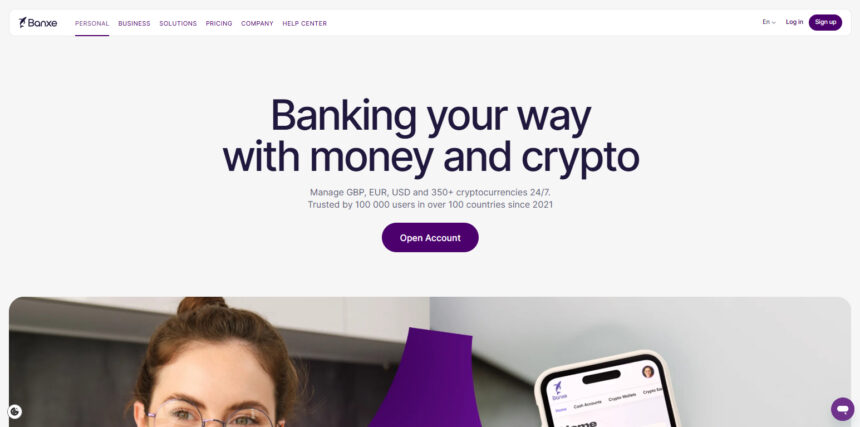

As a next-generation fintech platform, Banxe reshapes digital deals by integrating traditional banking with cryptocurrencies. For personal and corporate use, tools.

Access to multi-currency bank accounts and over 350 crypto accounts with advanced features for smart, transparent, and global financial services at your fingertips for secure global payments. Global payments and secure transactions.

What is Banxe?

Banxe is a pioneer in providing traditional banking services blended with digital currencies. As a global fintech firm, Banxe for both individuals and businesses is designed for customers who want hassle-free management of transactions, crypto access, and multi-currency flexibility.

Founded in England with regulated status, Banxe LTD, Electronic Money Institution authorization through Tompay LTD guarantees safe and regulated operational criteria. Security offered is industry best with comprehensive AML compliance, multi-layered encryption, a dedicated IBAN for fiat account transactions, and access to more than 350 crypto coins.

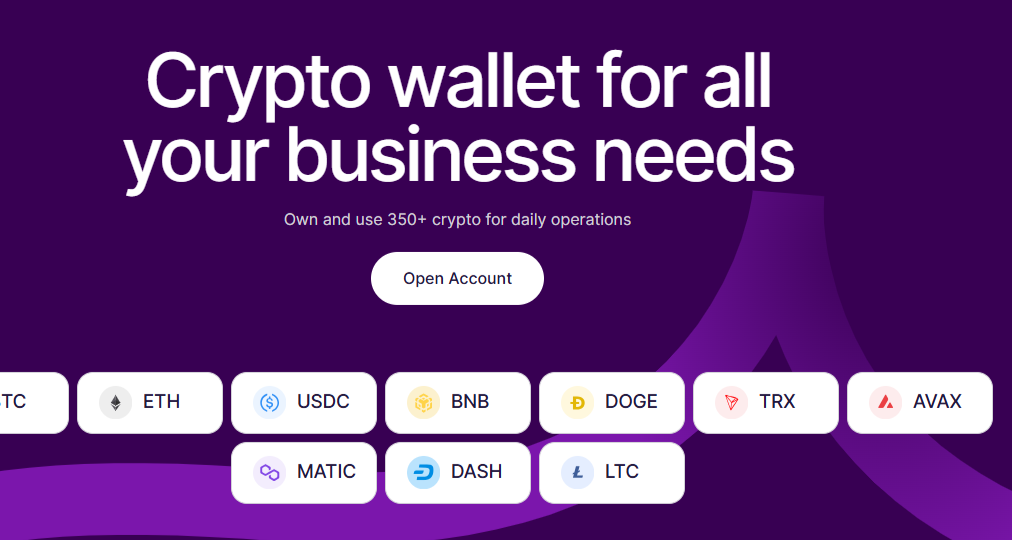

Business customers are offered Mass Payment automation and crypto-friendly payment processors. Banxe is adaptable to meet the diverse modern financial requirements of customers with crypto top-ups anytime and 24/7 enterprise grade fiat account services.

Banxe Overview

| Category | Details |

|---|---|

| Company Name | Banxe LTD |

| Founded In | England |

| Type | Financial Technology (FinTech) Company |

| Regulatory Status | Operates under Electronic Money Institution (EMI) authorization via Tompay LTD |

| Platform Type | Global Digital Banking & Cryptocurrency Platform |

| Account Types | Personal Accounts & Business Accounts |

| Supported Currencies | Multi-currency (Fiat & Crypto) |

| Crypto Access | Supports 350+ cryptocurrencies |

| Core Services | Banking, Payments, Crypto Exchange, Card Management, Mass Payments |

| Personal Account Features | Currency exchange, crypto wallet, 24/7 top-up, debit card services |

| Business Account Features | Mass payments, corporate debit cards, bulk transactions, white-label API |

| Security Measures | Multi-layered encryption, AML checks, fraud protection up to £85,000 |

| Card Services | Physical and virtual debit/corporate cards with customizable limits |

| Compliance & Verification | KYC and AML verification for all users |

| High-Volume Trading | Special FX and crypto exchange rates for transactions over €100,000 |

| Mobile & Web Access | Available through secure web and mobile platforms |

| Target Users | Individuals, entrepreneurs, and global businesses |

| Unique Advantage | Combines traditional banking reliability with crypto innovation |

How do I get started with Banxe?

Choose Your Account Type

Depending on your preferences, you can select either a Personal or a Business Account. Individuals account for day-to-day transactional and financial activities, and businesses gain access to mass payments.

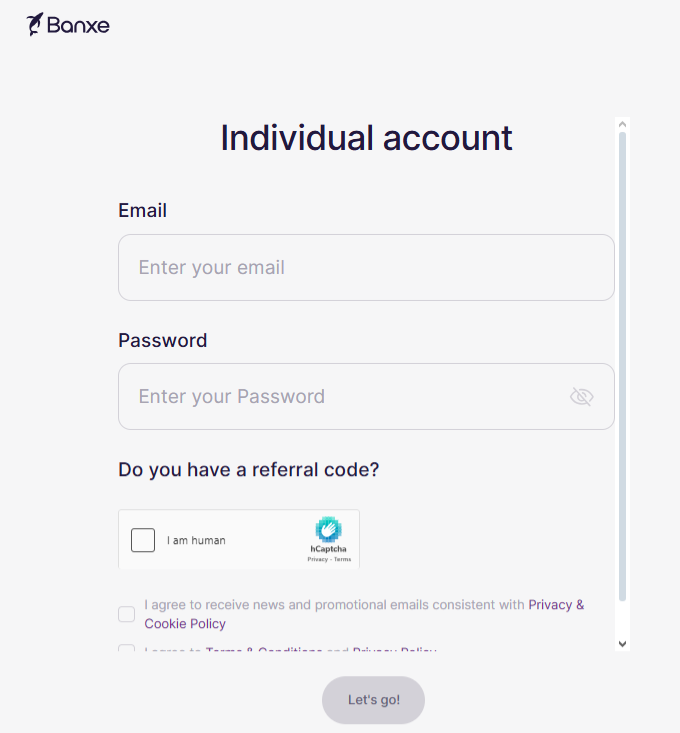

Sign Up on Banxe

To start using Banxe’s financial and crypto features, just go to the Banxe app or website and sign up by creating your account with your email and password.

Complete Identity Verification (KYC)

Business clients must provide identical documentation plus company registration, ownership, verification of directors, and other detail to complete the circle of KYC to start using Banxe.

Fund Your Account

After verification, you can start managing your accounts and making international transactions by topping up your account via SEPA or SWIFT transfers or crypto deposits.

Access Your Account Details

Once activated, you can start using Banxe’s banking, trading, and exchange services by transferring fiat to your account via the dedicated IBAN you receive and crypto wallet access.

Order and Activate Your Card

Get a Banxe debit or a corporate card for fast international spending. You can activate it through your account dashboard for secure payment management in different currencies.

Make Your First Transactions

Start your first transactions; send, receive, and exchange your crypto or fiat in minutes with real-time transfers and low fees with premier grade security.

Unlock Even More Features

Advanced business tools and Pro Wallet crypto management tools tailored for professional traders and growing businesses looking for additional versatility.

Account Security Procedures

Activate two-factor authentication (2FA), monitor account activity, and adhere to Banxe’s compliance framework to secure your finances and digital assets.

Pricing Outline

For both individual and corporate accounts, Banxe provides clear and easy pricing that caters to different user requirements. On the pricing model, the company attempts to capture every detail, such as the difference in pricing model based on advanced geographical, transaction, and currency specifications. Banxe also emphasizes advanced pricing tiers for corporate accounts.

Personal accounts

No monthly fees are charged to standard personal accounts, but nominal fees, in the case of express and standard physical cards, are charged for card delivery.

In terms of transactions, incoming payments for SEPA transfers are charged €2 while payments are extended €3. Incoming payments for international SWIFT transactions are charged €0.35% of the total transaction amount, which is considered to be in the realm of international fees.

For supported currencies (fiat EUR, GBP and USD), personal accounts have currency exchange fees of 1%.

For every volume and type of currency, users gearing towards cryptocurrency have a wide range to perform transactions while incurring fees of 0.5% to 1%.

ATM and Card Fees: Banxe personal debit card holders can make GBP transactions with no fees, while other currency transactions are charged a 1% fee. ATM withdrawals are processed with a 2% fee, and card reissuance is £10 for each card replacement.

Business Account Fees

Banxe has an assortment of business accounts with different operational flexibility. These accounts have transparent and flexible pricing. For standard business accounts, the monthly charge begins at €10.

The Blue Whale advanced plan designed for offshore and specialized jurisdiction clients, has a €100 monthly charge. For clients in high-risk industries or regions that require extra compliance scrutiny, account onboarding and compliance charges will also apply.

Business teams receive corporate cards for free for the first card issued, with a fee at reissuance. These cards have generous transaction limits and provide high-acceptance and 1% currency conversion rates.

Corporate clients also benefit from Banxe’s Mass Payments and bulk transaction options for a more optimized payment process, with discounted pricing for high volume transfer of fiat and cryptocurrencies.

High-Volume and FX Transaction Fees

Banxe engages users that specialize in high-volume transactions specifically for those who do over €100,000 in exchanges, whether fiat or crypto. Fiat FX transactions enjoy rate discounts that are based on volumes so that clients doing high fiat currency exchanges enjoy greater savings.

Crypto-to-crypto exchanges now offer reduction in fees to 0.2% for high-volume trades, thus making it easier for high frequency traders and businesses to maximize on savings. Withdrawals of crypto deposits are free and there is a fixed withdrawal fee of €1, which may slightly change based on the currency and network used, making the charge nominal.

For the clients in the corporate segment, Banxe also delivers additional integrate facilities like customized white-label API integrations and Pro Wallet upgrades which supply clients greater control over the complete set of private keys, along with their crypto assets.

These innovations are based on clients’ transaction volumes and tailored to their corporate needs. Compliance fees may be levied on clients located in high-risk or offshore locations due to compliance restrictions.

Banxe further promotes user protection via its APP fraud reimbursement policy, which covers losses of up to £85,000. Non-vulnerable clients may incur a small excess charge of up to £100, while vulnerable users are fully covered.

To ensure clear communication, Banxe provides access to all fee-related information in downloadable files and during support interactions. For businesses that operate in ways that are different because of their unique needs, customizable pricing plans are allowed so that services and their associated costs can be adjusted to specific operational needs.

Advantages of Banxe’s Mass Payment System

Efficient Bulk Payments: Preference of Banxe allows businesses to easily carry out multiple payments simultaneously, drastically cutting down the time and effort to handle the distribution of payroll, payments to suppliers, or vendor payments.

Cost Savings: Discounted fees for high volume transactions enable the cost of bulk fiat and crypto transfers to shoot down; processing individual transactions costs much more.

Multi-Currency Support: Payments can be made in fiat and crypto, helping global businesses in seamless payments to employees, partners, or suppliers in the currencies of choice.

Automation and Integration: Mass Payment features of Banxe can be blended into corporate workflows for automated payment scheduling, reconciliation, and reporting which reduces operational costs and manual error.

Custom Limits and Controls: Businesses can set transaction limits with customizable approval workflows to ensure secure controlled disbursement of funds.

Real Time Tracking and Reporting: Detailed reports can be built and payments can be tracked in the defined time, which enhances transparency in financial management.

Enhanced Security: Compliant safe and bulk transfers are guaranteed through the multiple encryption layers and AML compliance which protects the transactions and transfers them across the borders.

Flexibility for Businesses: No matter if you have a small team or a large global workforce, Banxe’s Mass Payment system is flexible for all business sizes and industries.

What countries are supported?

Banxe is available in the UK, EU, and the following countries: Australia, Canada, Chile, Dominica, Georgia, Grenada, Hong Kong, Israel, New Zealand, Saint Lucia, Saint Vincent and the Grenadines Singapore, South Korea, Taiwan, United States, Uruguay, Bahrain, Japan, Montenegro, Qatar, Saudi Arabia, South Africa, Argentina, Malaysia, Seychelles, Ukraine, Andorra, Liechtenstein, Monaco, San Marino, Kazakhstan

Restricted Regions

Regions classified as high-risk or restricted will not be onboarded as users or customers by Banxe. This helps confirm adherence to worldwide financial policy manuscripts and enables Banxe to nurture a secure transactional ecosystem. The more prominent restricted regions include:

States and Politics of North Korea, Iran and Syria: These regions are heavily sanctioned under the policies of United Nations and other global bodies and as a result, no financial or economic transactions are allowed.

Russia and Belarus: Due to active international sanctions, Banxe has curtailed or prohibited services to users situated in these countries.

Other Restricted Regions: This also includes regions with weak regulatory systems which Banxe cannot apply policies of compliance, particularly in relation to the laws covering money laundering and the Anti-fraud standards policy.

The Banxe debit card

Banxe allows users to get a debit card to be able to pay wherever they want. Users can add money to their Banxe account and pay without any hassle. Users get their debit cards delivered free of charge and without any monthly costs.

Versatility best describes a debit card for a crypto account. For example, with Banxe, the card is able to be topped up with crypto from anywhere and anytime. Also, unlike many other crypto services, Banxe users can smoothly switch between crypto and fiat for their payments.

Banxe Wallet

The Banxe Wallet is a safe multi-currency wallet which combines banking and cryptocurrency management at ease. It supports access to 350+ cryptocurrencies and multiple fiat currencies making it easy to store, send, receive, and exchange all arms of cryptocurrencies.

It is designed for easy access round the clock for both individuals and businesses with the added advantage of real time transfers and AML compliant encryption security. Thanks to Banxe Wallet, users can gain all the financial flexibility needed to oversee global payments, investments and digital assets all from one easy to use platform.

Team

Banxe started operations in 2019 establishing a vision to provide a multi-currency payment account to individuals and businesses. Today, after four years, the platform has grown and serves users from many countries around the world.

Current members of the leadership team consist of:

Alex Guts – CEO

Alex has been the CEO since July 2021 and is responsible for steering Banxe in its mission to become the bridge between traditional banking and the blockchain.

Sasha DiMarsico – Chief Communications Officer, Co-Founder

With a rich background spanning over 15 years in marketing, communications, management, and product development, and Banxe’s founding team, Sasha is responsible for overseeing the communications function.

Regulatory Compliance

The financial services sector varies by jurisdiction. Banxe has the following licenses or registrations to ensure continued smooth operation:

In the European Union – FIU licenses Banxe’s services.

In the United Kingdom – Banxe’s services are registered by the FCA as an Electronic Money and Payment Institution.

In the United States – Banxe’s services are registered as a Money Service Business by FinCEN.

In Canada – Banxe’s services are registered as a Money Service Business with FINTRAC.

Customer support

Responses to customer queries on Banxe will come in no time and usually within 15 minutes. Given the clientele that is still adjusting to crypto currency and tech-ency issues and problems. Banxe customer support definition includes documentation and any inquiries that the users might have.

Conclusion

Blending traditional banking with banking innovation is what makes Banxe exceptional. Users are able to oversee their fiat alongside digital assets because Banxe provides personal and business accounts, supports cross-currency, and keeps safe resources with access to more than 350 cryptocurrencies.

Global users mass payments, custom security layers, and corporate cards that are issued with a course and and relations comprehensive. The difference is trust and regulation that being prepared and followed is what deliver high standard to change digital finance. Digital assets are everywhere so and with Banxe, it is possible to oversee everything everywhere.

FAQ

What is Banxe?

Banxe is a platform that provides banking and crypto services for both individuals and businesses. Pay, receive, send, exchange, and earn with us. We support EUR, GBP, USD and 350+ cryptocurrencies.

How do I get started with Banxe?

To register an account, please follow these steps: Click the “Sign up” button in the right upper corner, enter your email and chose a password (min. 8 characters, at least 1 uppercase, 1 digit, and 1 special character), go through identity and account verification, top up your account. You’re ready to use Banxe

How can I withdraw my money?

If you wish to withdraw fiat funds select the ‘Send Cash’ button and fill in the required fields to complete the transfer. You will be prompted to complete the 2-factor-authentication to finalise the transaction. You may also withdraw fiat funds through an ATM by using your Banxe Card. If you wish to withdraw cryptocurrency, select the ‘Send Crypto’ button and fill in the required fields to complete the transfer. You will also be prompted to complete this 2-factor-authentication to finalise the transfer.

What countries are supported?

Banxe is available in the UK, EU, and the following countries: Australia, Canada, Chile, Dominica, Georgia, Grenada, Hong Kong, Israel, New Zealand, Saint Lucia, Saint Vincent and the Grenadines Singapore, South Korea, Taiwan, United States, Uruguay, Bahrain, Japan, Montenegro, Qatar, Saudi Arabia, South Africa, Argentina, Malaysia, Seychelles, Ukraine, Andorra, Liechtenstein, Monaco, San Marino, Kazakhstan

What is a Banxe Card?

The Banxe Card is a debit card. It can be used in the same way as a standard debit card.