This article covers Bitcoin ETFs with 3x leverage, which provide investors with increased exposure to Bitcoin’s price fluctuations. These funds are high-risk and high-reward and suited for short-term investors looking to achieve three-fold returns on a daily basis.

With regard to the current dynamic cryptocurrency and stock market, one can take advantage of various leveraged funds such as TQQQ, which provides exposure to technology, or the sector-oriented SPXL, SOXL, and other leveraged funds.

Key Point

| Symbol | ETF Name |

|---|---|

| TQQQ | ProShares UltraPro QQQ |

| SOXL | Direxion Daily Semiconductor Bull 3x Shares |

| SPXL | Direxion Daily S&P 500 Bull 3X Shares |

| TMF | Direxion Daily 20+ Year Treasury Bull 3X Shares |

| UPRO | ProShares UltraPro S&P500 |

| TECL | Direxion Daily Technology Bull 3X Shares |

| SQQQ | ProShares UltraPro Short QQQ |

| FAS | Direxion Daily Financial Bull 3X Shares |

| FNGU | MicroSectors FANG+ 3 Leveraged ETNs |

| TNA | Direxion Daily Small Cap Bull 3X Shares |

1. ProShares UltraPro QQQ (TQQQ)

ProShares UltraPro QQQ (TQQQ) is an equity-based ETF that aims for a target return of 3x the daily performance of the NASDAQ-100 Index. It has total assets under management of $27,784.60 million, revealing this ETF is quite popular among those traders looking for leveraged exposure to tech companies. It has a YTD return of 37.26%.

This ETF is the most traded fund with an average volume of 56,985,272. The fund’s most recent closing price was $107.89 with a 1-day change of 3.75%. It is a Best 3x Leveraged Bitcoin ETFs substitute due to the good liquidity combined with the provision for aggressive investors.

ProShares UltraPro QQQ (TQQQ) Pros & Cons

Pros:

- Allows for high returns due to triple exposure on the top NASDAQ-100 tech stocks.

- Extremely high levels of liquidity alongside tight bid-ask spreads.

- Allows for use in short-term momentum strategies as well as day trading.

- Underbullish tech market conditions, it has a strong performance.

Cons:

- High volatility means risk of rapid loss of capital which can occurs in a short period.

- Performs poorly in market corrections.

- Due to compounding decay, it is unfit for long-term holding.

- High exposure to large swings in mega-cap tech stocks.

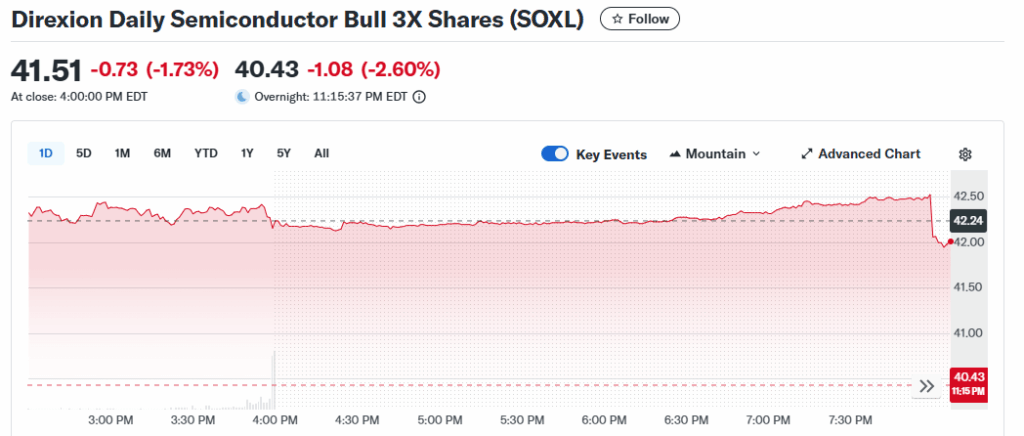

2. Direxion Daily Semiconductor Bull 3x Shares (SOXL)

Direxion Daily Semiconductor Bull 3x Shares (SOXL) aims for a return of 3x the daily performance of the equity ETF which is focused on the Semiconductor industry. This equity ETF has assets under management of $12,893.50 million.

It has a strong YTD gain of 55.67%. This equity ETF has an average trading volume of 84,852,784. The equity ETF closing price was $42.24, with a 1-day change of 4.84%.

This ETF is among the Best 3x Leveraged Bitcoin ETFs as it allows traders to take advantage of the growth in demand for semiconductors and AI technologies.

Direxion Daily Semiconductor Bull 3x Shares (SOXL) Pros & Cons

Pros:

- Grows with the semiconductor and AI sectors which are currently in boom.

- Weighted towards the highest daily volume which allows for easy entrance and exit.

- Captures short-term profits during rallies of chips, effective for rapid traders in the market.

- Provides leveraged exposure to tech for those unpassively investing in the innovative tech sectors.

Cons:

- Extreme volatility leads fine losses during minor sector pullbacks which erode profits.

- Not appropriate for passive as well as long-term investors.

- Focus on a single sector increases risk.

- Global chip slowdowns make significant losses due to leverage on far the chips are from the apex.

3. Direxion Daily S&P 500 Bull 3X Shares (SPXL)

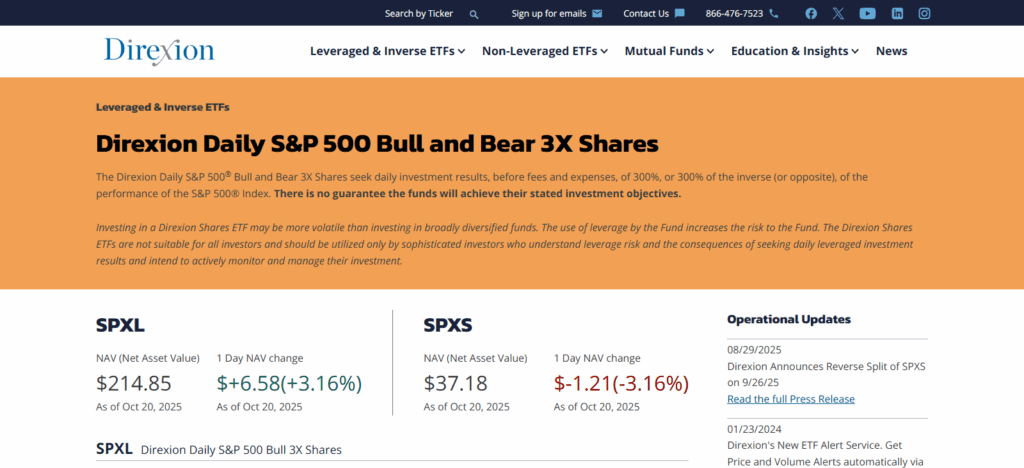

Direxion Daily S&P 500 Bull 3X Shares (SPXL) is seeking to deliver triple the daily returns of the S&P 500. This fund is intended for investors who want increased exposure to the S&P 500, which is also a passive investment.

SPXL shows strong institutional support with total assets of $5,488.05 million. Currently, it enjoys a YTD return of 28.36% and an average volume of 2,884,815.

The ETF’s previous closing price was $214.79, which was an increase of 3.06% in one day. It is recognized as a Best 3x Leveraged Bitcoin ETF alternative and is a strong choice for investors wanting exposure to large-cap U.S. equities on leverage.

Direxion Daily S&P 500 Bull 3X Shares (SPXL) Pros & Cons

Pros:

- Offers 3x exposure to overall U.S. equity market.

- Within reach for bet traders anticipating market strength.

- All-round liquidity and reasonable expense ratio.

- Good during bull market cycles returns.

Cons:

- Aggressive bearish market.

- Daily rebalancing and the possibility of compounding errors.

- Not applicable to architectural investing.

- Those market corrections can erode quick.

4. Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF)

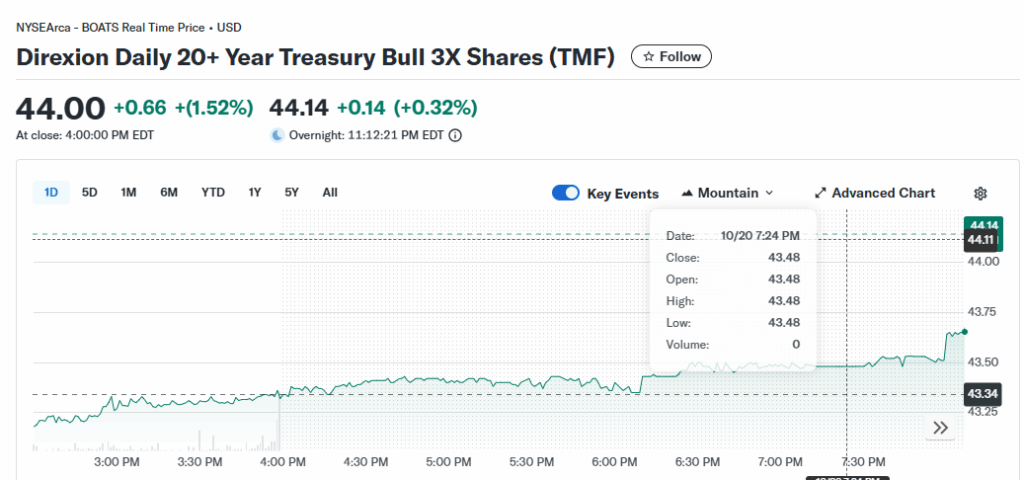

The Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF) is aimed at investors seeking 3x exposure to long-term U.S. Treasury bonds. TMF is also a bond-based ETF, and it has $4,756.65 million in assets along with a YTD return of 11.35%.

It has an average trading volume of 7,026,092, with a previous close of $43.34 and a 1-day change of 1.07%. TMF is also among the Best 3x Leveraged Bitcoin ETFs as it offers leveraged bond exposure, making it ideal for traders wanting to balance the volatility of crypto and bonds.

Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF) Pros & Cons

Pros:

- Long U.S. Treasuries by investing and providing a hedge.

- Strategic equity market downturns.

- Tactical fixed-income trades.

- For those investors and strategists anticipating interest rates.

Cons:

- Exchange of interest rates.

- Bond dynamics apply to narrowed changes.

- Lack of long-term compounding.

- Rising Inflation.

5. ProShares UltraPro S&P500 (UPRO)

The ProShares UltraPro S&P500 (UPRO) aims to achieve three times the daily performance of the S&P 500 Index, which makes it favorable for short-term bullish traders.

It has $4,448.77 million under management, with YTD returns increasing to 28.42%. The ETF has an 1-day volume of 4,631,373 and 1-day returns of 3.11%, close at $113.05.

UPRO is regarded as one of the Best 3x Leveraged Bitcoin ETFs because it gives traders access to leverage on the U.S. equities, high speed and high power on the market.

ProShares UltraPro S&P500 (UPRO) Pros & Cons

Pros:

- 3x exposure to the S&P 500 and through to the broad market.

- Excellent liquidity with institutional grade of the fund.

- Bear U.S. equities bets during bullish propagations.

- Subsequent expansion during strong economic recovery.

Cons:

- Sideways market incurs high volatility.

- The need for close action monitoring.

- Minimal defense against inflation or economic downturns.

- Unfit for risk-averse investors.

6. Direxion Daily Technology Bull 3x Shares (TECL)

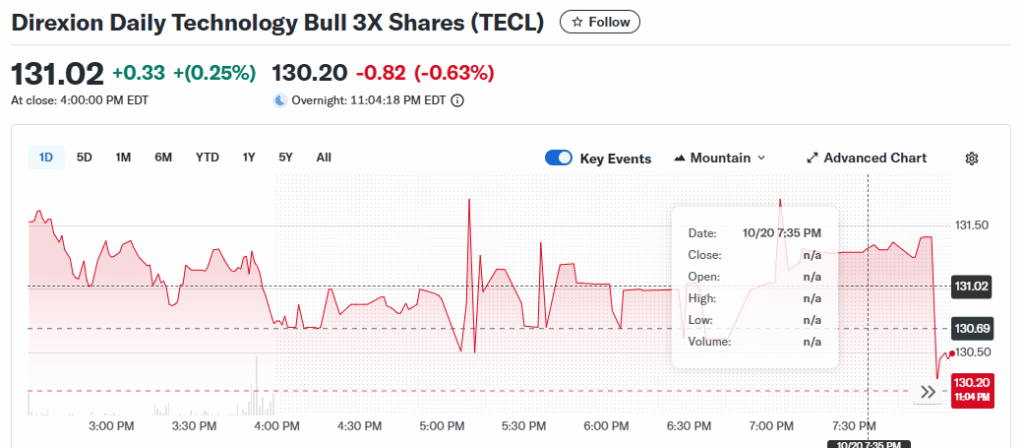

Direxion Daily Technology Bull 3x Shares (TECL) aims to triple the daily returns of the Technology Select Sector Index. With $4,108.00 million in assets and a YTD gain of 45.11%, TECL is highly favored by growth investors.

It has an 1-day volume of 1,210,785, a close of $130.69 and 1-day returns of 3.31%. TECL is one of the Best 3x Leveraged Bitcoin ETFs, giving investors the. opportunity to enjoy high returns in the rapidly growing technology sector.

Direxion Daily Technology Bull 3X Shares (TECL) Pros & Cons

Pros:

- Triple the exposure to leading companies in the technology sector.

- Exceptional growth opportunities in high-growth technology industries.

- Attractive to traders looking to make quick gains because of high growth potential.

- Well-rounded investments in numerous major technology companies.

Cons:

- Unpredictability of technology industries and high potential for significant losses.

- Underperforming investments in declining economic conditions.

- High risk due to potetential for significant loss in value.

- Requires a lot of active management (adjusting the investments frequently).

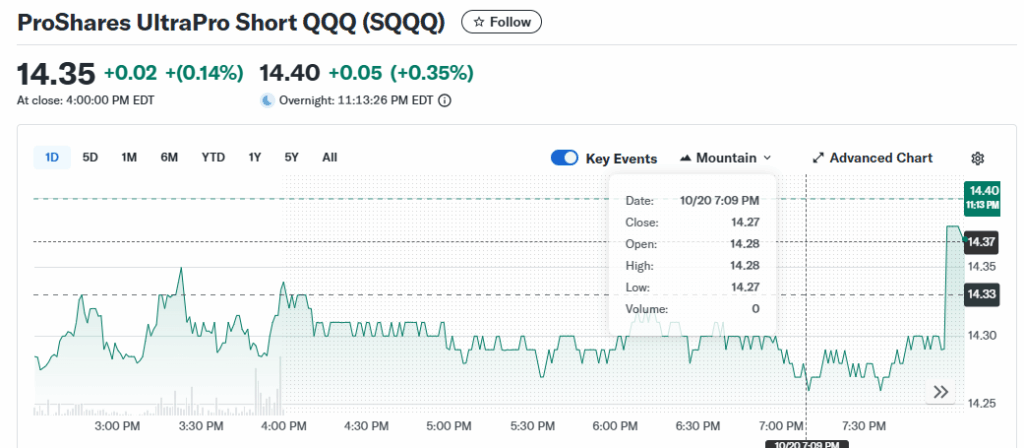

7. ProShares UltraPro Short QQQ (SQQQ)

ProShares UltraPro Short QQQ (SQQQ) provides inverse leveraged exposure to the NASDAQ-100 with a target of -3x daily performance. It has $3,220.59 million in assets, acting as a defensive play on tech downturns, which is to be expected.

With a year-to-date (YTD) loss of -51.99%, it averages 111,103,072 in volume, one of the highest in the market. Its previous close was $14.33, down 3.76%.

Traders looking for downside protection when investing in the Best 3x Leveraged Bitcoin ETFs still see SQQQ as a reliable option for short-term hedging.

ProShares UltraPro Short QQQ (SQQQ) Pros & Cons

Pros:

- Provides a -3x inverse exposure for the NASDAQ-100.

- Perfect for investors with a tech-heavy portfolio looking to hedge.

- SQQQ has high liquidity and large trading volume.

- Protects investors during tech market downturns and bear markets.

Cons:

- High potential losses if the market is bullish.

- Large losses during bear markets.

- Not meant for long-term investments.

- Can lead to significant losses if an investor incorrectly predicts market behavior.

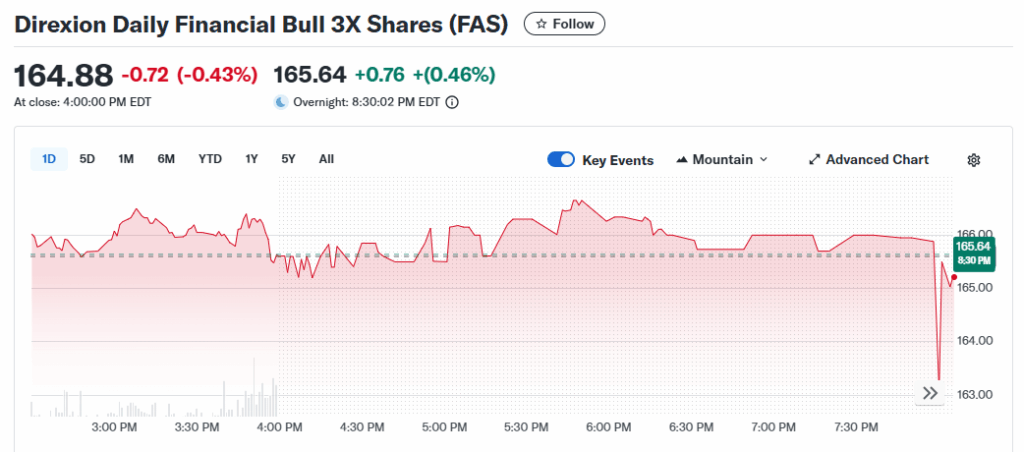

8. Direxion Daily Financial Bull 3X Shares (FAS)

Direxion Daily Financial Bull 3X Shares (FAS) provides 3X daily exposure to the russell 1000 Financial Services Index. With $2,466.53 million in assets, the ETF has a YTD return of 10.58% and fends off competition in the averages with an average volume of 535,083.

For the financial bull FAS, the previous close was $165.60 and the 1-day change was 3.38%. Also as one of the Best 3x Leveraged Bitcoin ETFs FAS has exposure to the major US banks and financial institutions.

Direxion Daily Financial Bull 3X Shares (FAS) Pros & Cons

Pros:

- 3x exposure to the financial sector, inclusive of banks, insurance, and other financial providers.

- Increased profits due to favorable economic conditions and strong financial sector earnings.

- Improved ability to trade due to strong market liquidity.

- Contributes to sector-specific trading strategies.

Cons:

- Can be sensitive to financial crises or credit events.

- High leverage means higher volatility.

- Poor performance when rates fall.

- Not suitable for risk-averse investors.

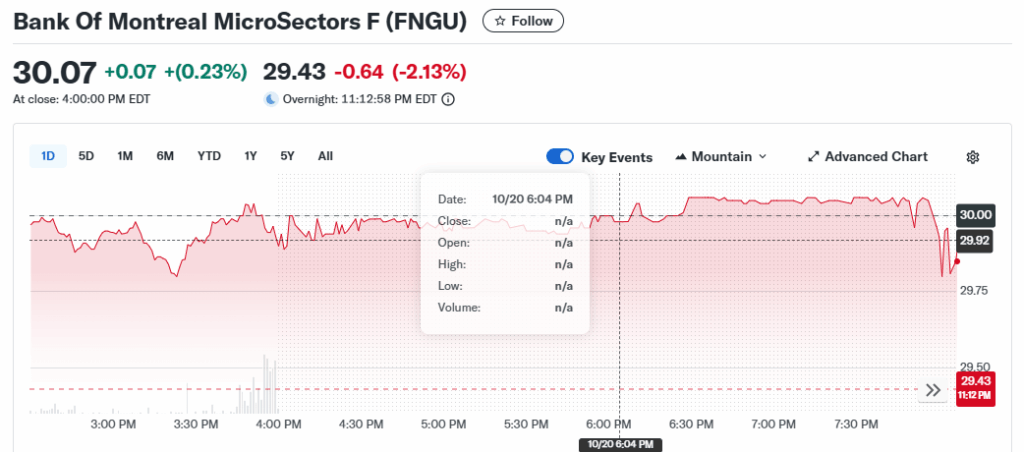

9. MicroSectors FANG+ 3 Leveraged ETNs (FNGU)

The MicroSectors FANG+ 3 Leveraged ETNs (FNGU) are designed to follow a set of high-growth tech stocks, among them the FAANG companies, the famous tech stocks, having 3x daily exposure to them. FNGU manages $2,275.42 million, and even though no YTD data is available, it has managed to obtain a large interest.

As of the previous day, it closed at $ 30.00, and has a 1 day increase of 5.63%, trading at a 5,455,070 average volume. Since it is counted among the Best 3x Leveraged Bitcoin ETFs, it provides trading to those wanting high risk and high return on investment on tech driven market increases.

MicroSectors FANG+ 3 Leveraged ETNs (FNGU) Pros & Cons

Pros:

- Targets high-growth tech giants like Meta, Amazon, and Nvidia.

- Delivers 3x daily returns on FAANG performance.

- Excellent for capturing tech momentum.

- Active traders chasing short-term spikes will find this attractive.

Cons:

- Highly volatile because of concentrated holdings.

- ETN structure exposes investors to issuer credit risk.

- Not for buy and hold investors.

- Rapid decay during sideways or declining markets.

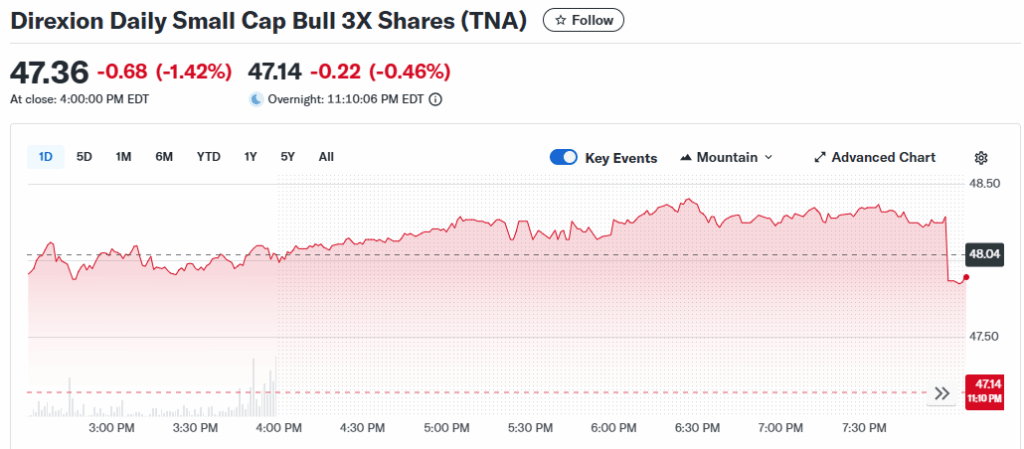

10. Direxion Daily Small Cap Bull 3X Shares (TNA)

The Direxion Daily Small Cap Bull 3X Shares (TNA) focuses on the small-cap U.S. companies and aims to give three times the daily performance of the Russell 2000 Index. It has a managed asset of $2,087.26 million and it has a ytd return of 15.77%.

The ETF has an average trading volume of 13,377,755, a previous closing of $48.04, and a 1 day gain of 5.79%. As an alternative to the Best 3x Leveraged Bitcoin ETF, TNA is perfect for investors trying to exploit the more sensitive small market sections for greater profit prospects.

Direxion Daily Small Cap Bull 3X Shares (TNA) Pros & Cons

Pros:

- Triple exposure to small-cap U.S. stocks (high growth potential).

- Profitable in economic upturns and expansion phases.

- Excellent for short-term leveraged plays.

- Strong average daily trading volume.

Cons:

- Underperformance during recessions.

- Small caps are highly volatile and sensitive to market shifts, so leverage is risky.

- Not for long-term investors or beginners.

Conclusion

The Best 3x Leveraged Bitcoin ETFs and the ETFs that are comparable are crafted for the traders who wish to increase their profits and will take the consequences that come with high-risk investments.

The ProShares UltraPro QQQ (TQQQ), Direxion Daily Semiconductor Bull 3x Shares (SOXL), and Direxion Daily S&P 500 Bull 3X Shares (SPXL) are mostly preferred for their high liquidity and volume while also providing high returns within bullish market conditions.

Because of their extreme volatility and the peculiarities of price compounding, such ETFs are more apt for high frequency trading which makes them unsuitable for holding periods of more than a few days.

These 3x leveraged Bitcoin ETFs positioned within an appropriate trading plan, will provide excellent opportunities for advanced traders willing to take sensible risks to pursue moving trends in the crypto and equity markets.

FAQ

What is a 3x Leveraged Bitcoin ETF?

A 3x Leveraged Bitcoin ETF is a fund designed to deliver three times the daily performance of Bitcoin or related market indices. It allows traders to amplify potential gains—but also magnifies losses—making it suitable only for experienced, short-term investors.

How do 3x Leveraged Bitcoin ETFs work?

These ETFs use derivatives such as futures, swaps, and options to achieve 3x exposure to Bitcoin’s price movements. If Bitcoin rises 1% in a day, the ETF aims to rise 3%, and if Bitcoin falls 1%, the ETF aims to fall 3%.

Are 3x Leveraged Bitcoin ETFs safe for long-term investment?

No, they’re not ideal for long-term holding. Daily rebalancing and volatility can lead to compounding decay, meaning returns may differ significantly from expected long-term performance. They’re best used for short-term trading or hedging strategies.

Which are the best-performing 3x Leveraged Bitcoin ETF alternatives?

Top-performing leveraged ETFs similar in structure include ProShares UltraPro QQQ (TQQQ), Direxion Daily Semiconductor Bull 3x Shares (SOXL), and Direxion Daily S&P 500 Bull 3X Shares (SPXL). These funds offer strong liquidity and exposure to growth sectors often correlated with Bitcoin’s performance.

What are the risks of investing in 3x Leveraged Bitcoin ETFs?

The main risks include high volatility, leverage decay, and large potential losses if the market moves against your position. Traders must actively monitor positions and use strict risk management strategies.