The Top AI Co-Investor Platforms That Select Assets will be covered in this post. To assess markets, find high-potential investments, and assist investors in making data-driven decisions, these platforms make use of cutting-edge artificial intelligence.

They enable both inexperienced and seasoned investors to securely co-invest, optimizing portfolios while lowering risk in an increasingly complicated financial environment by fusing automation, predictive analytics, and customized strategies.

Key Point & Best AI Co-Investor Platforms That Pick Assets With You List

| Platform | Key Features / Focus |

|---|---|

| Magnifi (TIFIN Group) | Personalized AI-driven portfolio recommendations, advanced research analytics, goal-based investing insights. |

| Zignaly | Crypto-focused AI trading bots, copy-trading features, automated strategy execution, multi-exchange support. |

| Numerai Signals | Crowd-sourced AI models for stock predictions, hedge fund collaboration, encrypted data submission, performance-based rewards. |

| Delphia | Data-driven AI investment strategies, predictive analytics for stocks, sentiment and alternative data integration. |

| Capitalise.ai | Strategy automation platform, no-code trading rules, multi-asset support, backtesting and live execution. |

| Stoic AI (Cindicator) | Fully automated crypto portfolio management, AI-based market analysis, low-fee passive investing. |

| Wealthfront AI | Robo-advisory with AI-enhanced portfolio optimization, tax-loss harvesting, goal-based planning. |

| Betterment AI | AI-driven automated investing, goal-based portfolio allocation, socially responsible investment options. |

| Sharpe AI | AI-powered stock and options trading strategies, risk optimization, portfolio hedging tools. |

| Alpaca AI Trading API | Commission-free algorithmic trading, AI strategy integration, developer-friendly API, multi-asset execution. |

1. Magnifi (TIFIN Group)

One of the greatest AI co-investor platforms is Magnifi (TIFIN Group), which actively works with investors to choose assets rather than merely recommending them. Its AI engine examines financial documents, market movements, and behavioral patterns to produce tailored investment advice that fit your risk tolerance and objectives.

Magnifi offers an interactive co-investing experience that allows users to see the reasoning behind each advice and make real-time strategy adjustments, in contrast to standard robo-advisors. Its distinctive feature is its ability to combine sophisticated AI analytics with user-friendly interaction, enabling investors to make more intelligent, data-driven decisions without sacrificing portfolio control.

Magnifi (TIFIN Group) – Features

- Analyses data with AI to find the best performers among ETFs and stocks, looking at the records on the market and at realtime data.

- Offers custodial accounts with tailored suggestions on which portfolios align with the investors’ risk preferences and financial goals.

- Arm retail investors and professionals with the ability to use advanced AI technologies through an easy-to-use platform with personalized visualizations.

2. Zignaly

Zignaly straddles the line between automated trade and AI co-investing. Analyzing waves of the market, liquidity, and history, Zignaly AI opens the co-investments alongside the professionals. Zignaly isn’t just another trading bot.

Zignaly also allows copy-trading where the investor copies the successful trader but also maintains control of their funds. Zignaly offers complete automation with the ability to set trade parameters, alerts, and the ability to execute trades on multiple exchanges. This opens the data-driven crypto market to any investor, regardless of experience.

Zignaly – Features

- Automated investment strategies and signal AI from expert traders on the platform for crypto.

- Users can mirror the strategies of professionals, in real time, for automated investment with no added comm.

- Offers automated crypto asset allocation and simplified portfolio management through integrations with top crypto exchanges.

3. Numerai Signals

Because it crowdsources predictive models from data scientists all around the world to find high-potential assets, Numerai Signals is a leading AI co-investor platform. In order to produce investment suggestions that are more precise and varied than traditional methods, our AI system analyzes encrypted datasets and combines thousands of independent signals.

Its collaborative, data-driven approach is what sets it apart: users co-invest with a worldwide network of professionals by contributing models and earning rewards depending on success. Numerai Signals enables investors to take part in complex, AI-powered portfolio decisions while utilizing collective intelligence for more intelligent asset selection by fusing cutting-edge machine learning, secure data handling, and community-driven insights.

Numerai Signals – Features

- Uses the algorithms of many data scientists to outsource and to predict market movements.

- Paid in crypto to ensure the underlying data used to predict market movements by the portfolio, in the hedge fund.

- Empowers portfolio managers to implement advanced AI signal generation in their funds (particularly hedge funds) to liquidate for enhanced diversification.

4. Delphia

Delphia uses personal data driven market analysis and intelligent investment strategies to monitor behavioral and sentiment analysis and other alternative data to discover assets for users to to co-invest alongside data based prediction strategies.

Users can construct individually tailored poltfolios based on their risk profile and investment/financial goals. Users get to make market data informed and proactive investment strategies. They are not just following market data but actively co-investing alongside AI.

Delphia – Features

- Uses anonymized data from consumers and AI to discern movements to predict which market opportunities are exploitable.

- Constructs portfolio using predictive analysis with an aim for sustainable growth and risk-adjusted returns.

- Provides data insights with time relevance aiding users in making data-backed decisions.

5. Capitalise.ai

One of the greatest AI co-investor platforms is Capitalise.ai, which enables investors to precisely automate and co-manage their trading methods. Without the need for technical expertise, customers can execute intricate investment rules thanks to its AI, which converts natural language instructions into tradeable trades.

Its unique blend of strategy automation, backtesting, and real-time market monitoring allows investors to co-invest alongside AI-driven insights while retaining complete control over execution. Capitalise.ai guarantees that every investment move is prompt, data-driven, and customized by combining human decision-making with algorithmic precision. This makes it an effective platform for both inexperienced and seasoned co-investors.

Capitalise.ai – Features

- A no-code AI application that helps users form trade automation by leveraging conditional statements.

- Provides backtesting facilities along with live execution in stocks, crypto and forex markets.

- Integrates human strategy and AI for automation ensuring that traders’ complex strategies are implemented with ease.

6. Stoic AI (Cindicator)

Because it completely automates cryptocurrency portfolio management while functioning as a cooperative co-investor, Stoic AI (by Cindicator) stands out as one of the top AI co-investor systems. To precisely choose assets, its AI integrates market data, predictive analytics, and Cindicator’s hybrid intelligence from qualified experts.

The capacity of Stoic AI to dynamically modify tactics in response to market movements while providing users with clarity regarding investing choices is what sets it apart. Co-investing is simple and allows investors to take advantage of cutting-edge AI insights without continual oversight.

This combination of cognitive forecasting, automation, and user-aligned portfolio management keeps the investor actively involved in strategy outcomes while guaranteeing optimal performance.

Stoic AI (Cindicator) – Features

- AI portfolio management with quantitative algorithm for crypto with optimized risk/reward ratios.

- Offers persistent portfolio balancing based on market volatility and position.

- Provides accessible automated crypto investing by implementing advanced strategies for institutions.

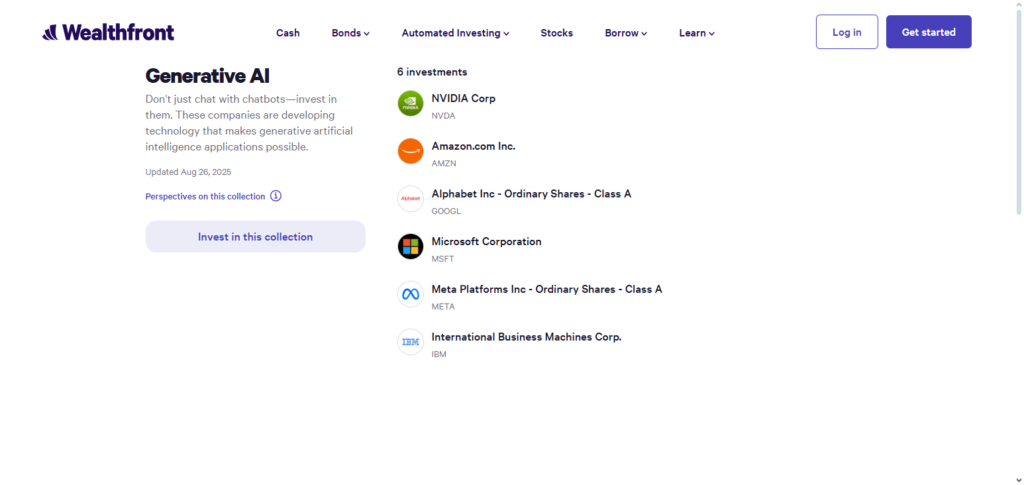

7. Wealthfront AI

Wealthfront AI is one of the top AI co-investor platforms because it blends intelligent, individualized investing advice with advanced robo-advisory technology. In order to suggest and oversee asset allocations alongside the investor, its AI examines market trends, personal risk tolerance, and financial objectives.

Wealthfront AI is distinct because to its goal-based planning, automatic tax-loss harvesting, and portfolio rebalancing, which enable users to co-invest effectively while lowering risk and increasing profits. It functions as a reliable AI co-investor who collaborates with you by combining data-driven insights with a hands-off management style, enabling investors to take part in superior investing strategies without continual supervision.

Wealthfront AI – Features

- Offers automated portfolio creation with the use of AI and robo-advisory tools to optimize tax savings and maintain a personalized portfolio.

- Works on risk-based algorithms that help in the growth of wealth over a long period without human interjection.

- Provides an array of features, Path planning, among others, allowing users to simulate retirement alongside their savings and investments to meet goals.

8. Betterment AI

Because it integrates sophisticated algorithmic investing with individualized, goal-oriented strategies, Betterment AI is among the top AI co-investor platforms. In order to choose assets that support particular financial goals, its AI assesses market movements, economic factors, and individual investor profiles.

Betterment AI stands out for its emphasis on long-term wealth optimization via tax-efficient tactics, socially conscious investing options, and automatic portfolio rebalancing.

It eliminates uncertainty from asset selection while preserving transparency and control by enabling investors to co-invest alongside intelligent AI-driven suggestions. For both new and seasoned investors looking for data-driven portfolio growth, this makes Betterment AI a dependable companion.

Betterment AI – Features

- Offers features for goal-based investing alongside risk-based automated portfolio management with AI asset allocation.

- Provides personalized guidance as well as tax-loss harvesting to help clients maximize returns.

- Simplifying investing for novices while offering advanced AI tools to help automate risk-adjusted growth.

9. Sharpe AI

Sharpe AI works as an AI particularly customer-centric AI co-investor platforms and offers one of the finest available owing to its machine learning and risk-optimized investment strategies. The AI predicts optimum market movements by detecting patterns and measuring volatility indicators while drawing correlations with other assets.

The AI offers actionable investment recommendations according to the investor’s risk profile. The AI offers real-time market strategies and works dynamically on the portfolio hedge. This works to balance investor confidence in the market co-investing. The AI provides advanced asset selection for the investor to keep control while investing dynamically. This is especially unique since AI co-investing and maintaining portfolio while investing is not common. This offers unique intelligent co-investing.

Sharpe AI – Features

- Optimizes trading strategies in equities, crypto, and ETFs with machine learning.

- Predictive analytics for asset selection and portfolio rebalancing.

- Risk-adjusted return improvement is the focus of AI decision systems.

10. Alpaca AI Trading API

One of the greatest AI co-investor platforms is Alpaca AI Trading API, which makes it easy for investors to create, test, and implement algorithmic trading strategies. Its AI-powered tools enable users to precisely co-invest while identifying high-potential opportunities by analyzing market trends, asset performance, and historical data.

Alpaca’s developer-friendly API, which enables completely automated trading across many asset classes and incorporates AI techniques straight into user portfolios, is what sets it apart. Alpaca enables both individual and professional investors to co-invest wisely, utilizing AI insights while retaining total control over their investment strategy, by fusing flexibility, real-time data, and execution efficiency.

Alpaca AI Trading API – Features

- Automation of stock and crypto trading is offered through an AI-integrated API.

- Provides algorithmic trading, backtesting, and order execution in real-time for users.

- Fully automated portfolio management is available through the deployment of custom AI models.

Conclusion

To sum up, the top AI co-investor platforms are transforming the way investors choose and manage assets. These systems include Magnifi, Zignaly, Numerai Signals, Delphia, Capitalise.ai, Stoic AI, Wealthfront AI, Betterment AI, Sharpe AI, and Alpaca AI Trading API. These solutions offer co-investing in addition to clever AI insights by combining sophisticated machine learning, predictive analytics, and customized tactics.

Both inexperienced and seasoned investors may confidently make data-driven decisions thanks to their special advantages, which range from automated portfolio management to dynamic market analysis and risk optimization. These platforms provide a more intelligent and effective way to increase and safeguard wealth by integrating human judgment with AI precision.

FAQ

What is an AI co-investor platform?

An AI co-investor platform uses artificial intelligence to analyze markets, identify high-potential assets, and provide investment recommendations. Unlike traditional advisors, these platforms allow users to co-invest alongside AI-driven strategies, combining human decision-making with machine intelligence.

How do AI co-investor platforms pick assets?

They leverage machine learning, predictive analytics, and alternative datasets to evaluate asset performance, market trends, and risk factors. Some platforms also incorporate community models or behavioral data to refine their recommendations.

Are AI co-investor platforms safe to use?

While they provide data-driven insights, no platform can guarantee profits. Most platforms focus on risk management and diversification, but investors should monitor portfolios and invest according to their risk tolerance.