I will discuss The Benefits of Using Stablecoins focusing on why stablecoins have become an integral part of the digital finance ecosystem. Stablecoins provide price stability, low fees, global access, and fast transactions.

They are the intersection of traditional finance and cryptocurrency, offering users a safe, dependable, and efficient means of exchange.

What is Stablecoins?

Stablecoins are special types of cryptocurrency that have their value ‘pegged’ to a reserve asset like the US dollar or even gold and other commodities to maintain a limited volatility.

Unlike other cryptocurrencies that may have extreme price volatility within a short period of time, stablecoins have a steady price which makes them suitable for day to day payments, trading, and value storage.

Stablecoins are digital currencies that offer the unique ability of rapid and inexpensive payments without borders, as well as the reputability of conventional currencies that tend to have broad international acceptance.

Stablecoins like USDT and USDC are also prominent stablecoins that are commonly used in trading, lending, and payments in crypto markets.

How To Choose Stablecoins

Pegged Asset Stability – Check if the stablecoin is backed by reliable assets such as the USD, EURO, or other reliable commodities to ensure value stability.

Transparency & Audits – Pick stablecoins that have transparent audits and regular reports on reserve audits by third parties.

Regulatory Compliance – Choose stablecoins that conduct business in a legally-compliant manner to minimize possible legal issues.

Liquidity – Make sure the stablecoin has high trading volume on major exchanges to facilitate quick and easy transactions.

Blockchain Compatible – Confirm that it functions on the blockchain networks where you have DeFi wallets or use other DeFi platforms.

Reputation & Adoption – Choose stablecoins that have a strong user base and are recognized as trustworthy within the industry.

Low Fees – Check to see whether you are charge minimal transfer costs at the time of transaction or swap.

Key Point & Benefits of Using Stablecoins List

| Key Points | Description |

|---|---|

| Price Stability | Maintains a stable value, reducing volatility compared to other cryptocurrencies. |

| Low Transaction Fees | Enables cost-effective transfers and payments across platforms. |

| Global Accessibility | Can be used worldwide without the need for traditional banking systems. |

| Safe Haven During Volatility | Protects funds during market fluctuations in the crypto space. |

| Programmable Money | Can be integrated into smart contracts and decentralized applications. |

| Transparency | Backed by assets with clear audits and reserve reporting. |

| Stable Value Storage | Serves as a reliable store of value for individuals and businesses. |

| Fast Transactions | Enables near-instant transfers across blockchain networks. |

1. Price Stability

One of the benefits of using stablecoins is price stability. It is much different than traditional cryptocurrencies that usually increase and decrease in value.

Unlike those stablecoins, are tied to stable assets, mostly fiat currencies which ensures predictable and consistent pricing. Unlike in the case of cryptocurrencies, users do not have to endure market swings with stablecoins.

For traders or investors, stablecoins provide a safe place to put their funds in case of a market crash. Stablecoins can be used to make payments and payroll as well, without the risk of losing value. The benefits of a stablecoin is that funds are protected with predictable flexibility.

Price Stability Features

- Minimizes volatility by pegging to stable assets like fiat currencies.

- Value is predictable for transactions and savings.

- Provides availability for businesses and traders requiring constant pricing.

2. Low Transaction Fees

Low Transaction Fees is one of the many advantages of using stablecoins. Unlike stablecoins which operate on blockchain networks and don’t have to deal with intermediaries, using stablecoins is an easier and direct payment method with little to no transaction costs.

Transfers of stablecoins are borderless which means that sending funds across different countries is much faster, cheaper and more effective. Also, freelancers, everyday user, and businesses enjoy the benefits of more funds sending to the receiver due to almost zero transaction charge.

With increased benefits of speed and lower costs, stablecoins are an effective and easy means of digital payment which improves access to funds across the world.

Low Transaction Fees Features

- Saves more than traditional banks and remittance services.

- Reasonable even for micropayments.

- Saves money lost to intermediary banks on cross-border transactions.

3. Global Accessibility

One of the biggest advantages of stablecoins is Global Accessibility. People can send, receive, and store funds without the need of owning a bank account as long as they have access to the Internet.

Such accessibility is vital in places which have poor banking systems and being able to access the banking sector is highly restricted.

Stablecoins can also be used in any part of the world without any delays as they avoid the delays and conversions of foreign exchange and remittance. For businesses, self-employed individuals, and the everyday consumer, this means they can effortlessly participate in the global economy.

Stablecoins provide digital currency which can be used in any part of the world and is a stable, reliable currency. This allows both people and businesses to have access to financial services, anywhere in the world and at any given time.

Global Accessibility Features

- Does not require a bank account and can be used from anywhere in the world with an internet connection.

- Currency conversion is simplified even in different countries.

- Enhances access to financial services in regions with no banking access.

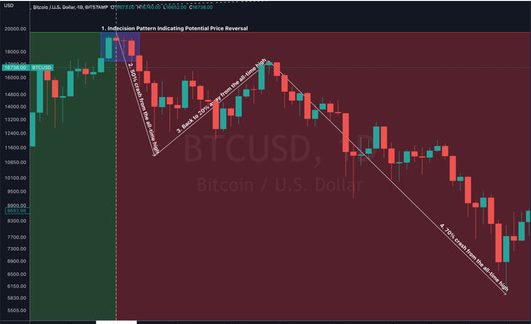

4. Safe Haven During Volatility

Safe Haven During Volatility has its Touch While using Stable Coins has its benefits and this has become ever so appreciated during the unpredictable flow of the crypto market.

While the prices of so-called “traditional crypto” like Bitcoin and Ethereum surges and take massive dives, instead of capitalizing on loss, stable coins help preserve the value, thus providing a better option.

Investors or traders can strategically position their funds and sustain purchase value by protecting their funds.

This features benefits businesses and individuals alike, who purely would appreciate a stable option for carrying out transactions while the market is going through turbulence. Stable coins provide the benefits of both crypto money and stable money by providing a digital safe haven during financial turbulence.

Safe Haven During Volatility Features

- Safeguards assets in periods of instability in the crypto markets.

- Empowers traders to quickly convert assets to a stable value.

- Maintains the purchasing power during a market dip.

5. Programmable Money

Among the various utilities that stablecoins offer, programmable money is the most unique. Stablecoins program payments and even execute finances autonomously, unlike traditional currency, which requires manual intervention at each step to pay, allocate, and perform other tasks based on a set of instructions.

This is particularly useful for businesses automating payroll, payments, and settlements in a supply chain.

Automation not only helps in saving time, but also helps in minimizing mistakes. The efficiency, opacity, and trust in the financial operations of DeFi applications is further strengthened by programmable stablecoins.

The combination of integration of stability and automation in programmable stablecoins offers endless benefits on how a person or an organization relate with digital finances. This helps in untapping a multitude of innovation that can be provided with programmable money in the DeFi sector.

Programmable Money Features

- Smart contracts can automate certain payments.

- Works for payments made on a regular basis like payroll and subscription and even settling supply chains.

- Improves productivity in DeFi (Decentralized Finance) applications.

6. Transparency

Users benefit from Transparency as users can check the backing as well as the reserves of the digital currency at anytime with the most recognized stablecoins.

Each of the reputable stablecoins conducts periodic audits as well as provides reports online that prove that every stablecoin is collateralized with real world assets.

This visibility fosters confidence between the issuers as well as the users and mitigates the chances of fraud or mismanagement.

Hence the users can be rest assured while engaging in transactions or even saving or trading with the stablecoins. Apart from the users and the business investors stand even more profit due to integrated blockchain with reliable reporting. stablecoins.

Transparency Features

- Rest reserves backed by public scrutiny and regular audits.

- Provides accountability to the users fostering trust.

- Lowers the chances of inadequate management and improper silos.

7. Stable Value Storage

Stable Value Storage offers the benefit of storing value digitally and in a reliable way. Stablecoins are unlike cryptocurrencies which are extremely volatile.

A stablecoin is always worth a dollar because it is backed by an asset, whether a fiat currency or a few commodities.

Such a currency is perfect for people or businesses that wish to store value without fear of sudden changes in the value of the currency and the purchase power it offers.

Stablecoins can be stored in digital wallets, can be used for trading, or can be sent and received across the globe without changing the value of the coin.

Such wealth in digital form storable in any digital wealth holder wallet is the type of currency that also offers the rapidity of cryptocurrencies and the security offered by mainstream currencies. This makes a stablecoin a reliable form of finance.

Stable Value Storage Features

- Why digital wealth is stored is also a question of security.

- Keeps funds safe from volatile market Crypto prices.

- Convenient as savings for both individuals and businesses.

8. Fast Transactions

Fast transactions Transactions are quick with Stablecoins which is one of the main advantages with its use. Transactions can be done instantly almost and are done with no dependence on traditional banking systems and done blockchain.

Stablecoins are done with confirmable transactions which are done on blockchains and are done within minutes. This is very useful for freelancers, businesses and individuals who need payables and remittances on the spot.

It also cuts down on trading, lending, and other financial operations. Transactions with stablecoins are done rapidly and the value is stable. This gives the user a reliable, efficient and seamless system for payment. It also enhances financial freedom due to its global payment methods.

Fast Transactions Features

- Transactions across blockchains are done nearly instantly.

- Transfers are faster because there are no banks or other middlemen.

- Monsters cryptocurrencies, and also remote trading and international payments.

Pros & Cons

Pros:

- Price Stability – Limits exposure to volatile cryptocurrencies which lowers risk.

- Low Transaction Fees – Stablecoins charge a fraction of what banks charge for transfers

- Global Accessibility – Can be accessed anywhere there is the internet

- Safe Haven During Volatility – Secures funds during market swings

- Programmable Money – Money that can be automated through smart contracts.

- Transparency – No hidden reserve and other audits

- Stable Value Storage – Offers a reliable form of value store in the digital assets

- Fast Transactions – Can be sent and received in a matter of seconds.

Cons:

- Centralization Risk – Most stablecoins are issued by a centralized entity

- Regulatory Uncertainty – Changes in government policies can have a major impact.

- Limited Growth Potential – Value will remain the same as growth is stagnant.

- Dependency on Reserves – Depends on the correct reserve backing of assets for stability.

- Technology Risks – Smart contracts can be hacked or have bugs.

Conclusion

Conclusion: The well-defined nature of a Stablecoin provides the crypto-economy with attributes such as stability, accessibility, and cost-effectiveness.

These currencies strive to solve several issues pertaining to cryptocurrencies as well as the global financial system by providing price stability, low transaction fees, rapid cross-border transfers, and universal accessibility.

The highly accepted value of Stablecoins as programmable money, pure money, crystal-clear transactions with minimal ambiguity, utmost safety during value retention, and market downswings provides added value to businesses, investors, and common folks.

Above all, Stablecoins synthesize the classical financial system with the modern techno-financial system and allow the users to optimally manage, transfer, and store digital currencies with a highly dependable and protective method.

FAQ

Why use stablecoins?

They offer price stability, low transaction fees, fast transfers, and global accessibility, making them ideal for trading, payments, and value storage.

Can stablecoins be used globally?

Yes, stablecoins can be sent and received anywhere with an internet connection, bypassing traditional banking limitations.

Are stablecoins transparent?

Most stablecoins provide clear audits and reserve reporting, ensuring trust and accountability for users.

What are stablecoins?

Stablecoins are digital currencies pegged to stable assets like fiat currencies, providing a consistent value and reducing volatility compared to traditional cryptocurrencies.